I wrote about Pulse Seismic in my October “What’s Wolf Watching” article about ten days ago. Within that piece I mentioned I wouldn’t chase the stock where it was but if it dipped down into my identified buy zone leading into or post financials, it should be something to consider.

Not only did it fall into the buy zone on the day of earnings but subsequently fell further in the three trading sessions afterwards as well. In all, a 14% decline since releasing their Q3 after hours on Monday. Revenue was up by 25% but they did experience a miss on the bottom line of 6% to the comparable quarter.

It’s rare that a microcap produces clean, easy to read financials and for someone who literally reads dozens every week, it does not go unnoticed nor unappreciated.

While I’ve covered the stock in previous WWW articles, this will be my first complete review of their financials. With it just hanging by a thread to the 200 daily MA, is this still a good place to attack or wait for even cheaper days ahead?

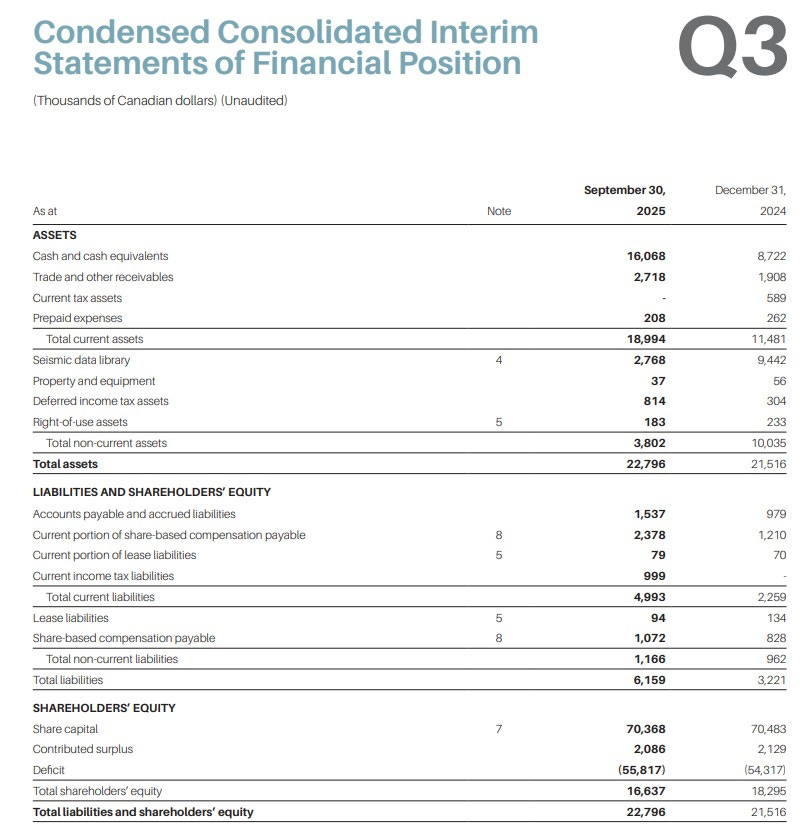

Balance Sheet:

The current ratio has more than just a ‘pulse’ but a rapid heartbeat with an excellent current ratio of 3.8. At the end of Q3 they had $16.1M in cash, $2.7M of receivables and $200k in prepaids against only $5M in short term liabilities. Half of those liabilities ($2.38M) is within “current portion of SBC payable” - an account you do not see every day.

In 2024 PSD modified their SBC plan to allow RSU and PSU’s to be settled in cash, rather than award the stock to plan holders. This is beneficial in terms of dilutionary measures and allows insiders to benefit financially from share price appreciation without the optics of insiders selling.

Is $2.4M excessive? At first glace that’s my impression but I’ll save my final opinion after reviewing the share table.

While the company does not disclose an aging report, 93% of the $2.7M of receivables is from one Alberta company. Below is the company’s statement within the MD&A. I’d still like to know how old it is. Last quarter is was two customers making up 98% of $4.4M.

Pulse has no debt but they do have a $5M credit facility at 5.2% that has gone unutilized in the last eighteen months.

Overall this is a very strong balance sheet with excellent liquidity.

Cash Flow:

$30.4M of operational cash flow generated so far through three quarters, that is 2.6x more than they generated at the same stage of their fiscal year in 2024. What’s more impressive is that also includes paying $5M more in income taxes than last year.

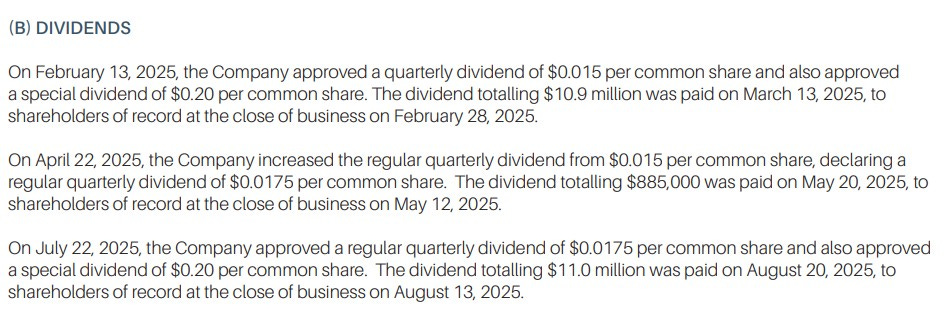

The company paid out over $22.8M worth of dividends to shareholders including two hefty special dividends awarded in Q1 and Q3. They also spent $200k buying back stock under their NCIB.

Even with that special dividend and NCIB usage, Pulse has increased their cash position by 84% from where they began the year.

Share Capital:

50.9M shares outstanding, over 3% less than the beginning of 2024 through buybacks

2.07M of combined PSU/DSU/RSU’s outstanding

45% of the outstanding float closely held via insiders and institutions

Current dividend yield of 2.4%.

With the share price at $2.06 a year ago, shareholders since that time have earned a 23.5% yield including special divvy’s - not bad

Income Statement:

Revenues of $3.4M were achieved in Q3, a 25% increase over the comparable quarter, but their YTD business is $44.5M, and 150% above the $17.8M achieved through three quarters in 2024.

PSD’s total operating expenses grew by 24% with the main culprit - Salaries, internal commissions and benefits growing by 75%, most likely related to the incentive plan touched on earlier.

That all contributed to a $1.5M net loss in Q3 not dissimilar to the 1.4M loss experienced in the same quarter a year go.

The results through three quarters are a much difference story as mentioned with their revenue gains of 150%. Conversion of operating expenses look much better through nine months, only growing by 17%. Earnings before taxes are 5.6x better than last year at $29.6M and net earnings are $21.44M, 8.2x better than last year.

Overall:

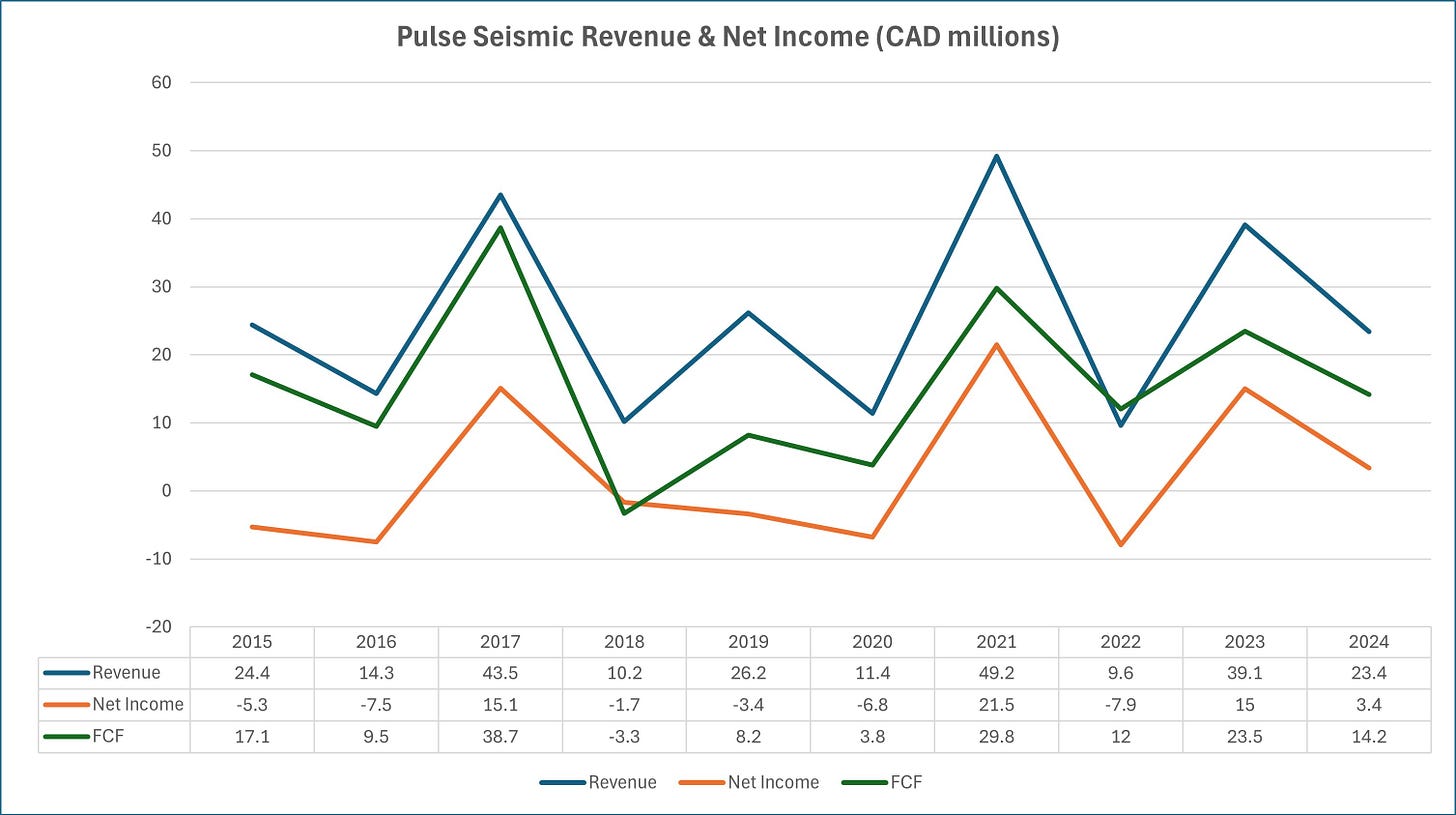

An incredible performance YTD which would typically be worthy of a four or more star rating. But given the extreme lumpiness of their results, it’s very difficult to rate them that high.

Pulse Seismic is probably not for your typical growth or value investor with revenues of $44M in 2017, under $10M in 2022 and everything in between over a ten year period including a net loss in six of those ten years. To be honest I expected the ten year chart below to show a lot more volatility than it does. Even with the stock down 45% from their ATH back in August the stock is still higher than any point in their prior 23 years of trading on the TSX.

The 6.6 P/E, 3.3 EV/EBITDA and incredible 122% ROIC have to be measured along with the extreme variances in their results. I don’t think you can treat Pulse like you would most other stocks.

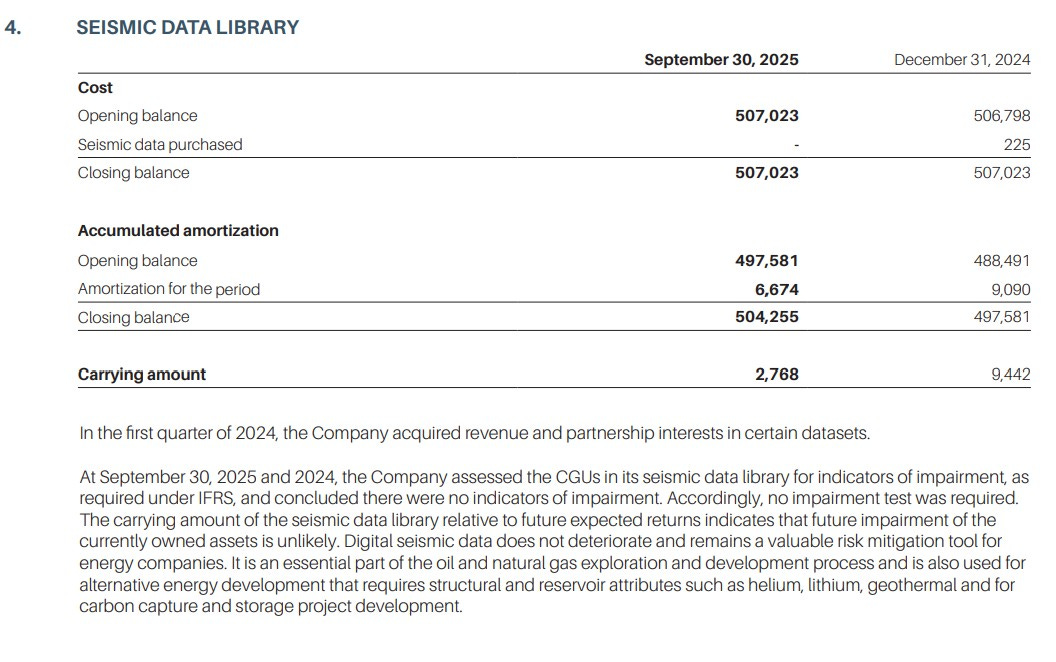

What I will say is their cash flow is much more consistent than their net income and that is due to their high amortization costs of their seismic library. So far YTD it accounts for 44% of their operating costs.

Since their inception the company has spent over a half billion dollars on these library assets. The interesting piece here is that asset is almost fully amortized. In a couple of quarters, they won’t have any more of these expenses to write down.

This will have a big positive impact to their net income, but most likely a negative impact due to higher income taxes, and those will of course be cash burning.

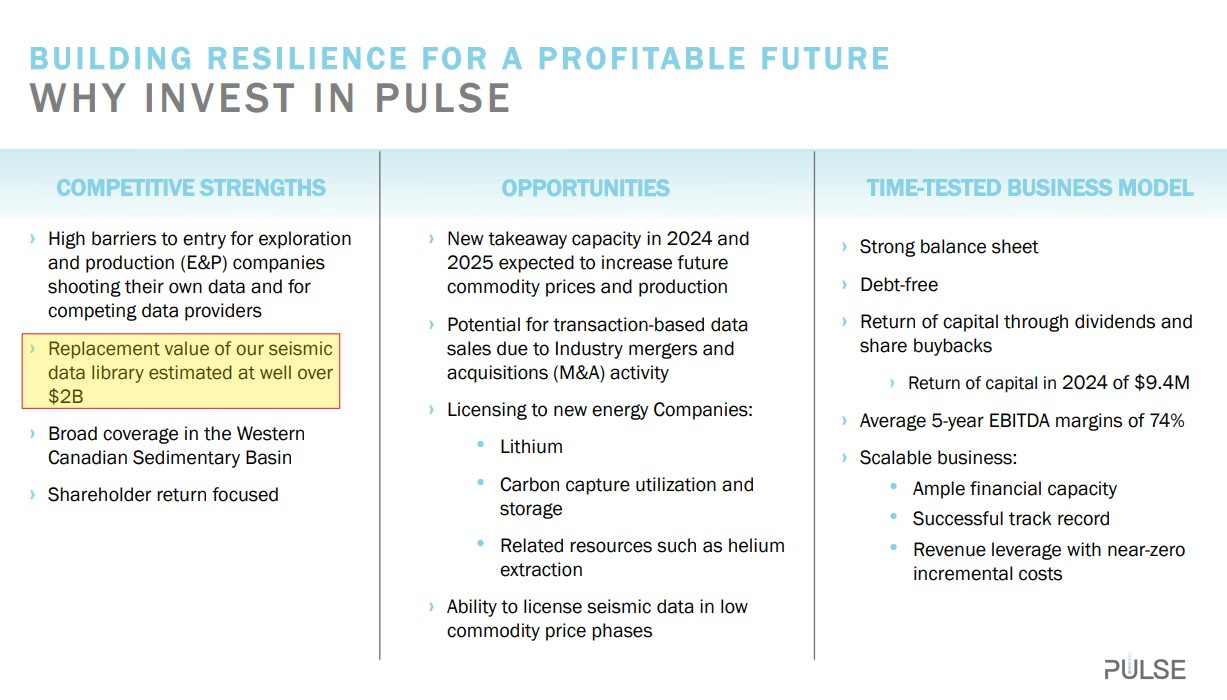

Even though those assets will be fully amortized, they will continue to drive revenues well into the future. In fact the company estimates the replacement value of their seismic data to be well over $2B. That in itself is interesting for a $150M market cap.

Even if you have been a casual reader of my reviews of the past number of years, you know I can be quite opinionated, and I rarely shy away from making those known. I must say I’m having trouble nailing down a rating. If I looked at nothing else other than the YTD numbers here of a 150% revenue increase, a modest 17% increase in opex spending, growth of 700% profitability and dividend returns of over 20%, it’s easily a 4 - 4.5 star.

At the same time, I can’t tell you if the company will do $10M or $50M in revenue next year, and are heavily reliant on revenue in one province and one sector. That sector being O&G and in addition to compressed commodity pricing which have led to reductions in capex across the sector, the tariff situation is also having an indirect impact creating uncertainty with energy investments. Therefore I don’t think the company itself can tell you whether they’ll do $10M or $50M next year.

One thing appears to be certain and that’s a well led company who will reward shareholders when things go very well. To be honest I’m considering throwing some money it’s way.

Let’s call it a Rated R Superstar.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

As long as results are this lumpy (which sounds to be just simply a feature of the business cycles), it caps the multiple I would assume? however, if the depreciation releases, you could get some real blow out earnings which seem to track headlines better than cash flows.

You're right, Wolf. Rating this company seems tricky. The FINS seem great, but the focus on 1 industry, province and only 1 or 2 clients gives me pause. Remember what happened to Cal Nano?