5:30 on a Saturday morning, and I’m sitting with a cup of coffee writing a review on Plurilock. It feels like I need to revisit my life choices.

This is inevitably going to be a verbose review and it could get ugly at times so you might want to grab a coffee yourselves and strap yourselves in for a lengthy read.

I wrote a special piece on Plurilock about six weeks ago just prior to making the leap to Substack, titled “Plurilock's rise has an expiration date”. Much of what I said there has played out as expected. That might be a good place to begin for prerequisite reading, although I will likely make some references here as well.

My first FINS review for PLUR was way back in June of 2022, and I’ve completed several since. My latest was in September of last year. It received a downgrade all the way down to one star, and I have never awarded them more than two as I’ve never been a fan of their low margin, high operational cost (relative to margin) model.

Split adjusted, the stock was in the $2.40 area going way back to that first review, and after dropping 75% from my latest September ‘23 review, it has recovered dramatically since the beginning of July, closing yesterday at about 4x from it’s low, and at one point earlier this month was a twelve bagger from it’s all time low back in early April, around twenty cents.

So what occurred since the start of July that has brought some major volatility to the share price? For that, you need to go back a few more months and I’ll try to summarize the highlights.

On April 1st (odd choice) the company made several announcements including a new Executive Chairman, a 10:1 reverse split, and a $3M raise to “fuel growth in its VAR business, its growing Critical Services offering, and in its Plurilock AI sales team.”

Ali Hakimzadeh is the gentleman who was named as the new executive chair, touted as someone who held the same position at HS Govtech and who was at the helm when they sold it to a PE firm at a 150% to the then market price. What the news release did not mention is that during Mr. Hakimzadeh’s time, the float diluted by over 430% through multiple raises and a reverse split, and the value of the sale in September 2023 was 60% less than what they IPO’d back in 2015. HS Govtech’s revenue rose from $2M to $5.8M during his tenure, but their net losses did as well, from $1.9M to $5.2M over the same time span.

The reverse split took the share count down to approximately 10.3M shares and that announced $3M raise turned into $5.5M when all was said and done due to increased interest.

That 10.3M outstanding share count did not last long with the raise and additional dilutive measures including debt settlements, repricing convertible debentures, and IMO once of the most egregious SBC maneuvers and plans that I have ever witnessed (more on that when we get into the numbers).

The company also engaged several IR and stock promotion companies, a couple with some eye popping 6 figure deals, and one in particular greasy YouTuber with a questionable track record in terms of finding success within the markets - you know, like stocks that actually go up in value.

The Bet:

If you looked closely at the weekly chart posted earlier, you may have seen a tiny box in the bottom right. I’ve always thought I’ve drawn grey boxes on my charts. I’m colourblind and Mrs. Wolf tells me it’s actually more of a light purple. Whatever.

I had previously lost a PLUR bet to a certain FinTwit user on how quickly the stock would go to $1.

Our next wager was placed near the end of July when the chart looked like the one above. I submitted that between the dates of Aug 23rd and Sept 16th, the range of that “grey box”, the share price would fall within it ($.50 - $.70). I figured that both the financials and the share unlocking would be occurring around then.

I draw these boxes on charts all the time for stocks I already own or ones I have on watchlists, and I use them for target areas to enter, add, or exit. Perhaps one day I’ll write a separate piece on that methodology.

As you can see in the updated chart above, I secured my victory on day two in that date range when it touched 69 cents and on day three it left no doubt touching a low of 59 cents. I did start to doubt my chances when the share price vaulted in the $2.50 range. I also shared this bet with the folks in my discord and created a survey on whether or not people felt I would win it. Nearly 60% voted that I would lose. To those that voted against me - eat shit.

How about we look at the Q2 financials now.

Balance Sheet:

I always start with a current ratio view and at .83, we’re not off to a good start, although its modestly better than the .76 they started the year with. That consists of $2.9M in cash, $9.1M in receivables, $2.1M worth of inventory and about $750k of other short term assets against $17.85M of short term liabilities due within the next twelve months (unearned revenue removed). You want to see your current ratio above 1, and to be considered a healthy one, I’d suggest at least 1.5 or higher so we are a long way from that. Adding to their challenges is their lack of liquidity with less than 20% of their current assets in cash. If you add their cash and receivables together, they are still $3.3M shy of being able to pay off their accounts payables, and that doesn’t include the $2.5M due on short term loans.

They don’t provide a very detailed view on their A/R aging, but they do state that 16% of them are past 90 days. Ideally you would like to see 90% of your A/R as current, and without even knowing what is 30 or 60 days overdue, we can see they are not very close to that. We also know that the majority of their business is via government contracts who aren’t exactly known for paying their bills on time. Typically, they are eventually good for it so their receivables are probably fine, but businesses with a high reliance on getting paid by governmental agencies suffer from cash flow timing issues.

The $2.5M short term debt is from a line of credit facility at prime plus 4.25%. Plurilock has no long term debt but does have about a half million left in those repriced convertible debentures.

Cash Flow:

In a word, ouch. In two words, fuck me.

After burning $607k during Q1 via operations, Plurilock burned $1.45M in Q2, 238% more QoQ.

The $1.45M is nearly a half million per month, and 82% more than they burned via operations in Q2 of last year. Their YTD number isn’t very comparable due to a large swing in their A/R in 2023. On several occassions in the past few months since the major changes in early April. I’ve read about how improvements to cash flow were a priority, so this seems like pretty piss poor progress.

That was what happened via operations. Next to nothing occurred in fiscal 2024 on the investing side, and on the financing side, they raised nearly $5.3M through issuance of stock, and they paid down $2.2M of short term debt. Overall they improved their cash position by 45% since the beginning of the year. That includes that very large raise however. So with less than $3M in cash, $9.1M in A/R, $15.3M in bills due in the next year and the most recent quarter operationally burning $500k a month, can they avoid going back to the capital markets by the end of the year? I don’t think they can without dipping back into that line of credit. Watch this space.

Share Capital:

This section should be entertaining.

As of June 30, 42.9M shares outstanding, 320% dilution since their reverse split a little more than four months ago.

3.5M options outstanding, 3.4M of which are well ITM at 30 cents

36M warrants outstanding, 33.5M ITM ranging from 30 - 33 cents

3.8M RSU’s granted and outstanding.

Approximately 2M of additional dilution from remaining repriced debentures

Per YF and other sources, insider ownership of approximately 5%

No participation in the open market, but insiders did participate in the 20 cent PP and the new chairman exercised 625k warrants post financials

Fully diluted float including ITM options and warrants is approximately 85.6M or 8.3x dilution since the share consolidation. Put that in your pipe and smoke it.

Let’s get into the insiders and these RSU’s and options under their new SBC plan. As you know the April share consolidation took them to 10.3M shares on April 19th. Next they closed the private placement adding 27M shares to the float, then added some additional shares though debt settlement. After the share count quadrupled, the company announced it’s newly adopted Omnibus SBC plan which consisted of 10% rolling options, and a fixed 10% RSU’s. The sequence of events is striking, as their first order of business could have been to announce the SBC plan, but instead they waited for the number of shares to quadruple to over 40M shares to effectively quadruple the available shares in the new plan. Also, most companies when announcing a new plan will piece meal the options or RSU awards over time. Not these guys as 86% of available options under the plan were immediately awarded at 30 cents, and 93% of the available RSU’s were awarded on the day of the press release - June 21st, when the stock closed at 27 cents. What happened next? The IR and promo went into effect taking the stock nearly 6x touching $1.60 by July 15th. The value of those options and RSU’s (vested and unvested) increased by $11.1M in approximately three weeks (on paper at least).

I have a personal rule, almost a golden rule that I simply will not invest in companies that have a 20% SBC plan. I don’t think companies with this type of plan are looking out for the best interests of retail shareholders. If you’re a frequent reader of mine, you know I’ve preached this before so I’m not singling PLUR out. But, add in the previous paragraph, and I also just can’t trust these guys, and if I can’t trust you, I’m not investing in you.

Income Statement:

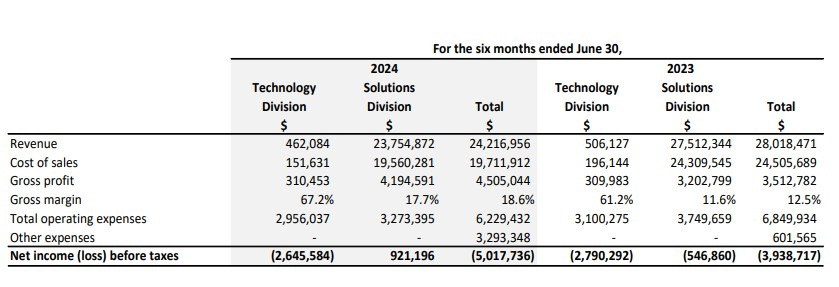

Revenues in Q2 were $12.6M, up 3.2% from last years comparable quarter and for the year achieved $24.6M, 13.5% down from last year through two quarters.

Plurilock’s gross profit may be a bigger story than the top line however. In previous reviews it has been what turned me off the most, but they have started to make some strides here. Q1 gross profit rate came in at 15.6%, 450 basis points better than Q2 of last year, and at the mid way point of the year have achieved a gross profit rate of 18.6%, up 610 basis points from a year ago. So on 13.5% less revenue YTD, they actually delivered 28% more dollars to the GP line, almost $1M YTD. That’s decent progress.

The downsides are Q2 came in at 630 basis points lower than Q1’s 21.9% and it’s hard to get excited about mid teen gross profit when your operating expenses are 26% of revenue, and 93% of those are cash burning. To their credit, operational spending is down 9% from a year ago, but that is less than their revenue erosion so I would have to call that terrible conversion.

Their total operating losses are down to $1.7M from $3.3M last year through six months but when you add in financing, interest costs and a couple of one time items, their net loss YTD is 27% worse than a year ago.

Overall:

When the stock was at it’s low point, I believe it was at a lowly $12M market cap. If you figure the company is trending towards $50M in revenue this year, then I can understand someone wanting to take a deeper look at a company trading under a .25 MC/Sales ratio.

Next I bring you perhaps the dumbest slide ever included in an investor deck. It tries to make the case that Plurilock is vastly undervalued compared to it’s peers. All of the companies listed have gross profit more than double what Plurilock has achieved so far this year. The large ones are excellent companies with market caps in the billions. The smaller ones, like PLUR have issues of their own, and I wouldn’t invest in them either. When it comes to Booz Allen, CACI and Globant, you don’t look like their peers, you look like their bitch.

Looking at the segmented breakdown of their business, their mid teen margin segment is actually profitable, whereas their high margin tech business, loses $5.72 for every dollar in revenue it generates. That is one heck of a break even point in that segment to overcome.

Post financials, they engaged Clear Street Investment to explore strategic options in the US. There was very little meat and plenty of fluff in the news release but it did get retail talking about potential of acquisitions and perhaps an uplist to a US exchange. If their goal is to become Pyrogenesis 2.0, than I think a Nasdaq uplist is a great strategy <sarcasm>.

On August 16th, the company released a $200M BSP which they could potentially issue at market prices going forward over the next 25 months. Interestingly, no press release accompanied this. Now I have seen BSP’s go completely unused before, so there is no guarantee that they will act on it, but it’s out there and at the current share price you can do your own math on potential dilution.

Plurilock did a great job on executing this raise, helping to improve their balance sheet somewhat but as I showed you early on in the review, it still pretty weak and operational cash burn escalated exponentially in the most recent quarter. With the increased IR spend and additional sales staff, I don’t see this improving in their next two quarters which will cause them to draw additional funds through their LOC facility or tap into this new BSP. Given the pump play looks like it will continue my bet would be on the latter. The pump over the last several weeks also likely created quite a few retail bagholders on the FOMO, and I feel for those who are holding bags at $2 plus.

If you made out like a bandit during the 12x run up and made some cash, then I am super happy for you. If you are considering this as an investment then my opinion is there may be a day, but that day ain’t today. Tough to land on a rating here, but I’m going with a potentially generous two stars.

I apologize for the length (not really - I warned you at the beginning).

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.