You’ve heard of Dollarama, the $57B behemoth trading on the TSX delivering $7B in TTM revenue. If you’ve never heard of Pesorama, it’s exactly what you’re thinking it is - a chain of dollar (or Peso) stores in Mexico and for some reason they trade on the TSXV (their store fronts are named JOI Canadian Stores). Ok.

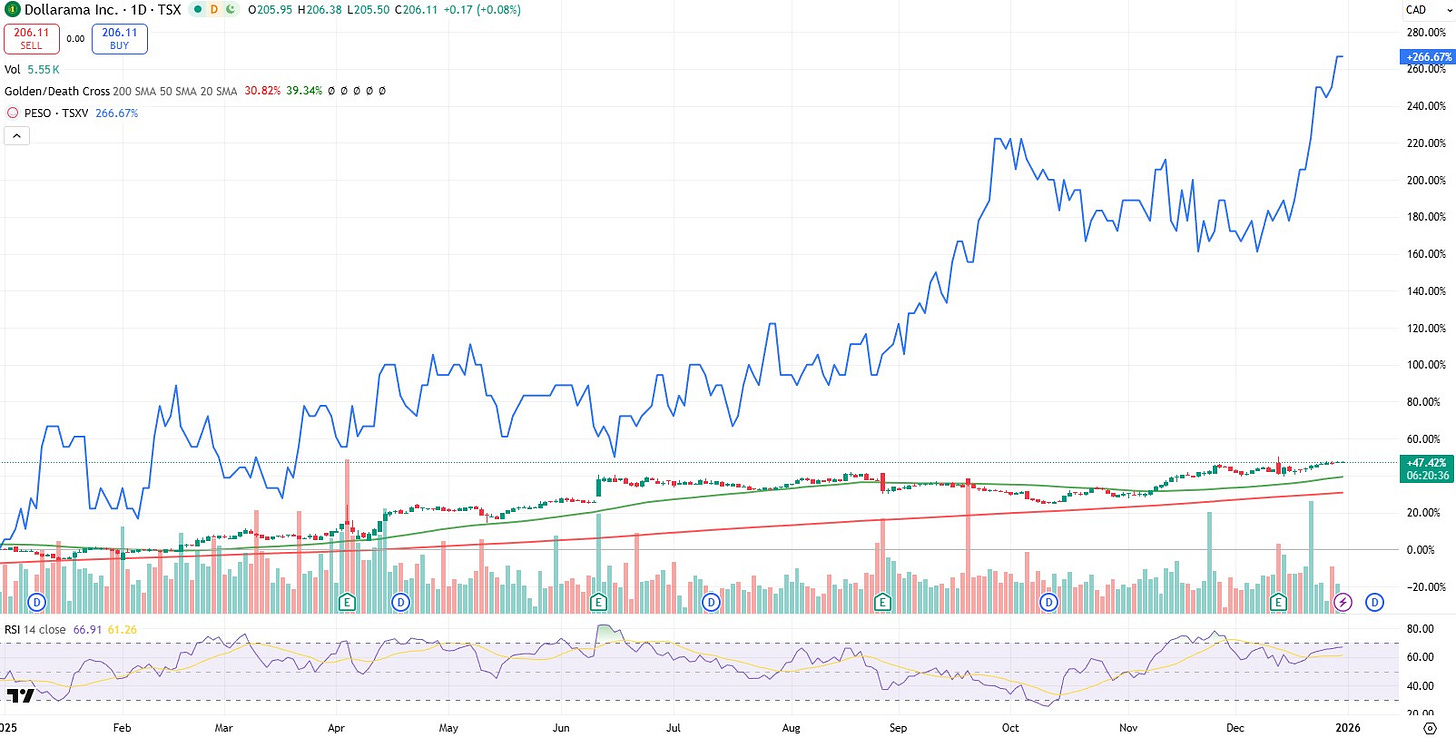

Dollarama is up an impressive 47% over the past year. PESO has significantly surpassed those returns delivering a 267% return over the same time span (both charted below).

PesoRama currently have 31 locations open (investor website says 28) with a goal of getting to 640 stores over the next five years. That is one heck of a target and if they ever achieved that, one would have to wonder what their current $52M market cap would look like then.

This will be my first ever deep dive into the company and I’ll be honest, my expectations are rather low going in. Since I was in Mexico earlier this month for my birthday this seemed appropriate. Let’s dive in and see if there is any birria on this bone.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

We get off to a poor start with a paltry looking current ratio of just 0.42. That consists of $700k in cash, $11M worth of inventory and $2.25M of other short term assets against a harrowing looking $33.3M in liabilities due over the next twelve months.

To be fair, $19.3M of those current liabilities is within a revolving loan. This revolving loan matures in June of 2026, and one would assume will be extended. But there is a lot to say about this loan and none of it positive for shareholders or those looking to be. Just reviewing note 8 within their financial statements solidified my hunch going in that I will never take PesoRama seriously as a potential investment.

The original structure of the loan (signed in June of ‘23) has a rate which is the greater of 13.5% or RBC’s prime rate plus 7.55%. Don’t let that RBC mention fool you. The loan is not with the Royal Bank of Canada, but with a company called Third Eye Blind Capital Corporation.

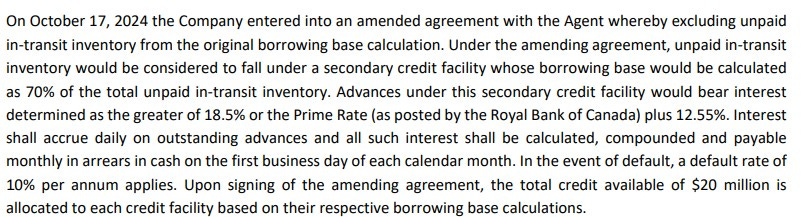

Those were just the original loan details. In October 2024, the loan agreement was amended as follows:

It obviously adds a lot of complexity and splits the credit facility into two parts with the new portion at an even higher rate of interest than the original. If you thought 13.5% was high, this one comes with 18.5% of interest. Now look at the interest calculation payment terms.

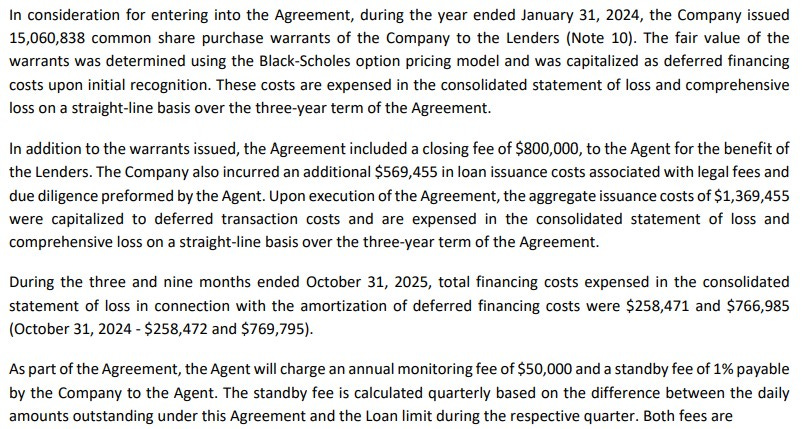

There’s more. As a token of appreciation for doing business with Third Eye, they were granted 15M warrants at 14 cents, paid them a closing fee of $800k, and covered Third Eye’s legal and due diligence fees of $569k. In addition to all of that, PESO will also pay Third Eye $50k + 1% of the loan balance as “monitoring and standby fees”.

That third eye apparently needs to be blind so you won’t see yourself getting fucked. While I don’t want to invest in PesoRama, I’ll surely be an investor in Third Eye Blind based on this.

So, let’s assume this loan gets extended in June pushing that loan into long term payables. Their revised current ratio still sits at just under 1.0 and with 79% of their current assets tied up in inventory, their liquidity looks terrible with a revised quick ratio of 0.15. Ouch.

It should come as little surprise then that the company raised $5M post financials with an equity financing at $0.25 a share with a half warrant at $0.40.

That still leaves a significant cash runway shortfall given their current balance sheet, so let’s hope the cash flow section provides some better news.

Cash Flow:

It does not.

PESO has burned $1.3M in cash through their first nine months, although that is a heck of an improvement over the $3.1M at the same stage last year.

So far this year the company has utilized $1.75M in asset purchases, received a net of $6.3M on an earlier raise, incurred $2.06M of additional debt, made $2.83M of interest payments and made lease payments of $2.3M.

Even with raising $6.3M earlier in the year, their cash at the end of Q3 was $695k, up 10% from where their fiscal year began.

Share Capital:

161.3M shares outstanding (including the post financial raise) which is 68% dilution in just the past nine months.

15.9M options outstanding. 11.4M at 23 cents currently ITM with 10.4M of those awarded this year.

Including the recent raise, 91.1M warrants outstanding with over 81M of them currently ITM. That would represent another 50% dilution if fully exercised.

4.3% insider ownership. More selling than buying in the open market including minor participation in recent raises

Implied float of 254M shares with ITM securities driving an implied MC of $82.5M

Income Statement:

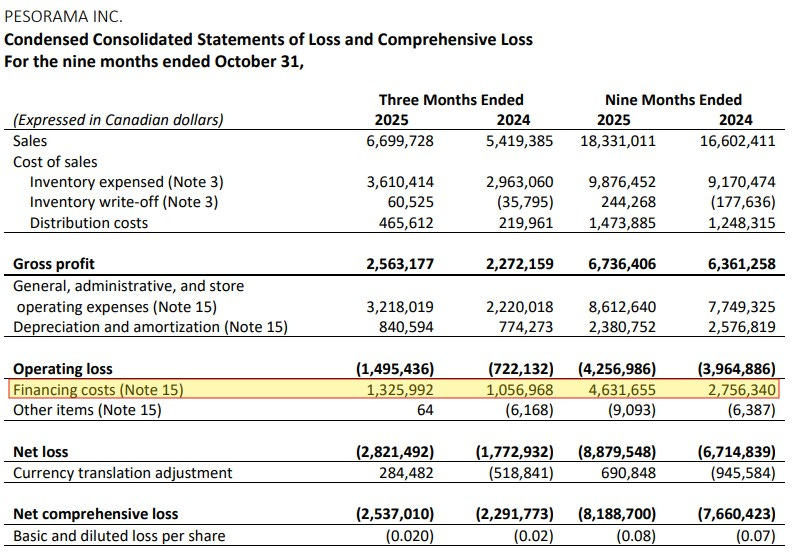

PesoRama had revenues of $6.7M in the third quarter, a 23.6% increase over the comparable time frame last year. They experienced 370 basis points of gross margin erosion in the quarter going from 41.9% to 38.2%, thereby only driving 12.8% more gross profit on those 23.6% more sales.

Their G&A and store operating expenses soared by 45% in Q3. Even without the non cash burning bogey in SBC expenses, Payroll grew by 16%, Management fees by 52%, Marketing by 42% and Professional fees by 83%, all significant higher than the 13% additional gross profit dollars generated showing significantly poor conversion.

That drove an operating loss of $1.5M which is more than double the operating loss in last years third quarter of $722k. After a 25% increase in financing costs below that line, their net loss swelled to $2.82M vs $1.77M.

YTD doesn’t paint a much better picture:

Revenues grew by 10% to $18.3M

Gross margin down 210 basis points to 36.2% with gross profit dollar growth of 5.9%

G&A and Store expenses grew at a higher rate than revenue and GP - 11.1%

Operating loss of $4.26M vs $3.96M

Financing costs of $4.63M vs $2.76M, up 68%

Net losses of $8.88M vs $6.7M worsening by 32%

Overall:

Do I really need to continue at this point. This is an abject disaster. The company has done $18.3M in revenue through nine months. If they doubled those sales they still would have lost $2.35M on the same margin and spending. The problem with that is they wouldn’t be able to maintain that level of spending on double the revenues.

The one line highlighted above is the company’s biggest hurdle, and the interest rates of 13.5% and 18.5% are a massive anchor around the company’s neck. Who knows what costs they will need to endure when the current loan matures.

It would be one thing if the company was generating operational cash flow, but they are burning $400k per quarter, and their liquidity looks terrible even with the $5M raise post financials. That raise also highlights the terrible float management with 68% dilution YTD with 92M more options and warrants currently ITM.

The company also has current litigation with a former CEO, former CFO and six additional employees. They only have 31 stores FFS!

These guys are not the Mexican version of Dollarama.

They have done some paid promo (find it on your own as I don’t link paid promo interviews), but other than that, I’m not sure where this recent retail share holder interest is coming from. I think they’re out of their god damn mind to be blunt.

One very generous star since it’s my first coverage (probably my last too). What a terrible way to end my 2025 reviews.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Never heard of this company till now. Will do my best to forget it.

Golly jeepers wolf lol....I,ll keep reminding myself that the cartel won't let this fail and gamble my 1000$..

Happy new year sir !