Busy night after hours Wednesday evening with three stocks I follow very closely reporting last night, ROMJ and DBO being the others.

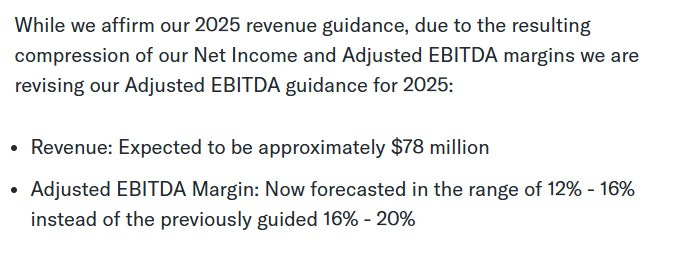

This one by far looked to be the most disappointing. The numbers didn’t look horrible themselves, but we saw the two most troubling words in an earnings release - “lowered guidance”.

A wise Vice President I worked for in my younger days had this motto:

They have failed in that regard.

So this 2024 Wolf pick selected at 3 cents (pre split) that nearly went 20x has now lost nearly half of it’s value since the end of May.

The market punished them severely down 16% yesterday as a result and it was much worse than that after the opening bell. Let’s dive in and see how bad it is.

Balance Sheet:

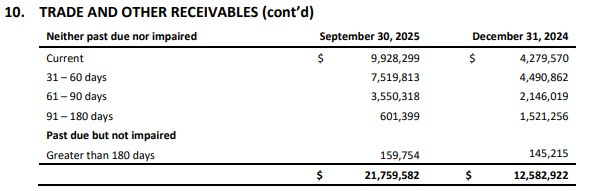

An improving current ratio of 3.1 vs 2.3 at the beginning of the fiscal year but that doesn’t mean liquidity has improved. At the end of the quarter, NCI had $6.6M in cash, a whopping $30.6M of receivables and $600k of prepaid expenses over top of $12.1M of liabilities due over the next twelve months.

I feel like I have discussed the company’s A/R ad nauseum, questioned the company’s payment terms and highlighted the risk of those policies into potentially unnecessary raises of capital. A situation that came true early in Q3.

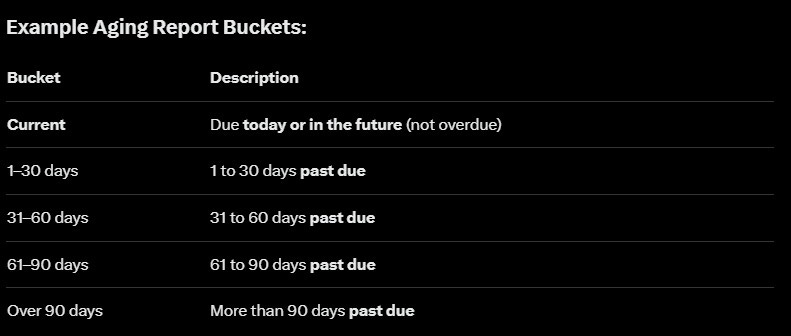

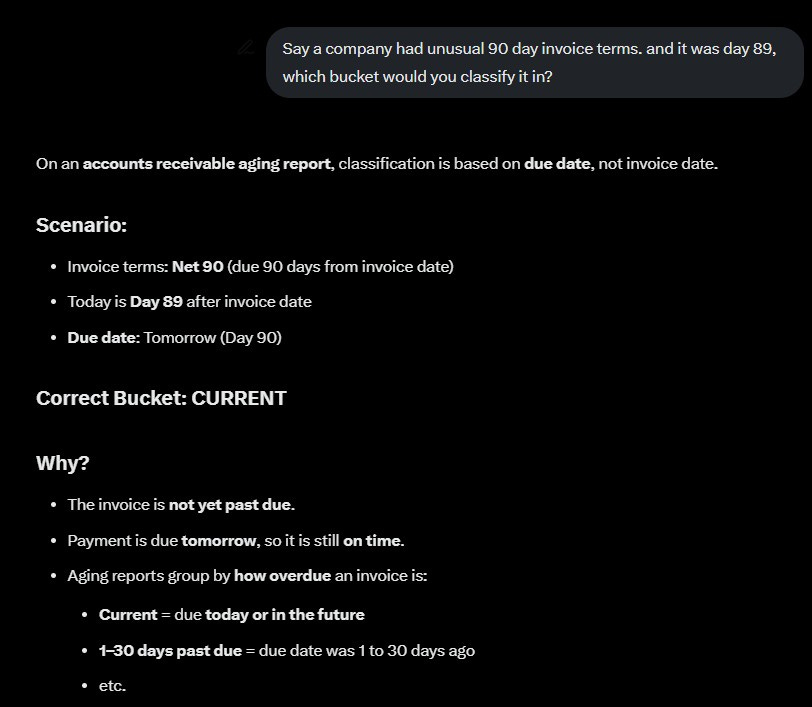

The formatting of their aging report doesn’t exactly due it for me either. If you have 180 day terms and there is a figure in 91-180 days that you deem as neither past due nor impaired, it should be in the “current” bucket.

To confirm I wasn’t crazy, and perhaps to make it easier to explain to readers, I asked AI:

Let’s move on. I think everyone gets the idea and the subject annoys me.

Cash Flow:

The result of the above has resulted in $5.65M of operational cash burn YTD compared to $1.6M of positive OCF a year ago and $3.36M of that burn occurred in the most recent quarter. While the company is net income positive the time span for getting paid the end result is $13.75M of working capital adjustments in receivables causing the negative flow.

The company has raised nearly $10.1M of capital YTD, mainly from their $8.9M raise in July. Note that was at $2.20, a long way from where the stock trades today for those who participated in the LIFE offering. In addition, NCI paid down their debt by nearly $1M and utilized $1.2M in asset purchases.

Overall the company has increased their cash position by 33%.

Share Capital:

47.4M shares outstanding, 12% dilution over the year. Approx three quarters of that due to the LIFE offering the balance from warrants and options

3.3M options outstanding, 3.1M of which are ITM but none expiring within the next twelve months

4.1M warrants, went from all ITM at the end of May to all out of the money today

Insider ownership at 36% (per Yahoo finance). No insider activity on the open market worthy of discussion

Income Statement:

Driving revenue has not been an issue for NTG Clarity and that continued in Q3 with $20.9M generated, 42% higher than last year. Through three quarters revenue stands at $59.4M, a 53% increase over where they stood through last year at this stage. Margins were softer in the quarter at 34.8% comparted to 37.5% and on a YTD basis are 90 basis points lower at 35.6%.

NTG’s year over year issues of course stem from 77% higher operational spending in the quarter and 107% more on a YTD basis.

On the bottom line, even despite the very large increases in opex, their Net Income before taxes is marginally better than last year in both the quarter ($2.39M vs $2.02M) and on a YTD basis ($6.89M vs $6.52M). Unfortunately the company has a $2.6M tax burden which they did not have last year so their YTD comprehensive income is $4.4M vs $6.9M.

Overall:

In large part, much of the above results were somewhat expected. The killer for yesterday’s share price performance stems from their revised profitability guidance - at least how I perceive it.

I’m a little confused with some of the company’s rationale. If the investments they made in people to drive revenue hasn’t paid off yet with some deal decisions being pushed back, confirming the annual revenue guidance doesn’t really jive. It sounds like they have gone over budget on their opex to me.

Even with all of the problems in these numbers YTD, it currently trades attractively at a 9 P/E and under 5 EV/EBITDA. It comes down to investors belief in improvements into 2026 and beyond.

There are plenty of reasons to be bullish, but we do live in a what have you done for me lately society, and even the biggest bull has concur that they haven’t done much. Tack on the cash flow issues related to their A/R, and as long as that is an ongoing problem, it’s just not going to garner the type of multiples many investors think it deserves.

Back to back downgrades. 3 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Good review. Reaction seems exaggerated given valuation. Even if margins are 15% (vs 20%), profitable company with 40% topline growth at 9x p/e seems pretty good to me.

I honestly don't have an opinion of this company, so I'll just say thanks for the review, Wolf.