What a ride NTG has been since announcing the company as a 2024 WolfPick longshot about 11 months ago. Are you still riding it, or has it bucked you off yet?

Chosen at 15 cents (3 cents pre split) the stock peaked at $1.95 back at the end of August for a thirteen bagger! The stock got too hot and of course pulled back, and the company killed the momentum altogether with their raise at $1.40 in September. Even with all of that the stock is still up 780% from the annual pick.

Full disclosure, I do hold a position with approximately a 21 cent average.

Balance Sheet:

NTG’s current ratio when I picked it as a longshot pick for this year was at a woeful .69. It now sits at a very healthy 1.8 that consists of $5.35M in cash, $16.1M of receivables and $300k of prepaids against $12M of liabilities due over the next year. With cash making up 25% of their current assets and not accounting for half of their payables, liquidity still isn’t their strong suit, but thanks in large part to their capital raise and massive YTD growth, this looks miles better than it did compared to last year.

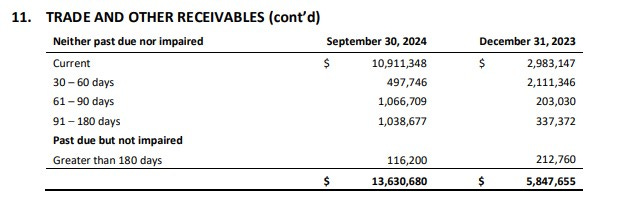

We can’t talk about their balance sheet without diving into their A/R.

There is actually some continued improvement when you dig in here. Trade receivables are 30% higher than they were last quarter, but this occurred in a quarter where they smashed revenue by over 100%. Aging has also improved since last quarter. Current receivables went from 60% last quarter to 80% this quarter and as of these financials do not anticipate taking any impairments.

NTG has $6.1M of debt, owed to the two leaders of the company.

Cash Flow:

$1.6M of operational cash flow YTD and $600k in this third quarter, both down to last year due to working capital changes and the main culprit is no surprise, the accounts receivables, delivering a $9.7M bogey. When revenue is going gangbusters like it is, this unfortunately can be the impact, and it may actually take a softer quarter on the top line before this balances out. As long as their aging continues to improve and experience no impairments, investors should continue to see some improvements. Perhaps in Q4, as they state a record amount of receivables in October of $7.2M.

YTD, they have paid down $640k of debt, paid $244k in interest charges and received $5.1M through their LIFE offering and exercise of options. They also utilized $700k in purchasing of hard assets.

Overall their cash position has grown by $5M from the beginning of the year and while their balance sheet isn’t the best I’ve ever seen, it’s the best I’ve ever seen theirs look.

Share Capital:

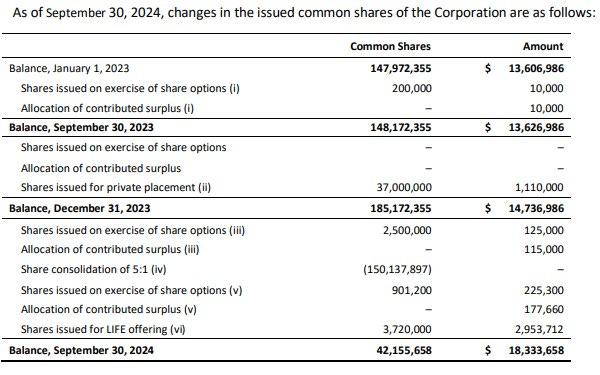

42.1M shares outstanding with 14% dilution since the beginning of the year mainly due to their LIFE offering (shame on the company for not restating last years share count)

4M options outstanding, all but 120k currently ITM but none expiring for over two years.

$2.1M warrants, none ITM at $2 expiring in two years

40% insider ownership. No recent insider buying, but recent selling to free up cash to exercise options

Income Statement:

A barn burner on the top line, 109% up from the comparable quarter last year to $14.7M. All that extra revenue did come at the expense of some margin rate, with gross profit coming in at 38.4%, more than 500 basis points less that the 44% they delivered last year. YTD margin is at 37.5%, off by 230 basis points (39.8%). So on 109% more revenue, they delivered 83% more gross profit dollars, a lost margin opportunity of $820k, but that is getting a little nit picky. I’m very impressed with one of the areas I was concerned with coming into these financials - their operational cash burning expenses. Their Marketing and G&A costs only rose by 39% in the quarter while delivering more than double the revenue and 83% more margin dollars. This is excellent conversion, (not as great as Q2 - 10%), but still very exciting to see considering they are expanding their operations.

At the bottom line they delivered $2.02M in net income, almost 14 cents for every dollar in revenue. YTD now sits at $6.52M in net income, 153% better than what they achieved last year.

Overall:

The beat most of my expectations coming into this quarter, and so far the market is rewarding them for it at 11 a.m. EST, up 11% on the day.

They now sit at $47.1M TTM revenue with 2024 guidance of $55M, meaning they are expecting a $16M Q4 which would be another double to last year. With that level of revenue and based on trend I put them at about $8.7M of net income for their fiscal year. So from a valuation perspective on the $53M intraday MC, it is still trading under a 1 MC/Sales ratio for a company producing 15% net income, with a P/E ratio around 6, and an EV/EBITDA ratio around 4. Understandably, investors will discount it due to the A/R, cash flow, some related party debt, and where on the globe their revenue comes from. But even after all that, I still see value here and I’m holding on tight for better returns.

For those same discounting reasons, holding my 3.5 star rating so the consecutive upgrade streak will stop at two.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.