It’s not often that you get to review two of your twelve baggers in the same week, but here we are with Happy Belly Food Group occurring earlier in the week and today we get to look at NTG Clarity which dropped their financials Thursday after close.

I wasn’t feeling great about this quarter. I had this to say in my August “What’s Wolf Watching” article two weeks ago:

Well, it played out much like that. Revenue was up 51%, operating expenses were $4.5M and investors did not react kindly to the results indeed with the stock dropping by 15% and was as low as 23% in early trading. While I wasn’t thinking about adding pre financials, I did take the opportunity to add some at session lows yesterday. Let’s get into why and review their numbers in more detail.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

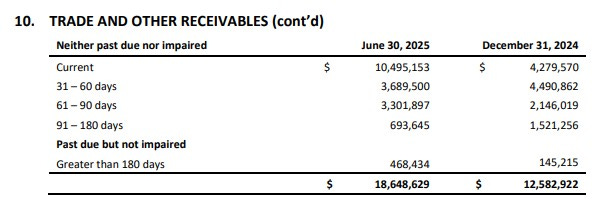

I feel like a bit of a broken record each quarter when I talk about NCI’s balance sheet. Continually improving ratios but one who’s liquidity continues to be questionable. At the end of Q2, NCI had a current ratio of 2.5 (2.3 at prior year end) that consisted of $2.2M in revenue, $23.3M in receivables and $900k in other short term assets over top of $10.7M in liabilities due over the next twelve months. Once again current ratio is more than adequate for a microcap of this size, but their A/R is up by 38% from their 2024 year end numbers and accounts for 88% of their current assets. Not ideal.

While their A/R and more specifically their terms has always been a sore spot for me, their aging report does look better than it has recently with 56% being current compared to just 34% at their year end. Past due amounts are also relatively low and un-concerning. The company has also taken no A/R write offs in the last year and a half.

But when you allow your customers up to six months to pay their bills (30-180 terms), you incur a lot of expenses during that time frame which has a very negative impact on cash flows. This can result in dipping into debt through lines of credit, or in NCI’s case, entering into dilutive financing which occurred slightly after their Q2 ended. Let’s use that as a segue into their cash flow sitch.

Cash Flow:

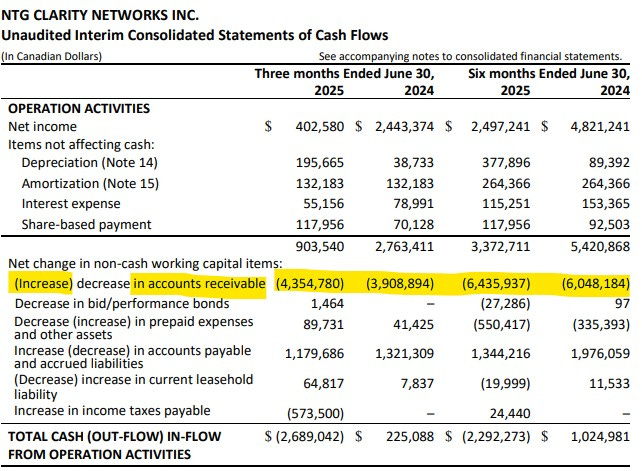

Through six months, NCI burned through $2.3M in operational cash flow (OCF) compared to $1M of positive OCF generation at the same time last year.

As you may have guessed, the main culprit is working capital adjustments due to the growth in receivables.

Note, I will have an educational article as part of my Scholastic Series coming soon on managing cash flow for paid subscribers as soon as this busy earning season slows down.

In the company’s defense, this is the company’s SIXTH straight quarter with revenue growth of greater than 50% and four of those have exceeded 90%. Therefore it is natural to expect growth of A/R and timing differences of cash inflows. I just have not yet had a great explanation on why the company’s terms are so vastly outside of the norm which exacerbates the issue. Breath, let’s move on.

Outside of operations the company invested $460k in assets, paid down nearly $500k worth of debt and received $820k from warrants and options. Overall their cash position depleted by 55% from where they began the year.

As mentioned, post financials the company raised $9M through a LIFE financing that closed in mid-July. The raise was done at $2.20 with a half warrant at $2.95. Unfortunately the raise was also done as a 6&6 LIFE deal - 6% commission and 6% in warrants and done through microcap bottom feeder, Cannacord. Based on what the company has accomplished in the past 18 months, they really should have been able to secure a better deal IMO. Participants in that offering are down 17% as of yesterday’s close.

Share Capital:

43.1M shares outstanding (as of June 30) with 15% dilution over the past year

3.5M options, all ITM, none expiring for a year and a half

1.86M warrants expiring in Sept 2026 at a deuce.

Insider ownership at 36% (per Yahoo finance)

No insider buying of late, but some selling to free up funds for option exercises.

Income Statement:

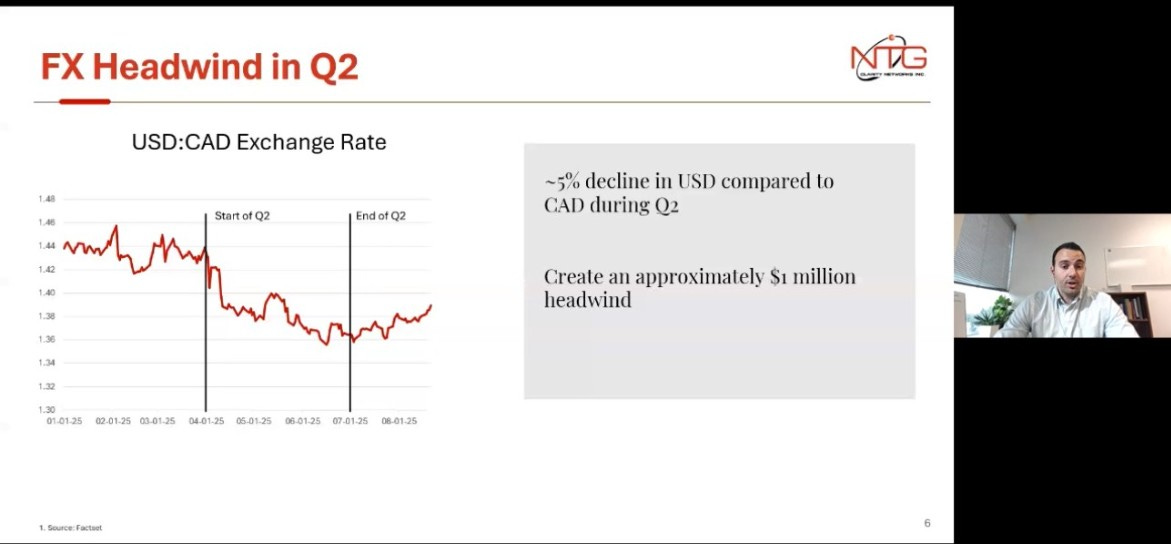

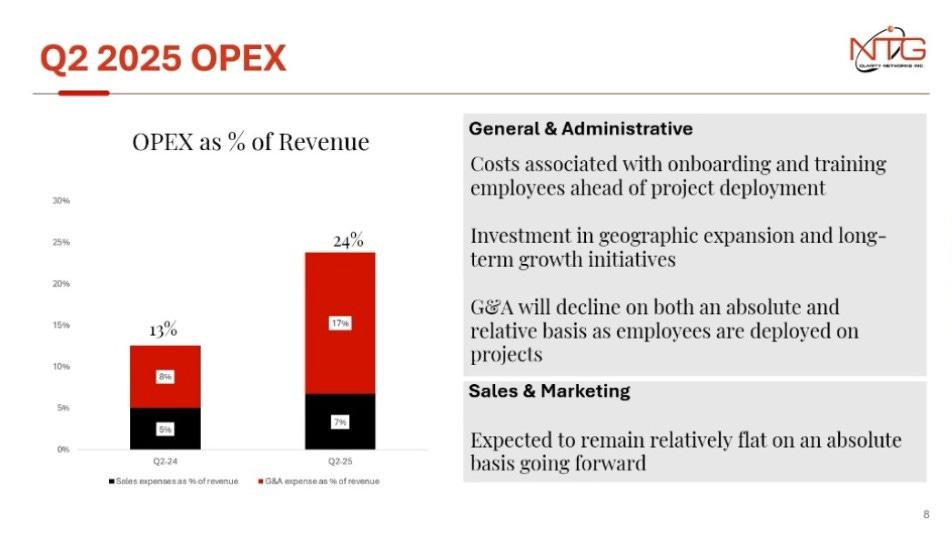

Top line as we have come to expect was solid, just eclipsing my 50% target at $18.9M in revenue, 51% better than the $12.5M in the comparable quarter. Gross profit also improved by 380 basis points to 37.9% and that resulted in 68% more gross profit dollars. Expenses, as expected continued to ramp up with a doubling of Selling and Marketing costs and tripling of their G&A expenses. What was not expected was a nearly $1.2M hit in foreign exchange, over $1M worse than last year.

Tack on an additional tax burden of $860k over last year and net income shrunk to $464k vs $2.47M - a $2M worse effort on the bottom line vs a year ago on 51% more business.

YTD numbers tell a similar story:

Total revenue of $38.6M, up 59%.

60% improvement in GP dollars

Expenses up 103%

$774k & $2M bogeys in foreign exchange and income taxes respectively

Net income off last year by $2.3M ($2.5M vs $4.8M)

Overall:

I had a lot of folks asking why I wasn’t calling out a buy zone leading into their Q2 and I think that rationale should now be quite clear.

While the results are disappointing, that level of disappointment will likely be related to your engagement with what the company has told us, and what they said they were going to do in 2025. Increased spending to fund future growth was the plan this year and forecasted within their guidance.

The best part of yesterday was their earnings call. They talked about their misses, the respective rationale and how the company planned on moving forward. It’s called accountability and a massive contrast to what you would have heard from a company like Trubar’s call which I talked about in their review a couple of days ago.

I’d share a link but I don’t think they have released the recording yet. A transcript is available in the Wolf Den discord but I will share some of the slides here.

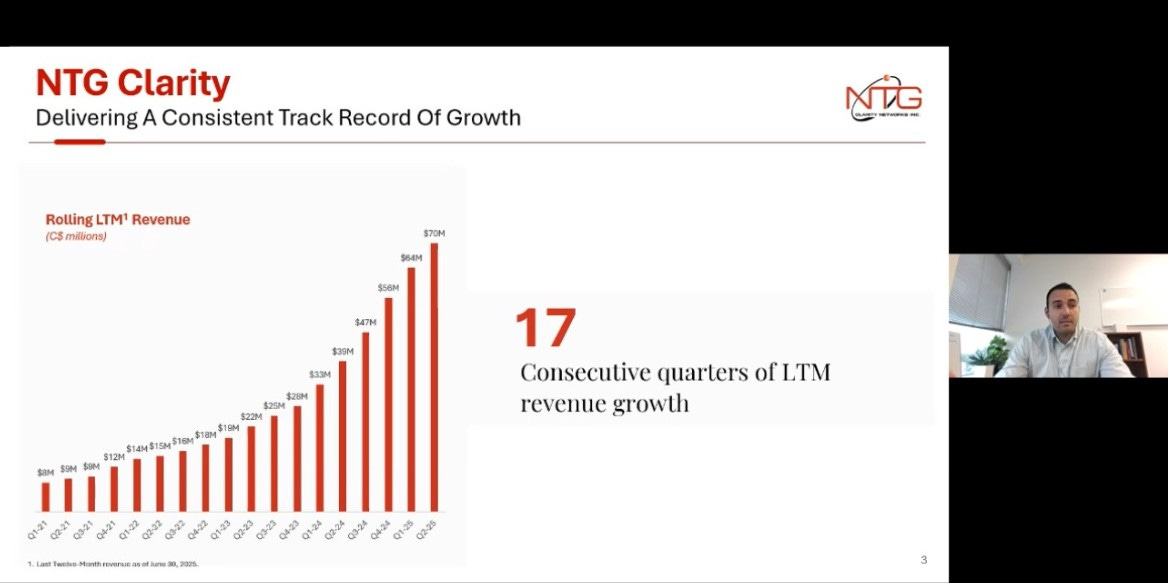

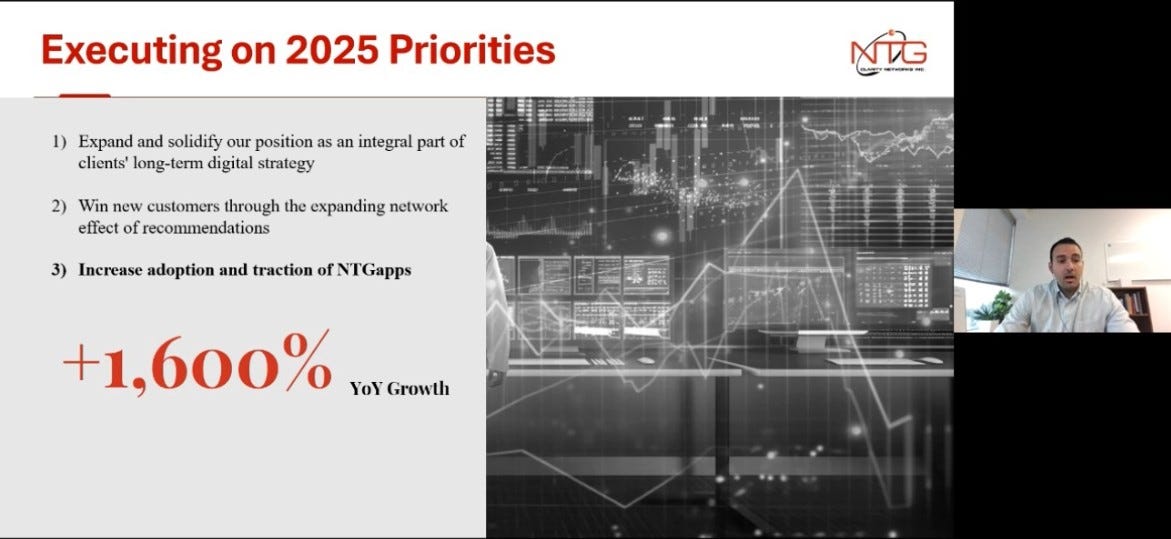

They first touched on their tremendous growth path which is not surprising to anyone following the story. The NTG apps on the other hand is becoming a much more meaningful story, up 1600% from last year. This is not only expected to continue but as this part of the business segment grows, it will also continue to gain in market as, more in line with SaaS type margins which will improve the overall margin of their total business.

Next, they addressed their shortcomings head on. First. something out of their control, a big whack in foreign exchange and not related to the Saudi Riyal, but the overall recent weakness in the US greenback.

What was in their control was their operating expenses. Much of that increase in G&A was related to onboarding new staff that are in the process of being deployed in the field to help support their revenue growth.

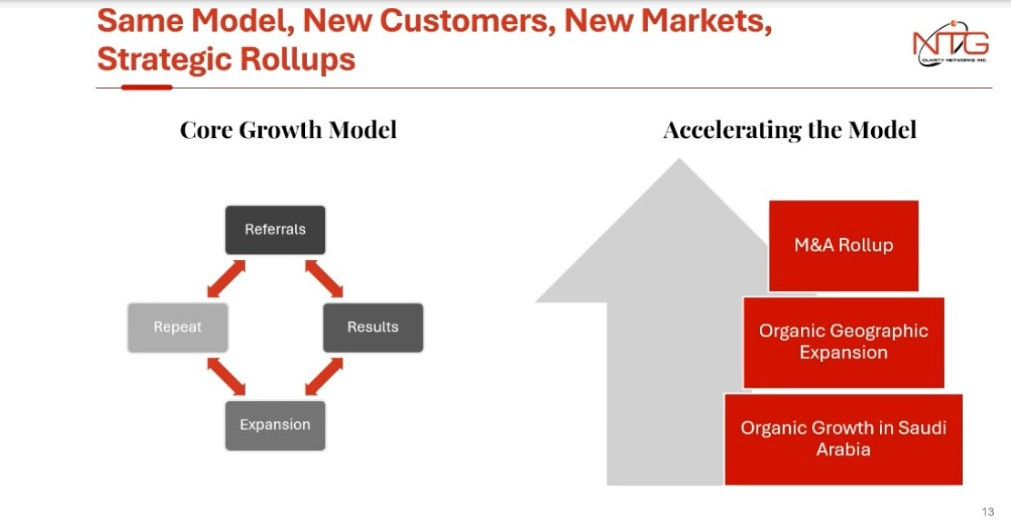

They also touched on growth initiatives including geographic expansion into other areas of the Middle East and potential M&A opportunities, although that part was extremely vague.

Perhaps most importantly was their guidance which was re-confirmed on the call, adn they still have a backlog in excess of $100M. While I would much prefer a better profitability metric than Adjusted EBITDA, it was very encouraging that the full year guidance remained as it was from the start of the year.

Disappointing quarter? Yes, and as mentioned the level of that proportionate to your expectations I suppose. Outside of the foreign exchange I was only surprised by G&A coming in higher than Q1.

Far from perfect here with a lot of pros and cons for investors to weigh. Still a strong hold for me.

As always, beware of irrelevant analyst coverage, like the $3.25 target set by Cannacord the sole beneficiary of that 6&6 deal I mentioned earlier.

Downgrade worthy, despite the bullishness for the long term. 3.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

thanks for the honest review as usual Wolf. as for the earnings call recording- if found that yahoo.finance already had it (only audio) within a few hours from the actual meeting.

cheers

Thanks for the review, Wolf. Wish I had gotten in earlier on this company.