I no longer hold a position in this 2023 Wolf Pick. I keep threatening to stop reviewing the company but I continue to get sucked in to doing so from subscribers. After their 2024 annuals in April, I awarded them an upgrade. While that was only up to three stars this consolidator appeared to be on the verge of finally making some strides within their opex - something I’ve been on them about for years, or at least it feels that way.

I also wrote about the company in my most recent “WWW - What’s Wolf Watching” article. I surmised that if they were able to deliver a similar net income as their very solid Q4, it could create a narrow buy zone opportunity. Based on previous disappointments I was not inclined to throw some of my own investing dollars their way, and it appears that was wise. The stock dipped on the earnings release by as much as 20% but did recover much of that decline by the end of the week.

Not only did NowVertical not achieve similar profitability as their previous quarter, they experienced a net loss. I have yet to dig into the details, but that is about to change. Let’s find out what happened.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

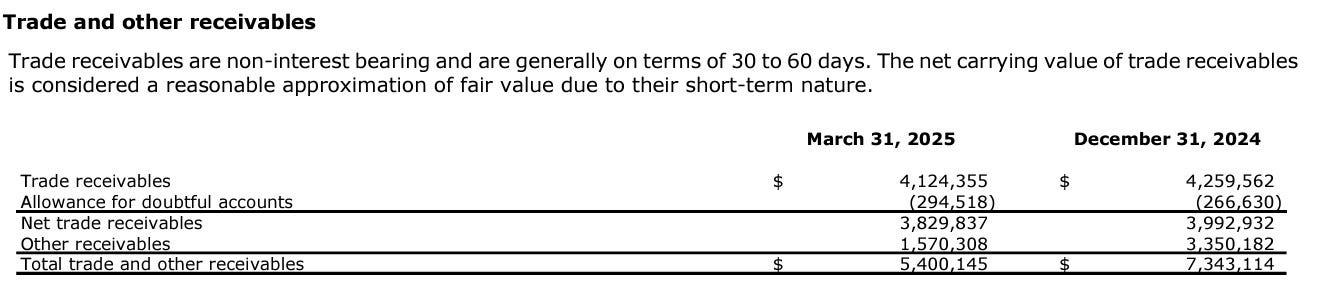

Last quarter I generously referred to their balance sheet as “looking like ass”, and after their first quarter of 2025, not much has changed. NOW has a weak current ratio of .76 which consists of $3.6M in cash, $5.4M in trade receivables, $7.5M in unbilled work, $1.3M in taxes receivables and $1.2M in other short term assets overtop of a daunting looking $25.2M in liabilities due over the course of the next twelve months.

The company does not provide a lot of detail surrounding their receivables, but 7% of their trade receivables are classified as doubtful and $1.57M within a generic “other” bucket. They also have another $7.5M in unbilled which raises an eyebrow.

On the current liabilities side, they have $3.3M in non cash burning convertible debentures and I would guess a good portion of the $2.6M in considerations payable will likely be paid out in the form of equity. But if you just take their A/P, accrued expenses and taxes payables, that amounts to nearly $15M due over the next twelve months and they sit with $3.6M in cash and their receivables aren’t enough to overcome that deficit. That deficit does not include the current portion of their debt, which is a combination of six different small loans.

NowVertical also has $10M of long term commitments relating to those loans and deferred taxes.

Let’s hope their cash flow section looks more promising.

Cash Flow:

Nope. The company burned $1.7M of operational cash flow during Q1 compared to generating $533k a year ago. Much of the reason for the variation comes from working capital adjustments. Most notably a $2.3M increase within unbilled receivables. Why they would have such a significant amount of $7.5M of unbilled is unknown as is the increase of it by 43%. What is known is it is very unfriendly to a cash flow statement, particularly when a company has quite the illiquid balance sheet as NowVertical does.

NOW received their final payment for the sale of Affinio for $2.2M and another $233k for Allegiant. They also disposed of $1.6M worth of investments leaving under $350k. After paying down $630k of debt in the quarter, their cash position improved by just over $1M from their recent year end.

The company no longer has large sums of future influxes of cash from selling off portions of their business and they sold off 80% of their investments in Q1, presumably to pay some bills and debt payments.

With the state the balance sheet has been in, I don’t believe a raise of capital through dilutionary measures or adding to their debt can be ruled out. Watch this space.

Share Capital:

96.4M shares outstanding, a considerable 10.2% worth of dilution in the quarter alone. The vast majority of which was a result of paying out considerations for the past acquisitions of Acrotrend and CoreBI. YoY, the float is up by 24%

4.4M options outstanding with none expiring for 6 or more years

2.2M RSU’s including 750k within the quarter

9.6M warrants at 80 cents expiring next February and 1.6M at $1.05 expiring this October

$3.3M of convertible debentures maturing in October at a conversion price of $1.05. If a raise is done prior to then it would impact the conversion price. Hmmm

$3.5M of future considerations payable and I would guess a considerable portion of that would be settled in shares.

31% insider ownership (per YF) with the former CEO continuing to be the company’s largest shareholder

Multiple insiders have made open market buys so far in 2025

Fully diluted float in the neighbourhood of 117M shares and that doesn’t account for contingent considerations on acquisitions

Income Statement:

As expected, total revenues fell by 20% in the quarter to $10.37M vs $12.95M in the comparable quarter. Due to the sale of Allegiant these numbers are non comp. Once the Allegiant numbers are removed revenues came in at $10.4 vs $8.4M, a pretty impressive 23% improvement on the top line. Gross profit also improved by 460 basis points to 49.6% in Q1.

With the assistance of the non comparable sales data, they were able to reduce operational spending by 38%, so income from operations look rather healthy at $1.5M compared to $202k last year. Unfortunately after one time items, interest on their debt and a higher tax burden, the company still experienced a net loss of $700k, more than halving their loss of $1.51M last year.

Overall:

After just reviewing the highlights, I think I was expecting to be more disappointed but for NowVertical bulls there are some encouraging numbers in here. Admin expenses were reduced again from 44.8% as a percentage of revenue down to 34.7% this quarter. That is up fairly substantially from the 27% in Q4 of last year. This also includes nearly a half million in foreign exchange losses in Q1.

But a net loss is a net loss and there are lots of remaining question marks around their liquidity and cash flow.

The company now trades at just shy of 1x of revenue with a 6 EV/EBITDA and a 15 P/E. Their next quarter looks tough with 81% of their TTM net income achieved in Q2 of 2024. For that reason, it looks like a ticker to avoid until those earnings are released in August.

Reluctantly maintaining three stars. Not sure if the balance sheet and cash flow still warrant it with potential dangers ahead in Q2.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Revenues are inflated with future income on subscriptions for few years out that cant be billed. Lots of future income that was pushed into the q1 without cost on thoes future incomes. So we have nice revenues and net income with lots of improvement on cost vs revenues but no cash flow thatcan be billed. Pure manipulation.

I have no interest in this company, but thanks for the review anyway!