Just when I think I’m out, they pull me back in. I’m talking about my subscribers here and not the company itself with review requests. The company and myself have gone through some things and even though I’ve declared this stock “dead to me” on multiple occassions, here I sit. The attempt to review this stock without bias will be a challenge - just putting that out there.

Going way back to late 2022, I chose NowVertical as one of my 2023 picks. That marriage never plateaued to a satisfactory consummation as I downgraded and exited the stock shortly thereafter. I’ve had arguments with past CEO’s, removed their IR people from discords and completed bunch of mediocre reviews in between. It has been a bit of a revolving door in the leadership chair and as you can see from the chart over the last few years, the market is still trying to decide if they like it or not.

My latest review did show some encouraging signs with an upgrade in large part due to their ability to cut cash burning expenses but there were still lots of warts to go around. The stock has gone 7x from their low of eight cents just before their Q3 dropped. Was that incremental improvement deserving of that much of a leap and the current $53M CAD market cap?

I’m starting to have some regrets already, so let’s get through this.

(All amounts in USD unless otherwise stated)

Balance Sheet:

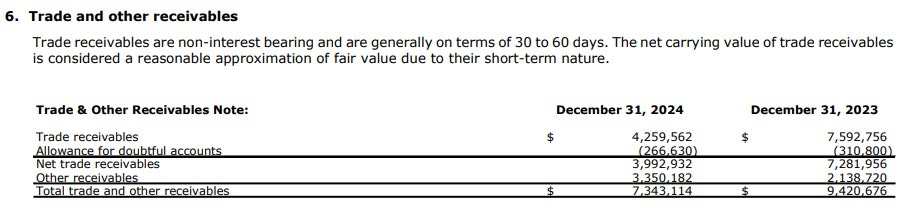

NOW’s balance sheet has historically looked like ass and today it’s not a lot different with a current ratio of .75 and that is with deferred revenue removed from current liabilities. That is the same ratio the company was at six months ago but improved from the .55 about a year ago. They currently sit with $2.6M in cash, $2M in investments, $7.3M in receivables, a surprisingly high $5.2M in unbilled and $2.9M in other current assets over top of nearly $27M in liabilities due over the course of their 2025 fiscal year.

The company’s note six regarding their A/R is not very helpful. $5.2M in unbilled revenue feels odd as represents 48% of the revenue in the quarter leading you to believe that they had a late December sales push to pull the quarter out.

Aiding their liquidity issues is that some of their current liabilities will be settled in the form of equity, including $3.2M of convertible debentures, scheduled to convert at an unflattering $1.05 per share in early October (stay tuned to see if this is renegotiated). Post financials, the $1.4M in equity consideration was settled for 5.4M shares for the Core BI acquisition.

NOW has reduced their long term debt to $8M from $12.6M a year ago. That total makes up six separate loans and the majority of that remaining $8M will be settled equally over the next four years.

Cash Flow:

In years past, NowVertical has been a cash burning pig to put it mildly, but in 2024 were able to deliver $2.8M in operational cash flow which is a staggering improvement from burning $5.4M in 2023. There were a heck of a lot of working capital adjustments which took their OCF from a negative $500k to a positive $2.8M in the last quarter so I’m not ready to call them a cash producing juggernaut just yet, but nonetheless the transformation cannot be ignored.

Also occurring during the year was receipt of $7.5M for the sale of Allegiant, they paid out $3.6M in consideration for past acquisitions, invested $1.5M, and reduced their long term debt by $5.5M.

Overall the company finished the year with $200k or 7% less cash then they began the year with. Fairly successful overall, but the pockets will still remain tight through 2025 given the weak liquidity of their balance sheet and no more big assets to sell.

Share Capital:

87.3M shares outstanding experiencing 12.2% dilution during the fiscal year

4.35M options outstanding including 1.4M awarded at 20 cents and 2.77M forfeited at 66 cents - none expiring within six years

1.4M RSU’s awarded during the year

No warrant table provided but it would seem there are 9.6M at 80 cents expiring in Feb 2026 and 3.6M at $1.05 expiring in October of this year.

Post financials added 5.4M shares for the equity settlement ($1.4M) for CoreBI

Post financials added 3.4M shares to settle $750k of debt related to the Acrotrend acquisition

750k awards to the CEO post financials

Current accurate share count around 97M outstanding shares

Former CEO is still the largest shareholder with 14.3M shares

27% Management ownership and insiders have been buying shares in the open market - a welcome change to long term retail holders. I’ll have more to say on this later.

Income Statement:

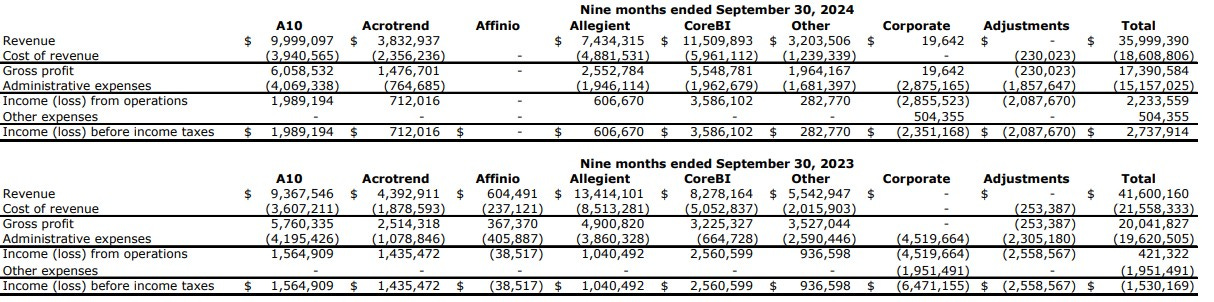

The overall P&L in terms of comparisons are tough with the sale of Affinio and Allegiant impacting last years numbers, and the fact that the company absolutely shit the bed in the final quarter of last year. So I’ll try to keep it limited to the numbers I think matter.

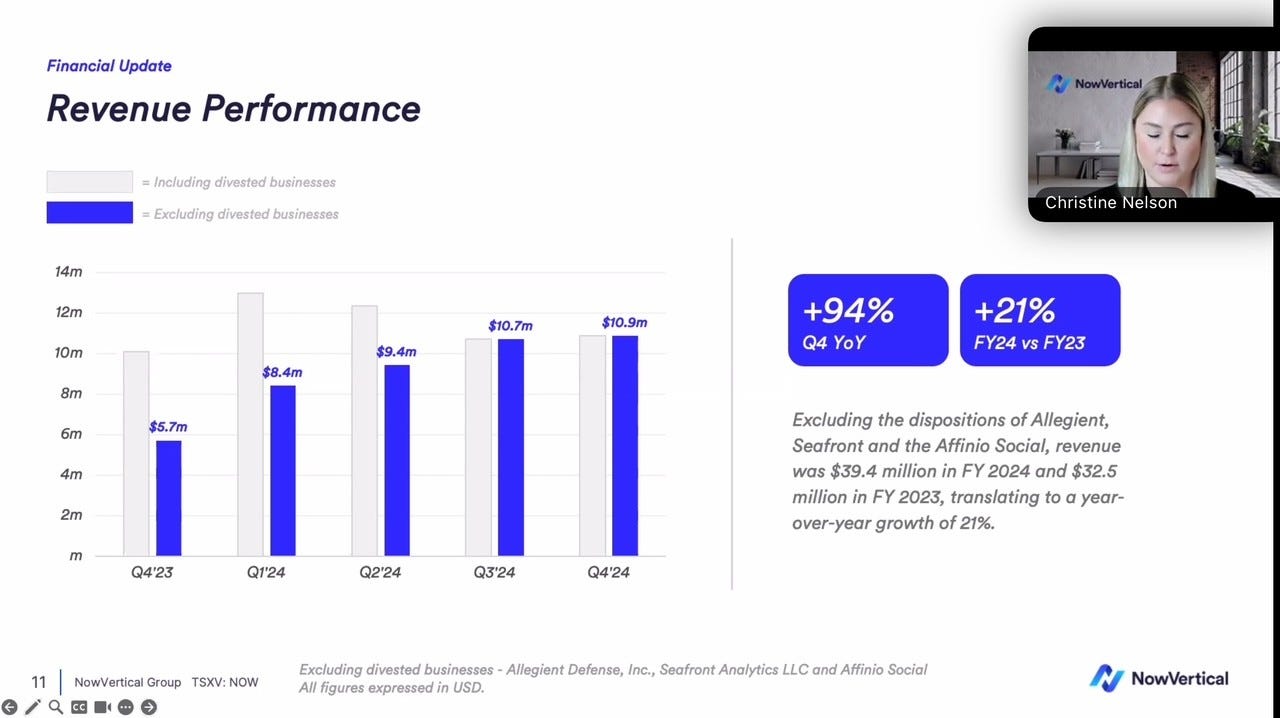

Overall NOW produced $46.9M in revenue and 49.2% gross profit, relatively comparable to the non comparable businesses they were up against a year ago of 49.7%. Did you follow that last sentence ok?

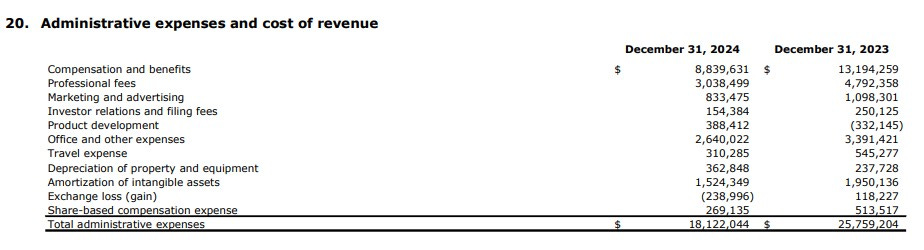

The biggest change within the P&L was within their operating expenses, taking out close to $7.5M. More impressively, this isn’t a case of PowerPoint sleight of hand with a serious reduction in SBC or other non cash burning expenses. The vast majority of the improvements in here are from the grunt work necessary to make a roll up story a successful one.

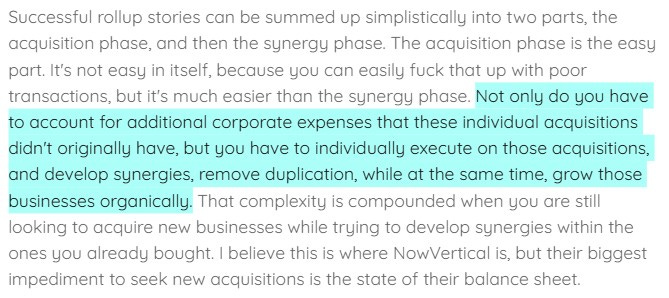

Let’s get romantic and sentimental and look back at a paragraph from a review I completed about two years ago when the company was not in great shape.

The highlighted section is what NowVertical could not achieve under previous leadership. It is why I gave up on them a long time ago, and is why I’ve deemed this stock as “dead to me”. Not only has new leadership started to execute on this, but they did it in a relatively short amount of time.

Income from operations was $4.9M vs losing $65k last year and after a bunch of one time items and taxes, delivered $1.6M in net income vs a loss of $5.9M in 2023.

Overall:

Let me first touch on this conference call, as it should be watched by the vast majority of other company’s on the Venture exchange, and probably many on the TSX as well. It’s the difference between listening to a sales leader as opposed to the snooze-fest of someone in Ops. I know Sandeep can deliver a great elevator speech. The CFO is also top notch with one of the better explanations of the numbers and analytics I’ve seen in a while. (ZOMD? - paying attention). I notice she is still listed as the “Interim” CFO - it’s been fifteen months I believe, so make this right Sandeep.

Going forward we are going to see more comparable numbers which will assist in an apples to apples progress measurements.

Here are a few things I don’t care for.

Integration. While this may sound great internally, where they can throw around some other corporate buzzwords like “Sustainability” and “Best in Class”, this is a loss for retail investors who lose visibility to segmented reporting, which is useful as it can assist retail investors identify strong and weak spots.

One of those weak spots was Acrotrend which after three quarters this year was down 13% on the revenue line and 50% in profit. This is also where the CEO and other leadership come from. For me this is a disappointment.

The balance sheet, while improving is still trash, limiting their liquidity and other options. If I were to choose between 2024 and 2023 balance sheets, I would take this one but it’s still kind of choosing between the beauty pageant winner of North and South Dakota.

I also want to take issue with this slide used within the conference call highlighting management ownership increasing from 7% to 27% of the float.

Let’s remember here that many, many of the people who will read this are long term shareholders or followers of the stock. Many of these people had pretty good ongoing access to discuss issues with previous CEO’s and IR personnel via the TSA discord (Hi guys). I can’t tell you how many times it was communicated to management that stepping up and buying in the open market would send positive signals to the market.

To current leaderships credit, they have done a little bit of that, but let’s not pretend they achieved an additional 20% ownership through their own pocketbook which is what that slide is trying to suggest. The vast majority came via share issued via acquisitions, and some on renegotiated terms with none other than themselves.

Let’s talk valuation. I have the stock at 97M shares and and the stock just broke through sixty cents, so let’s put the market cap at $58M with an EV around $73M. The company is talking about a run rate goal of $50M with 20% EBITDA which would bring it to $70M CAD roughly with $14M of EBITDA.

So a 5.2 EV/EBITDA and still under 1x revenue does suggest there is more upside room to be had here on that forward guidance. I’d also like to see how much of that EBITDA will translate to the EPS line. Sandeep was not very committed to that $50M and 20% as 2025 guidance also, more of a vague future target.

Stock just hit 64 cents now as I’m wrapping this up. Is the stock worthy of the now 8x it has run since mid-November. I would have to say that it probably is and I would not be surprised to see this continue to run throughout the year if these numbers continue to improve.

Will I partake? No. I just can’t. Twenty seven months after I chose it as a 2023 Wolf Pick, it just broke even from that selection last week. I was fortunate that I made it out on the plus side, and I’m stoked for any longs who stuck around and perhaps got into this based on my positive words long ago. Too much scar tissue for me here, would feel like hooking up with an ex - can’t do it.

Still upgrading to three stars.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Wolf I am a very satisfied subscriber. Why? the frequency of the reviews. I appreciate that your own personal opinions but you stay on the numbers and facts. Provide proof of what your typing I hope you continue this you will get more subscribers. I also love your trade alerts