My first look into Neupath came in early December, and that review awarded them three stars. Right around that time I was also beginning to finalize my 2025 Wolf Picks. While they didn’t quite make the cut, I did include it in my bonus picks as one to watch.

The stock is up 39% since then with most of that move coming in the last week including a 12% move upon the release of their annual numbers Thursday morning.

With NPTH close to being a break even business and generating positive cash flow, I was pretty convinced some minor P&L improvements would earn Neupath a significant re-rate given the very low P/S the stock was trading at. My concern at the time was exactly where those improvement may come from. Are those potential improvements evident in these financials?

Balance Sheet:

This was a the glaring weakness in my first review and their current ratio is actually considerably worse than the .96 it was then. At year end they sit with the ratio down to .72 which consists of $2.9M in cash, $7.7M worth of receivables and $500k of other short term assets against $15.4M worth of short term liabilities due over their 2025 fiscal year.

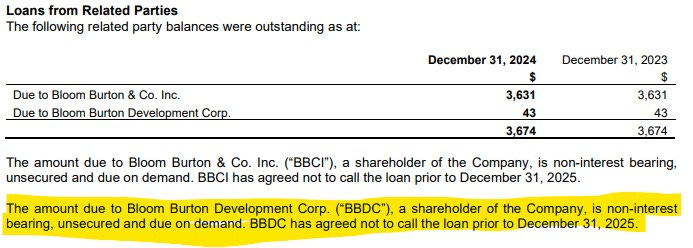

The biggest factor which worsened their current ratio is the friendly debt owed to their largest shareholder (Bloom Burton) is now listed as a current liability. Since the company has agreed to not call that loan, removing it from the current liabilities puts their ratio at .95, right back in line to where they were at the end of Q3.

BUT, new news released at the same time as the financials changes that up. I’ll cover that within the cash flow section.

Regardless of that, liquidity is still not their friend with their current cash plus A/R not quite being able to cover their A/P, leases and bank debt.

Aside from the Bloom Burton loan which is interest free, the company has no other long term debts, or liabilities aside from lease obligations.

The company provides dick when it comes to their receivables or their age so we’ll have to go with “trust me” that the 69% of their current assets and liquidity are ok.

Cash Flow:

Neupath generated $2.6M of operational cash flow, about $400k less than last year but it’s notable that it is slightly better before working capital adjustments (see my earlier review of CEMX posted today if you wish to get your freak on to understand working capital changes better).

They utilized $1.1M on asset spending including the minor acquisition early in the year for London Spine. They paid down $200k worth of debt and bought back a small amount of stock for $24k.

Overall, the company’s cash position depleted by 8% during the year ending at $2.9M.

Therefore the new debt financing announced at the same time as these financials were released may need to change the way we view Neupath.

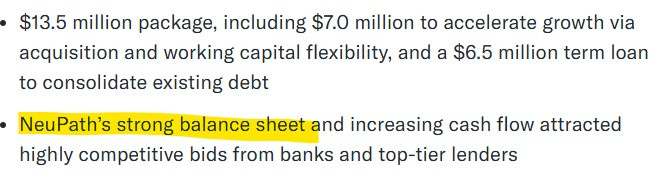

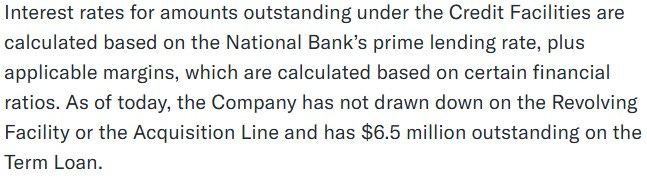

The facility itself will provide up to $13.5M through the National Bank of Canada, broken out through three different facilities. They state that they used the $6.5M portion to pay off the $2M in 10% debenture debt and the Bloom Burton interest free loan. That amounts to about $5.7M of the $6.5M. Here are a couple of issues I have within the press release however.

I’ve already demonstrated the above highlighted portion is not accurate, so let’s move the most important part.

No terms disclosed. These “applicable margins” are very important when you are extinguishing 77% of your total debt owed to a related party at zero percent interest.

If Bloom Burton was indeed willing to see this loan extend into 2026, then I’m having a hard time believing their first point of action on securing this new facility would be to pay them back. It feels like a very odd omission as it is glaringly apparent that the company will experience a much higher interest expense on their debt in 2025 compared to 2024. Due to that omission, we can’t tell how much.

With the debentures maturing a week later than April 25th, they were subject to a 3% early repayment premium which appears as if it could have been avoided if simply paid about a week later.

Debenture holders made out pretty well here, and since the holders are made up insiders and institutions, I feel it’s notable to point out. The original net proceeds were $1.1M to the company. In exchange holders received a total of 1.61M bonus shares, 836k broker warrants at 15 cents, accrued interest at 10% and a seemingly avoidable 3% early repayment premium.

Food for thought.

Share Capital:

56.4M shares outstanding with less than 100k of dilutive shares during 2024

4.8M options with about 3.8M currently ITM at or under 19 cents

516k RSU’s, with 485k awarded in December

Company has an internal share purchase plan, but has not implemented it

4.3M warrants at 25 cents expiring next February and the 836k broker warrants at 15 cents expiring May 2nd

2% insider ownership with 34% ownership Bloom Burton.

CEO did slap the ask for $30k of shares back in December

Announced a NCIB back in November to buy back up to 5% of the float. In recent weeks bought back about 300k of shares. Given the balance sheet and debt, I do not expect to see this on a regular basis

Income Statement:

Revenue for the year finished at $72.8M, up $6.7M or 10.1% from 2023. The company doesn’t calculate a traditional COGS to come up with a margin number but utilizing Cost of medical services seems to suffice and by doing that would deliver gross margins of 19%, about 40 basis points higher than last year.

The company’s other two cash burning buckets (G&A and occupancy costs) rose by a combined 9.7%, so extremely little conversion on 10.1% more revenue. Add in some other expenses including one time restructuring, interest and taxes, and their net losses for 2024 amount to $485k, about 1.5x more than the company loss in 2023.

The quarter is slightly better than their YTD with revenue increasing by 12.4% to $18.9M and the bottom line experienced half the loss of the comparable quarter at $180k vs $368k. G&A costs rose by 15.3% with occupancy costs slightly down.

Overall:

I’m left feeling very much the same way as I did back in December when I reviewed them the first time. It’s an ok break even business but I’m having difficulty seeing how they get to the next level.

Is that worth more than the .16 P/S ratio it is trading at today? I think you can make that argument, but by how much?

I’m going to throw out some numbers and this is just me doing what I do and not based on any company guidance.

Revenue grew at 12.4% in Q4 so let’s assume they can grow by 15% for 2025 which would bring them to $81.8M. Let’s also assume they could deliver 2% Net income on those revenues which is $1.63M. Let’s further assume they could trade at a 12 P/E and that would bring you to a market cap of $19.6M. That is a 57% upside to where it trades today.

My problem with those assumptions is a 2% net income would require a 250 or so basis point improvement from where they are and I don’t see the path to get there. Margins are very sticky in the 19% range, and they have not shown the ability to convert on their cash burning expense buckets with their G&A costs rising at the same or higher rate than their revenue increases. In 2025 it appears interest costs will be higher than 2024 as 3/4 of their debt went from zero interest to an unknown rate.

These results aren’t bad by any stretch but I don’t see a path to them improving significantly. Still awarding three stars but some three stars are more investable than others. Like Jay-Z, I’m on to the next one.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

thank you wolf always a good read and most importantly for me saves me money and time

Does feel like a meh. You get trapped by thinking it doesn't need to do a lot to improve, but then management never does it. Hope I'm wrong. $NPTH