It’s been a long wait since their Q3 was released back in March. It felt even longer since I was rather unimpressed with those numbers just coming off of selecting them as a 2025 Wolf Pick a couple of months earlier.

The headlines and details this time around are vastly different, and since Monday the stock has gained each day, setting a new 52 week high Wednesday at 48.5 cents, which is 155% higher than the 19 cents when it was selected as an annual pick.

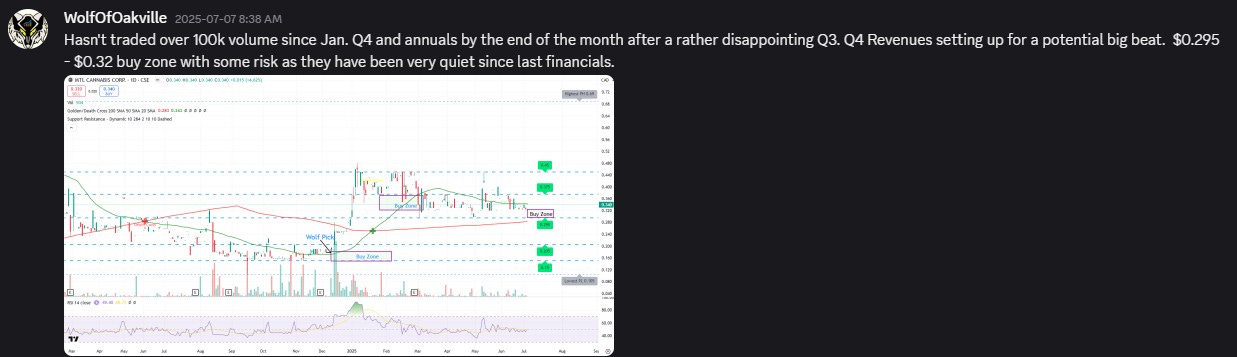

Two weeks ago, I highlighted a potential buy/add zone in the Wolf Den discord. Judging by the low volume, not too many capitalized on an opportunity which would have seen a 50% bounce.

Let’s get into the details to ensure it’s not all sizzle and no steak.

Balance Sheet:

This has not been MTLC’s strength with a weak current ratio of just .76 that consists of $5.7M in cash, $11.8M in receivables, $19.1M worth of inventory and biological assets and $500k in prepaids against a rather daunting looking $48.6M in short term liabilities due over the course of the next twelve months.

The company has $14.6M in notes payable and $7.6M convertible debentures within their current liabilities. Post financials, all notes were extended basically kicking the can down the road to the end of August on related party notes and the end of next March for the balance. As for as the convertible debentures are concerned, the majority (Archerwill debentures) are scheduled to convert at 57 cents or payable in cash (lender’s option). With the price at 49 cents currently, that poses an interesting decision for them, particularly considering the warrants attached to that debenture and expiring next August are currently well out of the money. Don’t be surprised if these are either extended or renegotiated within a couple of weeks.

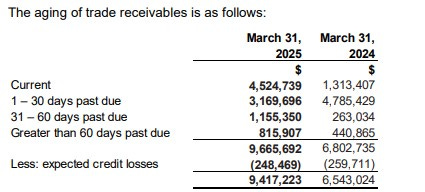

MTLC’s A/R aging report is ok at best, but definitely better than last year. They also have nearly $2M in A/R in addition to their trade receivables from Hydro Quebec for upgrades to light fixtures. That’s a lot of lumens.

Cash Flow:

MTLC produced $18.2M of operational cash flow (OCF) during 2024 which is a 32% improvement over last year. They also invested a net amount of $5.5M in property, equipment and leaseholds and paid down $5.1M worth of debt.

Overall they significantly improved their cash position by over 3x from where they began the year from.

The fact they are producing $1.5M per month in OCF does make the lack of liquidity on their balance sheet more palatable but it will be important for investors to manage their progress to ensure this trend continues.

Share Capital:

117M shares outstanding with 0 dilution occurring during 2024

Potential of 11.9M worth of dilution with the Archerwill debentures if converted

8.15M warrants outstanding with none ITM and 1M set to expire at the end of August

6.4M options with the majority (5.7M) currently ITM but not set to expire for four years

5M DSU’s and 2M RSU’s outstanding

77% insider ownership (per Yahoo Finance)

Steady stream of insider buying through December and January

Income Statement:

Net revenue for 2024 was solid with a 21% increase to $84.1M, but not as impressive as their gross margin which came in at 57.4%, a full 1700 basis points better than 2023. Therefore the company delivered 84% more gross profit dollars compared to 2023 on a 21% revenue increase.

Expenses on the other hand grew at a much faster rate than the top line at 49% including G&A costs which rose by 42%, Marketing by 133% and non cash burning expenses of Amortization and Depreciation by 43% with SBC rising by over 12x. Below the operating income line, finance expense grew by a whopping 112% to $7.4M and after a tax recovery of $662k last year, MTLC was on the hook for $1.8M to the tax man in 2024.

After the last paragraph it’s pretty amazing that the company was able to nearly triple their net income from last year, but that is what they indeed achieved, growing their profitability from $2.44M in 2023 to $6.8M in 2024.

Conversion on their expenses looked much better in the second half of the year, growing by 7% in Q3 and 24% in Q4. For the fourth quarter itself revenues grew by 61% with 74% gross profit and $4.6M of net income which was over 20% of net revenue.

Overall:

Great overall results so it is no surprise that the stock has had the week it did.

MTLC’s valuation metrics suggest there could be more room to the upside with an 8.4 P/E an EV/EBITDA ratio of just 4.5 and over 20% ROIC. But given their weak looking balance sheet and significant notes outstanding along with convertible debentures to friendly parties, some of which with substantial overmarket finance expense, it’s likely won’t garner much higher valuation metrics until those are finally resolved.

They are also not up against any more “cupcake” quarters going into 2025. We will see their first quarter results very shortly at the end of next month.

Feels like a time for very cautious optimism. The risk/reward doesn’t seem to be as great here as it did when I chose it as a 2025 longshot pick back in mid December.

3.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Appreciate the review, Wolf. After HASH, I'm staying away from cannabis stocks for a while.