Just back from my month long vacation and the timing couldn’t be better since we are now going to be embarking on a much busier earning season over the next few months. After 24 hours of driving over the past few days I’m still shaking off some feelings that are awfully like jetlag, but I have a pot of coffee on and we’re ready to go.

This will be my first formal review of MTL Cannabis which is a little odd considering this stock was one of my two longshot picks for 2025, back in mid December. In less than a quarter the stock is up by 108% since making that selection.

Outside of the two days after making it a top pick, shares have been hard to come by with very light volume on this rather illiquid CSE play with an estimated 77% of shares in solid hands.

I did have a quick look at their Q3 financials while I was on the road. I think it is safe to say that I expected somewhat better results, but even though the stock was traded down on Friday, it’s not like investors were headed to the exists en masse with only 7500 shares traded on these earnings. So what does it all mean, Basil? Let’s dig into the details.

Balance Sheet:

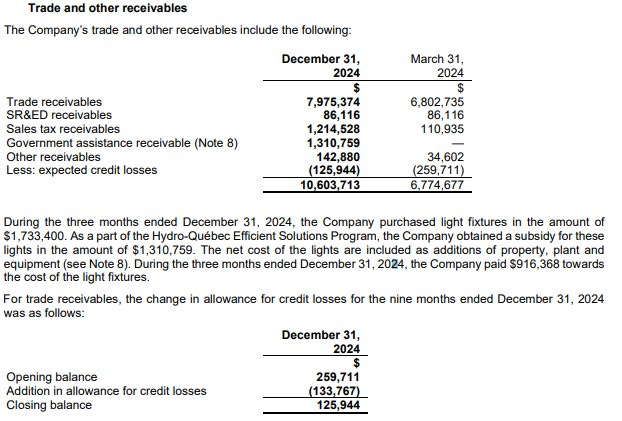

We begin with a rather daunting balance sheet with a current ratio of just above .7, but we knew that going in as that’s one of the reasons this was a long shot and not your normal “Wolf Pick. Their balance sheet consists of $3.5M in cash, $10.6M of receivables, $15.1M worth of inventory and $2.3M in other current assets against $43.7M of short term liabilities.

The 57% jump in receivables stands out, but the jump in trade receivables only rose by 17% with the balance coming from government related receivables and subsidies.

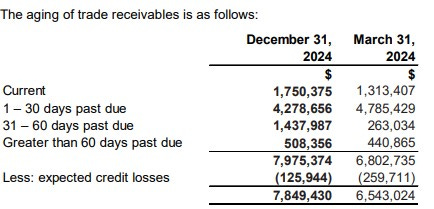

We move over to the company MD&A to find the A/R aging report, and with 24% of their receivables being over 31 days, I’ve certainly seen better but on the other hand it is encouraging to see that they cut in half their anticipated credit losses.

Like 2024 Wolf Pick NTG Clarity a year ago, the biggest issue on their balance sheet is their debt which amounts to $14.7M, made up mainly of $14.4M in notes payable. These promissory notes are due in the first couple of days in June. It is pretty clear that the company will not be able to fully satisfy these notes in three months time so I would fully expect the company to have these extended into 2026.

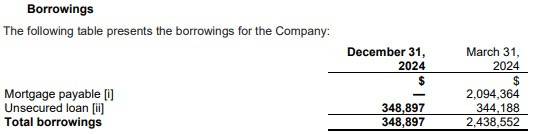

In terms of their “other debt”, they have been able to reduce it by $2.1M so far this fiscal year by fully extinguishing their mortgage payable in December. The remainder is a $350k unsecured loan bearing interest at 2%

Cash Flow:

MTLC has had very strong operational cash flow for sometime and through nine months of 2025 have generated $13.1M in OCF compared to $10M generated at the same stage in 2024.

The working capital adjustments are rather significant however due to large investments in inventory and payables growth. In total, they net out to negatively impact their operational cash flow by about $1.6M. Overall though, this nearly $1.5M of OCF generation per month is very important to see given the company debt.

Also occurring during their fiscal year were $3.6M in asset investments, mainly within leasehold improvements, and more importantly paid down their debt by nearly $4.9M.

Overall, MTLC has improved their cash position by 158% since the beginning of the their fiscal year.

Share Capital:

117M shares outstanding, with zero dilution occurring this year or since their RTO in July 2023.

8.15M warrants, all significantly out of the money with 1M expiring in August of this year

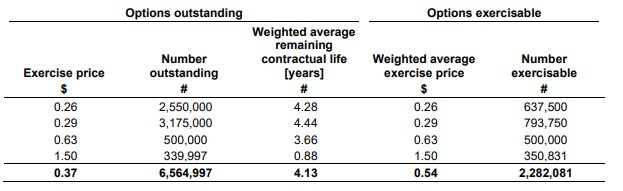

6.6M options outstanding, the majority awarded this year and ITM but not expiring until 2029.

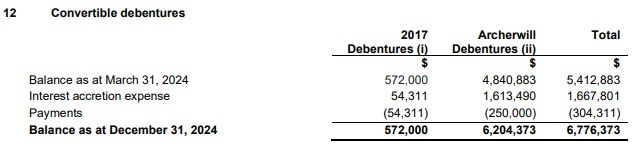

The 6.2M in convertible debentures owned by Archerwill investments due in August will be something to keep an eye on. Archerwill has the option of cash or conversion at 57 cents, 44% above where the share price sits today. Q4 annuals in July may provide a glimpse into how these will be handled.

Approximately 77% insider ownership, and they were buying significant blocks of shares during the December-January timeframe

Income Statement:

MTLC delivered $20M of net revenue after excise taxes in Q3, a modest 3% increase even though their product revenue was 8.2% greater. After making great strides within their gross margin on a YTD basis, they experienced a pretty good set back in Q3 with margins 220 basis points lighter than Q3 of last year. On a YTD basis, the company is still showing a dramatic improvement of over 800 basis points to last year at 45.4% but when you live in a “what have you done for me lately” world, Q3 is disappointing.

Herein lies one of the bigger risks of investing in cannabis stocks. In almost all other industries, gross profit is a much simpler calculation. The cost to produce your product is more easily defined, and the difference in what you end up selling that product for is your gross profit. The weed equivalent of that is the Gross Profit before fair value adjustments.

The fair value of inventory will differ over time as the company needs to estimate the “sale-ability” of their product (cannabis plants) as they grow over time. Under or over estimating this value can and will have an impact on their overall gross profit when it’s harvested and ultimately sold. One way to better see the impact of these chances is to review OCF (Operational Cash Flow) since these adjustments are non-cash adjustments, and the good news there is OCF is up by over 30%.

MTLC cash burning buckets of G&A and Sales and Marketing rose by 7% which took their Operating Income down to $900k vs $1.78M in the comparable quarter. Tack on the $1.8M in finance expense due to their debt, a $500k bogey income taxes and it resulted in their first Net Income loss of the last five quarters. YTD of course looks much better with 20% revenue growth, 800 basis points improvement in margin and doubling of their operating income. The $4M of additional finance expenses and the $2M bogey in income taxes unfortunately ruins that party as well however.

Overall:

This quarter is certainly a step backwards and the company disappointed on what I felt was one of their easier quarters to deliver on.

The worst part about dropping an egg in Q3 is investors now have a long wait until most likely the end of July until they see Q4 and the company’s annual filings.

What looked like a potential steal in valuation when I chose it at 19 cents, now looks very reasonable at 40. After a quarter such as they had, I find this commentary which didn’t address any of their shortcomings as particularly weak.

Not giving up on these guys but after a 110% gain since my annual pick there could be better value weed plays out there right now. Management could sway me more with a continuation of open market buys and how they handle the insider portion of their pricey promissory notes. It’s a hold and wait and see right here for me. 2.25 stars.

Paid Subscriber Benefits:

Priority Review Requests

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat. My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks Wolf. As above, I'll wait for a bit on this one

Thanks wolf