We get to look at a company whom I’ve always rated quite well, (my last after their Q1 which received 3.5 stars), but I’ve never actually pulled the trigger. I wrote about them a couple of weeks ago in my monthly “What’s Wolf Watching” article.

After a rather tough Q3 which saw revenue drop by 6% and profitability by over 70%, the stock took a beating, but it was starting to trade at very attractive valuations. Instead of repeating my full diatribe, here is what I said then:

So the order intake and backlog, perhaps assisted by tariff frontrunning appears to have delivered a great quarter on the surface. Let’s dig into it.

Balance Sheet:

As we have just come to expect (or at least I have) MCB has a very strong current ratio of 2.6 that consists of $17M in cash, $16.4M in receivables and a much larger than normal $40.3M worth of inventory against $29.1M worth of short term liabilities. Those liabilities include $5.7M worth of customer deposits, so it could be argued that their current ratio looks even better.

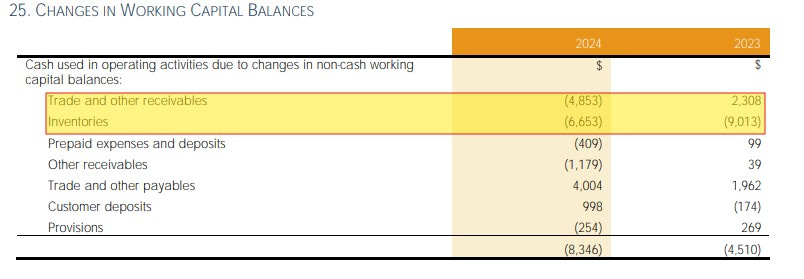

Receivables are up by about 60% and inventory levels are about 33% higher than the beginning of the year and since my Q1 look.

I’ve certainly seen much better aging statements, with over 53% of their A/R over 30 days, and 37% over 60. It seems like their credit manager may need to go out and bust some kneecaps. This will ultimately have a negative impact on operational cash flows, not to mention increasing risk of write offs, although the company is only budgeting $434k currently. Definitely something to keep an eye on to see if this improves when the company reports their first quarter sometime next month.

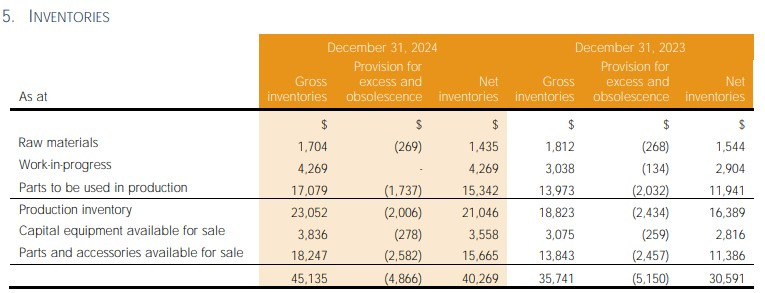

I’m much more interested in McCoy’s inventory values than I am for most other companies I review. The reason is they take a lot of provisions for excess and obsolescence. These can be fairly dramatic write-downs that will impact COGS and in other disposal write offs which will ultimately impact their gross profit and profitability in a negative way.

So when you see inventory values increase, that brings with it more future risk, and with $4.9M in provisions, that is more than 10% of their gross inventory value. The impacts on 2024’s fiscal year amounted to more than $1.25M.

McCoy Global is now debt free with their only long term liabilities coming in the form of lease commitments. Great start with some minor concerns worth watching.

Cash Flow:

Operational cash flow (OCF) was slightly down from last year coming in at $6.5M, 3.5% off the $6.7M they achieved a year ago.

As I suggested above the large increases in receivables and carried inventory were the main contributors for the slippage in OCF. This could likely come back next month when the company reports Q1 if inventory sell through and A/R collection improves, so they could be sitting on a Q1 OCF birdie. Note that when accounts payable grow, that assists cash flow working capital adjustments, but eventually those bills have to be paid and will offset the potential positive changes already mentioned. Clear as mud?

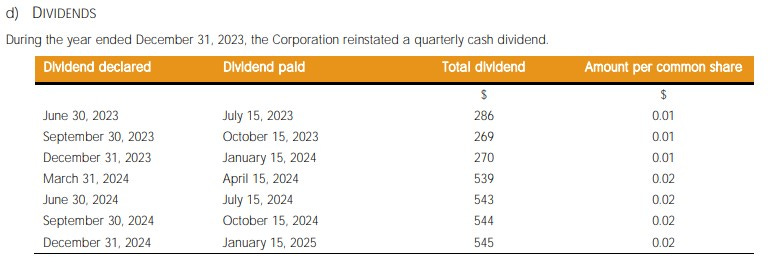

McCoy utilized nearly $3.5M in asset purchases during the calendar year, received nearly $400k through share issuances from the company purchase plan and stock options, and paid out just shy of $1.9M of dividends.

Including a $900k birdie in exchange rate adjustments, McCoy improved their cash position by 8.5% during their fiscal 2024.

Share Capital:

27.2M shares outstanding for a company with a great history of float management - they experienced less than 1% dilution on the option exercises and employee plan purchases

1.7M options outstanding with 330k granted in 2024 - the vast majority ITM

494k DSU’s, 160k DPSU (director performance), 136k RSP’s (Restriced Plan), and 187k in PSU’s outstanding

All of the above are part of the company’s 10% Omnibus SBC plan. In total, MCB awarded $1.73M in share based compensation in 2024, up 33% from 2023

Per yahoo finance, 4% insider and 28% institutional ownership

In the last six months and beyond, insiders have not only been buying as part of the company stock plan but in the open market as well

Cannell Capital, one of their institutional investors sold off a considerable amount of shares in the fall and now are below the 10% ownership reporting threshold as of their latest reported sale at the end of October

As part of their press release announced a quarterly dividend increase of 2.5 cents per share. At ten cents annually bringing the yield to 4.2% from yesterdays close and that’s 2.5x higher than their dividend payouts from just 2023.

Income Statement:

The above has been very good up until this point but this is where the rubber meets the road.

On the year, MCB delivered $77.5M in revenue, up from $69.7M in 2023, an 11.1% improvement YoY. Their fourth quarter more than made up for the turd they left in the punch bowl in Q3 on the revenue line, exploding to $25.2M, up 28%. At least as far back as 2016, this is the first time McCoy achieved over $20M in a quarter, never mind $25M. It was also a 59% improvement on a QoQ basis.

For their total year, gross profit improved by 280 basis points with 35.6% or margin compared to 32.8%. Therefore on 11% more revenue they delivered a very impressive 21% more gross profit dollars.

They narrowly miss out on the Wolf Trifecta as total expenses rose by 12.6%, just higher than their revenue increases, but while they didn’t convert on the top line, that expense rate increase was much lower than their gross margin dollars, which will all translate to an improved bottom line.

Net earnings therefore came in at $8.87M, a very impressive 36% more than last years $6.53M.

Below that McCoy Global had a considerable win due to foreign exchange of over $5M and a $6.2M birdie to last years overall financials. Therefore the company’s comprehensive earnings were $13.9M compared to just $5.3M in 2023.

Overall:

This was a slam dunk quarter and an excellent year for McCoy any way you slice it and does not look indicative of the company’s chart and stock performance over the past several months, as the share price is down 37% since their October highs.

Much of this was as a result of their poor Q3 showing, institutions appearing to lose faith and tariff threats with about half of their business coming out of the USA.

On the encouraging side relating to the US market, in 2023 their balance of sale amounted to 56% with the US business a little better than flat and the company gaining more ground with European, Asian and Canadian customers.

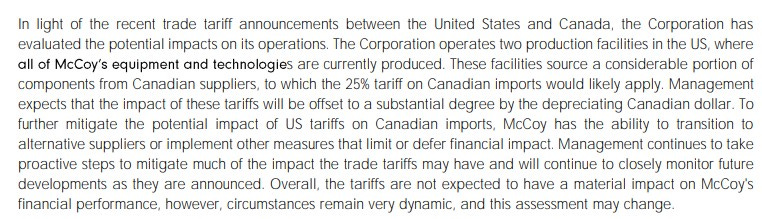

So how much of a threat is still out there. Without getting too political you may be more adept at figuring that out being a psychologist rather than an economist or a stock picker. Here is what the company is saying:

I feel this is a rather overall positive statement. It won’t be perfect, but not be material to impact their future results due to mitigants currently in place, and future actions they could take.

Even though more and more countries are promoting energy independence and pipelines, the bigger near term risk may just be the depreciating price of oil which may depress a desire for new drilling. But the company also has mitigants there as they could improve their market share just through superior technology.

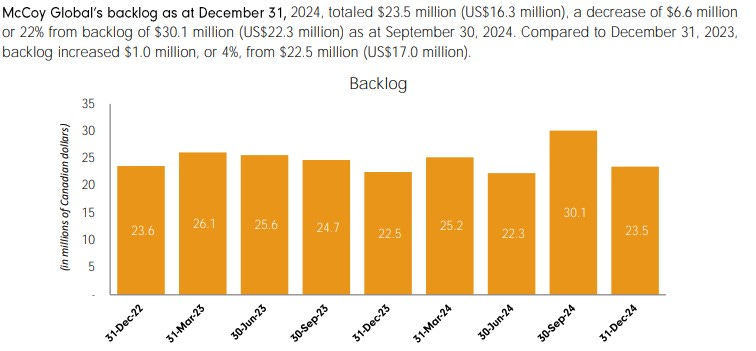

In terms of McCoy’s backlog, it has come down since it’s high water mark last quarter, but it is higher than where they ended 2023.

With this full year now complete, McCoy Global now sits with a P/E of 7.5 and a Price to Sales of .85, so still trading quite attractively, particularly given the 4% yielding divvy.

Outside of general investor sentiment, general volatility and occasional panic, I don’t see much of a downside here. MCB is also up against rather soft numbers in Q1 which we should see in four or five weeks time.

Not only upgrading McCoy to 3.75 stars, but also giving them the Wolf Seal of Approval. I’m on the bid.

Fantastic review, Wolf. I can't recall any other companies you've given the Seal of Approval to. Btw, you've been posting positive reviews of some great companies recently, but I still haven't pulled the trigger on any of them because of all the uncertainty. And like you said, I'm not a psychiatrist...or an economist.

Thanks for the review Wolf. I have been in MCB under 2$ for a long time and added earlier this week with an new average of 2.05$. Thought about selling when it it 3.70$ area and didn't do it ... kicked myself a little for that, but I'm happy to be long on this and love that the new equipment they promoted is paying off. More important than this, happy to hear your daughter will be good. Cheers !