McCoy Global received a Wolf Seal of Approval pick back in early March for their 2024 annuals which is not long after I sat through their presentation in Las Vegas at the Planet Microcap showcase. That review also received a 3.75 star rating.

While the stock is still up 32% from that pick, it is a far cry from the $4.48 peak in early July. The company dropped their Q2 late last week and as you can see from the gap down on the chart on earnings day, investors were not pleased. Were the numbers as bad as it looks? Will that gap fill and is it setting up a buy zone above $3.06 support right now? Let’s find out.

Balance Sheet:

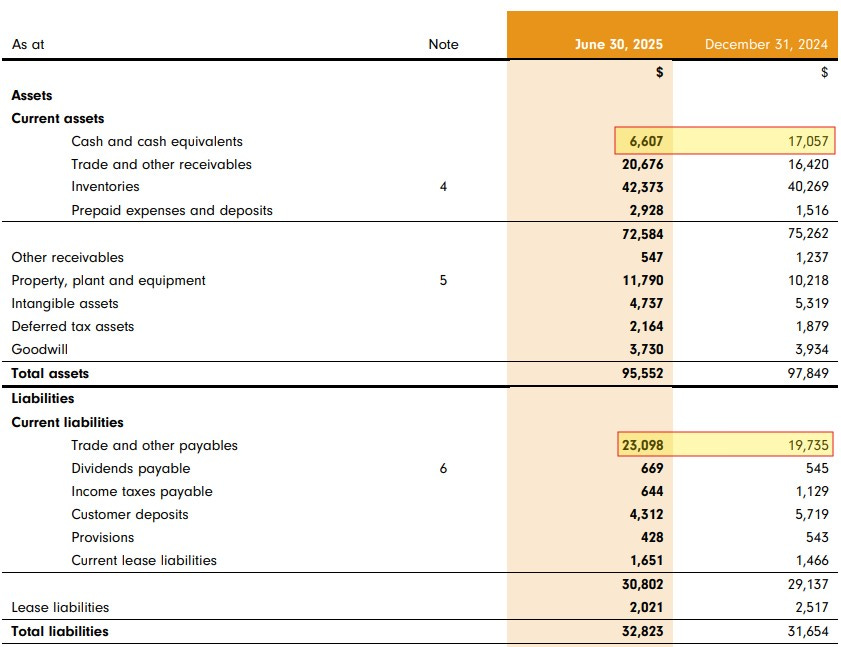

MCB sports a solid current ratio of 2.40 consisting of $6.6M in cash, $20.7M in receivables, $42.4M worth of inventory and $2.9M of prepaids against $30.8M in current liabilities.

While the current ratio is strong, their liquidity isn’t with only $6.6M in cash with nearly 5x that in liabilities due over their next twelve months. Their inventory levels are nearly at the level of their first six months worth of revenue as well, and have risen by over $2M since the start of their 2025 fiscal year.

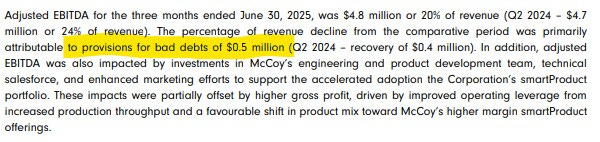

When a company has over $20.6M in A/R and adds a half milly in provisions for bad debts, it’s weak sauce to not provide some sort of detail on your A/R aging within the financial notes or within the MD&A.

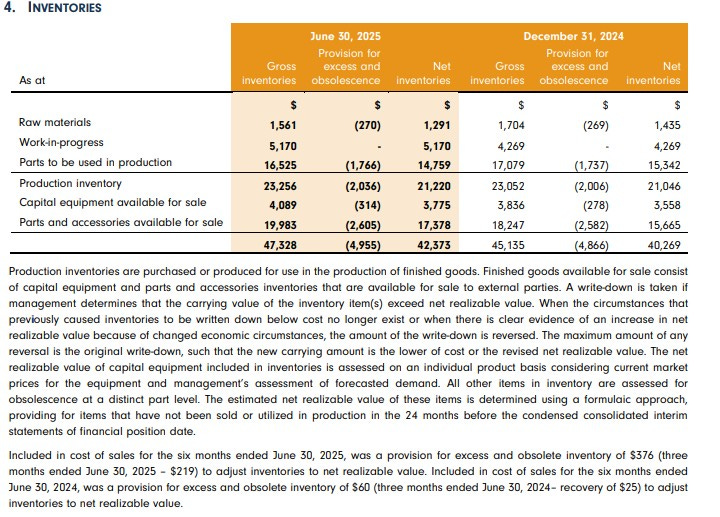

The concerns I raised back in March of $4.8M of inventory write down provisions have now nearly grown to $5M - that’s not exactly chump change on their level of revenue.

Cash Flow:

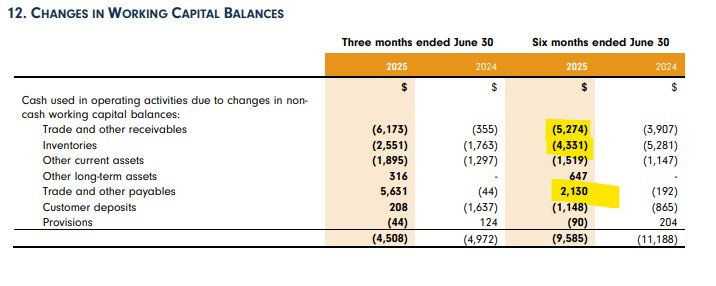

McCoy Global experienced $820k of operational cash burn during Q1, raising their YTD burn to $3.6M. While these are both improvements over last years figures, it looks pretty disappointing for a company producing positive net income.

The company historically (or at least since I’ve covered them) has had very large swings within their working capital adjustments, and this quarter is no different.

Outside of operational spending the company spent $3.3M in capital investments, bought back $1.4M worth of stock and paid out $1.2M worth of dividends.

Overall McCoy has blown through over 60% of the cash they had on hand at the beginning of the year.

Share Capital

26.8M shares outstanding, approximately 400k less than what they began their fiscal year with

518k shares bought back YTD - approx 1/3rd of what they are entitled to under the current NCIB which expires next week

2M options outstanding with approximately 3/4 ITM, but none expiring within the next three years.

4% insider ownership and 29% held by institutions

Insider open market purchases and purchases through the company plan in January but nothing since.

Income Statement:

Revenue in the quarter was strong at $24.05M, 21% up from the comparable quarter a year ago, as well as gross profit which ross by 270 basis points to 36.2% resulting in 29% more gross profit dollars.

That is where the good news ends as McCoy’s operating expenses grew by 118% - $7M vs $3.2M. All of their expense buckets grew with G&A rising by 177%, Product Development by 43% and Sales and Marketing by 56% as well as taking another $200k in unnamed “other” losses.

After taxes, which were a $55k birdie to last year, net earnings fell by 56% to $1.37M, down from $3.13M in Q2 of last year.

Through six months is a similar tale - revenue is up by 19%, gross margin is up by over 200 basis points, but with expenses up by 71% and net earnings lagging last year by 44%.

Overall:

There is no getting around it, this was a very disappointing quarter for McCoy Global and their investors. When I initially reviewed the highlights I assumed I would be able to shrug most of it off and potentially add to my position targeting the $3.06 - $3.16 area where the stock currently sits, particularly since the stock is currently oversold technically. But after going through the financials in detail, I’m not so sure.

I still believe that McCoy is better positioned than anyone with their product offerings than anyone else in the sector, particularly their smarTR system which delivered $11M in the most recent quarter just after their product launch. They also have bids on approximately 100 rigs with contracts anticipated to be awarded over the next year. But this is all occurring in a stagnant at best industry where customers have been pulling back and limiting capital expenditures.

Further evidence of this is the $800k in bad debt provisions taken by the company YTD which represents 20% of last years net income - far from insignificant.

This puts further focus on their management of cash, which looks a little suspect on a balance sheet which is not as good as it may look at first glance. Their ratios are very similar to what it looked like at year end but their liquidity is in much worse shape.

Six months ago the company nearly had enough cash to cover their payables but now only holds $6.6M, or 28% of their payables and this doesn’t include dividends or taxes. Assuming all of their receivables can be banked on and on time, this may not be an issue, but given they’ve already taken rather significant write downs and they provide no aging disclosure, it’s something to consider in your risk assessment.

Investments in inventory have not worked out either with customer decisions delayed and now sit with a rather unpleasant looking turnover ratio under two when inventory write down provisions are included. It makes me wonder if all of the above has the company regretting earlier decisions on share buy backs and increasing their dividends.

The share based compensation topic has received the most chatter in social circles in relation to the poorer than expected results, but I think within that chatter investors are missing a key piece, and that is the use of cash based awards over equity based ones. The benefit of these types of awards is it minimizes dilution. The downside is it depletes cash, and McCoy is not in a very strong cash position currently.

Since the SBC amounts were reversed from their cash flow statement, I assume these have been added to their Trade and Other Payables line. If the company had Third Party disclosures within their financial notes, we would know for sure, but like the absence of an aging report, disclosure within their financials is not exactly McCoy’s strong suit.

In addition to the above, the company is also planning to spend $6M (CAD) in capital expenditures for the remainder of the year. Their OCF really needs to improve in the back half of the year or they could be forced into taking on some debt.

I have certainly focused more on the negatives here, but I think it is warranted based on the number of yellow flags presented here in the quarter. With all of those listed, the company was still profitable at the end of the day and do have a lot of potential catalysts which could turn things back around quickly. I’m not going anywhere, but I don’t think I’m adding to my position right here.

A half star downgrade is certainly warranted here. 3.25 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. That's a big jump in operating expenses. Hopefully company can turn things around.