I don’t typically like performing reviews on company’s who’s financials are this old, November 19th in the case of LSL. But the stock has popped 22% this week and looked intriguing enough to do a little bit of a deep dive.

While the stock has seen some recent success, their one year chart shows them as pretty much flat with some wild swings with 52 week lows of $0.29 and highs of $0.53.

There isn’t much microcap chatter about LSL. These are the last two mentions on FinTwit from some familiar faces, but these were nearly two years ago.

LSL Pharma, as the name would imply is a Pharmaceutical company, and they are located in Quebec. The last Quebec pharma company I recall covering and once holding a position in was Tetra Bio Pharma. I still possess some facial ticks from that experience as they went bankrupt back in mid 2023.

But let’s not lump LSL in with TBP just yet, as they certainly appear to have a lot more going for them. This quarter we’re about to look at is the seventh straight quarter with revenue increases of at least 55%, going from a pre-revenue company in 2022 to $27M worth of revenue on a TTM basis.

Post financial activity also raises an eyebrow with two significant looking acquisitions and an equally interesting debenture raise. Am I ready to get hurt again by a Quebec pharma play?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

This balance sheet is a pretty good example of one with a decent looking current ratio with a stanky quick ratio and liquidity situation. The current ratio is an acceptable 1.5 consisting of $450k in cash $5.9M of receivables, $13.4M worth of inventory and $900k in other short term assets against $13.5M in liabilities due over the next twelve months.

On the other hand, cash plus receivables falls well short of their twelve month liquidity commitments.

$6.7M of those short term commitments are within a new revolving credit facility (max $7.5M). This is a rather new debt facility which they utilized to extinguish two others.

That’s also far from all of the debt LSL holds. It amounts to $24.4M in total with about two thirds of it classified as long term made up of various bank debt and notes payables.

LSL did quite a bit of debt restructuring back in the summer including three separate $5M loans with expiry’s ranging from 2033 through 2049 making this truly long term debt and was done at variable rates just above prime.

They also have $4.4M in various notes payable at much less attractive rates in the double digit range of 11 - 14%. Post financials they paid down $1.6M of the notes with new bank debt and entered into another $600k bridge loan from a related party.

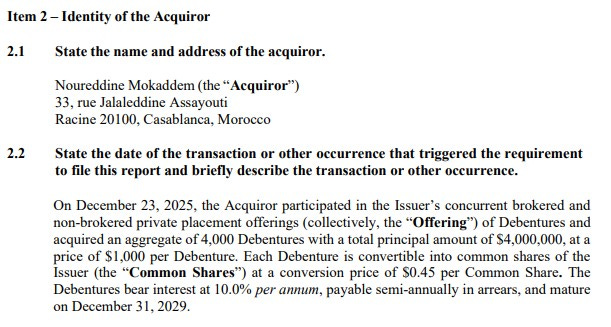

Are we finished talking about their debt? No, as two weeks ago closed on $12M of new debentures as part of their acquisition of Juno OTC. Those convertible debentures were done above market at 45 cents and bear 10% interest and expire in four years at the end of 2029.

A lot to digest there, including the acquisition, but I’ll get into that later.

Cash Flow:

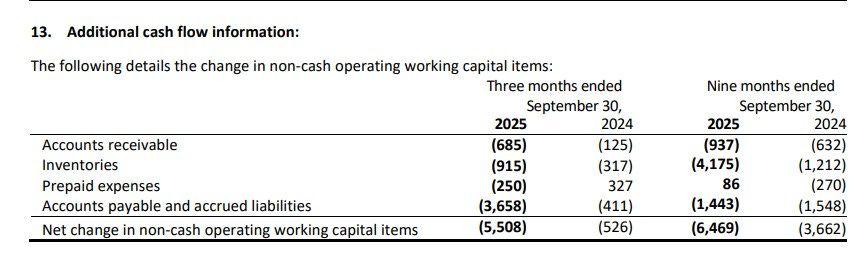

The company went from producing positive operational cash flow through their first six months to burning $3.4M on a YTD basis with $4.4M of operational burn in Q3.

It’s probably not as bad as that would look or sound as they had some pretty significant working capital changes in Q3 with large reductions in their A/P as well as a big YTD ramp up of their inventory position. Their overall OCF still isn’t anything to write home about at this stage but I believe it to be better than it looks.

Through nine months LSL has added $3.2M of assets, raised $2.3M through an earlier September raise and have added $4.7M to their total debt load. Those figures of course only take us to September 30th and I’ve already discussed all of the activity since.

Share Capital:

Again as of Sept 30th 121.2M shares outstanding, 5% dilution in the year but 47% since the start of their 2024 fiscal year.

41.6M warrants outstanding, all of them at 70 cents and well out of the money

8.85M options with about 2.8M ITM

As of Sept 30, about 27% insider ownership

Minor insider activity in the open market, but big participation in the most recent debenture. Again, I’ll touch on that later

5.5M in dilution post financials to the previous owners of Juno OTC

$12M of debentures would convert to 26.7M in future dilution at 45 cents in four years (based on principal only)

Fully diluted float of 156.2M but at a share price of 70 cents or more could reach over 200M

Income Statement:

Total revenues of $7.6M in the third quarter, an 89% increase over the comparable quarter. Gross margin improved by 100 basis points to 30.8% which drove gross profit dollars up by 95%.

All of their corporate operating expenses are lumped together in one large SG&A bucket, and that rose by 67%. A rather large rate of increase by still less than their sales and GP increases showing some ample conversion.

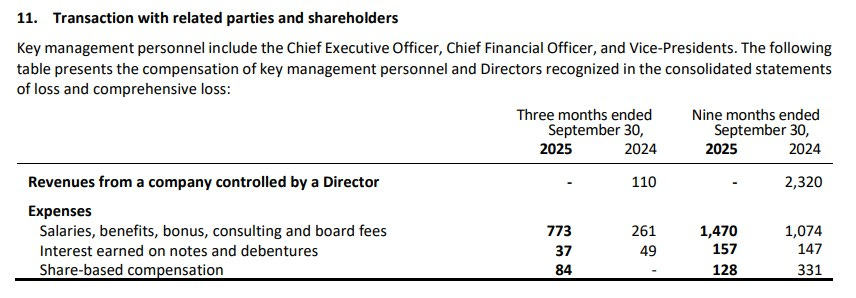

With non COGS depreciation making up a portion of that, their cash burning expenses appear to have risen slightly less than 67%, but when you look at where the bulk of those additional cash burning expenses went, you’ll find that they went to insiders in the form of salaries, benefits, bonuses and board fees with those costs rising by nearly 200% in Q3.

Operating profit increased by 5.6x from $85k to $482k but due to increased financing expenses relating back to all of that debt, and taking a one time loss on some of that debt settlement, the company’s net loss increased by 3x, with a net loss of $1.18M up from $386.

Through nine months:

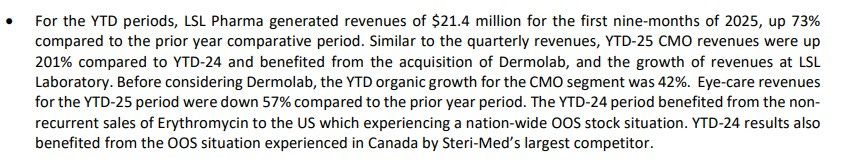

Revenues up by 73% to $21.4M

Margin erosion of 100 basis points from 31.3% to 30.3% with GP dollars rising by 68%

SG&A costs up 56%

Operating profit of $1.27M vs $524k

Finance costs of $2.1M up 55%

Net losses increased by 46% to $1.72M

Overall:

That was a lot to get through, with most of my time analyzing their debt and post financials activity. Thus far I’m rather unimpressed as I was hoping to see some better metrics within the financials.

First, some DD material for your reading pleasure, starting with the company’s investor deck. Unfortunately this is dated June of 2025 without any updates and as we know they have had a busy year.

Acquisitions:

Their recent acquisition of Juno OTC was not their first as they acquired two companies within their 2024 fiscal year. To get a better understanding of how successful Juno has been, let’s look at their previous ones.

Virage Sante Group:

LSL acquired VSG back in June of 2024 for total consideration of $2.4M. That pretty much worked out to a book value deal with very little ($157k) allocated to goodwill.

Metrics on VSG when announced were light at best with the initial and post acquisition news releases extremely vague regarding what type of revenue or profitability they were generating. The highlights in the LOI news release were all that were disclosed.

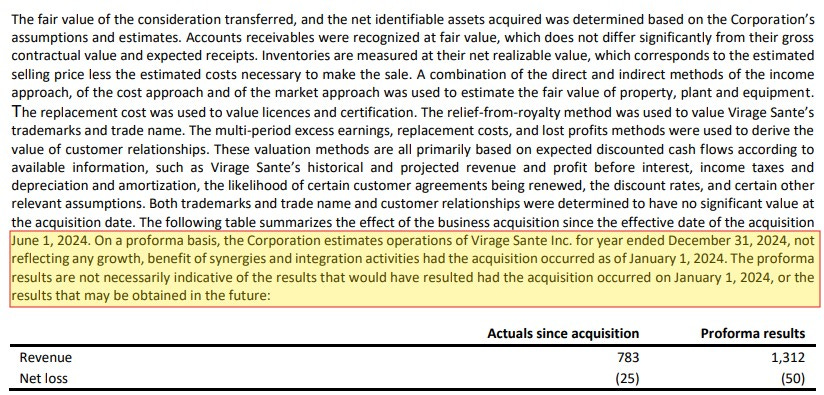

In their 2024 annual filings, LSL had this to say regarding Virage Sante’s performance:

With their prior year at $10M in revenue, perhaps they were close to the low end in their 15-20% annual revenue estimate, but it certainly did not boost their overall profitability as described. Ss far as I have seen the company have not spoken to specific results from VSL since these numbers.

Dermolab Pharma Ltd.

The Dermolab acquisition occurred near the end of 2024. This one appeared to be on the cheap with total consideration of only $1.2M for a company with net assets of $6.1M, therefore the company booked a one time gain on the acquisition of $4.9M (remember that figure).

In the accompanying news release the company stated an expected boost to revenues of approximately 40%, but again no profitability metrics provided.

Revenue for Dermolab out of the gate does appear to be meeting or exceeding those expectations. Their CMO business (contract manufacturing) in total has grown by over 200% YTD. Organic growth grew by 42%, an impressive feat of it’s own. Therefore, inorganic growth can be calculated to be somewhere near $10M on it’s own, with a large portion of that attributable to Dermolab.

Laboratoire Du-Var

About six weeks ago, LSL acquired another Quebec based competitor in Laboratoire Du-Var (LDV). The purchase price for LDV is expected to be around $3.2M. Interestingly, they did provide more metrics here with recent twelve month revenues of $4.4M and Adjusted EBITDA of $500k. AEBITDA doesn’t tell us a whole lot but it is more information shared on previous acquisitions. This deal will also double the company’s production capacity for their liquid and semi solid products.

Juno OTC

That brings us to the most recent, and largest of the four, Juno OTC acquired on Dec 23rd for a total purchase price of $5M. This purchase adds over 40 Health Canada approved OTC drugs, natural health products and medical devices to the LSL Pharma business with a 2026 revenue estimate of $25M. The seller who will remain within the business interestingly subscribed for $1.5M of the convertible debenture offering announced at the same time of the acquisition.

I wasn’t completely impressed with their overall financials, but after considering everything that has happened since these financials, how do I feel now? I’m not 100% sure, but they are interesting.

With one quarter to go in 2025, they appear like they will come in somewhere in the neighbourhood of $30M in revenue, and they just added another potential $30M in accretive revenue with their two Q4 acquisitions. Therefore their revenue could look like $60M for 2026 and that is without any organic growth that is currently up 43% this year.

$60M plus in revenue would put them at a sub 1 P/S ratio at their current $51M market cap. Now I think it’s a fool’s errand to buy a stock solely on a price to sales ratio but there is little doubt the company is poised to create some relatively huge headlines when they release financials into 2026.

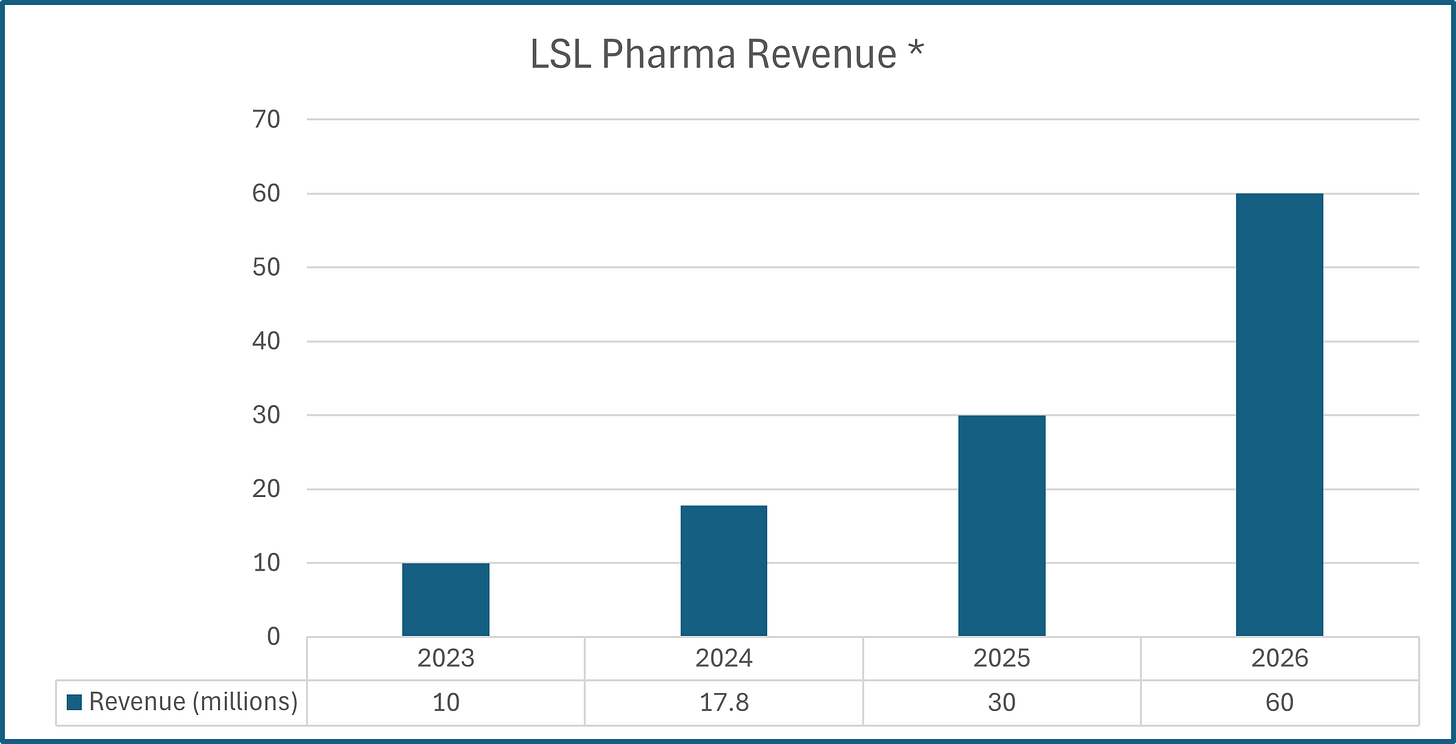

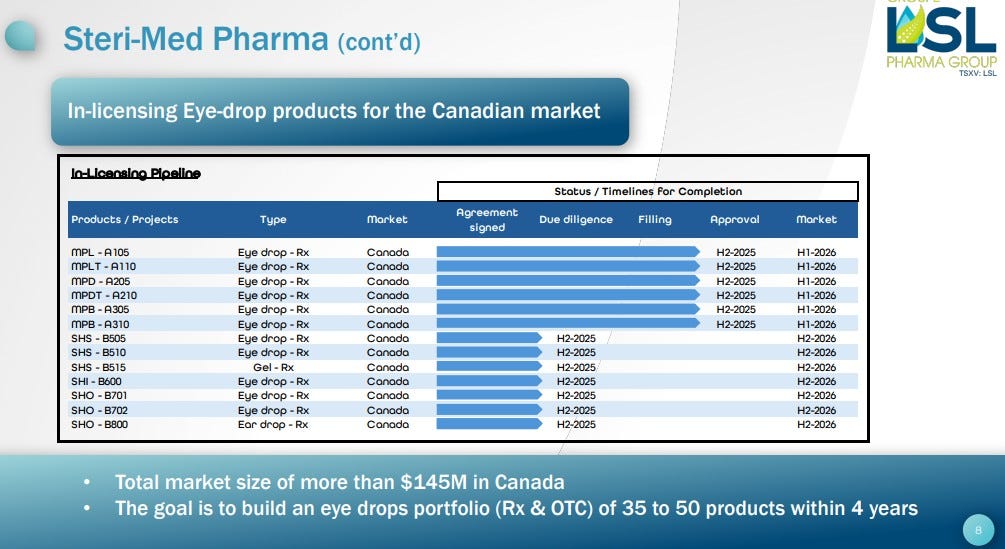

Those also do not include potential catalysts from their product pipeline:

One investor and board member stepped the plate with a $4M investment into the recent convertible debentures representing one third of the total. That being Noureddine Mokaddem, an investor known much more for his role in investing into Canadian mining companies, most notably as Chairman of the Board for Abcourt Mines and a significant holder of Trigon metals and others. How much of a factor is that to consider? I’m not sure.

Over 4 years Mr. Mokeddem is slated to receive $1.6M of interest for that investment, which brings us back to LSL total debt load, and the fact that the significant increases in their financing expenses have been their main stumbling block in being profitable so far in 2025. Those debt costs are only going to escalate a great deal into 2026, so we are likely looking at a similar story in next years financials.

Lastly is their Q4 comps, and profitability wise they will be up against that $4.9 gain I mentioned earlier, solely responsible for the $4.5M net income they showed in Q4 and the only reason why they currently show a positive P/E ratio on a TTM basis.

Opening my coverage of LSL with a 2.75 star review. It was 40 cents a year ago and currently 41 now in a much more interesting spot IMO even given all of the warts I described. I don’t normally throw money at a 2.75 star stock, but I did today.

I’m ready to get hurt again Quebec. Qu’ai-je fait ?

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the review, Wolf. Surprised that you decided to buy, given all that debt.

Good luck, or as they say in Quebec, bonne chance.