A Saturday morning review as Wolf is dead tired from 5 rounds of golf in six days and still a little sunburned from a Thursday round at TPC Osprey Valley (highly recommend).

Kraken has been on a steady run since it was selected as a 2024 Wolf pick back in mid December of 2023. It was 61 cents at the time and with yesterdays close of $3.46 has resulted in a greater than 5.5x return (Five Bagger).

Personally, I’ve been in since 58 cents. Approximately six weeks ago, I peeled off a small portion to cover my original cost basis - riding free shares is always a great place to be.

I also wrote a special blog about them in last September.

Anatomy of a 2024 Wolf Pick - Kraken Robotics

If you have been following my reviews and other adventures on Twitter or message boards than you know that I tend to attract some haters. Most investors take their individual investments a little too…

It’s market cap of course has also soared along with it, now surpassing $1B. That’s quite the feat for a company yet to surpass $100M in revenue and currently sitting with under $15M of TTM net income, 92% of that occurring in one quarter (Q4 of 2024). $9.7 of that was from income tax recovery also.

From a pure fundamentals point of view, Kraken would certainly appear overpriced at over 10x sales, a 61 P/E and 77 EV/EBITDA. After a quick review of their numbers which dropped on Thursday morning their Q2 results didn’t do anything to improve those ratios.

Let’s dig deeper.

Balance Sheet:

As of June 30th Kraken had a very solid current ratio of 3.4 with $32.9M in cash, $16.8M in receivables $24.6M worth of inventory and nearly $27M in other short term assets against $30.2M in liabilities slated to be paid over their next twelve months.

Liquidity was very strong with just their cash position covering all of their short term commitments.

The company does not provide an A/R aging report but I have no reason to believe there is any cause for concern here - 22% of receivables is made up of government assistance.

Kraken has $23.7M worth of debt made up of seven different individual loans and facilities. The majority of them quite small, with the largest being $14.7M drawn on their $35M credit facility.

If you noticed above I emphasized past tense more than normal. That is because just a week after their Q2 closed the company closed a bought deal raising a whopping $115M, fully oversubscribed by the way at a price of $2.66.

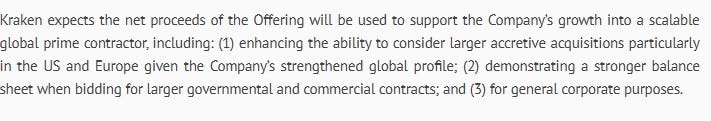

What will those proceeds be used for, you ask? Well here is the company’s explanation from their news release and below that, more detail was provided in their prospectus.

Since the offering was oversubscribed, they raised an additional $14M than the amount above after commissions. That is a massive chunk of change with perhaps up to $80M to seek potential acquisitions and since they specifically mention the US and Europe one would have to think they have already begun kicking some tires.

Cash Flow:

Through six months, Kraken generated a rather pedestrian $1.5M in operational cash flow. Not a very significant amount given their $1B market cap, but it certainly is substantially better than the $6.6M of cash burn at this stage last year.

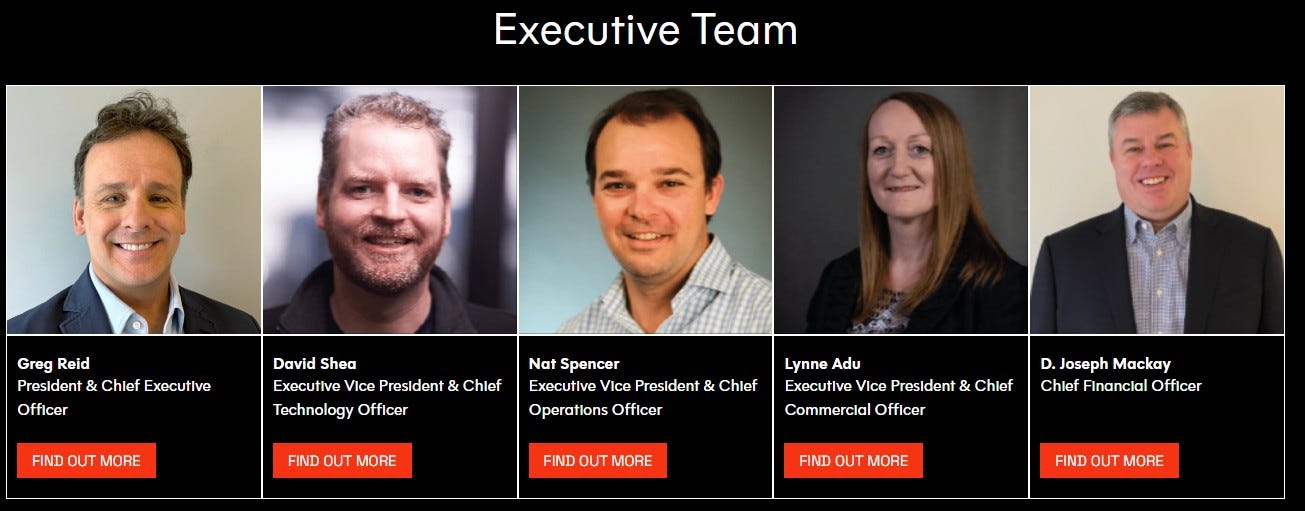

On the first day of their second quarter, the company announced the acquisition of 3D at depth, spending $23.5M on the deal and notably 94% made up of goodwill and intangible assets. In addition, they also utilized another $9M worth of asset purchases and added $9M worth of net debt.

Overall the company’s cash position depleted by 41% during their first six months, but obviously that becomes a moot point given the cash haul received post financials.

Share Capital:

Including the post Q2 raise, the current float stands at 306.2M shares with significant dilutionary measures of 48% over the last year and a half

13.9M options outstanding, all of which are well ITM including 3.4M granted at $2.42 earlier this year. The earliest expiry of 3.6M not occurring until May of 2027

Zero warrants or other future dilutionary measures

Insider ownership sits at only 2.6% but nearly 1/4 ownership from institutions.

Notable that insiders have peeled off 900k more shares than purchased on the open market in the last year including 800k sold on June 13th - just a few days prior to announcing their $100M raise. Looks pretty sus there Gregory!

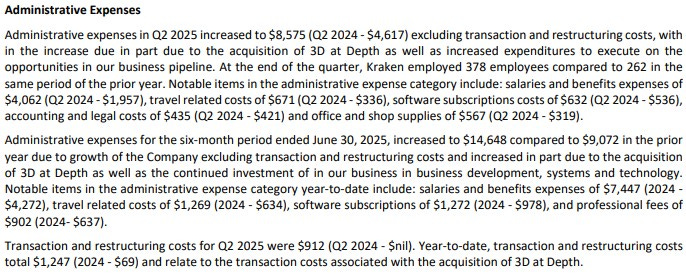

Income Statement:

After a disappointing top line in Q1, Kraken had a decent rebound with a 16% increase in revenue this time out at $26.4M vs $22.8M in the comparable quarter. They also had a successful quarter on the margin line with a near 500 basis point improvement to 55.9% gross profit which calculates to 27% more gross profit dollars.

Unfortunately they fall well short of a Wolf Trifecta with massive operational spending in the quarter, increasing by 85% to over $14M. $1.6M of that is non cash burning with an additional $1M in depreciation and amortization and higher SBC costs due to timing of option awards this year vs last. But cash burning expenses still rose by over 78%, and even if you remove $912k in additional costs related to their Q2 acquisition, they are up 64% which is terrible conversion on 16% more business.

That poor conversion is even more relevant when you consider without the 3D acquisition, their comparable revenue was actually down 7.2% to last year with the $5.4M of 3D revenue excluded.

The reason for the significant increase in spending is explained mainly by the significant increase in headcount year over year with 44% more employees.

Below operational expenses, Kraken also had a net bogey of over $500k in foreign exchange losses and nearly $1M in financing expenses. That all totals a $4M net income swing to the downside with a $715M loss vs a $3.3M profit in Q2 of last year.

On a YTD basis their highlights (or lowlights) include:

$42.5M in revenue, down 2.6% to last year. Comparable sales of $37.1M, down 14.9%

Significant margin gains of over 1000 basis points (58.5% vs 48%) resulting in $4M more gross profit dollars than last year on less revenue

Higher opex spending by 65% YoY

A net loss of $200k vs net income of $5.6M

Overall:

There is no denying that the quarter and YTD numbers are duds, which does provide bears with some extra ammunition and gives more credence towards an overvaluation if measuring based on pure fundamentals.

But that is only one part of the story of course as Kraken is very well positioned for future growth. Even with lagging in revenue to last year on a YTD basis, the company is still standing by their 2025 guidance issued after Q1 of $120M and $135M in revenue. Those equate to anywhere to a 31% to 48% increase above what they produced in 2024. The only profitability guidance they provide is on an Adj EBITDA basis so who I won’t opine on that irrelevant metric.

So at the low end of their guidance they are expecting the back half of the year to grow by at least 62%. That in itself is exciting, but that could be just the start. Their new Dartmouth facility when completed will have upwards of a $250M manufacturing capability for subsea batteries, and the company is uniquely positioned to take advantage of a windfall in new NATO defense spending over the next several years. This new war chest of capital after their $115M raise puts them in a very cash rich position making them that much more attractive to receive governmental defense RFP’s, and it also opens up the door for additional acquisitions presenting excellent catalyst opportunities for the back half of the year and beyond.

I want to talk about analysts coverage of Kraken Robotics for a second, just to outline how dirty the microcap game can be and why for the most part, retail investors should take what they say with serious caution.

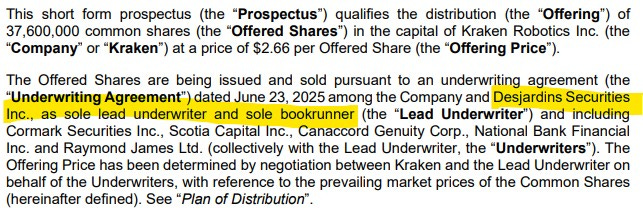

Desjardins Securities only began covering the company in February. Since July 11th the company has increased their targets and ratings twice. Why is that July date relevant?

They also happened to be the lead in that raise that closed four days earlier and that came with a 4% commission totaling $4.6M. How much Desjardins received is unknown but it’s safe to assume it was the vast majority. It’s worth mentioning 4% is a pretty good deal here as many microcap offerings can be as high as 6% with another 6% in warrant issuances.

Cannacord on the other hand was the only analyst coverage to downgrade the stock to a hold. Did they just get a smaller piece of the pie this time around?

By the same token it’s worth mentioning that anything that I have to say should come under the same scrutiny since I hold a decent position here. But I think I have a pretty good track record of calling balls and strikes for positions I own (even Wolf Picks), and I have never accepted compensation of any kind for companies I cover.

My last review for Kraken awarded them 3.25 stars. To be honest these results are very downgrade worthy, but due to the company maintaining their 2025 guidance, future potential and the new found cash windfall they are sitting on, I’m somewhat reluctantly going to maintain it as is. I’m looking forward to much stronger results in the back half and beyond.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Nice job of financial interpretation for us lesser educated beings....thanks and as always, very appreciated 👍