It feels like there is going to be a trend with my next several reviews - they will likely be current or former annual picks with Thermal Energy and Gatekeeper Systems reporting the other day, Happy Belly Food Group reporting last night, and Simply Solventless expected to report later today. There’s a handful of others I’d like to review as well, so if you’re a frequent reader of mine there will be no shortage of content over the next couple of weeks.

Kraken was part of my 2024 selections, and was 61 cents at the time. That works out to a nice four bagger since with their close at $2.50 yesterday, once touching $3 for a brief moment at the end of January.

$2.50 is actually the range the stock was in November when I last reviewed the company. I referred to those financials as a stinker with the company reporting their softest revenue of the past five quarters, and worst net income of the last six. As a result I gave them a quarter star downgrade.

Let’s dive into how they ended their 2024 fiscal year.

Balance Sheet:

Kraken has a very strong balance sheet beginning with a current ratio of over five that consists of $58.5M in cash, $18.7M of receivables, over $19M worth of inventory and $21.5M of other short term assets against just $23.4M in short term liabilities.

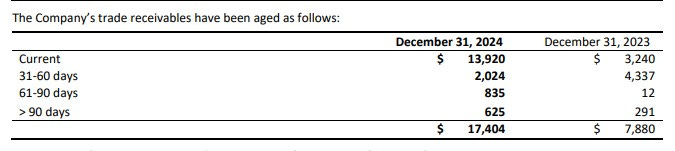

No issues with their aging report with the bulk of their receivables being relatively current which suggest a good chunk of their Q4 revenue came later in the quarter. They have only written off $500k over the last two years but it is notable that their trade receivables are double what they were from last quarter and 63% of them are from two customers.

The main reason the balance sheet has improved significantly since last quarter was the raise of $51.7M from the raise they completed in late October.

The company also has $15.8M of debt with the majority coming from their revolving credit facility ($15M of $35M used) at a prime plus margin of 1-1.75%.

Cash Flow:

The operational cash flow (OCF) numbers look horrific on the surface with $11.6M of cash burn in 2024 against $8.4M of positive OCF generation the year prior.

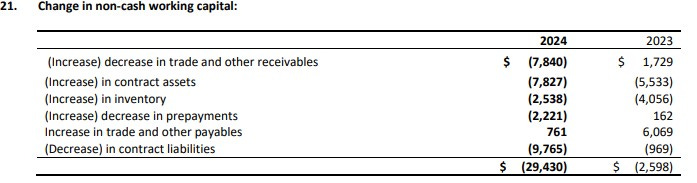

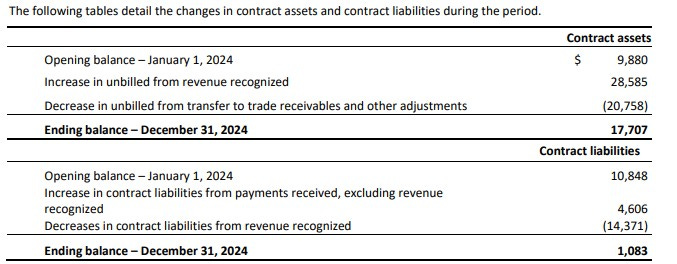

The main reason for this is in working capital adjustments for which has become a theme over the last few quarters. As you can see above there are numerous adjustments and of them are working against generating positive OCF.

Much of these adjustments can be attributable to the increase in receivables and the way customers are billed. These will eventually reverse and contribute positively to OCF, but since revenue was down in Q3 and flat in Q4 it’s a bit curious why that hasn’t started already.

The rest of the cash flow statement is busy as well. $5.1M was invested in assets, they raised a substantial $67M in cash, and in the process of restructuring their debt, added $4.2M to the total.

Overall Kraken increased their cash position by $53M during 2024, but when you consider it was done via $67M of raises and increased debt, the story isn’t a pretty picture and that all relates back to the working capital changes. It also left investors wondering what they would utilize all of that cash for. Part of that answer came at the beginning of April when they acquired 3D at Depth. That transaction cost approximately $24M (CAD) and despite their strong cash position partially utilized more debt (about $7M CAD) to complete the transaction.

In summary let’s just say I have a lot of questions about how Kraken manages their cash.

Share Capital:

262.7M shares outstanding with 27% worth of dilution during the year, the vast majority via two raises and 2.67M options exercised

10.9M options outstanding, including 6M awarded in 2024. All ITM but none expiring for over two years.

Share consolidation proposal still in effect that was approved last June which could RS the stock anywhere from a two to seven to one ratio. I’d be on the lookout for this within their 2025 fiscal year with an outside chance of uplist discussions

3.3% insider ownership which is way down with the dilution this year but institutional ownership is significantly up to 28% (per Yahoo finance)

After being allergic to buying in the open market for sometime, three different insiders purchased $100k of stock in early January.

Income Statement:

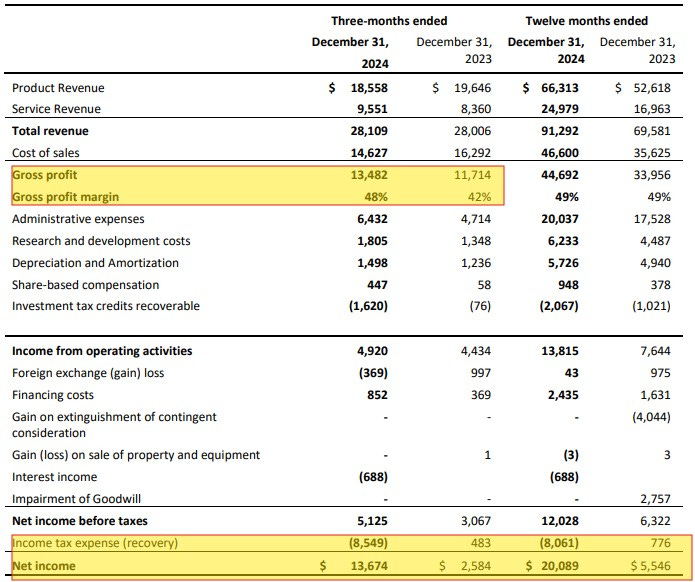

In total the year looks very solid with $91.3M in top line achieved in 2024 which is 31% greater than 2023. Margin was up fractionally by 15 basis points to 49%. Total expenses only rose by 6% creating excellent conversion on the Operating Income line which grew substantially by nearly $9M or 282%.

Operating expenses were helped by a doubling in investment tax credits received and a $2.8M impairment taken in 2023. On an apples to apples view of Kraken’s cash burning expenses, they increased by 18%, which is still pretty darn good on 31% revenue growth.

Thanks to $9.7M in income tax recovery, Net income was an enormous $20.1M compared to $5.5M in 2023.

While Q4 itself was flat to last year, it is 44% more on a QoQ basis and it does set a new quarterly top line record. After margins slightly suffered through three quarters, it was up significantly in Q4. Administrative expenses growing by 36% on flat revenue is not a good look but that still nets out to an 11% growth in operating income and $2M growth in net income before taxes.

Overall:

I’d have to say Q4 met the very minimum of my expectations, but even that is better than the disappointment I felt after Q4. What was more headline worthy was the 2025 guidance provided which was between $120M - $135M in revenue with greater adjusted EBITDA growth. Bottom achievement of guidance would be at 31% with top end at 48%.

The news flow since their Q3 has also been pretty impressive with $60M in subsea battery orders, introduction of a their new KATFISH sonar service, the opening of a new battery plant and lastly the acquisition of 3D at depth. $10M of capital spending will be required for the new plant.

3D, the company’s newest acquisition did approximately $20M in revenue in 2024. On nine months of business that translates to $15M for 2025 assuming no growth within that new segment. Given the company paid a potentially rich 15x of operating income, let’s hope they can deliver more. That would mean on the low end of guidance the company is targeting around 15% organic growth. With the $60M in new subsea batteries announced and a more than doubling of their pipeline from $900k to $2B they could be sandbagging the low end of that guidance. As someone who has managed small to medium sized sales teams before, I don’t put a lot of stock in sales pipeline numbers as these can be easily manipulated. Unless you know historical close rates, these are just numbers being thrown around.

In terms of valuation their P/E is very misleading due to the significant tax breaks they received this year, so the company is trading closer to a 50 P/E than the 29 currently shown. The 35 EV/EBITDA ratio is further proof of that.

Therefore it is hard to argue there is significant value in today’s price, as there is still a lot of future baked into this $650M market cap company. With that said, I’m still holding, and still long.

Maintaining my 3.25 stars.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf I am with you still holding and long. This is not a over night success story nor do they deal with mickey mouse outifits they deal with military governments.

Thanks for the write-up, Wolf! Do you think they'll get more/bigger contracts from the govt, given the pressure to meet NATO's 2% GDP target and political tensions?