I’ve been covering Kraken for four (maybe five?) years and have been a shareholder for a little over two. I made my initial entry at 58 cents and later selected them as a 2024 Wolf Pick at $0.61. Just over a month ago they achieved a 52 week and all time high of $7.44, resulting in a twelve bagger in about 22 months. It has since pulled back a considerable 28% since, but still close to a 900% return.

I did reduce my position on October 28th at $7 however. A stock within your portfolio going 12x has a considerable change to it’s weighting, and after trading in overbought territory for the better part of October, it felt like it was time to take some profits off the table. That is the second time I’ve done so and I’m currently holding about two thirds of my initial position.

The incredible run (this year in particular) has also come after their previous two quarters would be best described as duds. A Q1 top line miss of 23% and bottom line erosion of $2M, followed up by a similar $2.6M bottom line miss with better revenue numbers in Q2.

Investors initially sold today’s news with the stock retreating to under $5, but as PNG often does, it rebounded into the close picking up 3 cents or 0.56% to close the day.

Enough preamble, let’s get into it.

Balance Sheet:

We begin with the best state of the balance sheet the company has ever been in with a current ratio of 7.3. That consists of over $126.6M in cash, $29.6M of receivables, $29M worth of inventory and $27.8M of other current assets against only $29.2M in liabilities due over their next twelve months. Liquidity is also phenomenal with a quick ratio of 5.35.

No aging report but YTD A/R is up 52% while revenues are up by 17%.

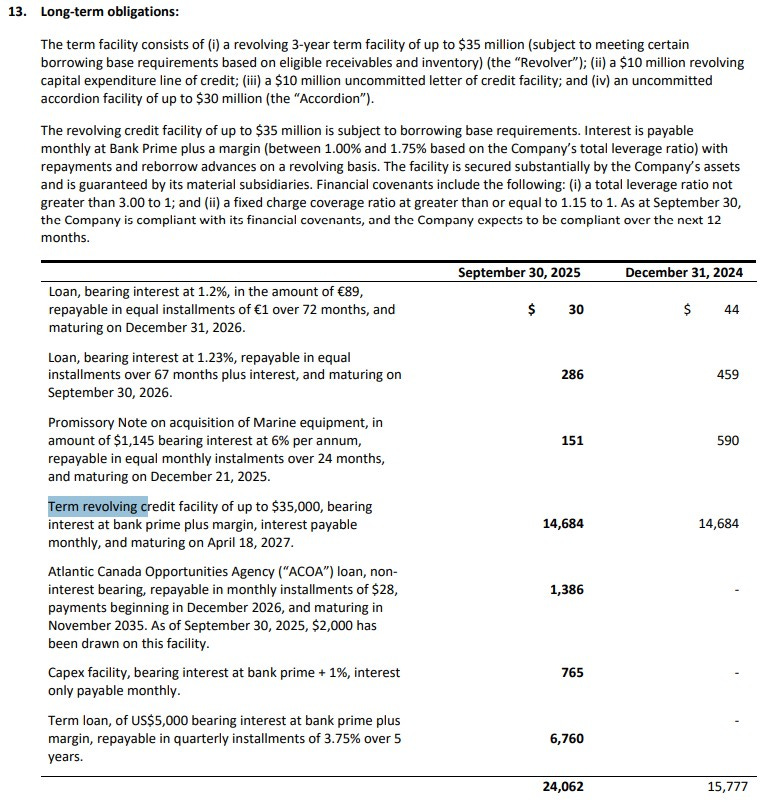

$22.9M of debt, oddly coined as “long term obligations” on the balance sheet. Details below.

Cash Flow:

$9.2M of operational cash burn through their first nine months, modestly better than the $10M of burn they experienced at this time a year ago.

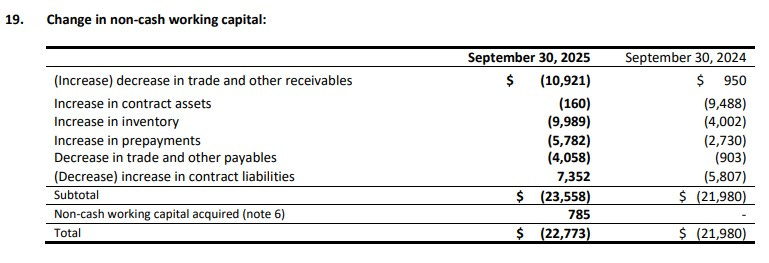

The main reason for cash burn rather than having positive flow is significant changes within their working capital. Nearly $11M related to their A/R and once again, no aging disclosures were provided. The bulk of the rest is due to a near $10M investment in inventory. So we have A/R growing at a greater rate of sales and an erosion in inventory turnover as they presumably ramp up for the future.

Through their first nine months, Kraken has utilized over $40.7M in investing activities. $23.5M via their purchase of 3D at depth earlier this year, and another $15.4M in property and equipment.

The biggest reason for the fantastic state of their balance sheet is due to raising nearly $110M in cash through a raise at $2.66 back at the start of the third quarter. Curiously they have also incurred an additional $8.8M of net debt.

Overall, Kraken has more than doubled their cash position from the start of the year from $58.5M to $126.6M (116%).

Share Capital:

306.4M shares outstanding - 33% dilution over the past twelve months and 48% since the beginning of 2024. We’re getting a little plump.

Filed a Base Shelf a month after their last raise with no potential $ figure

13.7M options outstanding, all well ITM including the 3.5M awarded this year at $2.43. None expire for at least a year and a half

No warrants

Insider ownership is a little light at 3% but it does have 23% institutional ownership including the likes of Mawer Investments and Penderfund.

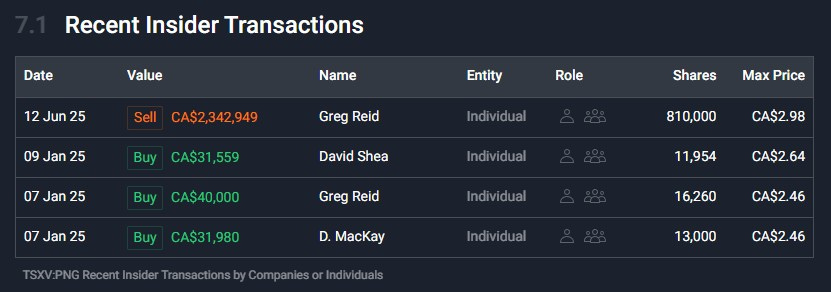

CEO sold off approximately 1/8th of his stake in June between $2.88 & $3 for proceeds of over $2.3M. At the time it looked rather douchey (perhaps regulator eyebrow raising) as it came within weeks of their raise at $2.66. Now he looks like a numpty who left over two milly on the table.

Income Statement:

Revenues came in strong in the quarter at $31.3M, 60% higher than the comparable quarter. That includes 46% more of product revenue and 85% more of margin rich service revenue. With service revenue as a higher proportion of sales, margins surged, nearly 700 basis points higher to 59.4% and that delivered 81% more dollars to the gross profit line.

They did not convert very well below that however with an increase of 105% in their admin expenses (the company’s only cash burning expense bucket), and total operating expenses grew by 80%, therefore missing out on a Wolf Trifecta.

Below that they had a $550k birdie within foreign exchange, the interest income on their cash windfall offset the interest on their debt, and after a $1.5M bogey in income taxes in the quarter they posted $3.3M of net income, a little more than doubling what they did a year ago.

Their YTD numbers look as follows:

Total revenue of $73.8M, 17% higher through three quarters with product revenue still off by $3.7M and all the YTD gains coming via the service side

Margin growth of over 900 basis points to 58.9%. Gross profit up 39%

Total expenses up 70% and cash burning expenses up by 84%

YTD net income down by $3.6M or 56% to 2024

Overall:

Almost everything you’ve read up until this point. Virtually meaningless. Kraken Robotics is trading within a jet stream right now completely independent of what their results look like.

It’s trading at near Telsa like multiples. Ok not quite but at a $1.6B market cap its around 16x revenue with both P/E and EV/EBITDA ratios exceeding 100.

Not all stocks trade on traditional fundamentals but eventually all stocks will, so Kraken has a lot to do to grow into their current valuation.

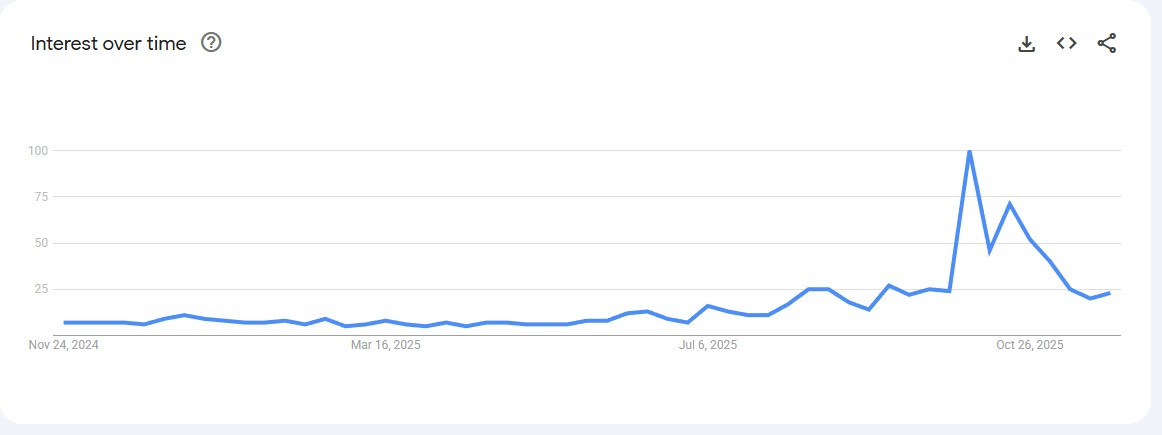

That is reason to be cautious enough, but another reason to take heed is the extreme increase in attention the stock is getting, and mainly on the OTC side. Below are comparable PNG and KRKNF charts.

While there is definitely a bump in volume on the Canadian side it is no where near the variance seen on the OTC side. On days where the stock had the biggest moves, the OTC ticker is outpacing the volume on the TSXV side. Extremely unusual for any ticker with “cross pollination”.

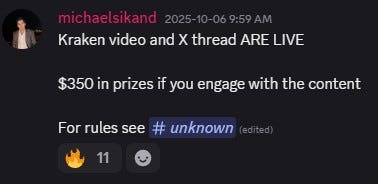

Much of the increased attention (I think) can be traced back to Michael Siklan’s interest, his X feed, YouTube platform and discord channel which has swooned to over 4000 members in just a couple of months since it’s launch. The chart first gapped up in early September, but the real spike in volume happened on October 6th.

Now I don’t know Michael Sikand. I’m not familiar with any of his previous work, market successes or lack thereof. But let’s just say offering cash prizes for engaging with content and making announcements of putting 70% of my portfolio into one play with a YouTube title that includes “could 10x” has never been my approach. It’s not illegal but let’s just say I don’t like it. A new moniker has been born too - “Krakheads”.

With that said, it’s an excellent introduction into what Kraken does, their initiatives and catalysts they have in the future. It no doubt had a significant impact on the stock as well.

Whether or not it’s a positive impact likely depends on where you stand. Has it put more cash in my account and increased my portfolio? Certainly. But more than 10% of the current shares outstanding were purchased at $6.50 or more (CAD). My bet is the vast majority of them don’t have an average under $0.80 like I do, therefore creating a lot of current bagholders. That is an extremely disappointing thought as Kraken Robotics is a great story, and one that I’ve been happy to be a part of since 59 cents. Now it feels a little tainted, and a little dirty. Doesn’t it?

It’s not only Mr. Sikland. The KRKNF tag on Twitter has seen huge surges over the same time and new people are popping into message boards on the daily. Many of them with their own agenda’s and not looking out for your best interests - I guarantee you.

Pumpy stocks can be fun, multi-bags are fun until you’re new on the train and catch the FOMO bug and are left holding a 20% red bag. Kraken is not deserving of a $1.6B stock today. I’m sorry but that’s just a fact. It could also trade at $12 within six months with the right momentum. I believe it can be deserving of it’s elevated valuation one day and hopefully those holding bags today will one day reap the rewards I have too. I want to be a shareholder. I don’t want to be a Krakhead.

Maintaining 3.25 stars - not like that matters here.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the blunt and fair review, Wolf. Had no clue about the so-called "Krakheads." Your average under $0.80 makes me wish I had gotten in earlier.

Nice review. One potential is all the cables of internet being layed on the ocean floors by alphabet and meta. They could be needed to monitor and protect this billion dollar investment in internet for both companies. I agree one thing I noticed about youtube the theme is "get rich" or "fear" it's a shame youtube had allot more value in the past now the greed and stupidity dangerous combination is in a video format. You were a wise man 4 years ago to cover it even wiser to have held allot since last October. Keep up the great reviews.