You might say this 2024 pick has gone on a little bit of a run this year. Even with yesterday’s pull back on these results the stock is up 251% from naming it as an annual pick, and reached as high as a four bagger about ten days ago.

With a personal average under 60 cents and seeing it in the neighbourhood of a $600M market cap, I did sell one third of my position at $2.45. The stock was just getting too far ahead of itself as far as I was concerned and now I sit in the enviable position of basically holding free shares with the opportunity to add those shares back potentially at a cheaper price.

So the market ripped a tentacle off of Kraken in yesterday’s trading, finishing down 12.3% on the day. I was worried about these financials not being able to support the meteoric rise in share price, and it appears that’s what has occurred. My last review was an upgrade to 3.5 stars. Can they hold that rating? Let’s go for a deep dive swim with Kraken.

Balance Sheet:

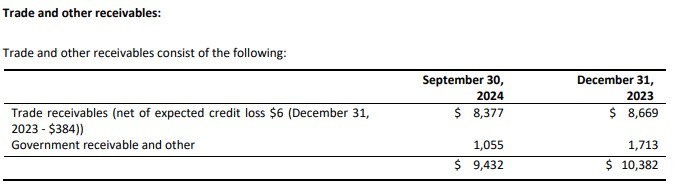

Their current ratio is very strong at 2.8 which is made up of $14.9M in cash, $9.4M in receivables, $19.4M in contract assets. $20.5M worth of inventory and about $3.4M in other short term assets, against $24.4M of short term liability commitments. Receivables are consistent with last quarter and do not appear to contain any issues but we would would never know due to the company’s lack of disclosure on aging or even their “gross” receivables amount.

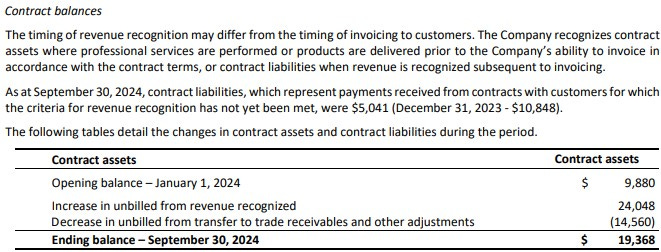

Contract assets more than doubled from the beginning of the year and up over $4M from last quarter. Basically these are receivables before officially becoming receivables - the company has recognized the revenue, but has yet to invoice the customer. This will likely have a large negative impact on cash flows. Inventory investment is also up both QoQ and from the start of the year.

Kraken has restructured their debt moving amounts owed under a line of credit to a longer term facility, overall incurring about $5M in additional debt from the start of the year to $15.7M.

Cash Flow:

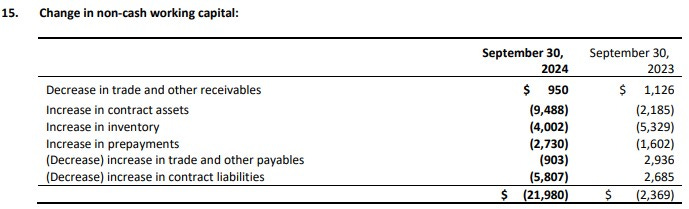

Operating cash flow looks really rough with $10M of operational burn through nine months, particularly when you compare it to $4.1M of positive operational cash flow through nine months last year. With that said, prior to working capital adjustments, cash flow improved to last year but a whopping $22M in adjustments have put a serious damper on inflows of cash so far in 2024.

Last quarter I also had concerns about these working capital adjustments and I was disappointed to find no corresponding detail in the notes. Thankfully this quarter they provided it, outlined below.

Revenues are not only slightly down from last year, but they are the lowest quarter of the last five. Given that I’m having a hard time understanding how $24M of revenue recognized has not been invoiced yet.

This is the biggest culprit for the cash flow problems so far in 2024 but inventory investments and prepaid expenses have also contributed.

In addition to above, PNG has utilized $2.6M in purchases of assets this year, raised $18.2M, and increased their debt load by $5M. Overall they have increased their cash position by $9.3M or 180%.

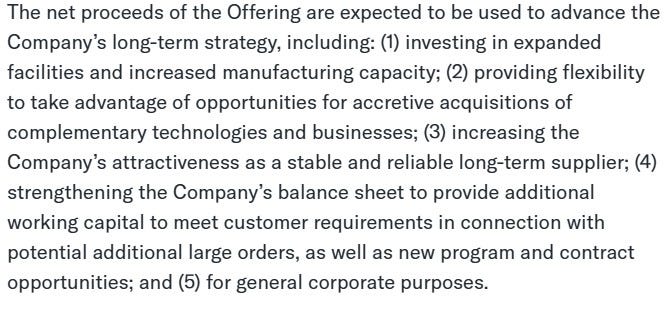

A month ago today (post Q3), the company raised an additional $51.8M in a bit of a surprise offering. Perhaps the most surprising is the raise was done at $1.60 and the stock price soared by 50% in the month afterwards. The company made the following statement following the raise as potential uses for that windfall to the treasury. Is the reason rise due to speculation on an accretive acquisition or large contract?

A disappointing overall cash flow section, and for a second quarter in a row. These are typically much shorter sections so when I need to be this verbose it usually means I’m displeased. We’ll see how they utilize these funds but I wonder if their cash flow was better managed, they wouldn’t have needed to raise as much through dilutive measures, not to mention needing to take on additional debt.

Share Capital:

230.2M shares outstanding with 11.7% dilution from a year ago

32.3M shares issued post financials bringing the approximate outstanding count to 262.5M, 27% dilution rate since the end of Q3 2023

11.2M options outstanding all well ITM but none expiring for two more years with more than half six years from expiry

Share consolidation proposal from a potential 2:1 or 7:1 was approved last June

9% insider and 10% institutional ownership (per YF) which may not be up to date with recent raise

Only insider transaction on the open market, a $225k sale by the CTO

Income Statement:

As mentioned earlier, Q3 revenue of $19.5M was the lowest quarter of the last five, down 4% to last year and off by 13% on a QoQ basis. Big swings in segmented revenue with service revenue up by 121%, but product revenue took a large haircut, off by 27% to Q3 of last year. YTD paints a much better picture with revenues of $63.2M, up by 52% through nine months.

The shift in segments did assist their gross margin which improved by 340 basis points to 52.1%, so they were able to produce 3% more margin dollars on a 4% reduction in total revenue. When a company is going to have a soft sales month, it is nice when a company can react with reductions in their cash burning expense, and that is what Kraken did reducing them by about 5%. Unfortunately, depreciation rose and SBC expense rose over 6x erasing those improvements as total operational costs were over $200k higher. Tack on a $600k bogey to last year on foreign exchange, and their financing cost doubling due to their debt, and the end result is net income worsening by almost $700k, and that includes a $270k tax benefit.

YTD is still trending much better with net income at $6.4M, up 117% from $3M last year.

Overall:

There’s no putting lipstick on this one, it’s a stinker. I can’t say that the management commentary in the MD&A was overly comforting either. No change to their year end guidance for $90-$100M in revenues for 2024 which predicts a Q4 of between $27M-$37 in revenues. The low end of that would be another slight miss as they are up against $28M from last year.

So I end the review with a lot of questions. Why the capital raise for starters? A lot of speculation and it certainly isn’t going to be capex related as they took the guidance for these expenses down. Big contract or M&A would be at the top of investors wish lists so we will see what happens in the coming months.

Why isn’t a $500M market cap company doing an earnings call at this stage of their growth?

Can they turn around this horrible trend in operational cash flow by year end?

And the biggest, is this really a $560M market cap company trading at over 6x TTM revenues and a 59 P/E ratio?

Not based on this quarter. Still overall bullish despite the negative slant here but I’m calling a spade a spade and Kraken dropped a turd in the sea in Q3. Downgrade to 3.25 stars due to the quarter and valuation.

Have a request to review a stock you are interested in?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

One of the good stories of the importance of patience and holding on for me.