KITS Eyecare ($KITS.TO) FINS Review

Q3 2025 (3.5 / 5 stars)

It has been quite the ride for this 2023 Wolf Pick, selected when the stock was back at $2.58 in late 2022. I exited my position for a 500% gain earlier this year when the valuation felt troublesome. It continued to rise peaking at over 7x to $18.40 just a month ago.

Seemingly for no reason the stock has lost 30% of their value since, but after releasing their Q3 numbers after hours on Thursday, the stock slightly rebounded 2.5% on a turbulent Friday.

While I’m no longer a shareholder, I am still a customer. In fact the Wolf household purchased five pair of glasses & sunglasses in September, contributing to these results. The header image used for this article is one of the pair recently purchased.

It’s actually been a couple of quarters since my last KITS review so let’s see how they did.

Balance Sheet:

KITS current ratio has improved quite a bit since my last look, now up to 1.75 vs 1.4 earlier this year. At the end of their third quarter they maintained $19.7M in cash, $2.7M of receivables. $22.1M worth of inventory and $1M of prepaids against $26M of current liabilities after deferred revenue is removed.

KITS has driven a 30% YTD revenue increase on slightly less inventory, dramatically improving their turnover. The company does not produce an A/R aging report which typically I find irritating, but given the nature of their B2C business and current A/R at under 2% of YTD revenue, it’s borderline irrelevant here.

The company has just less than $2M of debt including a promissory note, but those amounts are both current and the company should be debt free by April.

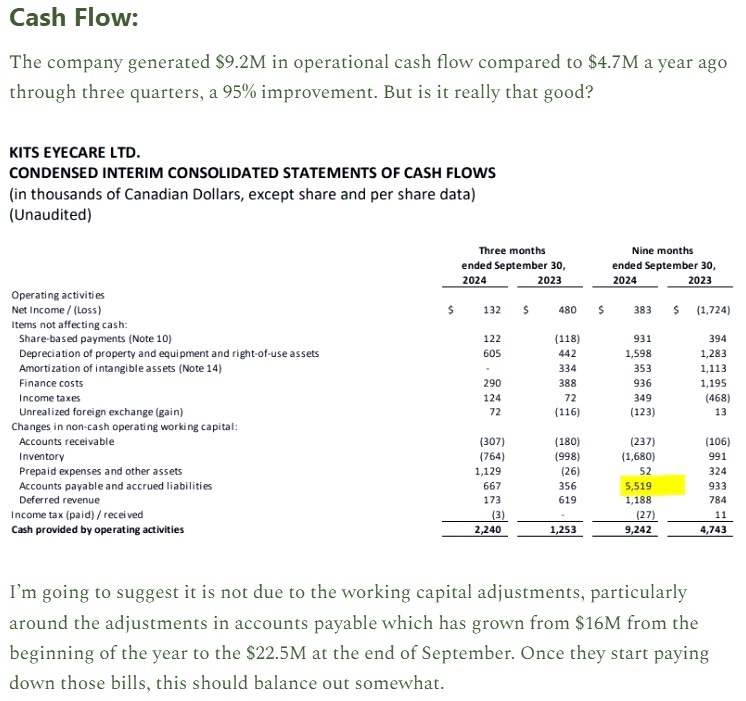

Cash Flow:

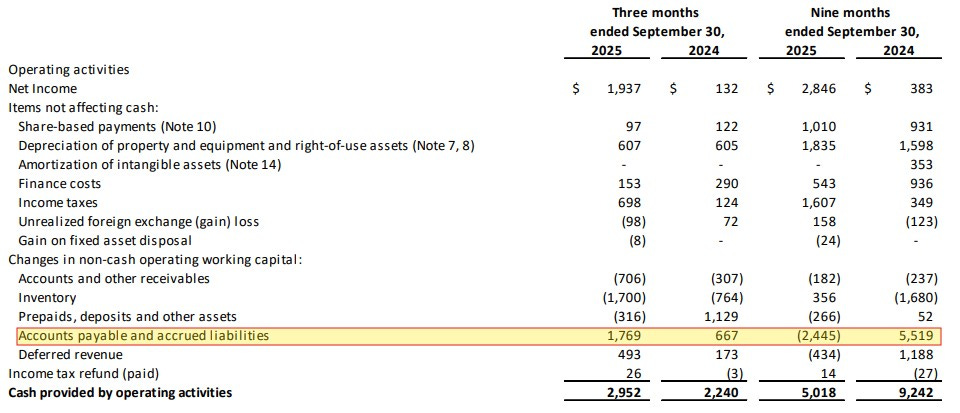

Through nine months KITS has produced $5M of operational cash flow. This compares to $9.25M at this stage last year which at first glance may raise a few eyebrows.

In my Q3 review one year ago, I told subscribers that they shouldn’t get accustomed to generating that level of OCF.

A year later, with the reduction in their A/P, is an $8M swing in working capital adjustments. Therefore if you’re concerned about this years OCF being 45% lower than last year, I don’t think you should be. Q3 OCF was $2.95M vs $2.24.

KITS has paid down over $5.4M of debt, and received $1.3M into the treasury from the exercise of stock options YTD.

Overall, they have improved their cash position modestly from the beginning of the year. No concerns to this point.

Share Capital:

32.1M shares outstanding in a well managed float with only 2% dilution over their last seven quarters

2.2M options outstanding with the average exercise price well ITM at $3.07

Top two shareholders (CEO - Roger Hardy & LD Group) own approximately 60% of the outstanding shares

More insider selling than buying of late with the CEO and Business Development Officer taking some profits off the table back in the summer

Income Statement:

For the first time, KITS surpassed $50M in a quarter reaching $52.4M in Q3, 25% more than they achieved in the comparable quarter last year and 5.6% QoQ. Gross margin is also trending upwards with 34.6% in Q3, 170 basis points better than last year, delivering 32% more gross profit dollars.

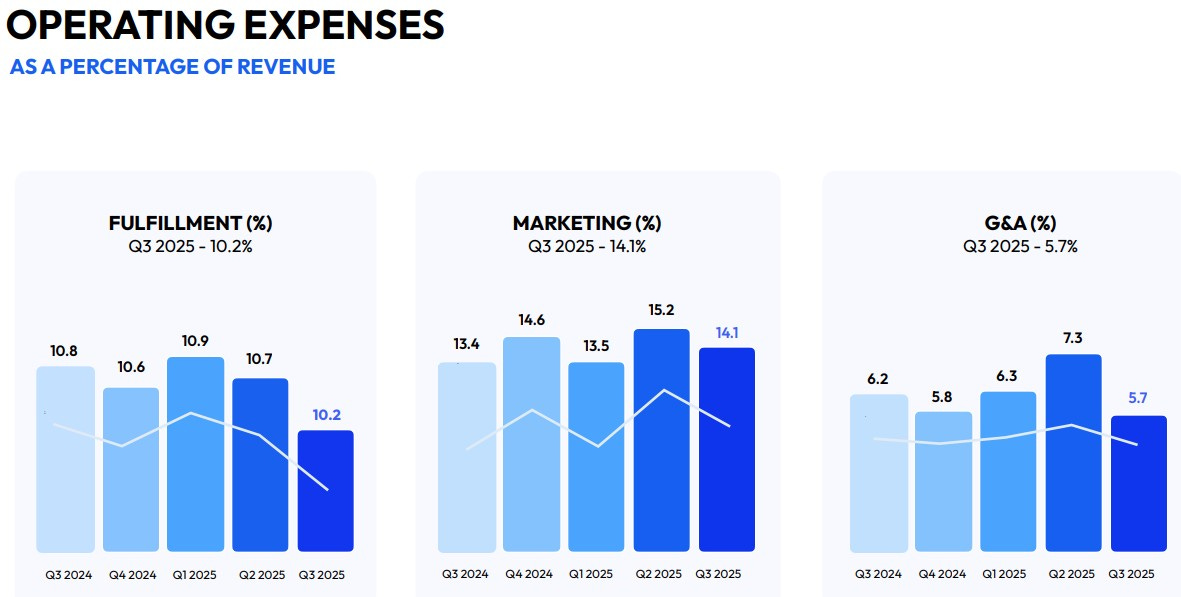

Total cash burning expenses (Fulfillment/Marketing/G&A) rose by 24% so they did not convert much on that 25% revenue increase. KITS significantly benefitting from foreign exchange gains of more than $1M in the quarter resulting in operating income of $2.7M vs $340k last year. After taxes, the company’s net income grew by nearly 15x, $1.94M vs just $132k last year.

Through nine months, revenues have grown by 30% to $148.6M and gross margin is up by 320 basis points to 35.8% delivering 43% more gross profit dollars. Those three cash burning expense buckets referred to earlier are up 28% on 30% more revenue.

Net income through three quarters stands at $2.85M, more than 7x greater than last year, and that is despite paying $1.25M more in income tax and experiencing a $1.9M forex bogey compared to last year.

Overall:

KITS has now delivered twelve straight quarters with 20% or more revenue growth with three year compounded growth of 31%.

On the profitability front, the increases experienced have really been all margin driven as their expenses as a percentage of revenue have been pretty stable outside of some modest improvement within fulfillment. I would expect similar moving into 2026 as they expect their marketing spend to continue in the 13-15% range.

That 30% share price decline mentioned off the top started on the day the company announced these preliminary numbers. With continued growth of 25% I’m left wondering what investors expectations were. I will say however that with a high level of insider ownership on a relatively small float, price swings can be fairly dramatic on slightly positive or negative sentiment, and with approx 100k average shares traded during this decline, that appears to be the case.

Now I’m left wondering what that will look like over the next four months until we see the company’s Q4, as their Q4 guidance is on the conservative side ranging from $52 - $54M. The low end would represent a slight sequential decline in revenue and that would be the first time that has happened since 2001. They would need the top end of that guidance to continue their streak of 20% YoY revenue gains as well.

With that said, they also have internal targets of revenue growth in for 2026 in the 25-30% range which would take them well over a quarter billion in revenue.

You can’t look at KITS without questioning their current valuation - a $415M market cap. That valuation produces metrics of a 78 P/E, and 38 EV/EBITDA, ones you would be very hard pressed to call cheap. By the same token if you look at one of their competitors whom I’ve used in the past, Warby Parker, they look much more attractive and that is with WRBY losing 40% of their value in the past month.

From a customer perspective, which I cannot do with almost all stocks I cover, they offer a fantastic shopping experience, deliver great value and have great customer service. All that while growing by 31% over three years and still remaining highly undiscovered in the Canadian market place.

With all of that said, am I looking to re-enter KITS right here?

Given the cautious guidance for Q4 and the length of time between now and when we will see their year end financials, coupled with this weak looking chart remaining below the 200MA for four straight days, probably not. I could get ready to pounce if this fell further into the $11 range near $10.90 support though.

I do think given their 2026 outlook, strong management team and everything else they have going for them, that this is definitely one to watch and keep a close eye on, particularly as we head into the early stages of 2026.

3.5 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Great company. Wish I had gotten in early, but hopefully there's a chance to enter soon. And thanks for the review!

New here. Any of your stocks one could buy today?