This turned into a longer piece than originally intended, but the next couple of months will be busier with many companies scheduled to report earnings. My August version will likely come earlier in the month due to an even heavier schedule of companies expected to report in mid to late August.

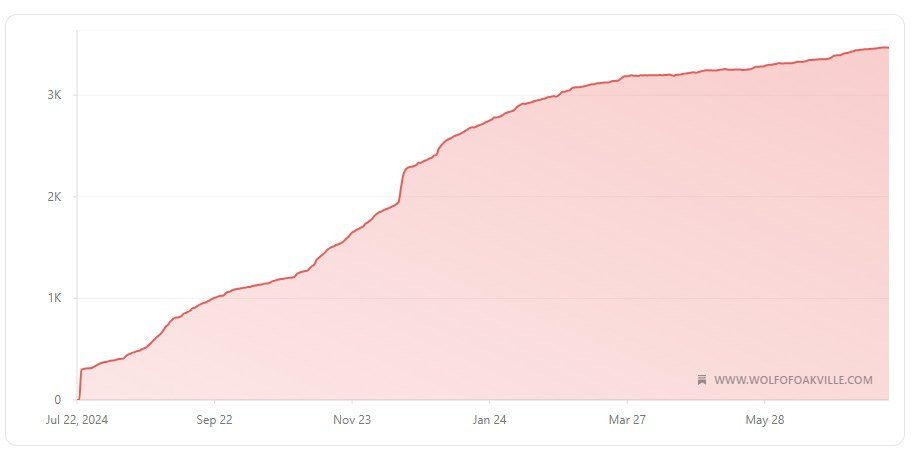

Tomorrow is also the one year anniversary of moving my blog to Substack. Thanks to everyone who has helped to grow my readership from 300 then to just shy of 3500 now. It’s greatly appreciated.

Before we get into who to watch over the next few weeks, let’s take a look back at some of what I had to say in last months version. Of the ten stocks I covered last month, I identified two buy zone opportunities, one danger zone and several stocks I was “fading”.

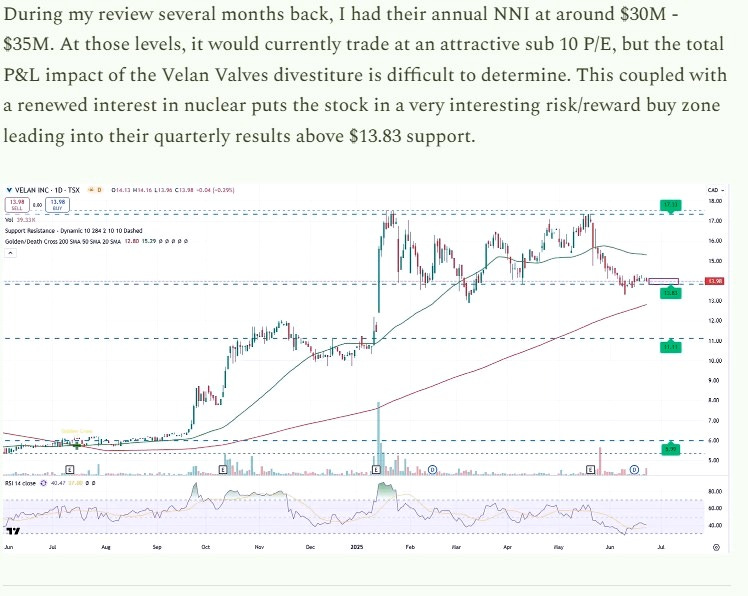

Velan Inc - VLN.TO

The company delivered a very impressive quarter with net income from continuing operations of $17.8M compared to a $2.2M loss. The stock is up 10% from that buy zone call and looks to have even more room upwards.

California NanoTechnologies - $CNO.V

“Swing play” turned out to be the key word here with the stock bouncing 35% leading into the day of their financials. I made a quick 21% personally. While the YoY results were strong the QoQ results were not and the stock has since retreated back to where it originally was. Potential danger zone play when they next report.

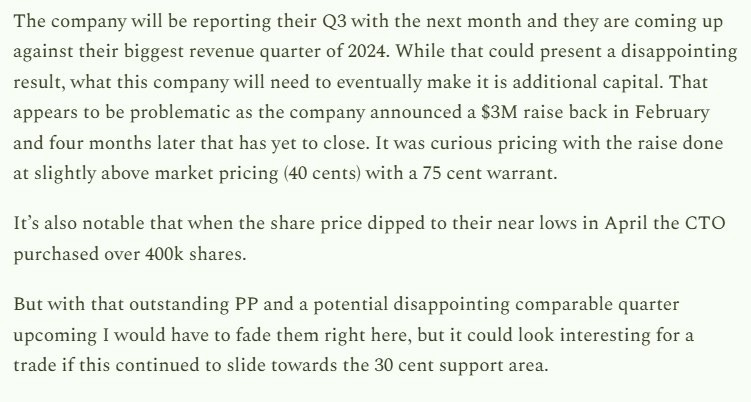

Telescope Innovations - $TELI.C

I did not like the way TELI was trading on low volume leading into their earnings.

The stock dropped by 23% from the day before earnings to the day after as it reported a 17% decline in revenue and much higher losses giving them the disappointing quarter I had projected. It didn’t quite get down to 30 cents as mentioned but has bounced 17% from the 33 cent low.

I also faded Avant Brands which dipped by 10% post financials, CanadaBis Capital by 10% as well and Firan Technologies by 9%.

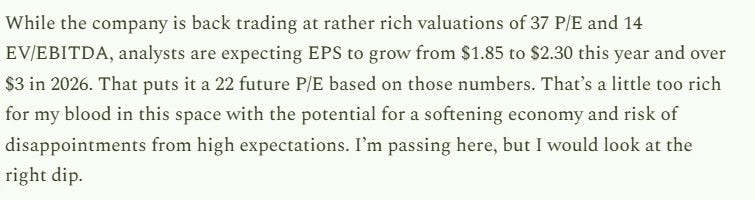

It wasn’t a perfect month however as I had this to say about Aritzia ($ATZ.TO)

Aritzia went on to deliver a monster of a quarter with 33% more revenue and 168% more net income. The stock is up 7.5% since my article. Clearly no dip.

Let’s get into some stocks who are scheduled to report in the next few weeks. Spoiler alert, more danger zones than buy zones this time around. Stocks covered including four annual Wolf Picks and a mid year Seal of Approval selection:

Tilray - TLRY.TO / Avante Corp - XX.V / Volatus Aerospace - FLT.V / Enterprise Group - E.TO / MDA Space - MDA.TO / Medexus Pharma - MDP.TO / Propel Holdings - PRL.TO / Dirtt Environmental - DRT.TO / Cematrix - CEMX.TO / Greenlane Renewables - GRN.V / KITS Eyecare - KITS.TO / Omni-Lite Industries - OML.V / Neupath Health - NPTH.V / Gatekeeper Systems - GSI.V / NTG Clarity - $NCI.V / McCoy Global - MCB.TO / Well Health - WELL.TO