This won’t be my first look at Illumin. I looked at them extensively a few years ago when they were called AcuityAds, but his will be my first published review of the company.

Over a one year timespan the stock has performed well, up about 33%. But they have had a rough six weeks, down 31% from their one year high of $3.26 and miles off their all time high of $32 from back in the covid days. Notably was also a time when the company looked to be on the verge of producing consistent profitability.

After producing nearly $12M in net income on $122M in revenue in 2021, they went on to lose on the profitability line including $11M on $126M of revenue just last year.

The sector also hasn’t received much recent love as investors fear a softening economy will lead to less ad spend.

Let’s dive into ILLM’s Q4 and total 2024 year.

Balance Sheet:

Illumin has a very strong balance sheet with a current ratio of 2.5. That consists of $56M in cash, $44.7M worth of receivables and $3.5M in other short term assets against $40.8M in short term receivables with no long term debt. With their cash position alone more than covering their 2025 liability commitments they are extremely liquid which opens the door to many options.

The company does not provide any detail into their A/R.

Cash Flow:

Illumin generated $10.1M of operational cash flow in 2024, about an eleven and a half million dollar turn around compared to burning $1.4M operationally a year ago. They utilized nearly $6M on assets including upgrades to their data center, and bought back $5.3M worth of stock (2023 bought back $15.3M)

Overall the company ended 2024 in a very similar cash position as when they began.

Share Capital:

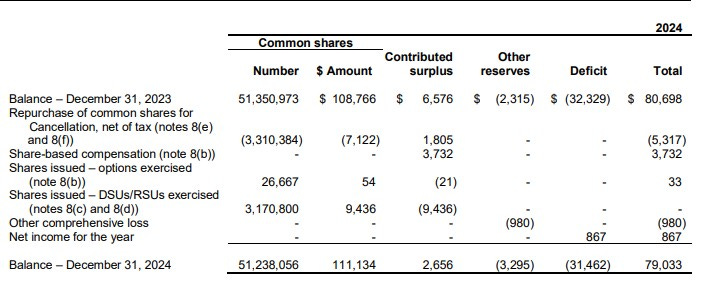

51.2M shares outstanding, about 100k less than they had to begin 2024

1.02M options outstanding with 1M granted in 2024, 450k forfeited and 26k exercised

1.95M RSU’s and 132k DSU were awarded in 2024 with 3M RSU’s and 204k DSU’s exercised

23% insider ownership per ILLM fact sheet data

ILLM bought back 3.3M shares during 2024. On December 23rd commenced a new NCIB to buy back a potential of 3.9M more, but have yet to report any through Q1

What I find interesting is after buying back 3.3M shares during last year, the overall float barely moved due to the significant RSU and DSU awards.

The company in my view has a retail unfriendly 15% Omnibus Incentive plan. Rough math suggests insiders went from about 17% ownership to 23% during the recent fiscal year without shelling out much of their own coin, and they still have nearly 5.2M awards left to give under the current plan over the next eighteen months.

It’s certainly a bit of a turn off for me.

Income Statement:

Illumin had 11.1% of revenue growth in 2024 finishing the year with $140.4M in revenue vs $126.3M in 2023. Margin slipped by 110 basis points to 46.6%, down from 47.7% a year ago which produced 8.5% more gross profit dollars on 11% top line growth.

Operational spending was well controlled during the year, actually decreasing by 1.6%. Those improvements still weren’t enough to bring them to profitability on the operations line, losing $5.03M although that is a a $6.3M improvement over the $11.4M loss experienced in 2023.

After interest received from their strong cash position and a $5.1M gain in foreign exchange the company did pull out a better than break even total year on the net income line with $867k against a significant $11M net income loss last year.

For the quarter itself revenues grew by nearly 35% to $49.9M. The margin erosion gap in Q4 was higher than their YTD numbers with 340 bps of GP erosion to 45.4% therefore on 35% more top line only took 26% down to the gross profit line. Operational spending within their cash burning buckets also bucked their annual trend which grew by 16.8% with Sales & Marketing up by 15%, Technology costs up by 27% and G&A costs by 10%.

Net income in Q4 came in at $4.1M, a big variance to the loss of $2.6M experienced in the comparable quarter.

Overall:

While Q4 looks great on the bottom line, 88% of that net income is the benefit of foreign exchange and of the improvement of $11.9M in net income year over year, exactly two thirds were derived from changes in current fluctuation.

Therefore when I see the company trading at over a 130 P/E ratio and over 200 on a EV/EBITDA basis it’s not all that surprising that the stock is down 17% since their financials were released a couple of weeks ago and 31% off from their 52 week high.

Toss in $9.5M in SBC costs over the past two years and I would need a serious pair of beer goggles to take this one out on a date.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf it was interesting the point about how much is made on foreign exchange thanks for the detailed review