Request comes from the Wolf Den discord to review this tiny $7.3M nanocap that has been getting a little bit of a buzz of late. The stock did have quite a nice little run over the past six weeks going from six to fifteen cents as of last Friday. Sorry for anyone who bought the top last week however as the stock pulled back 18.5% after releasing their annual financials yesterday and now sits at 11.

Common Sense investing impact? Hard to ignore the timing of Cam’s coverage of the stock, volume and price performance afterwards.

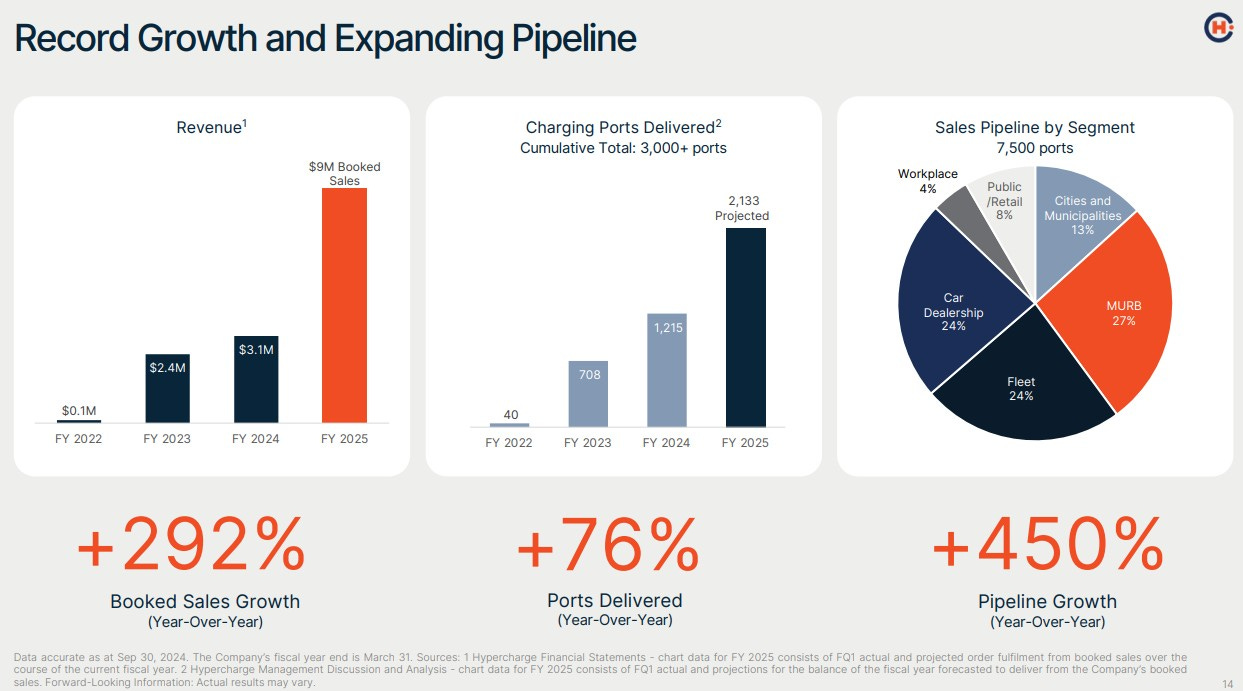

The sector that they play in certainly makes them worth a look at this stage. Hypercharge is an EV charging company founded in 2021, and they have taken the business from virtually nothing in 2022 to the $10M in revenue they posted in their recent fiscal year.

What do their financials tell us about their growth and future prospects? Let’s dig in.

Balance Sheet:

With the $2.45M in deferred revenue removed from current liabilities, HC’s current ratio is a decent 1.85, but consists of just $862k in cash, $2.57M in receivables, $1.12M of prepaids and $1.4M worth of inventory. That is overtop of $2.88M worth of current liabilities due over the next twelve months. The company has no debt and in fact, no liability commitments beyond one year.

Given 43% of the company’s current assets are made up of accounts receivable, I would have liked to see an aging report provided, but alas that is not the case. The company is anticipating taking $283k in A/R write offs. It doesn’t sound like much but that is nearly 3% of revenues, and on their margins and cash flow it isn’t insignificant.

I’ve seen worse.

Cash Flow:

Hypercharge suffered $2.35M worth of operational cash burn in their recent fiscal year but if there is any good news in that, it’s that it was less than half of the $5.34 they burned in the previous year.

Not a lot occurring within the investing and financing activities portion of the CF statement, but the company did raise about $1M from a March 2025 private placement.

Overall their cash position depleted by nearly two thirds from the start of the year. It’s also very notable that the company closed a second tranche from their private placement, adding $844k in gross proceeds to the treasury, just about doubling the cash position noted above.

Share Capital:

87.4M shares outstanding, with 24% dilution occurring during the year. Post financials added another 13M bringing the more up to date number to a little over 100M shares

A whopping 32M (non performance) warrants outstanding. All with an exercise price of 12 cents with 2.4M at $1.35 being repriced down to 12 cents during the year. 30M not expiring until May of 2028. Ouch, this is where Wolf starts getting much less interested.

3.1M performance warrants all well out of the money ranging from 25 - 60 cents with 1.6M at a quarter expiring post financials

4.05M options, with only 775k currently ITM

1.73M PSU’s and 672k RSU’s

9.5% insider ownership (per Yahoo Finance) with minimal insider buying in the last twelve months and minor PP participation.

Not counting well out of the money options, sitting at a fully diluted float of approximately 135M shares.

Income Statement:

Hypercharge performed very well on the revenue line, earning a little over $10M on the year, more than tripling the $3.07M achieved last year.

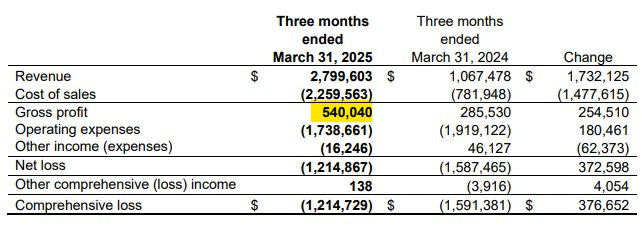

Margins are on the lighter side at 22.6%, an atrocious slide of nearly 1000 basis points from the 2024 rate achieved of 32%.

Total expenses were 27.6% less than a year ago with the bulk of the savings coming from G&A, nearly $2.6M or 36% less. It’s notable that over $1.2M of those savings were from non cash burning SBC costs while related parties took 15% more in cash related compensation.

At the bottom, Hypercharge ended the year with a net loss of $4.3M, nearly halving the $8M loss taken in the previous year.

Overall:

I have to say the share capital section took any air out of the balloon for me and there wasn’t much to begin with, but let’s break the P&L down a little bit more.

At their current opex spending levels and under 23% margin, they would just about need to double their $10M in revenues to break even - that is without being able to spend an additional penny beyond the $6.6M in opex last year. But after a 1000 bp decline in margins YoY, I’m not even sure the 23% could be used as a new baseline, as they only delivered 19.3% in their most recent quarter.

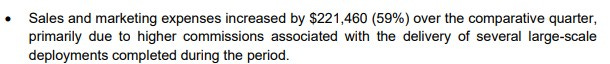

Not only do their larger scale deployments come with less margin, but also with higher commissions. This suggests to me that their commission structure could be broken. Offering higher commission rates on lower margin product is a bad recipe for a profitable business.

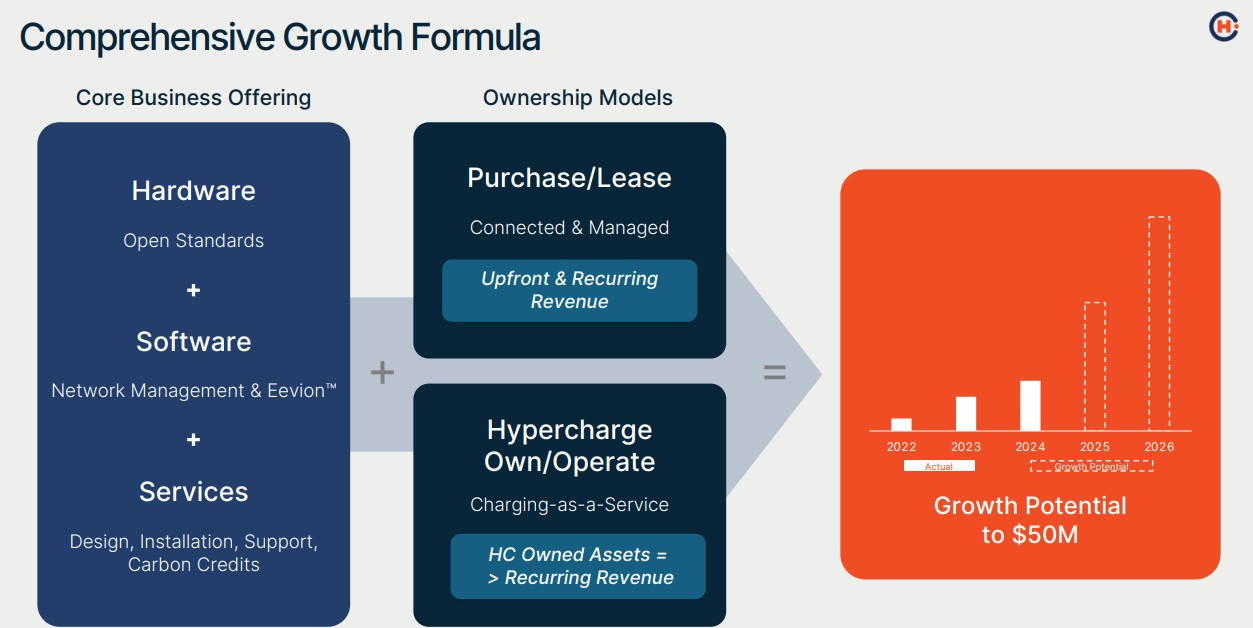

Within their investor deck they suggest they have the potential for $50M by 2026, but with a future current backlog of only $9M spanning the next 18 months, that seems like a big stretch from here.

Then you get into the share structure and what looked like a successful raise back in the spring, looks like an anchor around their necks with 30M warrants priced at 12 cents with the stock sitting at 11. Talk about overhang which would dilute the stock by 30% in addition to all those placement participants sitting on a healthy profit.

To sum up, a company within an interesting growth sector with lumpy revenue and even lumpier margin where large revenue wins will come with lower margins and a higher expense structure with a bloated float in a significant overhang position and will likely need to raise capital again in their new fiscal year.

Nice run if you were able to pick up some shares during the year for the latest run up but hard to see the party breaching 12 cents for any extended period of time in the near future.

Pass. 1.5 stars.

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wold fantastic review. Your comment of only 9 million back log and 28 months to hit target stood out. Keep up the frequency and most important fact filled reviews. I did own it I sold it on a feeling and you proved to me go with your feelings.

Thanks for the review, Wolf. Interesting company, but the dilution and warrants = hard pass.