It’s been a while since High Tide reported their Q3 earnings back in September. I gave them an encouraging 3.25 stars and the stock has performed rather admirably since going from around $3 to $5 as recently as December. The month leading into these annuals have seen the stock retreat back to the $4 area and the stock actually gapped down since released. So what gives?

Balance Sheet:

Their current ratio is an acceptable 1.44 that consists of $47.3M in cash, $3.3M in A/R, $29.3M worth of inventory and $5.8M in other short term assets against $59.5M in short term liabilities due over the next twelve months (deferred revenue removed).

Their current liabilities include nearly $26M of debt made up of loans and notes payable but their current liquidity coupled with their operational cash flow generation puts them in a good position to eliminate. Curiously, they added $8.7M in long term debt through debentures.

Cash Flow:

HITI produced $35M of operational cash flow during their 2024 fiscal year, 72% more than they generated in 2023. This contains very little in terms of working capital adjustments so this nearly $3M in monthly OCF generation is legit.

The company utilized $11M for asset acquisitions, received $3.1M through their at the market financing and with the addition of the secured debenture did not alter the total value of their debt. Overall HITI improved their cash position by 57% during 2024.

Share Capital:

Decent sized float of 80.8M shares outstanding, with 7% dilution this year, the bulk of which from settling convertible debentures and an odd and unnecessary issuance of shares through their ATM program

4.85M warrants outstanding with a whopping 46.3M expiring unexercised this year. Current ones are ITM but do not expire until mid 2027

3.1M options and 700k RSU’s

HITI has a retail unfriendly 20% fixed Omnibus plan, as evidenced by the slew of RSU’s awarded post financials

Per YF, 9% insider ownership and 8% held by tutes (per Yahoo Finance)

Much more history of selling into the open market than buying. When you’re still an unprofitable organization, shareholders should be asking why they have an RSU plan at all

Income Statement:

When you look at their overall P&L ones immediate reaction is they made some fantastic strides in 2024, but when you actually drill into the specifics it makes me wonder. I’ll explain.

High Tide improved their revenue by 7% during the year, exceeding the half billion mark at $522.3M vs $487.7M last year. They also improved their margins by 40 basis points to finish the year with 27.3% gross profit. They also reduced their expenses by nearly $35M so overall they went from an operating loss of $41M in 2023 to a $5M operating profit in 2024. Below that line including other expenses, most notably financing costs of $10M results in a net loss of $3.8M, a substantial improvement over the $41M in the previous year.

Overall:

While HITI reduced their expenses in 2024 by over $35M, the expenses that contributed to that were all non cash burning. $7M less in depreciation and amortization, $2M in SBC, and the largest - a $30M impairment. Actual cash burning expenses rose by $3.6M, and their largest expense bucket of payroll increased by 15%.

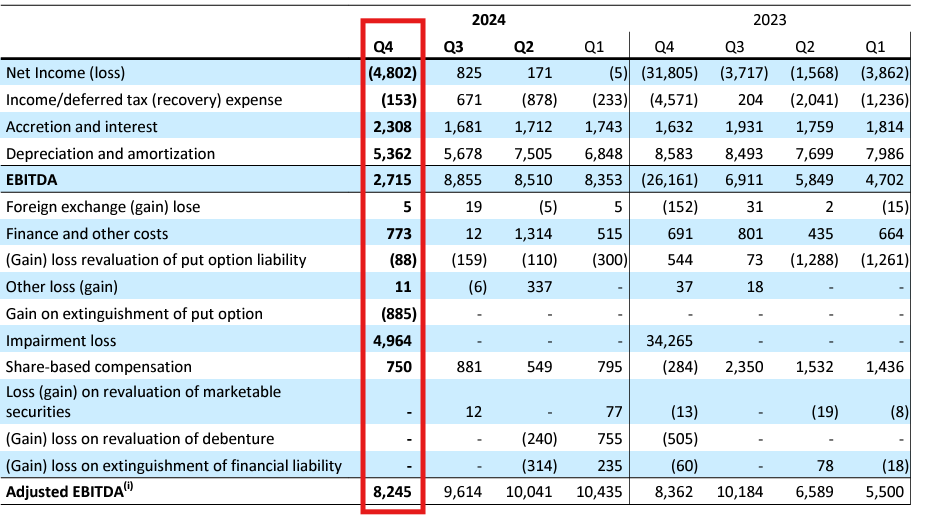

All of those non cash burning expense improvements didn’t quite get High Tide to net income profitability, and their most recent quarter was their worst in terms of profitability with the three previous ones coming in at break even or slightly better.

The good news for High Tide is their brick and mortar revenue increases were split between organic and new stores, which positions it well for additional increases in 2025 from the 18% increase in store count alone.

My problem when looking at High Tide is it’s very difficult to see the path to any significant profitability. Do they have a path to achieve $600M or $750M in revenue AND produce 5% net income? It’s hard to imagine this heavy bricks and mortar organization can squeeze 500 basis points out of margin or operational expenses or a combination of those to get there. With that said they look a heck of a lot better than some of their other sizable competitors, but I don’t think that’s enough to make High Tide any more that watchlist worthy. Maintaining the 3.25 stars.

Want your stock reviewed?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Agreed tough to get a higher margin at retail outlets until after consolidation of the weak mom and pops... website pricing also precludes variable pricing by market.

IMHO.... It is the CEO's tenacity, Euro expansion and a Nasdaq listed company, with turn key processes ready for US expansion, that make HITI a growth stock.

Thanks for the review Wolf.