So much to unpack with all of the recent news and these financials all dropping around the same time. You would almost think it was planned this way to flood the zone around the same time as releasing their financials which have the history of looking like the back end of donkey.

Healwell is my second review in a row that previewed their financials results with a news release last week, and then under the cover of darkness, dropped them after hours. One of the differences between AIDX and Intermap (my most recent review) is that Healwell had to correct their news release as their original EBITDA number was actually $15M worse than the original. Amateur hour stuff.

You’re probably getting the feeling that I’m not the company’s biggest fan. This would accurate. I’ve reviewed AIDX on several occassions with the best being 1.5 stars and the most recent a miniscule 1.0 out of 5 - that one coming in mid November. The stock is currently trading down 17% since their Q3 financials.

The stock has performed much better than that over the past year however, growing by 57%, but is off by 55% from it’s one year high way back in the middle of June. This share price has seen some things.

With the big acquisition closing this morning, Well Health exercising all of their rights to increase their ownership, and more importantly a significant grasp of voting control over Healwell, there is a lot to sift through in addition to these financials to properly evaluate which direction we think the company is headed.

Balance Sheet:

Frequent readers and any mediocrely trained finance bro will tell you that a current ratio (CR) under one is not what you are looking for, but that is what we have here with a .88 CR and that is with excluding deferred revenues from current liabilities. As of December 31, Healwell had $9.4M in cash, $6M in receivables, $2.35M of prepaids and about $600k in other short term assets against $20.9M worth of short term liabilities.

Given the rapid growth due to acquisitions, the large jump in receivables over last year is to be expected. While the company does not provide an aging report they have not significantly increased their expected credit losses so I would say that things look fine here.

Healwell has $14.8M of long term debt between traditional and related party loans, contingency consideration and debentures payable. Most of these payable to Well Health.

Things have changed rapidly in the past week to put it mildly. The company raised $25.5M via subscription receipts at $2 with a 1/2 warrant at $2.50, another $27.3M in convertible debentures (9% discounted) , with interest bearing at 10% and maturing in four years with a convertible above market price of $2.40. In addition the company announced a $50M loan with a $25M accordion feature. The initial $50M made up of a $20M term loan and $30 revolving LOC, but it is notable that no other terms including interest rates or other conditions were disclosed.

All of the above was to support the huge acquisition of New Zealand’s Orion Health. The total purchase price works out to approximately $143M CAD made up of 35.6M shares at $1.61, and a cash payment of approximately $86M CAD. Orion can also earn another $20M or so in future earn outs based on undisclosed future metrics.

So the above balance sheet is going to change dramatically over the course of the next two sets of financial statements. Since the deal closed on April 1, investors will likely not see the full impacts of the deal until they report Q2 in August. A pessimist may suggest it was planned this way.

Cash Flow:

Healwell AI burned through a staggering $22.6M in operational cash flow during their 2024 year, more than double their burn of 2023 which was $10.8M. $3.5M of that burn was experienced in their final quarter. In addition, they utilized $10.6M for acquisitions, invested $3.4M in four other companies, and received $28.2M via financing activities including via private placements and warrants.

Overall the company depleted their cash position by over 50% from the $19.2M they started the year with.

With all of the financing activities including a significant increase to their debt load mainly going towards their Orion purchase, it’s really too soon to tell where that would leave them in terms of cash runway given their greater than $1M operational burn rate. They of course now have some room left on their LOC, and a new $25M accordion feature to work with, but with no terms disclosed, watch this space in future quarters.

Share Capital:

This should be an adventure.

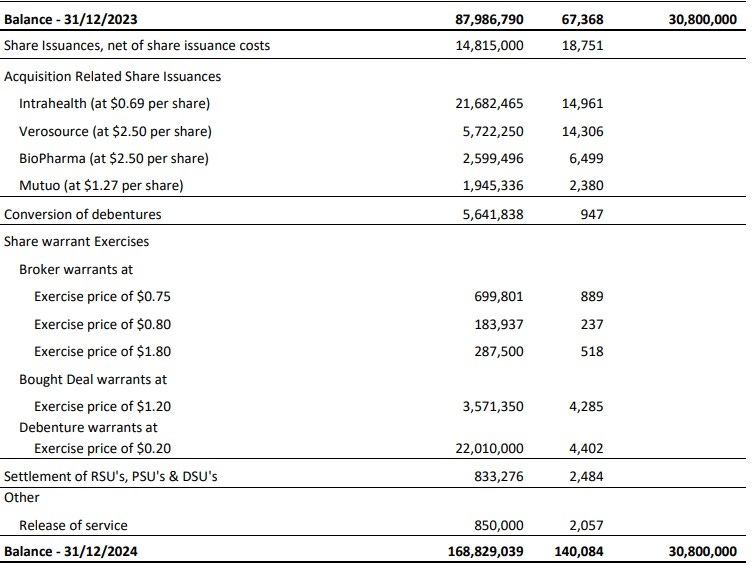

168.8M shares as of Dec 31 but with Well Health exercising their share rights and the 35.6M awarded to Orion as part of the acquisition brings the current non-diluted number to 261.5M shares. That is 3x dilution from the 88M outstanding on Jan 1, 2024. Below is a recap on how Healwell got there.

12M warrants plus 6.4M from the convertible debenture and about 900k broker warrants for a total of approx 19.3M outstanding. Approximately 9.3M of those are currently ITM

2.6M options, all but 920k currently ITM

5.66M combined PSU/RSU/DSU’s outstanding with 3M awarded in 2024

Not even going to take a crack at insider ownership with this bouncing ball but Well Health as of today owns about 37% of the economic interests and almost 70% of the voting interests due to their caste system of a share structure

$7.1M worth of share based compensation awarded this year and $10.4M over the past two years.

No recent open market activity but multiple insiders have participated in their recent raises of capital

Fully diluted float in the neighbourhood of 290M shares but is a serious moving target with everything going on

Income Statement:

We have reached the grotesque part of the evening as this P&L looks like a Nightmare on Healwell street.

The top line isn’t an issue with $39M against a non comparable $7.3M a year ago with current year revenue achieving a gross profit rate of 44.4%

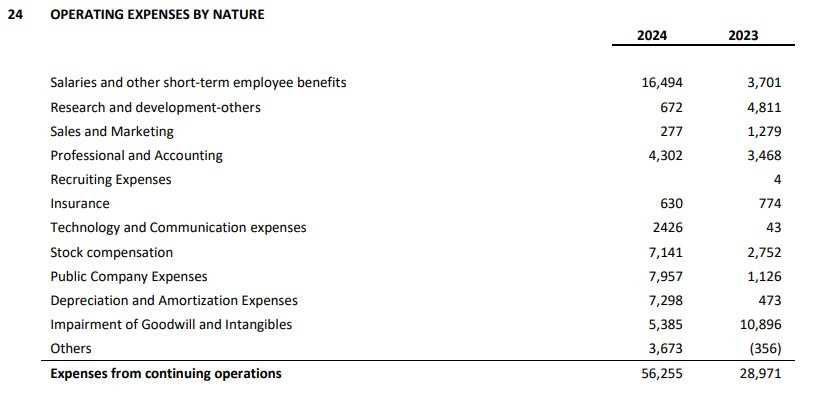

On $17.3M worth of gross profit, experienced operating expenses of $56.2M for an operating loss of $39M. After some one time items including $7.9M in debt forgiveness from Well Health, their Net Income loss was lessened to $27.5M.

Overall:

A lot to get through, but let’s stick with the 2024 P&L performance for a minute.

If we remove all of the one time items from this year which is everything aside from Finance expense in the other expenses, impairments, and if we were generous removed all of the Professional fees assuming it all came from acquisitions (it’s not), their net loss comes out to about $31.2M. On their gross profit that would put their break even point at around $70.3M in a year they did $39M.

You may have noticed I mentioned impairments in my previous paragraph.

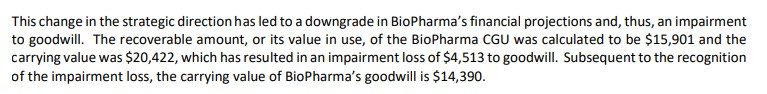

Healwell wrote off $4.5M relating to the goodwill of BioPharma, an acquisition that was only just acquired in July that went for an acquisition price of $17.5M. Within six months after acquiring the company wrote off 25% of their goodwill value based on a “downgrade in financial projections”. This is also after writing off all of the $7.4M worth of goodwill and customer relationships last year for Khure.

This really doesn’t follow in the footsteps of Well Health who with all of their acquisitions, hasn’t written off a penny of goodwill on their way to $1B in revenues.

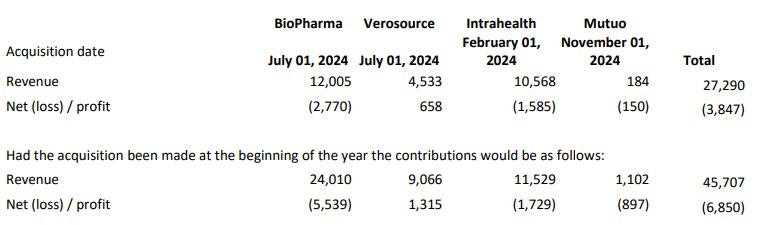

Notice if BioPharma had been acquired on Jan 1 the estimated revenue would have been $24M with a net loss of $5.5M. Let’s take another look at the June 2025 news release. It said they were expected to generate $35M - $40M with a TTM number of $31M. So how badly must things have gone wrong to only deliver $24M? That is a miss of 31% on the LOW end of their guidance.

Of other two larger acquisitions, IntraHealth was estimated to do $12M in 2024, which came close at $11.5M and VeroSource over performed at $9M when it was estimated to do $8M in the original NR.

So given the above, how confident can one be with the Orion deal expected to generate $100M in fiscal 2025 acquired while adding a significant amount of debt and burning operational cash?

Looking forward they have had some positive news flow aside from their acquisitions including up to $3M in cost savings and positive news on Khure including new agreements with service partners. Three million however is only going to put a very minor dent in their significant $39M worth of operational losses. I have their annual run rate somewhere in the area of $160M and even by the company’s own optimistic projections, they do not expect to be Adjusted EBITDA positive until 2027 at the earliest.

So is Healwell worth the implied $425M market cap (fully diluted float) based on these numbers? Not for me. Not today. One star once again.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf excellent job. I have little faith in well as well they seem lost or desperate