With two consecutive one half star reviews, you may have gotten the impression that I don’t like these guys very much. That would be somewhat accurate, but there is more nuance to my disdain. We’ll probably get into it as we move through the review.

Have never held a position short or long, but up until recently I did own Well Health. I exited while on vacation in Scotland a couple of weeks ago after previewing their financials. Well Health, for better or for worse financial statement success will depend greatly on how well AIDX performs due to the high percentage of ownership and run up on their share price. Up until now, AIDX’s share price has greatly assisted Well’s FINS, and in fact without them are mediocre. That’s about to change I believe, and Well’s financials are in for some future pain.

Balance Sheet:

As of June 30th, Healwell’s current ratio was pretty strong at 3.1 (deferred revenue removed) with $19.8M in cash, $4M of receivables. $3.9M in prepaids and $8.4M in “Advance against Investment” against $11.5M worth of liabilities due within the next twelve months.

Healwell has $12.1M of debt, $6.4M of it current. This is net of the $7.9M Well Health forgave at the end of Q2, a big relief to the balance sheet which also had a big impact on their Q2 income statement. They also have $2.9M in debentures payable and $5.7M in deferred tax liabilities.

The advancement against Investment relate to the two post financials acquisitions the company mad for Verosource and Bio Pharma Services. I find it interesting that they made these prepayments on June 28th, but the deal closed a day after the quarter, on July 1 for both deals.

Overall the balance sheet is in a much healthier position compared to my last review. For how long that might last lets move to cash flow.

Cash Flow:

Ouch. $13.3M of operational cash burn through their first two quarters, nearly $10M more burn than they had last year at this stage, albeit a much different looking company. In fairness, I don’t think this looks nearly as bad as it appears as their cash flow statement is highly impacted by working capital changes and the previously mentioned debt forgiveness.

They utilized nearly $15M through acquisitions year to date and received over $28M in proceeds from raises and an impressive $9M from warrant exercises.

Overall, they are in a very similar cash position as when they started the year. The OCF looks bad but I don’t think it is nearly as bad as it appears. Something to scrutinize next quarter with the additional businesses under the larger umbrella.

Share Capital:

153.3M shares outstanding, nearly 200% dilution over the last year and 35% greater share count than my last review three months ago

41.2M warrants, all well ITM. 25.5M warrants have already been exercised YTD

5.2M outstanding 2.5M RSU, PSU and DSU awards including 2.5M awarded YTD

2.2M Options, none ITM

Approx 13M more shares to be settled via debentures plus interest

$16.6M through the two recent acquisitions to be settled via shares at some point in 2025 based on future VWAP

36% insider ownership (per YF) but this has been a moving target given all the dilutionary measures

No insider activity on the open market

Income Statement:

The comparisons to last year are pretty irrelevant since this is a very different looking company so I’m just going stick to the quarter and YTD numbers.

Revenues of $5.4M in the quarter and $10M YTD, with QoQ revenues increasing by almost 19%. Strong margins of 60.9% which is over 800 basis points better than what they achieved in Q1 bringing their YTD margin up to 56.9%.

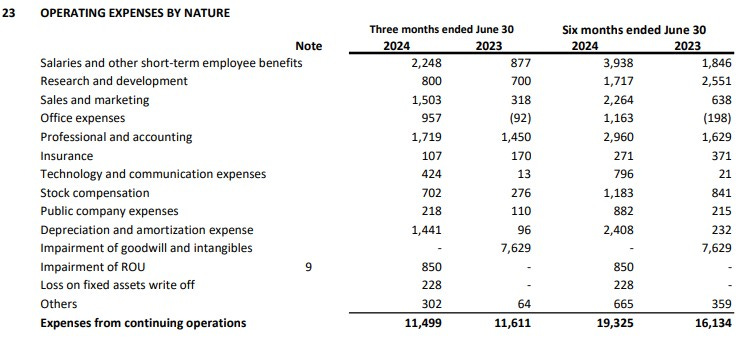

Underneath that is where the problems are with $11.5M of operating expenses in the quarter and $19.3M YTD. While their revenues grew by 19% QoQ, their operating expenses grew by 47% which nets out to a loss before other items to $8.2M in the quarter and $13.6M YTD.

Due to the one time items including the debt forgiveness, Healwell’s net losses were $8.3M in the quarter and $14.6M YTD.

Overall:

$19.3M of operating expenses on $5.7M of gross profit dollars looks really rough. The break even point to cover those expenses on that gross profit rate is $34M in revenue - they did $10M.

The two new acquisitions should boost gross margins and individually are reported to be EBITDA positive, 5% for BioPharma on $35M - $40M of anticipated revenue and 10% EBITDA on $8M of anticipated revenue. That is not going to be nearly enough as a whole to generate profitability. The first look at what this combination will look like will be in Q3, and those financials should be very interesting.

I really don’t hate what these guys are doing overall and one day it might look great but I think that day is a ways in the distance and doesn’t come close to justifying a current $300+ market cap, with a much higher implied market cap given the baked in future dilution. There will be many bumps and bruises ahead and one day maybe time to make an entry.

Awarding 1.5 stars here due to the over valuation, high expense to revenue ratio, and future dilution, predictably to grow even more with future capital raises. It’s actually a slight upgrade.

Buy Wolf a coffee which goes towards website maintenance costs

Have an request to review a stock you are interested in? Visit the TSA discord to make your request in our dedicated channel or email us at thewolf@wolfofoakville.com

Chat with me and 2900+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings and I do so without compensation. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.