Happy Belly Food Group ($HBFG.C) FINS Review - 2023 Wolf Pick

Q2 2025 ( 3.25 / 5 stars) *Upgraded*

Happy Belly was within the group of my inaugural Wolf Picks announced at the start of 2023. Four of those five have gone on to multi-bag with a equal weighted return of 395%. HBFG has been far and away the most successful of the group in terms of share price appreciation. The ticker was VEGN back then and in November of 2022, I awarded the company their first “FINS Upgrade” when the stock traded at just eight cents, and several weeks later were part of that illustrious group of 2023 picks when it traded at just a dime. As of close yesterday, it traded at $1.22 for a twelve bagger (15x if you snagged some on the upgraded review).

I covered Happy Belly in my latest WWW - What’s Wolf Watching article posted two weeks ago for paid subscribers, and had this to say:

Here is the updated chart which has bounced 22% from the bottom of that buy zone.

Enough charts and self fellatio (like I’d ever leave the house). Let’s look into their financials which dropped after close yesterday.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Happy Belly sports a current ratio of 2.1 that consists of $3M in cash, $1.1M in A/R and $1.3M in other short term liabilities against $2.6M in liabilities (deferred revenue removed) due over their next twelve months.

Liquidity is good with their cash position covering all of their commitments coming due over their next four quarters, but it is notable that their overall balance sheet ratios are slightly weaker than they were at the end of March mainly due to capital commitments for corporately owned locations.

The company has just $200k worth of debt, most of which from a CEBA loan back during the covid days, but do have $3M of rather expensive convertible debentures. While these were all done above market price at the time, they do carry a higher than ideal interest rate of 12 points.

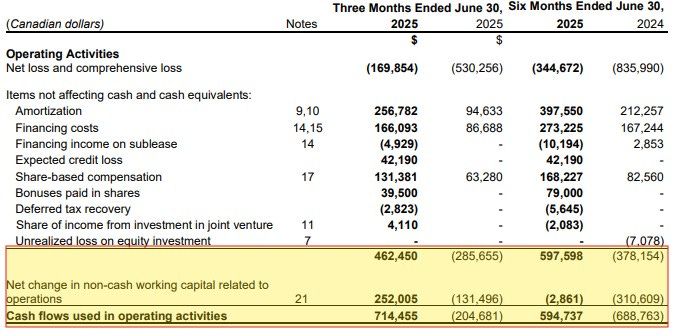

Cash Flow:

I’ve lost track of how many successive three star reviews I’ve awarded Happy Belly. I’ve always felt that due to the growing valuation it would take some positive cash flow and/or profitability (Adjusted EBITDA not applicable) to finally get that upgrade that so many HBFG shareholders have been calling for.

Happy Belly achieved over $700k worth of operational cash flow (OCF) in the quarter which also brings their YTD OCF number to $600k. For several quarters now the company has been treading around the OCF neutral mark. Is this a turning point towards producing regularly recurring positive OCF numbers? It appears it just might be and the reason I suggest that’s the case is the minimal impact that working capital adjustments have had - therefore giving more credence to the likelihood of it being repeatable.

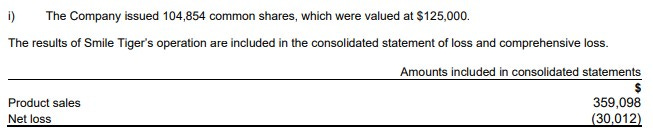

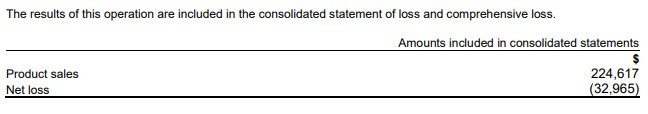

Outside of operations, HBFG raised $500k at an above market raise near the beginning of the year and YTD have utilized $1.24M on property & equipment and also spending $160k of cash through their 2025 acquisitions of Smile Tiger coffee and Via CIBO.

While neither are burning the doors down in terms of revenue generation as of yet, the small net loss suggests they would be on the right side of cash flow generation, and both were on the cheap at attractive EBITDA multiples.

Overall their cash position has depleted by 17% from the beginning of the year.

Share Capital:

129.5M shares outstanding, minimal dilution YTD and 17% over the past 18 months

6.2M options outstanding including 2M issued YTD. All ITM with 2.7M expiring by next June. Full exercise would bring over $1M into the treasury

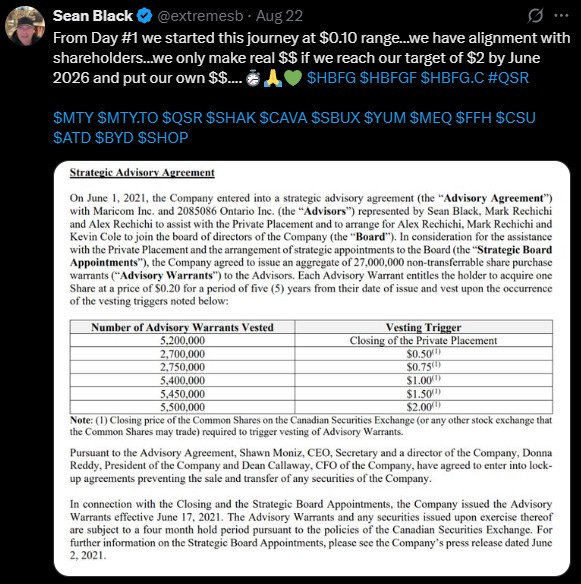

27.3M warrants, 27M of which are ITM at 20 cents and all are performance warrants issued to insiders with that performance linked to share price appreciation. 16M have vested with the other 11M vesting if the SP hits $2 by next June. The vested portion would bring in $3.2M to the treasury, but would come with a valuation of over $19.5M. I think you’ve already made some real $$ Sean but as a shareholder, I love the fact you are incentivized to get the share price over $2.

12% insider ownership (per Yahoo Finance)

Few companies I cover have had the track record of regular insider purchases on the open market as I’ve mentioned in several previous reviews

Income Statement:

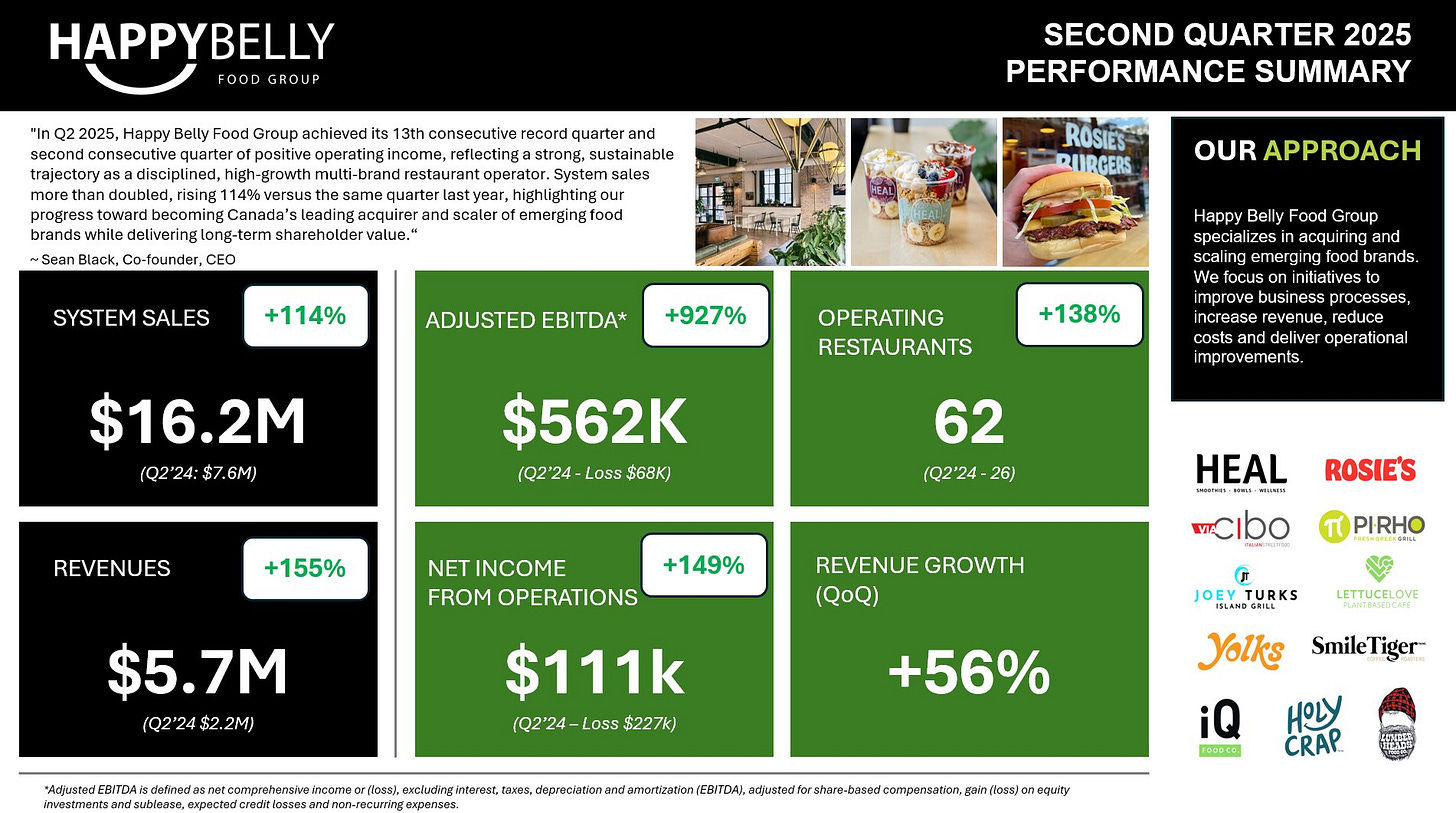

The record quarters continue here (13th straight) with $5.7M of total revenue in the quarter, 153% greater than the comparable quarter. COGS grew by 127% and cash burning operating expenses by 120%, both converting better than their revenue growth but not quite what I would refer to as a Wolf Trifecta.

The enabled them to produce their second consecutive positive quarter from income from operations of under $111k. Due to the financing costs (mainly stemming from convertible debentures, they were still in a net loss situation of $170k in the quarter.

On a YTD basis, revenues are up to $9.4M, 126% better than this stage last year, continue to be positive from operations, but still remain just shy of net income profitability ($344k YTD net loss).

Overall:

First, I’d like to offer my condolences to the Happy Belly team for the loss of their CFO, Gary Fung last month. Gary’s experience will certainly be missed with the bulk of his career spent during Tim Hortons rapid growth period.

Due to the nature of the business - a mixture of corporate locations and franchising network under several brands, the P&L doesn’t tell the whole story.

While revenues were $5.7M in the quarter, the entire network of system sales were $16.2M, and that metric is an important one when it comes to potentially being acquired down the road. Not only is that number 114% better than the comparable quarter, it also grew by 50% on a QoQ basis.

Continual strides are being made here with 62 operating restaurants at quarter end and their regular news flow continues to suggest “They are just getting started”.

In just the six weeks since this quarter closed the company has opened additional units, signed deals for several others under multiple banners including the company exercising their rights to purchase the remaining 50% of Heal and that same brand entering into the province of Quebec. Lastly and most recently added another brand into their portfolio, Salus Fresh Foods. Salus currently has 9 operating franchisees, and feels like a very good fit with their Heal brand which has been their most successful to date and that should offer some great synergies from operations to purchasing.

While I am a very happy shareholder, that doesn’t mean I’m not without any concerns.

A few of their brands have gone relatively silent in terms of progress. While Heal, Rosie’s Burgers and Yolks look like clear winners with many openings and announcements, I’m a little surprised at the radio silence on brands like Pirho and Joey Turks - a couple of brands which I really felt were underserved (Greek and Caribbean) with not a lot of great competitors (IMO).

The first suggestion of US expansion with Heal Wellness was twenty months ago signing their 10 unit deal in Florida. Nothing positive has come from this to date, so my excitement about another 10 unit deal in Dallas/Fort Worth announced in June was met with very cautious optimism.

Now with the very low cost of acquiring these brands, they don’t all need to be raving hits for the overall company to be successful. I’d also like to see a little better conversion within their cash burning opex if I were to get super into the weeds.

In terms of the valuation. I think both the bull and bear sides have a case to make about the current $158M market cap. I’ve certainly been making my bull case for over three years now.

I’m also extremely happy to award Happy Belly Food Group that long awaited upgrade to 3.25 stars.

I may just celebrate that with a Rosie’s Burger for lunch today. Tell Burlington I’m coming Sean.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks for the fair and honest review, Wolf. One of my favourite companies on the venture, and it's about time they got (and earned) an upgrade.