I’ve lost count now, but Happy Belly is my most reviewed stock of all time. You might think I’d be bored by this point, but how could one be on a chart that looks like this:

I was reviewing the company and holding shares well left of this chart too. As of today it’s a 22 bagger from that eight cent upgrade almost three years to the day ago, and it’s also over a 17 bagger from the 2023 Wolf Pick.

Below is what I had to say in my August WWW article just prior to releasing their Q2, and it’s made about a 70% move since.

Q3 dropped last night. As in the past, what I’m looking for it continued growth, particularly within their OCF - as this is the metric that will limit further dilution and go towards funding future brand acquisitions. Of course there are other things, including no land mines or red flags to surprise us as can easily happen with all small caps. I don’t think these financials are particularly important in the grand scheme of things. These individual financials are not going to justify the current market cap - that’s just a fact. Ideally, the financial portion of the review will be relatively short, as I have other topics I’d like to cover afterwards.

Let’s dive in.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Happy Belly has a current ratio of 1.9 consisting of $3.34M in cash, $1.8M of receivables and about $1M in other short term assets over top of $3.17M of current liabilities.

No aging reports for their receivables, but the growth in A/R lines up with their revenue growth. The company’s largest liability outside of lease costs are from debt via convertible debentures.

With a quick ratio of over 1.6, liquidity looks good with just their current cash position able to pay their current twelve month financial commitments.

Cash Flow:

$1.35M of operational cash flow through three quarters and the second consecutive quarter with over $700k, including $757k generated in Q3. If you’ve read my former reviews on HBFG, you may recall me referring to royalty revenues as the gravy. As the number of store fronts grow, more gravy will start to flow to the bottom line and generate additional cash flow. This is evidence of that. Even better is the company has very little working capital adjustments. When you have a large amount in this line, it can muddy the water and make a company’s OCF look better or worse than it actually is. This OCF is legit and should only get better as more restaurants come on board.

HFBG has utilized $1.37M in asset purchases including acquisitions which include Smile Tiger Coffee, Salus Fresh Foods and buying out one of the Via Cibo franchises which is currently being run corporately. The company also raised $500k at the beginning of the year at $1.50 (well above market).

Overall Happy Belly’s cash position remains in a very similar position from the start of the year (-4%).

Share Capital:

129.7M shares outstanding, under 1% dilution from the start of the year which includes the $500k raise referred to earlier

6.2M options outstanding, all ITM including 2M granted this year at $1.11.

4.7M options expire before the end of June 2026 which will bring in $3.5M to the treasury

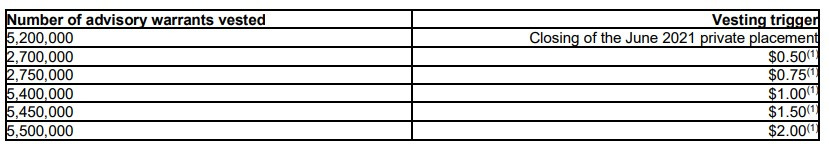

27.3M warrants. All ITM but 5.5M not vested due to the unique performance warrants within HBFG. The share price must close above $2 for the remaining to trigger

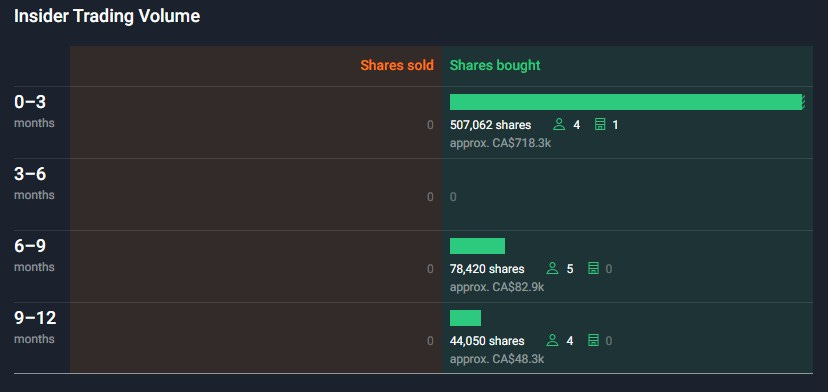

Insider ownership around 12% but slated to significantly grow when these warrants are exercised. Virtually ALL of management has been participating in the open market for sometime

Income Statement:

As the headline stated, their 14th consecutive record quarter. I got news for you - this number is going to continue to get much larger.

Total revenues grew by 194% to $7.2M vs $2.4M in the comparable quarter and that’s also 26% growth on a QoQ basis. Because of the mix of revenue sources HBFG no longer produces a pure gross profit number anymore but COGS or direct operating costs grew at a similar rate of revenue while cash burning expenses (G&A and payroll) rose by a lesser rate of 161% getting some conversion on that additional revenue. Income from operations was positive at $316k vs a loss of $97k last year. After financing costs from their debentures and an unrealized loss of $66k in their investment in Purebread, they suffered a loss of $7k vs $160k last year. We’ll call it a break even quarter.

On a YTD basis:

Total revenues up 151% to $16.5M

Income from Ops of $434k vs ($432k)

Net loss of $351 vs $1M

Overall:

Continued growth and even accelerated Q3 growth of 194% after the first half of the year grew by 126%. It also checked off the boxes of what I was looking for out of this team including on the cash flow side.

That’s been Sean’s catch phrase for a while now (in addition to “boring growth”, but there are lot’s of reasons for belief that is indeed the case here.

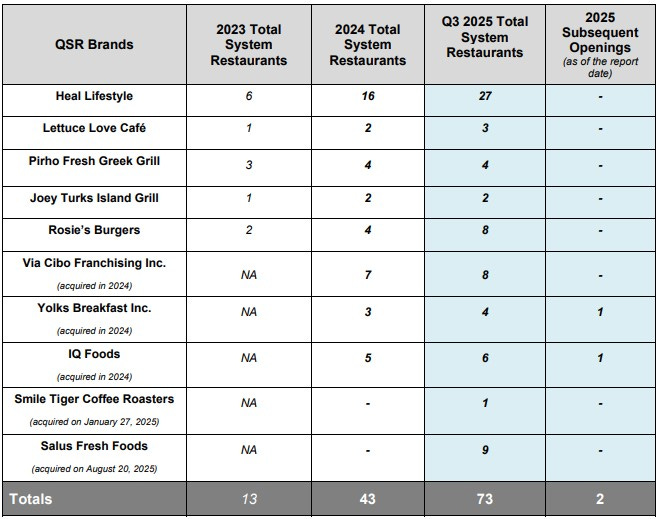

As of today, they are up to 75 opened establishments, 75% more than they ended 2024 with and nearly 6x from two years ago in addition to bringing on new brands. I’d like to take a snip of their subsequent news releases since their Q3 closed, but there are too many to fit into one image.

By my count, 13 new franchise agreements and/or real estate locations have been announced since the end of September across multiple provinces including making in roads into Quebec. The internal goals for Q1 of ‘26 is to surpass their record of 12 store openings in a quarter.

Wait, did I forget something?

Two real estate locations were announced in Texas in the last few weeks for the first locations of both Heal Wellness and Rosie’s Burgers. I will admit, I was skeptical when the team went to scout the Lone Star state. They had a similar trip in 2024 to Florida which has yet to bear any fruit. It’s only two locations so far but you start with one, and with Texas’ population 3/4 the size of all of Canada, the potential opportunities just grew by 75%.

It wouldn’t be a Wolf review without any concerns so let’s look at those:

While minor, I didn’t like the investment in Purebread at the time and without it, we’d have positive net income here in Q3. It’s relatively small dollars but it was done at a time when the company was still raising capital. While the SP of BRED has multiplied since the valuation in these financials, the investment is still underwater and I don’t like their chances. I was thinking it, I said it, it’s peanuts in the grand scheme of things so let’s move on.

Franchise growth has been heavily driven by one brand - Heal Wellness, with also some good traction in Rosie’s and Yolks (more difficult to scale). Salus and IQ and Smile Tiger to a lesser extent are too early to judge. The combination of Lettuce Love, Pirho and Joey Turks have contributed only one additional location in about a year. Pirho probably surprises me the most of this list as I just don’t think there are very many good options in this space. Maybe I just love Greek food too much.

I think it’s noticeable (at least I have) that the company hasn’t reported the number of “units in development” or announced large bulk agreements like the 80 Pirho under an area agreement as far back as July of 2023. It’s clear many of these are just not going to happen. With that said, they don’t need all of their brands to succeed in the same way. For the most part they were acquired for $250k of stock for a 50% stake and those are very low risk investments to make

Lastly is franchise support, and I bring this up due to spending almost all of my adult life managing and supporting large networks, although not in the QSR space. Multiple brands spread across large geographic areas will present challenges, and it’s important they have the field support to ensure franchisees succeed, and just as important, brand standards are met and adhered to.

The valuation is going to be a concern for some. I get that. Due to trading well above traditional metrics will tell you it should, the stock is exposed to some volatility risks at this valuation so investors need to understand that.

Let’s finish the review with what I deem as the biggest news in the past two months and it wasn’t franchise opening related.

It was a lot to digest on the first read and not something I was anticipating. If you look back at the share capital section, there were original performance warrants included when current new leadership purchased what was then $VGAN. With that incentive plan set to expire in June of 2026, this appears to be a continuation of that.

To summarize, essentially for each dollar the share price appreciates, 3.625M options or performance warrants will be granted up to $5/share, and 3.5M on each dollar up to $10/share. I’ll remind you that the share price currently sits at $1.77 a couple hours after the markets opened on Wednesday (+2.3%).

This is pretty unprecedented territory. I certainly don’t recall seeing anything like this. Some raised an eyebrow at the potential 30M of dilution and to an extent I get that. My counter is that would be that is over 5 years through June of 2031, and the share price would have to grow more than 5.5x from here to achieve that. The company was also under no obligation to do it this way. They could have easily had a vote at their upcoming annual meeting to re-structure their SBC to award DSU/RSU or PSU’s, and if they awarded 6M per year over that time span, I don’t think many would have blinked an eye. Those would have been free shares tied to no share appreciation or retail shareholder benefit and would have had the same dilutive result. These are also options so in order to exercise them they would have to put very large dollars back into the treasury.

Ask yourself this question. If you’re holding shares today and the stock goes to ten bucks, do you care? I don’t. Sign me up.

Anyone who has heard me talk about this stock, whether that be in my reviews, in discords or elsewhere, has likely heard me say that without a catastrophic event occurring, I’m here until June 2026 (when the old performance warrants expire), and then I will re-evaluate. Did Sean just keep my ass here until 2031?

I think he did. I know $MoneyMaker$ will be joining me. Nice new car by the way.

Maintaining 3.25 stars here.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Well written as usual, Wolf. You must have done well on your essays in school.

Just like you don't get bored writing about this company, I don't get bored reading about it. A true gem. Also appreciate laying out your concerns and explaining them so clearly.