Sometimes I don’t know where to start with Happy Belly because I feel my frequent readers have pretty much heard it all before. I first upgraded the stock in late 2022 at eight cents and in late December of that year chose it as one of my annual picks at a dime. From that selection it currently sits as a tenbagger that reached a twelve bagger status for a brief spell in December 2024. I peeled off about 10% of my holdings then around $1.25 so my cost basis is now next to nothing for one of my top small cap holdings.

Nine straight three star reviews as of my last one in November after their Q3. I don’t recall reviewing another stock where the companies news flow is so far ahead of the financials. Considering it’s May 1st, and the numbers we are reviewing ended December 31st, that couldn’t be more true this time around. The company has put out thirty eight news releases since the end of the year (yes I counted). I’ll attempt to summarize them:

Acquired Smile Tiger Coffee for $250k at 3.3x EBITDA

A number of grand openings were announced including their 50th - a multi-franchise location with Heal and Lettuce Love

Signed multiple unit development agreements for a total of 105 potential new locations across the following brands (IQ foods, Smile Tiger, Heal, Yolks and Rosie’s) including venturing into Atlantic Canada and Quebec for the first time

Signed agreements with two NYSE companies (TOST & SYY) to enhance franchisee tech platforms and to streamline purchasing to lower costs

A number of leadership appointments to manage growth

Ok, enough with the tire pumping for a stock that has certainly developed somewhat of a cult following that I don’t need to add to. Let’s take a closer lens into the financials and measure their fundamentals - note that an annual pick will always bring out my more scrutinizing magnifying glass.

Balance Sheet:

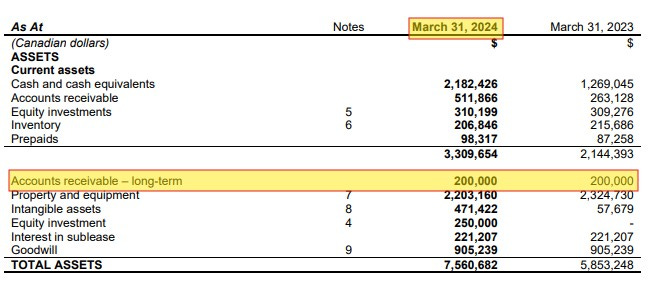

We begin with an excellent current ratio of 3.4 which is made up of $3.5M in cash, $720k of receivables and $500k in other short term assets against just $1.4M in short term liabilities due across their 2025 fiscal year. $3.2M worth of debt, over 90% of which is made up of convertible debentures which I’ll touch on later.

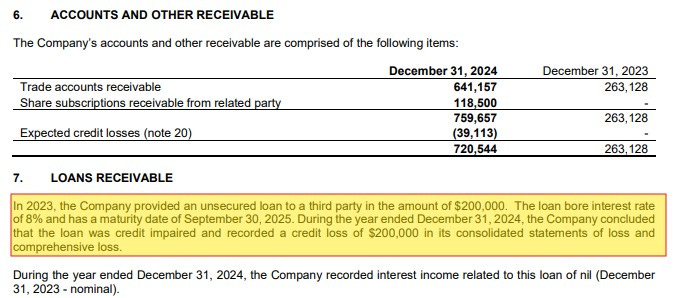

There is not a lot of detail within the accounts receivable but I do find a couple things disturbing in notes 6 and 7. First, a related party owns $119k of stock (perhaps from a debenture raise) for which they have yet to pony up the dough for. Even more concerning is note 7. Why is the company lending anybody $200k (unsecured) during a time when they are not yet cash flow positive and issuing financing through convertible debentures?

Making matters worse, this loan appears to have occurred sometime in Q1 of 2023 and it showed up in past financials statements as a long term receivable, never as a loan receivable even within their audited financials ending Dec 2023.

This is weak sauce and very irritating to see as a shareholder.

Cash Flow:

Happy Belly had operational cash burn of $888k during fiscal 2024, 23% higher than the burn of $722k. On a positive note, the actual cash flow in Q4 was $478k to the positive but this was more due to a reversal of working capital adjustments which were much higher after Q3.

I was hoping to see a little more OCF progress in 2024 than we have, but they are not miles off of being cash flow neutral and hopefully we will see more progress in 2025.

In the other sections of the cash flow statement, received proceeds of $600k from warrants and options, and $3M from multiple convertible debenture offerings in February and July.

Notably, the company raised an additional $500k post financials - after seeing the strength of the balance sheet and under $250k/quarter burn rate, this feels somewhat unnecessary.

Share Capital:

129M shares outstanding at year end with 17% dilution occurring during fiscal 2024 including 12.7M from previous convertible debs

27M warrants outstanding at 20 cents, expiring in June 2026 - 5.2M exercisable with the balance to trigger based on share price appreciation targets

4.2M options, all ITM, with 2026-2028 expiry dates

Approx 6.2M in future dilution from the $3M in outstanding debentures at year end

Insider ownership per YF sits at 12%

Insider buying has been a regular occurrence from multiple insiders including a 10k share buy yesterday at $1.07

Fully diluted float currently sits over 166M shares (this would also require a share price target of $2) - current implied float sits around 144M shares

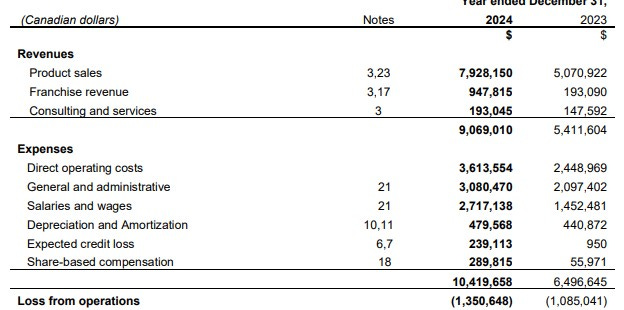

Income Statement:

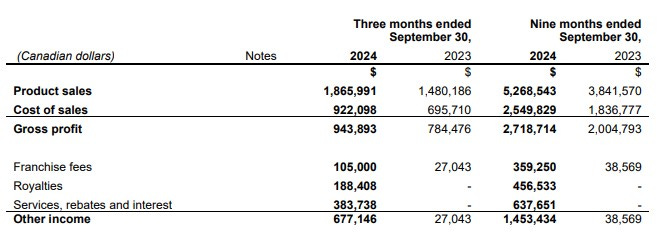

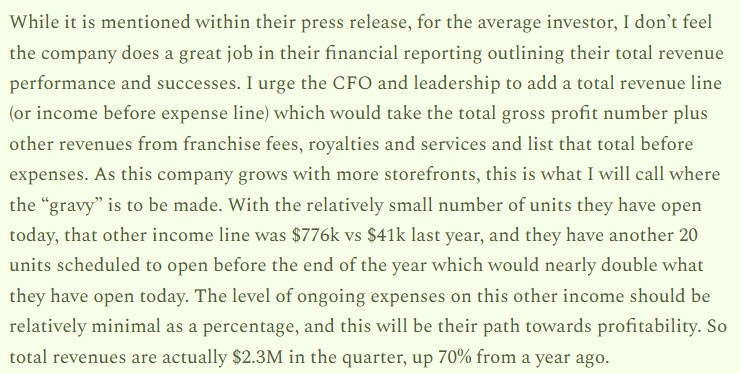

Happy Belly is notably reporting their P&L a little bit differently and since I’ve suggested they do so in my last couple of reviews, hopefully I’ve been able to influence that in some way. I’ve attached three images below. First, how they reported previously, then an exerpt from my August 2024 review, and the last one is how they reported their annuals last week.

Now it’s not exactly how I proposed it, but I think now this total revenue line is more indicative of the company’s progress as a franchisor. In previous speak they would have reported revenue increases of 56% to last year and now can report a more accurate 67% growth in total revenue that includes franchise fees and income from their consulting services.

What we do lose with these changes is a direct gross profit metric but I think it is pretty safe to use the direct operating costs as a COGS number. By doing so translates into a 320 basis point improvement going from 51.2% to 54.4% margin this year.

Other cash burning expenses (G&A and payroll) rose by 28% which is very good conversion on 67% more revenue, but the additional credit losses including that $200k loan and $289k of SBC resulted in a larger operational loss than last year.

In addition to nearly $1M in financing costs, mainly related to convertible debentures and an unbooked loss on investments (I’ll touch on this in a minute too) of $190k takes their net income down to a loss of $2.3M which is 24% worse than a year ago.

Overall:

Let’s start with the negatives.

We certainly started off on the wrong foot with that $200k loan. I’d call this out if I was reviewing a one star shitco, so just because I own a healthy amount of shares doesn’t mean that I will bite my tongue. Even during the best of times I don’t believe companies should be loaning shareholder capital, but it’s a terrible look when you do it at the same time when you are diluting by raising necessary capital and you look like a bunch of fucking donkey’s when you write off those amounts without even collecting a nickel in interest. Unacceptable.

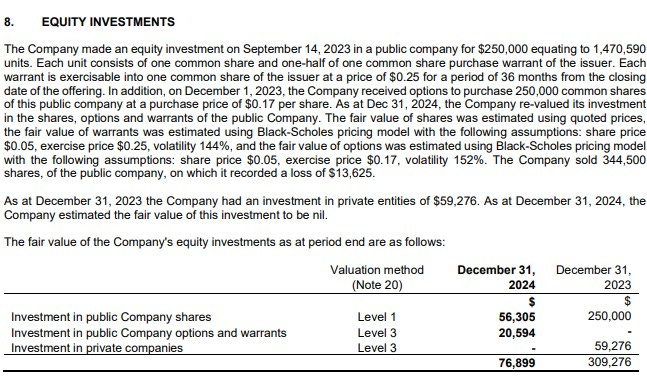

Next was their investment in $BRED.V, formerly $COHO.V. They invested $250k back in 2023 and that investment is now down over 77%. This company looked terrible at the time and while I don’t think I formally reviewed it, it wouldn’t have faired well if I did. I do find it amusing HBFG referred to the stock by name in their notes when they bought it, but now is unnamed in their most recent filings after being down 77%. Today the stock is down further and has reverse split. So between the last two paragraphs the company pissed away $450k from their 2023 year. Hopefully they’re back to focusing on what they’re good at.

It’s issues like the above which turn my focus to the amounts of convertible debentures issued in the past few year, for which the interest costs nearly amount to half of their losses, and another $500k were issued post financials. I’ll be happier when the need goes away to raise any more.

Now let’s focus on the good. The QSR business was up 419% in 2024 to $30.3M by more than tripling their restaurant count which ended the year at 43.

That count as of the financials is now at 53 with the breakdown by brand above. I’ve lost count of the number of units under development agreements, but it is over 500 so it is staggering to think about 10x the number of potential locations from here. I am getting a little concerns with the brands of Pirho, Joey Turks and to a lesser extent Lettuce love who have about 110 location agreements across Ontario and Alberta with very few announcements about them recently in comparison to other brands.

I haven’t identified a buy zone opportunity since the 60 cent range back in Q4. The way the stock has been consolidating and coiling between a buck and the $1.25 makes you think anything just above $1 looks like an opportune spot.

At a $133M market cap ($151M implied with dilution) the argument can be made that this is trading ahead of itself. I’m certainly not going to try to talk you out of that argument but I am still long here despite my listed concerns.

Definitely not upgrade worthy yet given the valuation. TEN straight three star reviews, perhaps a record never to be broken. Better chance of an upgrade perhaps if I had a Rosie’s Burger (coming soon) and a Yolks close by, just saying.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I'm still long. Having said that, there were some disappointing things I learned about in the review, but I'm glad you didn't hold back and held them accountable.