I first wrote about Greenlane back in 2021, but I haven’t reviewed them since May of 2023. It’s been so long apparently their logo looks like this now.

I recall initially being encouraged when I first reviewed them, although I don’t believe I ever held a position here. The stock traded at $1.58 on my initial review over four years ago trading as high as $2.96 earlier that year. It was down to 30 cents when I last reviewed the company (a downgrade to 2 stars) and as of November of last year it was all the way down to six cents.

So when I was asked to review this about a month ago, I have to admit I had very little interest. But since the company released their financials last Thursday the stock went on a tear going from 9.5 cents to 33 in just three heavy volume trading sessions peaking at over 5 million shares traded on Tuesday. Yesterday was a large pullback to close at 25 cents - not unexpected at a Relative Strength Index of 94. To put that in perspective, Hydrograph (HG.C) one of the most talked about stocks over the past month only hit an RSI of 91 at its peak.

I did have a quick peak at their financials the other day and they do indeed look impressive. But the company has had the odd impressive quarter previously as well. Was the 3x jump in three days justified, and can this legitimately be looked at as a long term investment again are a couple of questions I hope to be able to answer. Let’s dive in.

Not planning to spend much time on DD here (I have an afternoon tee time), but if you’re new to Greenlane I’ve attached their investor deck below.

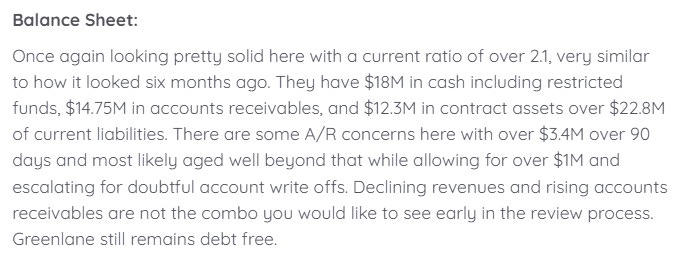

Balance Sheet:

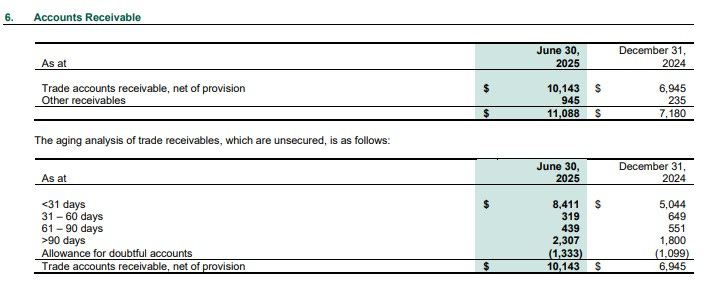

Greenlane has a better than decent current ratio of 1.65 that consists of $18.3M in cash (including $1.7M of restricted), $11.1M of receivables, $1.5M worth of inventory on hand and $3.9M of other short term assets over top of $21M in short term liability commitments over the next twelve months.

Trade receivables are up by 46% from the start of the year. For a company who had great YTD revenue growth this could be shrugged off, but as we will see later, Greenlane’s revenue for their first six months are down nearly 33%. In fairness much of this growth in A/R came in Q2, but when I see growth in the 90 day aged receivables when they already have $1.3M in write off allowances, it’s a bit of a potential yellow flag that the company isn’t doing enough due diligence with their customer base to ensure they actually get paid.

On a more positive note, liquidity looks decent with their cash position alone easily covering their payables. Also, Greenlane holds no debt and holds no long term liability commitments outside of lease commitments and a small deferred tax liability.

Cash Flow:

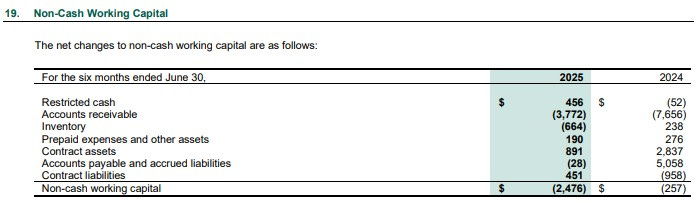

Through six months, GRN has burned $374k in cash through operations, therefore just on the wrong side of operational cash flow neutral compared to burning nearly $2.6M at this stage last year.

If it were not for large working capital adjustments in receivables, their OCF would have fared much better. It does set the stage for their OCF to improve as the year goes on, assuming they receive all funds and receive them in time, but that is not historically their strength. Here is what I said about them almost 30 months ago. Sound familiar?

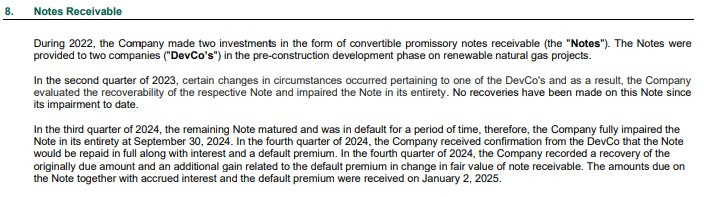

After writing off $1.6M last year for a note receivable (oh boy), they received those funds early this year.

They also paid out $700k from previous acquisitions. No items within their financing section aside from lease payments, so overall their cash position has remained relatively stable from the beginning of their fiscal year.

Share Capital:

157M shares outstanding - only 2.5% dilution since my Q1 2023 review

7.3M options outstanding, the vast majority now ITM at a dime. 6.8M were awarded during their 2024 fiscal year

4.9M RSU and PSU’s outstanding. Personally I find it a little disturbing to see this many free share awards given the stock is down 90% from ATH’s although to their credit cash based compensation for the C-suite is 26% less than LY

8.6% insider ownership (per Yahoo Finance)

410k shares purchased by insiders YTD, all at a dime

Income Statement:

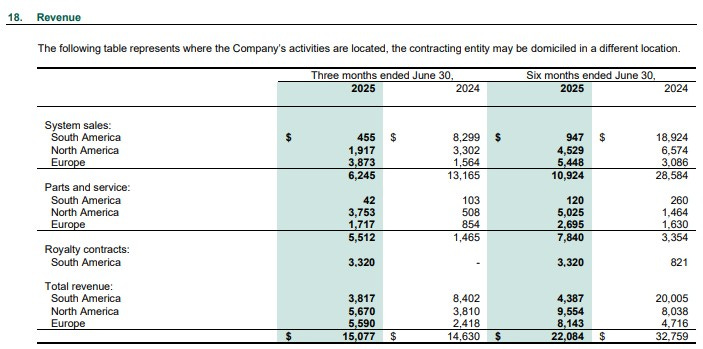

After posting terrible back to back quarters in Q4/Q1 with revenue performance of -49% and -62% respectively, Greenlane got off the snide with $15.08M of revenue in Q2, but that was only 3% better than they achieved in the same quarter a year ago.

Their biggest achievement in the quarter took place on the margin line with 47.4% gross profit compared to only 26.3% in the comparable quarter. That resulted in bringing in 86% more GP dollars, a heck of an achievement on a low single digit revenue increase. The company also saved over $1M in operational costs compared to last year and the vast majority of that was cash burning, with opex down 20%.

Their income before taxes was a massive turnaround of over $3.2M going from a loss of $518k to an operating profit of just under $2.8M. Unfortunately the tax man took over half of that - but even with that the company delivered $1.27M of net income compared to the $477k they lost in Q2 last year.

The YTD numbers are not as pretty of a picture however, but still improved from last year aside from the abysmal top line number. That includes:

Revenue down to 10.7M or 33% less

Higher margin dollars on this reduced top line due to their gross profit rate increasing by 1900 basis points (46.1% vs 27.1%)

$2.6M in YTD savings in operating costs including a 28% decrease in their largest expense bucket - G&A.

YTD net income through their first six months of $262k vs a $1.3M loss last year

Overall:

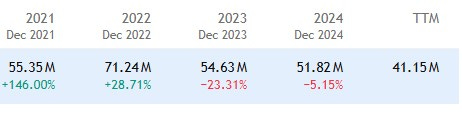

No matter how you look at it, they have to be given credit for an incredible quarter. They question now - is it repeatable and is this quarter something they can build off of? Let’s remember in my review nine quarters ago, they did more revenue than they just did here and that number was down from their previous quarter (13 quarters ago). Greenlane’s revenue numbers have been lumpier than a wet t-shirt contest.

As mentioned the largest difference between the comparable quarter was the dramatic increase in gross margin, and that is a result of dramatic swings within their revenue segments with system sales over 50% down, with large increases in their higher margin parts and service revenue, and a one time royalty agreement payment of $3.3M which contained 86% margin.

That suggests that this margin number seen here is likely something that the company is not going to be able to sustain.

The other item that pops this balloon for me is the backlog number at just $26.3M. Their backlog was over $36M at the end of 2023, so it is very difficult to project a serious upwards sales trajectory given that.

Above is the four year revenue history for Greenlane. Now tell me your bullish with a $26M backlog.

Listen, the company deserves some credit, particularly for the increased operational leverage they’ve achieved. But outside of that, this is nothing but watchlist worthy. In the first 40 minutes of trading on Thursday, it’s down another 8% to 23 cents. The market is figuring out what I just said.

2.75 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Appreciate the review, Wolf. Was considering investing in this back in 21-22. Glad I didn't, but there were some good opportunities to get in at around 10 cents.