I’m sure I have reviewed these guys before, likely way back during the pandemic days, but I can’t find it for the life of me.

I had some requests last time around but I didn’t get around to it, and I even had some with the ball sack to suggest I seriously consider the stock as a 2025 Wolf Pick. I’m not sure about the financials yet as I haven’t looked at these ones yet, but the stock certainly had a good 2024 gaining about 60%. Of course if you look four years back you’ll see that the stock approached nearly $15.

They certainly had an interesting business model four years ago that was ripe for the pandemic. They couldn’t do it profitably then and now their business is less than half of what it was then. Do their financials suggest any reason to be bullish in 2025? Let’s find out.

Balance Sheet:

Even with deferred revenue removed from liabilities the current ratio is at a shaky 1.09 consisting of $21.3M in cash, $3M of receivables, $3.8M worth of inventory and $900k of other short term assets against $26.5M in liabilities due over the course of the next twelve months.

The good news is that 75% of their current assets are in cash. The bad is that cash just covers their growing payables and twelve months of lease costs.

Their $45.7M of debt is comprised of convertible debentures. There are three sets of debentures outstanding that expire in Feb 2025, Feb 2027 and Feb 2028. The ones expiring next month convert at $4.70, so it will be interesting to see if these convert as is and the next at $4.60.

The latest set of debentures are much more holder friendly with a higher fixed rate and convert on a VWAP. with a premium. I think there is a chance the newer ones get renegotiated as well.

Cash Flow:

GoodFood produced nearly $2.2M of operational cash flow in their first quarter, down from $3.8M in the comparable quarter. Less OCF on basically similar net losses due to not having as much benefit from working capital changes as they did last year, therefore I wouldn’t read too much into the variance.

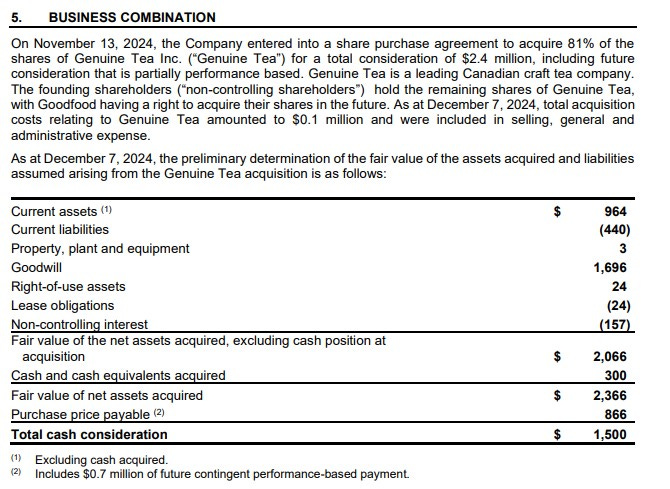

In November the company utilized $1.5M to buy majority ownership (81%) of Genuine Tea, and paid down $1.1M of debt and $1.3M of interest payments.

Overall the company’s cash position depleted by 11% in the first quarter. Even though GoodFood generated positive OCF in Q1 as they did throughout most of their fiscal 2024, these numbers don’t trend out well, as they need to produce about $2M of OCF each quarter just to offset interest and lease costs. It gets a little more concerning when you see $17M of accounts payable and a current ratio barely over one. Something to continually monitor here, otherwise more debentures or a raise in another form could be not too far off in the future.

Share Capital:

77.5M shares outstanding with less than 1% dilution over the past year

Considerable amount of future dilution expected upon the three separate debentures when they mature

3.05M stock options outstanding - none awarded in 2024, all considerably out of the money

When your stock price continually shits the bed making your options virtually worthless, you switch to granting insiders free RSU’s, granting 2.9M this year with 3.4M now outstanding resulting in $1.1M in SBC last year.

23% insider and 12.5% institutional ownership (per Yahoo Finance)

Continuous insider selling after RSU’s vesting by multiple insiders. While the dollars are small, it doesn’t exactly scream ringing endorsement now does it?

Income Statement:

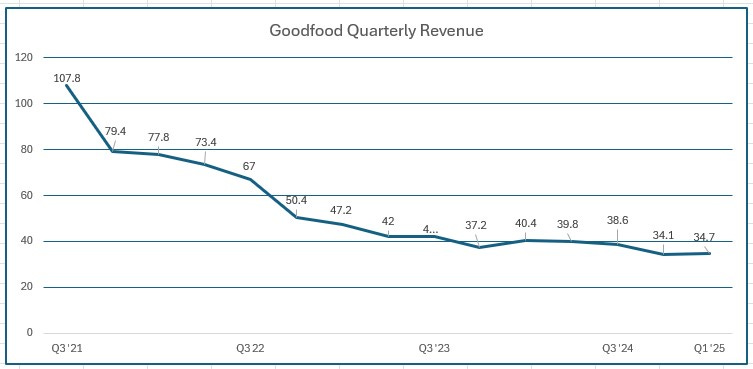

Q1 revenues were way off by 14.3% to get the year off to a very weak start coming in at $34.7M against $40.5M a year ago. Margin was a little better than flat with GP coming in 20 basis points better at 39.6%. Cash burning expenses decreased by 14.1% to last year so overall that results in a mildly better operational loss of $256k, about half of what it was in Q1 of last year at $517k. Then tack on finance costs driven from the stacks of convertible debentures and Q1 resulted in a net loss of $1.7M vs a $2M loss one year ago.

Overall:

So I spent two minutes putting this little chart together of FOOD’s previous 15 months of revenue which I think tells much of the story:

The most interesting thing is when I looked back at their record $108M quarter in Q3 of 2021, their net loss was $2M, almost identical to their loss experienced this quarter but on about one third of the revenue, $34.7M. This review feels like it is going south in a hurry.

Now let’s take a look at their late 2024 acquisition.

They paid $2.4M (including “partially” based performance consideration) for a business generating $3.5M in annual revenue with no profitability metrics mentioned in their press release. This for a business with a very tiny net book value as evidenced by the $1.7M in goodwill allocated for the deal. GoodFood had $5.8M in revenue erosion in their first quarter alone on their core business. This deal isn’t going to put much of a dent in their top line problem and it remains to be seen what impact it will have throughout the P&L, but the lack of profitability discussion in the acquisition presser doesn’t make me feel great about their prospects.

You may think one of their most recent press releases would be about their plans for actually growing the business. Instead it was to develop a Bitcoin reserve strategy. They can no longer be considered a serious business. GoodFood, bad business. One and a half stars.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3200+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

that bitcoin strategy is very strange. Thanks wolf great breakdown. Food delivery like doordash might be a better play if your into the food delivery area yet they are two different plays

Nailed it! Seeing that their earnings were coming up, a few days ago I was reading their stuff wondering 'beat up diamond about to shine?'. Everything just kept adding up to NOPE. Revenue improvement, no. Margin improvement, no. Cash flow..NOPE, cap table...NOPE!!...then the bit about buying Bitcoin. I stopped reading in stunned shock.

Couldn't they have at least built up to the Bitcoin drop by talking about Cannabis delivery or engaging a qualified geologist to explore for gold/lithium in the Montreal sewers or something?