After several months I’m finally caving to requests for this sub $10M nanocap, a cannabis/nutraceutical hybrid. Rather than me try to explain what they do, here is the company profile from their MD&A.

The stock has been relatively flat since last summer with a few multibagger bounces along the way. The stock was also under a cease trade order at this time last year for about three months for failing to file their 2023 annuals on time. It’s nice to see they were able to turn things around this year and get their financials out by the deadline.

Glow has a fairly active retail investor base with a lot of message board chatter, I’m assuming due to Small Cap Discoveries covering the company. While the company has touted large percentage increases in revenue, they are still extremely small potatoes overall with only $1.2M in TTM revenue which is the main reason why I’ve neglected to cover them in the past - there’s likely very little to review in terms of the financials here. Due to their size I assume it will be a relatively short review. If it’s not, that’s likely not a good sign.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

While small, Glow has a pretty solid looking balance sheet. They tout a current ratio of 2.9 that consists of $1.1M in cash, a half milly in A/R, $600k in loans and advances receivables and about $400k in other short term assets against only $900k in short term liability commitments spanning their next twelve months. When your cash position alone covers your short term liabilities it’s always a good start.

Things start to appear a little messy when you start looking into the “loan receivable’. Loaning a related organization cash in the fourth quarter of a year when you’ve raised capital through three separate private placements certainly raises an eyebrow and certainly a potential yellow flag for me.

Glow provides zero detail surround their A/R. The company has $112k of current debt which is non interest bearing and $251k of long term debt at twelve points.

Cash Flow:

Glow burned $218k in cash via operations within their first quarter, almost halving their burn rate of $405k in last years first quarter. Looking back at their annuals they burned $1.35M of OCF in 2024.

The company had very little activity throughout the rest of the cash flow statement but overall their cash position depleted by 15% from where they started their fiscal 2025 year from.

While their OCF is improving I think it is too early to suggest another capital raise is out of the question for 2025 despite their goal of getting to positive cash flow this year.

Share Capital:

170M shares outstanding as of March 31 with significant 3x dilution in the past five quarters from 57.1M shares from the start of 2024.

70.7M warrants outstanding between five and seven cents with nearly 60M currently ITM. 20.1M expire this October and 39.4M in March of 2026, both sets coming with an exercise price of a nickel.

14.2M options with all but 5M currently out of the money. Company has a retail unfriendly 20% option plan.

22% insider ownership with the majority of that owned by their strategic partner, Swiss PharmaCan

Nothing of note for insiders on the open market but multiple insiders did participate rather aggressively in their multiple 2024 private placements

Income Statement:

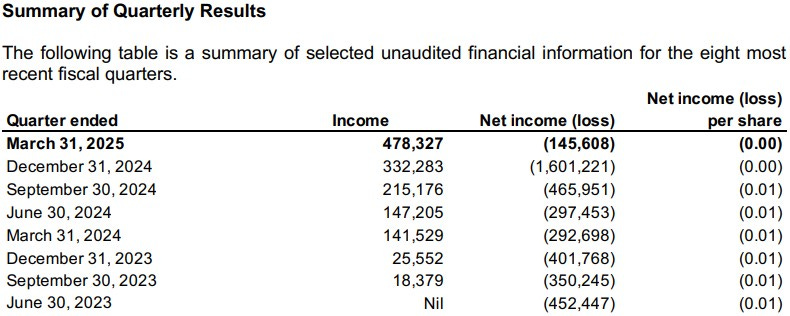

First quarter revenues of $478k, well over 3x of the $141k they generated in Q1 of last year. Glow delivered healthy margins of a 66.6% gross profit rate against a rather incomparable 72% a year ago due to product mix. Total expenses only grew by 20% on more than triple revenue which is a nice trend for them to get to eventual profitability.

They still experienced a net loss in the quarter of $145k, roughly half of their loss of $292k in the comparable quarter.

Overall:

Over the past eight quarters, Glow Lifetech has gone from a pre revenue organization to an annual run rate of around $2M in TTM revenue showing some continual progress along the way.

Based on this latest quarter, on the same level of spending and margins their break even point is in the $700k area. I don’t imagine they could achieve that level of spending on 46% additional revenue so we’re probably looking at achieving $4M in annual revenue before they could begin to deliver some positive EPS to shareholders.

If you are looking for a DD primer, I’ve included Small Cap Discoveries with Paul Andreola’s interview with the CEO - Rob Carducci.

There are some things for investors to like here including potential opportunities beyond cannabis which gets into some of their pharmaceutical visions through their IP and Swiss partnerships.

I’m having too much of a difficult time getting over their float management, shares for debt transactions, overall dilution history with three raises in 2024 and frequent readers know my feelings about 20% SBC plans - I avoid them.

On a fully diluted basis, we’re looking at 255M shares which is 4.5x where the company was just 18 months ago. This puts it at an implied $14M market cap, which is more than 7x their current revenue run rate based on this last quarter. Those 60M ITM warrants with expiry dates in the next nine months creates significant overhang and the company is going to have to massively overachieve on results to avoid this share price from getting locked down over the next few quarters.

I get the potential attractiveness of this nanocap given their relative growth, but it doesn’t appear like Glow Lifetech is a good fit for me. I don’t like the risk/reward.

Two stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.