I have not been very kind to Gatekeeper Systems in recent reviews, with successive downgrades as low as 2.75 for their Q2. I’ve used images of burnt out school buses, school buses with flat tires and even a dumpster fire to describe their performance over the past six to nine months.

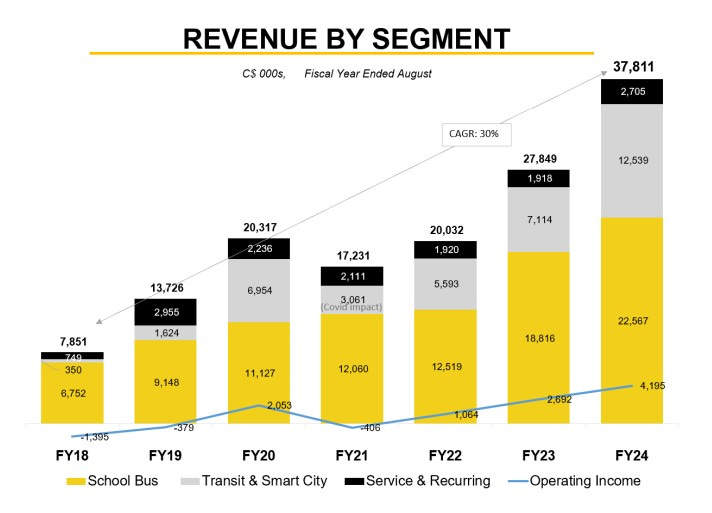

Deserved? Absolutely. In their previous three fiscal years starting in 2022, they delivered net income of $1.9M, $2.8M and $2M, but on a TTM basis have delivered a net loss of $2.3M their last two quarters had revenue declines of 26% and 40% and underperforming gross margin in their last four sets of financials. So yes, they’ve shit the bed of late.

They have certainly not looked like the same organization as when I chose them as a 2024 Wolf Pick. At the time of that selection the stock traded at 43.5 cents. After their most recent financials the stock tumbled as low as 39 cents.

Then the news flow began, with a fast and furious series of announcements of new contracts over about a 30 day period.

Then, the big one. LIRR (Long Island Rail Road) “leaked” on June 27th worth $23M USD and sent the stock soaring by 3.5x to $1.30 where it closed yesterday and as high as $1.52.

Of course, as luck would have it, I gave up and sold them long ago for a modest gain.

Now it is interesting that the company itself hasn’t officially released a news release confirming the LIRR deal, over a full month later. I don’t necessarily read anything into this as LIRR released the results of their bidding process as part of their public disclosure naming Gatekeeper as the successful bid. So what’s the hold up?

In the interim, the company successfully used that run up in share price to raise a whopping $11.5M at $1.20 in a public offering that took only nine days to close (oversubscribed btw). Some raises are better than others and you would have to rate this as a better one given that it was done without a warrant and done at a time of strength. That offering also came just a short time after they increased their short term credit facility from $2M to $7.5M.

What may be most interesting about the two newest news releases is the company did so while sporting one of the best looking balance sheets on the Venture. This leaves them sitting on a massive pile of cash moving forward.

So with the release of their Q3 financials after the close yesterday, how do they look now?

Balance Sheet:

As just mentioned, GSI has a stellar looking balance sheet with a current ratio of 9.8 that is made up of $5.7M in cash, $4.1M of accounts receivables, $5.2M worth of inventory, a $680k loan receivable and $2M in prepaids against only $1.8M in short term liabilities (unearned revenue removed). Gatekeeper has no debt and only $500k in long term liability commitments for long term leases.

This is of course before the company added $11.5M in cash last week from their public offering. That would bring their current ratio to nearly 16.

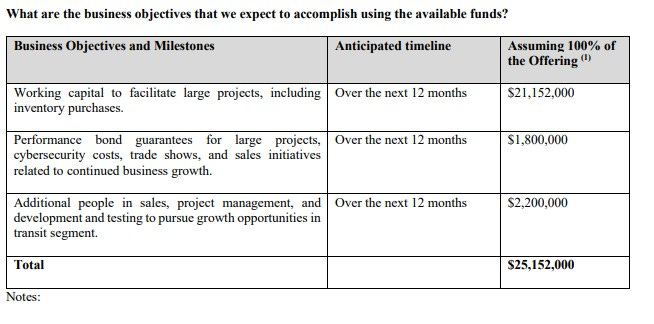

So, why the need for all the cash? While their news release was vague, the offering document was not.

Those are some pretty significant numbers encompassing virtually all of their current working capital.

Cash Flow:

Through nine months, Gatekeeper has burned through $600k in operational cash flow (OCF) which is a far cry from the $6M generated in positive OCF at this time a year ago. This is after their YTD OCF stood at $1.9M, so they burned through $2.5M in Q3 alone.

How concerned should investors be here? I’d suggest not overly so given the bulk of that ($1.5M) are in working capital adjustments from a big increase in prepaid expenses and a large pay down of their A/P in the quarter. Their balance sheet is also extra strong and could withstand a slowdown in OCF, but it certainly needs to be monitored as they are certainly not the cash producing juggernaut they were at this time last year.

Outside of operations, nothing substantial occurring elsewhere in the cash flow statement. Overall (as of May 31) the company had seen a 16% depletion in their cash position from the start of their fiscal year.

Share Capital:

94M shares outstanding, only 2.3% dilution over the past seven quarters

5.06M options - all well ITM and 600k expiring within the next twelve months

9% insider ownership and dropping. Interestingly no open market buying activity by insiders within the last twelve months, but there has been selling. As of yet it appears no insiders participated in their latest raise.

Approx 10% dilution post financials adding 9.6M shares through the public offering. Fully diluted share count approx 108.7M shares

Income Statement:

The company breaks out of their YoY revenue slump with a beat on the top line of $7.47M in Q3, 16% more than a year ago. Margin came in 700 basis points better than a year ago at 49.2%, also much better than where their YTD trend was. 35% more margin dollars on 16% more revenue is a very good start.

Expenses rose slightly higher than their rate of revenue increase at 17.7% but much better than gains in gross profit. That still wasn’t enough to get them to profitability in operating profit, losing $60k in the quarter. Below that they also experienced a $470k foreign exchange bogey to last year, so their total net losses increased to $300k, a marginal improvement over the $416k loss last year.

Things are not as pretty on a YTD basis however, still showing a 21% drop in revenue on the top line. That coupled with a 410 basis point in erosion in margin and a 14% increase in operational costs equated to a $919k net loss compared to a $3.2M profit thus far YTD.

Overall:

I don’t think anybody in their right minds would have expected these financials to warrant what has occurred with the recent share price performance. It will take a while for those news releases to start impacting their financial performance.

But even with that knowledge there was some encouraging metrics in here. Most notably is the rebound in margin which has been on the decline for four straight quarters. With the recent success in signing new deals over the past couple of months, this would be my main area of concern after seeing the share price rocket over the past two months. Does the recent run of news worthy items relating to new contracts wins suggest the company is dropping their drawers on price to win new deals? We probably won’t have the answers to those questions for a couple more quarters perhaps.

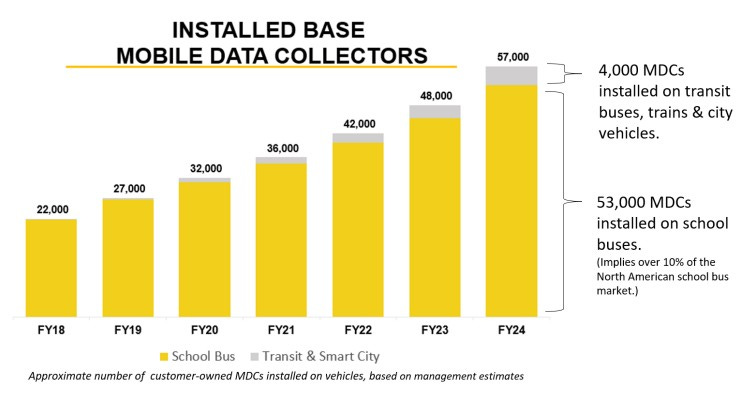

The company is now up to 57k installed MDC (mobile data collectors) which the company derives their SaaS and recurring revenue from.

While this is important recurring revenue with better margins, I think Gatekeeper bulls make too much out of this metric as it is was only 7% of total revenues in 2024, and the number of MDC’s actually under contract are significantly less than the ones installed. The company also does not update this information on a quarterly basis.

With the significant increase in valuation coupled with the 10% dilutive measures last week the market cap is now in the neighbourhood of $135M at today’s open. At a forward looking 15 P/E multiple that would equate to $9M worth of net income for 2026. That is over 3x the profitability of their best year in 2023. Therefore is Gatekeeper getting a little ahead of itself? I fear it might be, but I was clearly wrong about them before. Minor upgrade to 3 stars here.

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose own research skills may be limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Fantastic review wolf your point about margins is interesting because they're usually bidding on contracts and when you're dealing with schools they're really going for the lowest bid so I don't think margins would improve that much because there is competition in this industry. I love your charts and your work keep it up it's always a pleasure to read them.