Nearly five months since we reviewed Gatekeeper’s Q3. That unfortunately was a bit of a downer, which received a downgrade to 3 stars after a 3.75 star Q1 for this 2024 Wolf Pick.

The stock has bounced around a little bit, not unlike my FINS ratings, first giving GSI a 3.5 rating back in April of 2023. As of this morning the stock price has tripled from that upgrade and performed decently since my 2024 pick, up 49%, but it is off it’s April high of 87 cents by 25%.

I exited my position recently as we were getting close to new 2025 picks. One I just wanted to free up some capital, and I just haven’t felt all that great about them since those Q2 results. The Q3 results and the company being awfully quiet only solidified those feelings, despite them providing Q4 revenue guidance.

Market seemed to hate the results, with the stock getting absolutely destroyed, down 16% on the day. Let’s get to my take.

Balance Sheet:

Their current ratio looks brilliant at 6.3 (with deferred revenue removed) consisting of $6.7M in cash, $7.7M worth of A/R, $4.7M worth of inventory and $1.1M of other short term assets against only $3.2M worth of liability commitments for their 2025 fiscal year. Their cash position alone covers those liabilities so the balance sheet is in fantastic shape along with the fact that GSI is debt free.

Receivables jump out as they have doubled since last quarter. Due to the large increase in revenue in the quarter this is mostly just due to timing issues, but the company does not provide an aging report which would confirm it. Inventory is down by over 20% YoY with revenue up 36% so that is a very nice improvement in inventory turnover.

There is an insider $658k outstanding loan as a current asset left from a $1.12M loan issues almost two years ago. Never like to see this - go to a fucking bank like the rest of us.

Cash Flow:

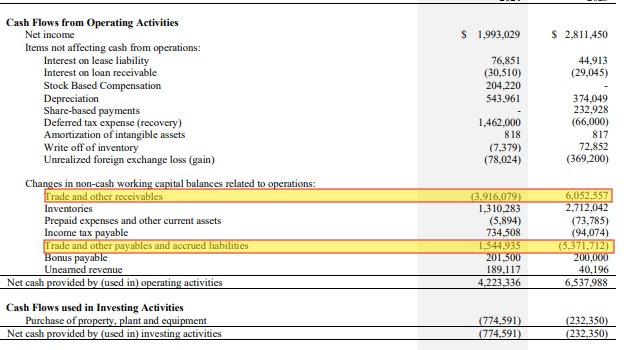

Operational cash flow came in at a pretty disappointing number of $4.2M when compared to $6.5M they achieved last year. In fact, they actually burned $1.9M of OCF in Q4.

I’ve discussed it in previous reviews, but Gatekeeper experiences wild swings within their working capital, particularly within their A/R and A/P. If their balance sheet wasn’t as healthy as it is I would be more concerned, but it does make their cash flow figures difficult to trend and predict - something which investors prefer.

Also in their fiscal year, they utilized $775k for asset purchases, received $315k via exercised stock options and paid out $800k in bonus payable. Overall GSI improved their cash position by 64% during 2024.

Share Capital:

93.6M shares outstanding, with 2.5% dilution over the past two years (all options) in a well managed float

6M options outstanding, all ITM.

2.2M options awarded during the year with reasonable SBC costs that are aligned with shareholders

11% insider ownership per YF. Insiders do not participate in the open market and one insider regularly sells shares in the open market prior to exercising options

You would have to wonder if an NCIB is being considered given the health of the balance sheet AND the beating the share price took today. If leadership feels they are undervalued it would be irresponsible not to at least have a buy back discussion internally.

Income Statement:

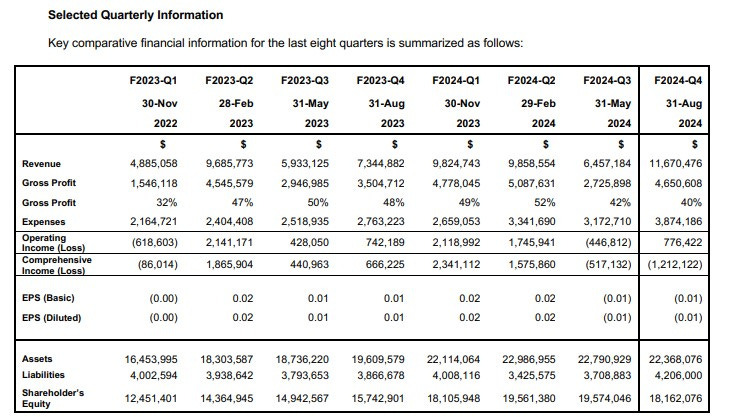

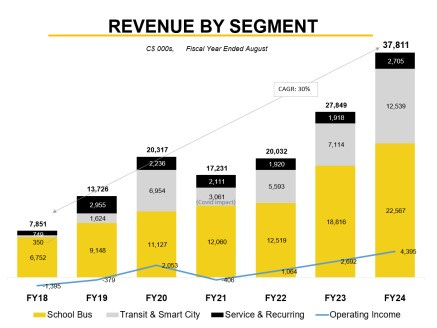

A successful top line in both the quarter and on a YTD basis with revenue growth of 36% in the full year and 59% in Q4 with a massive $11.7M in revenue achieved. Gross profit on the year came in at 45.6%, sixty basis points better than 2023. The quarter however came in 800 basis points lighter from 48% to 40%. Management stated this was due to one larger order at thinner margins. The result was only 33% more gross profit dollars on 59% more revenue so the 33% number becomes the more important one to see how well they converted below that line. You can see in the quarterly chart below that expenses grew by 40% over Q4 of last year, meaning they didn’t convert at all on that 33% additional margin.

While YTD numbers converted better, this is two straight quarters with 750 basis points or more of margin erosion with operational spending outpacing their gross profit dollar increase. That combination is going to have negative impacts on your profitability, and that is quite evident in the chart above.

Unfortunately, that is also coupled with another kick to the gonads, income taxes. While paying nearly zero in income taxes last year, they paid nearly $2.3M this year. That was a killer to their overall annual P&L, earning $2M in net income, 29% less than what they achieved in fiscal 2023.

Overall:

It’s never fun to be critical of one of your annual picks, but I’m never going to shy away from it. If anything, I look at these annual picks with a more critical lens.

Bottom line is after a great Q1, the following three quarters have been pretty lackluster at best. Revenue numbers have been pretty good, but growth in operating expenses have outpaced gross margin dollar growth for three straight quarters and their gross profit rate has been terrible in the last two.

Around this time a year ago there was a lot of talk about their recurring business and how growth there would help overall margins. I’m here to tell you without quantum leap improvements, this impact will be negligible. It only makes up 7% of their total business and a 40% growth rate isn’t going to be a large enough balance of revenue to influence the profitability of their overall business.

After yesterday’s beat down, the stock sits with a $51.5M CAD market cap giving it ratios in the area of a 26 P/E and a 1.4 P/S. That’s not what I would call cheap and screaming buy opportunity right here. In fairness, I think that $2M in net income should be normalized due to the $1.5M in deferred taxes they paid last quarter. That would put their P/E at a more reasonable 15.3.

In about four or five weeks, we will get a look at their first quarter from 2025. This was easily their best quarter last year where they produced $9.8M in revenue and driving 24% net income. After the last three quarters, can anyone feel confident they can improve on that? I sure as hell don’t.

Initially when I was looking at the chart I thought that 54 cent area could be one to target for a re-entry. Then I looked left and saw that big gap from September to 50 cents with 47 cent support just below that. Couple that with this monster quarter they are coming up against and I think those could be areas that get tested by the end of January. For those reasons, Gatekeeper is just a watch and wait for me. Still good enough to maintain three stars but rapidly moving down on my favourites list.

Have a request to review a stock?

Paid subscribers have priority status to request financial reviews of stocks they have interest in. Request via DM or email me at thewolf@wolfofoakville.com

Chat with me and 3100+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

If they can’t leverage sales growth, then no reason to own.

Wolf I just love your style and the depth of each stock that you cover. Keep up the great work. You're honesty backed with facts is very much appreciated by me