Whenever the boys over at Small Cap Discoveries have an introductory video on a new stock, you can be sure I’ll get asked to review it over the next little while. The stock has witnessed additional social media chatter in the past couple of months as well adding to the interest from the Wolf Den discord.

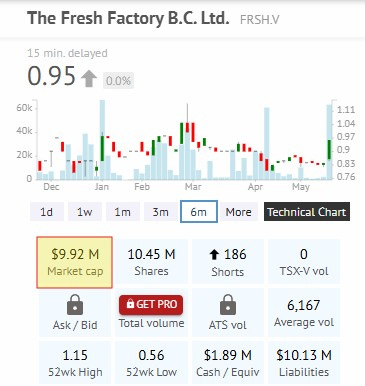

One look at the chart will tell you that it’s a low liquidity play, which isn’t going to garner much interest from technical traders. The largest daily volume this year was back in April with 61k shares exchanging hands with this ticker never seeing more than 64k volume in a single day.

I’ve also seen some incorrect statements from retail investors calling this a $10M market cap stock. It is actually far from that but we’ll get into that later.

Will Fresh bring out my inner Jerry Curl? Will it be so exciting to me? Let’s find out.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

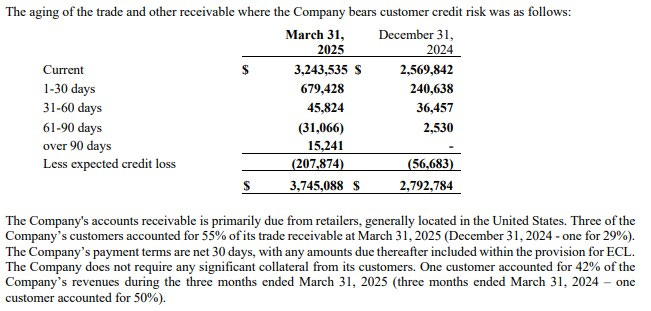

A borderline current ratio of 1.2 that consists of $2.2M in cash, $3.7M in receivables. $2.4M worth of inventory and $600k in prepaids against $7.4M in liabilities due throughout the next twelve months. Fresh Factory has no debt and $2.8M of long term lease commitments.

Fresh’s receivables are 87% current with very little beyond 31 days which looks relatively healthy, but they are anticipating taking over $200k in A/R losses in 2025.

No red flags on the balance sheet but I wouldn’t call their liquidity stellar and the 50% jump in inventory is noticeable and will likely negatively impact cash flows in our next section.

Cash Flow:

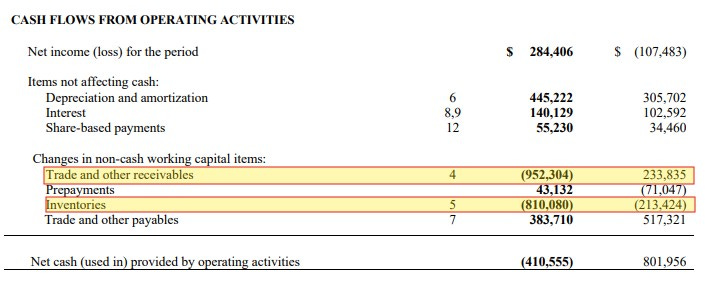

Fresh experienced $410k of cash burn within their first quarter, a negative turnaround of $1.2M compared to 2024.

As expected the large inventory investment within the quarter along with growing receivables hurt their OCF as both assets increased at a higher rate than revenues. This will likely balance out as the year goes on, particularly if those inventory investments turn into greater revenue increases.

Fresh spent $1.65M in Q1 to upgrade their facilities and to help fund that the company raised $3M in a bit of a unique share offering. Overall the company improved their cash position by 17% from their year end three months earlier.

Share Capital:

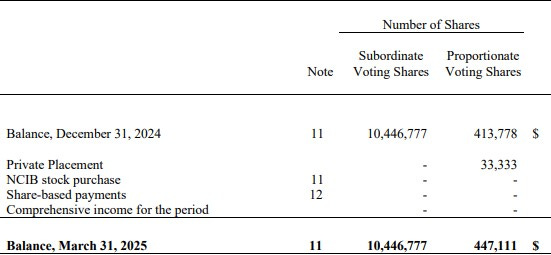

Here’s where things get a little bit interesting. Fresh Factory’s cap table is one that I commonly refer to a “caste system”. Quite frankly I don’t like these share structures and I try to avoid them when making my investment decisions.

On the surface, it looks rather innocuous with nearly 10.5M in subordinate voting shares and only 414k of these proportionate voting shares. But these proportionate shares convert on a 100:1 ratio and carry 100x the voting weight of your “peasant like retail shares”, so in reality these 413k “monarchy shares” are actually 44.7M peasant shares. Clear as mud?

While there are pros and cons to these types of structures, the reason I tend to avoid them is all of the pros benefit the company and most of the cons work against retail shareholders. Retail shareholders have much less influence than they think as the holders of these proportionate shares control 81% of the company. It presents higher risks for misaligned interests and a greater potential for abuse. Further to that, institutional investors tend to avoid companies with these structures and all of the above generally garners weaker valuations than a company with similar performance on a more balance share structure.

Other than all of that, I love it. LOL

The other negative is many of the websites retail investors rely on don’t capture this. A retail investor who frequently uses CEO.ca may think this is a steal at a sub $10M market cap when in reality it’s about $52M. That’s a significant difference.

10.4 subordinate shares and 44.7M (converted) proportionate shares for a total of 55.2M implied outstanding shares

3.33M options outstanding all just out of the money at $1. 3.2M awarded this year basically replacing the 2.9M that also expired unexercised

Fresh has a 10% SBC plan but note that is calculated on the converted proportionate shares so those 3.2M awarded recently are nearly 6% of the implied float.

Insider ownership is in the area of 30%, but due to the share structure one would have to assume a much larger portion are in friendly hands.

No recent open market activity but three insiders participated to the tune of 44% of the recent raise. That $3M raise was actually done above market at $90 USD per subordinate share - that converts to about $1.25 CAD with the stock trading at 96 cents today.

Current NCIB in place and have bought back $55k worth of shares. No buy backs since early January.

Income Statement:

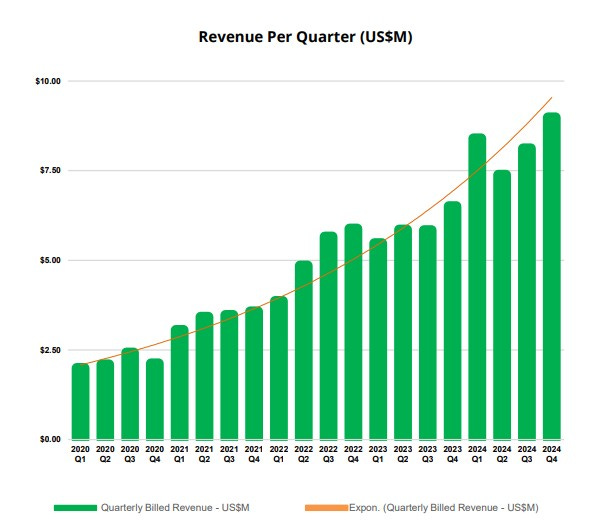

$10.66M of revenue achieved during the first quarter, an impressive 27% increase over the comparable quarter last year. They also delivered 240 basis points of better margins to 21.6% vs 19.2%. That assisted to generate 43% more gross profit dollars on 27% more revenue. Fresh also had some decent conversion within their operational spending with their main cash burning expenses bucket, G&A growing by 16.4% on 43% more margin.

Those metrics improvements had a positive impact on profitability with net income in the quarter of $284k vs the loss of $107k in Q1 of last year.

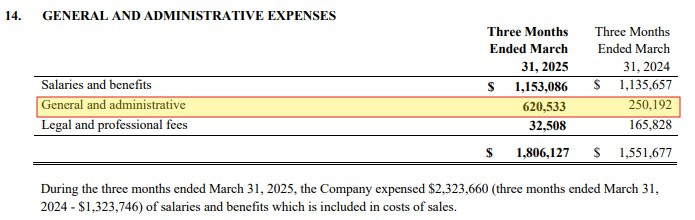

I don’t love their note 14 which doesn’t provide much detail on their non payroll G&A, and that grew by a whopping 250% year over year. Further digging in the MD&A reveals that it is partially due to accruing that bad debt when I spoke to their accounts receivables. That of course does balance out with 27% more business on a flat level of G&A payroll.

Overall:

Of the companies last seventeen quarters, Fresh Factory has failed to deliver double digit YoY revenue increases on only one occasion, and that one came in at 9.8%. Margins lagged that but have since picked up on a similar pace in the past two years.

So they have been growing the business at a nice CAGR and have delivered profitability to their shareholders in two of their most recent three quarters although their net income is still ($1.2M CAD) on a TTM basis.

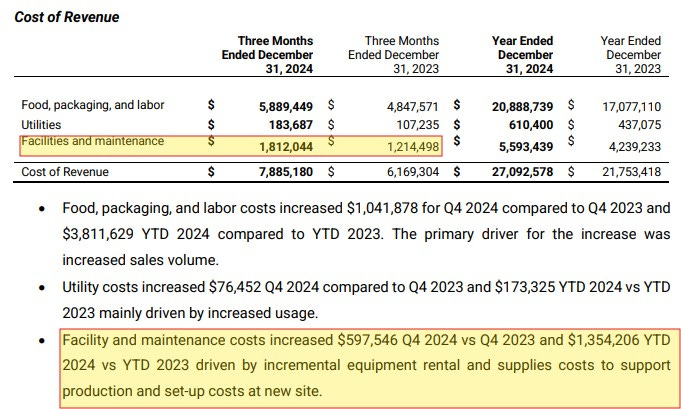

Their net income in the quarter came in at 2.6% of revenue, not a stellar number but it is moving in the right direction. Almost all of that was derived from that 240 basis point improvement in margin. So I wanted to dig into how stable their margins are. Over the first three quarters of 2023 it ranged from 18.4% to 19.4% but in Q4 it only came in at 11.8%.

I went back to their annual MD&A to see if I could find an explanation.

This was their explanation from that MD&A, so it does appear that margin hit within Q4 was a rare event. I would argue that these additional costs should be listed outside of COGS, but I’m just an asshole on the internet who opines on financial statements.

Will these new margins above twenty points stick around? I think that is pretty key for the company to produce consistent profitability.

Given the personal turn off of the share structure, the rest of the financials would have had to blow my socks off to get me interested, and they fell short of that despite their improving overall fundamentals.

2.75 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

A real eye-opening review, a great learning experience, and a welcome dash of humour (i.e. peasant and monarch shares). Brilliant analogy!