I’d suggest a good majority of you became subscribers from my annual Wolf Picks. Not including the recent ones made in December that includes 15 stocks over the past three years. During 2025 I started making mid year picks that I called “Seal of Approval” (SOA) picks to help differentiate them. Last year I made three of those. Of those 18 in total, 10 or 56% of them went on to at least triple and produced a total of three ten baggers (HBFG, PNG and NCI).

We are almost at the one year anniversary of my first ever mid year SOA pick - DBox Technologies on Feb 13th of last year. That pick is up 465% since.

In an unusual twist, this will be my first SOA pick that does not come on the heels of recent financial statements or a FINS Review - hence why I’m calling this a special opportunity.

For the record I do not see this stock going 7x like D-Box did in the following ten months, but I do like the potential opportunity for a 50% or more upside over the next four months.

It’s also likely one that you’ve heard of before as it has received a four star rating in the past.

Biorem received a four star review back in August of 2024 and over the next four and a half months the stock rose by 57% topping out at $3.45.

It has been a bumpy ride since however as over the next four and a half months dropped by 50%. It has since settled back in a range that it was at during that August 2024 review in the $2.25 - $2.40 area.

I was hoping for a dip after their latest financials, but the opposite happened and went on a run. I’ve been waiting for a pull back and that has happened over the last couple of weeks. I started of thinking about this article last week and the stock is up 9% from $2.26.

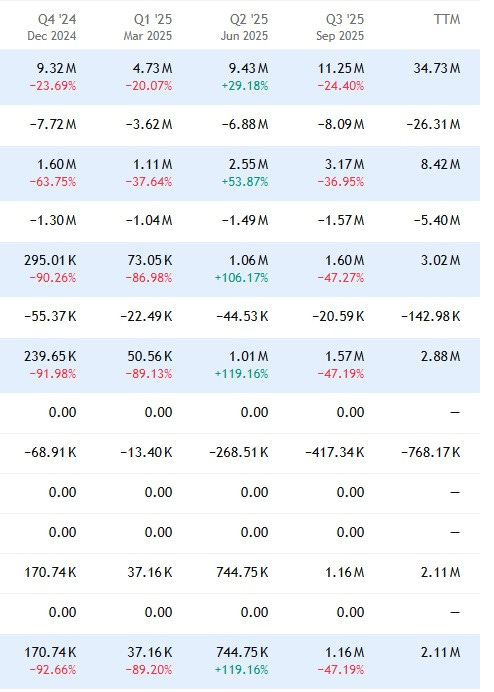

On a TTM basis, BRM has delivered under $35M in revenue, and far from shot the lights out with three of their last four quarters declining by 20% or more.

But their order intake has been a different story achieving a $71M total backlog after their last quarter with management estimating 75% of that total will be realized on the revenue line in the next four quarters. That would represent a 70% revenue increase over their current TTM numbers and 57% more than their best year - their 2024 annuals.

Biorem will be reporting both their Q4 of 2025 and Q1 of 2026 over a six week window between mid April and the end of May. They are up against weak comps, particularly in their Q1.

By the end of May, I believe we could see their TTM revenue climb to near $50M, with $5M in net income. Due to solving some logistics challenges last year, there is some additional profitability upside I believe also. BRM currently has a $39M market cap trading at 21 P/E and under 10 on an EV/EBITDA ratio.

At 12x earnings those numbers would drive a $60M market cap and $3.73 share price for a 54% upside, potentially better if those backlog numbers do not deplete with new order intake.

It could become a sell the news event following their Q1 financials. Best case they keep the momentum going with new contracts and their order intake exceeds reported revenue and it becomes a longer term hold.

Risks:

Liquidity - while it is wasn’t uncommon to experience over 200k shares traded daily in 2025, it averaged under 30k shares traded daily in January. Shares could be hard to come buy. Be prudent with your bids and I highly discourage market orders (Note I always discourage market orders but here in particular).

Revenue will always be lumpy here and while 75% of their $71M backlog is expected in the next twelve months, it’s not guaranteed to come in the next two quarters

With most of my Wolf Picks, I’m looking 18-36 months in the distance, so this one is a little unusual looking at a four month window with the potential to revisit it then.

For additional DD, here is a great writeup from my favourite Finnish investor - Heikki Keskiväli:

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.