It’s not often I tackle $1.5B market caps - mainly because I feel there are enough analysts and others doing this, but here we are. I have had requests from subscribers to review Enghouse and on the surface it would appear that they have been quite a strong performing company on the TSX. The chart suggests otherwise though looking back at the past two years. Enghouse traded as high as $42 in early 2023, then $37 at the start of last year, and now all the way down to sub $27.

Do these financials show enough to suggest that we should see a reversal of this trend?

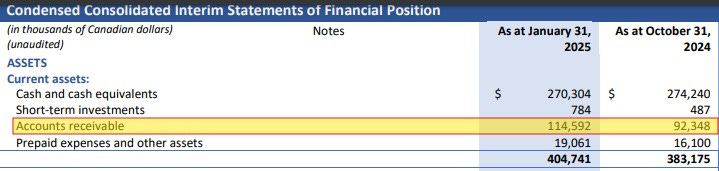

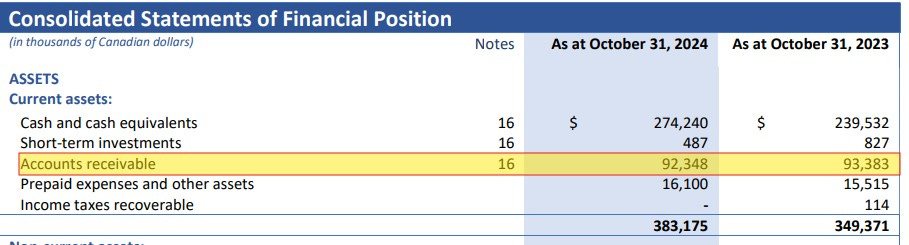

Balance Sheet:

With deferred revenue removed Enghouse has an incredibly solid current ratio of 4.2 which is made up of $270M in cash, $115M of accounts receivables and nearly $20M in other short term assets against just $97M in short term liabilities, and they carry zero debt obligations.

It’s an extremely strong balance sheet overall, but after some digging it is not without critique or concern and I’m referring specifically to their accounts receivables.

On a 2.9% revenue increase, receivables grew by 24% in the same period. Now that alone isn’t overly concerning as simple timing differences could be the cause. I am concerned however when I look at their credit risk section from last year’s annual report

As of the end of last year Enghouse reported an allowance of $16.7M for credit losses, up 40% from the previous year with 15% of their receivables over 90 days past due. Now on top of that we have seen their receivables grow by 24% on less than 3% more revenue in the last three months without similar disclosures in these recent financials statements.

This is a bit of an orange flag for me.

Cash Flow:

Operational cash flow for Q1 grew by 6.8% from $19.9M last year to $21.2M in this recent quarter.

During the quarter they had a net cash outlay of $6.6M for their acquisition of Margento which was announced just last week. They also paid out $14.4M worth of dividends, and repurchased nearly $6M worth of stock.

Overall, their cash position depleted by 1.4% from where they began the year at, but still sit with a very healthy cash position.

Share Capital:

A very healthy float of 55.2M shares outstanding, 220k less than they began the year at due to share buy backs.

Those share buy backs in Q1 are more than they bought back in all of 2024 (195k). Their NCIB expires May 7, 2025

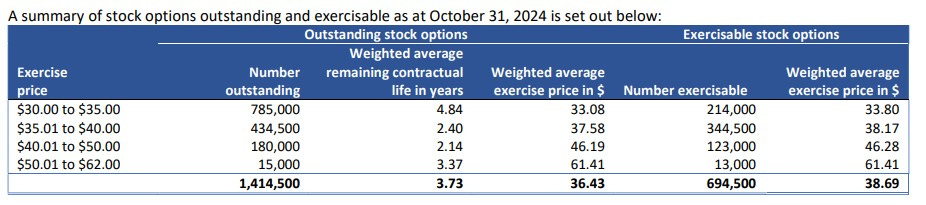

1.4M options outstanding, all currently out of the money but none expiring for more than two years

Minimal 31k of PSU and DSU’s outstanding under a quite reasonable appearing SBC plan

Increased their quarterly dividend to 30 cents which brings their yield to 4.5%

Strong insider and institutional ownership of 22% and 39% respectably but no recent history of any open market buying

Income Statement:

Revenue for Q1 came in at $124M on the nose, increasing by 2.9% compared to a year ago which includes slighting increases in all segments with the exception of their hardware business, which was down by 27% but as a whole only accounts for .9% of total revenue.

Gross margin (classified as revenue, net of direct costs) saw 140 basis points of erosion to 64.1% vs 65.5% a year ago therefore only achieving 0.8% more margin dollars on 2.9% more business.

Total operating expenses grew by a higher rate than their revenue and gross margin dollar growth at 4.9% with their two main cash burning expense buckets (SG&A and R&D) slightly higher at 5.1%.

That translates to Operating Income of $31M, which was 5% less than what they achieved a year ago.

The company did however grow their total net income by nearly 21% however from $18.1M to $21.9M. That was caused by a $4M birdie in foreign exchange and nearly $2M less in amortized costs. Therefore the company really benefitted from things out of their control while the results more fully within their control came in weaker.

Overall:

2.9% more in revenue at the best of times isn’t going to make it crowded in anyone’s pants so to speak. But there may be other concerns here regarding what appears to be relatively stagnant growth if not some organic slippage for Enghouse.

Enghouse has two net new acquisitions within these financials - Seachange which was acquired in May of last year and Mediasite purchased back in February. These were both companies previously trading on the OTC and according to Enghouse’s own press releases should have added approximately $40M in accretive total revenue.

While their 2024 revenue did increase by double digits this most recent quarter was their worst in their last four and that also includes about half a quarter of revenue from Aculab, acquired in December of 2024.

Enghouse breaks their business down into two main operating segments, IMG (Interactive Management Group) and AMG (Asset Management Group). Two of the three acquisitions which are non organic businesses slide into their IMG segment. That segment which accounts for nearly 60% of their total business was down 3.8% which includes two new acquisitions. It is also pretty common practice within annual financial statements to include impact of acquisitions to their total business and it is pretty notable that Enghouse did not. To quote Elon Musk, which I assure you will be a rarity from me, “concerning”.

Lastly, on a constant currency basis, revenues only grew YoY by $400k with 89% of their sales lift benefitting from foreign exchange.

Now I do feel like I’m focusing on much of the negative so far, but they do have a lot going for them as well. Aside from some potential A/R concerns, they have a superb balance sheet and are a free cash flow producing beast with over $130M generated on a TTM basis, and take over 16 cents of every revenue dollar down to the Net income line. They have made good use of that cash by buying back stock and recently increasing their dividend by 15%. Enghouse also acquired Slovenian Margento last week in a relatively small addition with Margento reportedly doing approximately $10M in annual revenue with no other financial terms were disclosed in the deal.

With Enghouse trading around 3x revenue and about a 17 P/E, it doesn’t look very undervalued given the relatively stagnant revenue, potential concerns surrounding their seemingly non existent organic growth and recent erosion within their operating income. When you add in a potential $16.7M timebomb of anticipated credit losses (20% of their TTM Net Income), that must be taken into your valuation criteria. The 4.5% yielding dividend makes them a little more attractive, but overall these financials were pretty underwhelming given my quite high expectations coming in. A solid 3.5 stars, but I’m afraid I’m taking a pass for now. The conference call hasn’t done anything to sway me otherwise.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Great review wolf

Thanks for the review, Wolf. I'll also be passing on it for now. Based on most of your review, I thought 3.5 stars was generous, but the last few paragraphs explained why quite nicely.