For starters, I’m a coffee drinker. I’ve been asked to look at this stock for quite a while now but found it difficult to get myself motivated enough to look at them.

Was that a mistake? It certainly looks like it could have been as from their September 2024 lows of 12.5 cents, the stock is currently up 840%, and was as much as a ten bagger from those lows back as of mid January.

The business is coming off of a great Q4. Even though revenues were off by 4.6%, the operational improvements they’ve implemented over the past couple of years paid off in a big way producing $2.5M of net income in the quarter compared to a near $4M loss in the comparable quarter. With up to 40% of their annual business coming in the closing quarter of the year, can they continue that momentum into the first quarter of 2025?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

DTEA has a solid balance sheet including a current ratio of 2.4 (deferred revenue removed) which includes $10.4M in cash, $2.2M of receivables, $13M worth of inventory and $2M in prepaids against just $11.5M in receivables due over the next twelve months. The company is debt free with their only long term liabilities in the form of long term lease commitments.

The notes the company provides in general within their financials is weak and I will likely refer to that on multiple occassions. That includes no A/R aging for an account that is up 26% on lower revenues. That combined with higher inventory and prepaids, and a huge reduction in payables is shaping up to be a nightmarish cash flow quarter.

Cash Flow:

It feels like I let the cat out of the bag already, but DTEA burned through a significant $4.6M in operational cash flow during Q1, $2M more than they did in Q1 of last year.

Time for investors to panic? I’d suggest not as it was due to working capital adjustments that I would not expect to trend. The company, once again does not provide a corresponding note for working capital which is highly unusual. Thankfully, you do not have to Mensa member to figure it out. $4.3M of that OCF burn is related to a significant reduction in accounts payable with other balance sheet differences contributing to a lesser extent. On the positive side, prior to working capital adjustments, the company’s cash flow improved by $2.6M, therefore I would anticipate their Q2 numbers to bounce back. On a TTM basis, the company has generated $7M of OCF.

Aside from that the company paid $1.2M in lease costs and overall their cash depleted by 36% from where they began the year just three months ago.

Share Capital:

DTEA has a relatively clean float of 27M shares outstanding with only 100k of dilution over their past five quarters

No options or warrants outstanding

634k of DSU’s

Vote upcoming at the annual meeting to increase available number of incentive shares to 4M, representing 15% of the current float

46% insider ownership and 11% owned by institutions. The largest shareholder (44%) owned by the estate of the company’s founder Herschel Segal, who passed away last month.

Insiders have no history of activity within the open market, even when the stock was suffering - in fact have a history of exercising their DSU awards for cash

Income Statement:

Revenues for their first quarter were just better than flat, up 0.6% to $13.5M. Where the company continues to make their most strides are below the revenue line. This includes a 780 basis point improvement in gross margin to 51.1%. That equates to 18.6% more gross margin dollars on flat revenue. In addition, they were able to take out $1.5M in SG&A costs during Q1 and combined results in a $2.5M turnaround on the bottom line in the comparable quarter. Unfortunately, all of those improved results still resulted in a small net loss of $166k, but a dramatic improvement over the $2.65M loss last year nonetheless.

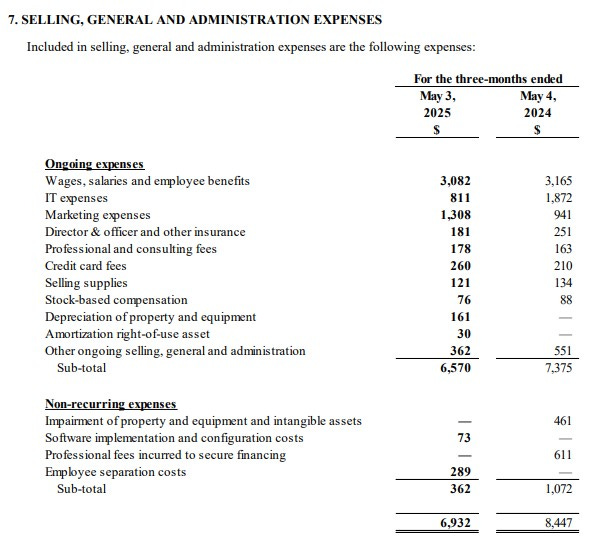

I should give the company some kudos for their breakdown of SG&A expenses. Of the $1.5M in total YoY savings, over $1M came from IT expenses, which makes you wonder what the hell was going within that account in the past. Another $700k came from non recurring expenses, but the account that catches my eye is marketing expenses - up by 39% only to deliver a 0.6% gain on the top line.

Overall:

While the company has made some strides over the past two years, they are far from the company that IPO’d on the Nasdaq for a $100M USD valuation back in 2015, and their TTM revenue is only about a quarter of what they did back in 2017. Their retail footprint is a shell of their former self after their restructure back in 2020, a year when they lost $56M on $121M in revenue.

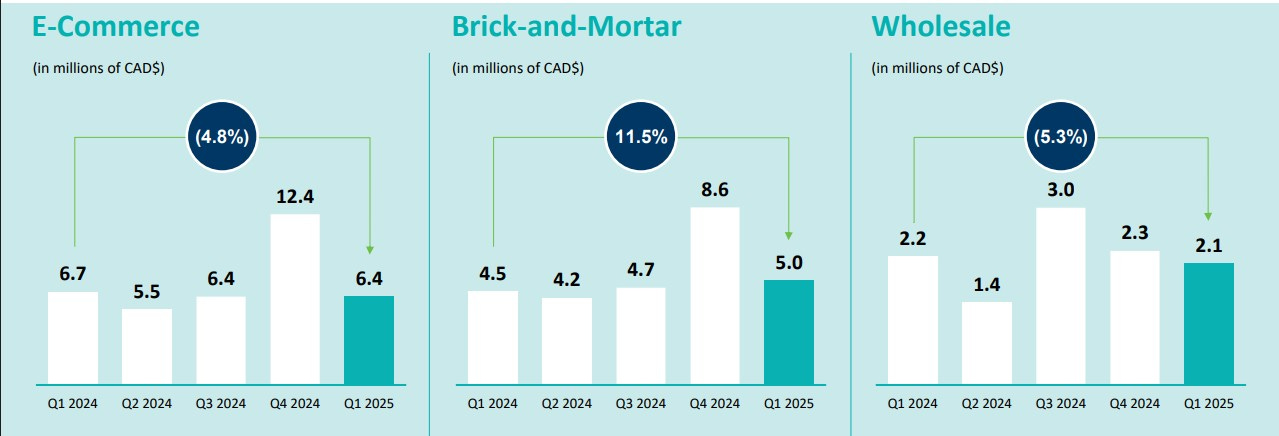

E-Commerce and Wholesale channels were down in the quarter while brick and mortar revenue was up double digits including 2.8% in comp store growth.

When I look back at their go to market strategy from a year ago compared to their initiatives now, I have concerns.

Of their three growth pillars, I would personally be less excited about flagship stores and that is where they are currently growing. With 4000 Canadian locations, a new agreement with Couche-Tard last year, new distribution channels south of the border and a 39% increase in marketing spend, the wholesale business being down 5% is quite concerning. Their initiatives into their digital platform to grow their online business has also not paid much dividends. Doubling their store front over the next three years feels like a been there, done that strategy that didn’t pan out too well last time.

Now the company is headed into their Q2, which they will report in September. While they have made a ton of operational improvements, they are likely as lean as they are going to get. With the top line looking rather weak over the past two quarters, I think I’m going to stick to my coffee.

2.5 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I have followed this story for so many years due to Value Digger promoting it on Seeking Alpha. The high insider ownership has been a curse. If you want to see how the business has been run please watch a few episodes of Arrested Development. The dad passed away a month ago but a year ago (when I assume his health was failing) he put his wife on the board. Despite the company burning cash and recently going through a restructuring they gave her something stupid like $250K to run the board. The daughter was running the company. Both had no reason to be there besides nepotism.

The cost cutting and turn around has saved the family's nest egg from being wiped out which is why I bought it when it was dang near $0. However, I have no desire to have that family be a steward of my capital and be a silent partner in their business.

Sorry, i am a Noob in Discord:-) Where can i find The Wolf Den?