It is almost a year to the day when I selected D-Box as my first ever mid year pick giving them the Wolf Seal of Approval. With the 86 cent close yesterday that left the stock one cent shy of a six bagger since that selection.

That initial review of 3.75 stars in February of last year has been subsequently upgraded twice, most recently in November for their second quarter to 4.5 stars. That has resulted in a 56% share price appreciation in the past three months.

Great performances bring higher expectations however. Let’s find out how their earnings drop after hours yesterday measures up to these new standards.

Balance Sheet:

D-Box possesses a pristine looking balance sheet with a current ratio of over 4.5. That consists of $16.2M in cash, $9M of receivables, $8.1M worth of inventory and $700k in other short term assets over top of just $7.5M of liability commitments in the next twelve months (deferred revenue removed).

D-Box is lacking somewhat with notes disclosures within their financial statements but the increase in A/R stems from late quarter royalty revenues and theatrical equipment. With that said I would still like to see an aging report on a quarterly basis also.

The company has only $370k of debt which runs to the end of 2027 at a very attractive 4% interest rate. They also have a $8M credit facility available.

Liquidity is extremely strong with their cash position at a greater than 2x ratio over their short term financial commitments.

Cash Flow:

$10.1M of operational cash flow through the first three quarters of their 2026 fiscal year which is 91% greater than the $5.3M generated at this stage last year.

In general they have quite a simple cash flow statement, utilizing $600k in asset spending, receiving $80k from stock options and paying down their long term debt by $860k.

Overall, they have increased their cash position by $8.4M or 107% from the start of the year and 155% from this stage last year.

Simple is good.

Share Capital:

222.7M shares outstanding, 0.4% dilution from 800k options exercised in the past twelve months

13.2M options, all ITM with 10.3M issued so far this year

2.5M RSU’s were outstanding at year end. 1M additional awarded on first of the year post financials. The company does not update the current number in these filings and leaving out this figure when calculating their fully diluted float within their MD&A. Not the greatest disclosure once again.

Insiders and institutions hold approximately 26% ownership

Multiple insider buys during the past nine months as well as institutional buying. The largest shareholder and audit chair however has peeled off a significant amount of shares, particularly in this past quarter

Income Statement:

D-Box generated $13.8M of revenue in Q3, a 4% increase over the $13.3M they achieved in the comparable period. Gross margin increased by 110 basis points to 51.4% which drove an increase of 6% higher gross profit dollars.

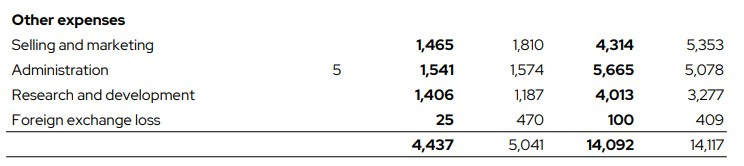

Total operational expenses decreased by 12% in the quarter, but this total figure could lead some to believe there is better operational leverage than actually exists. Of the $604k in operational savings over last year, $445k or 74% of that came from lower foreign exchange losses. Marketing costs decreased by 19%, Admin costs were a little less than flat while R&D spending rose by 18%.

Net income (before taxes) increased by 72% to $2.65M vs $1.54M a year ago. The company also utilized $6.4M of deferred tax assets in the quarter pushing their total profitability to $9.06M, compared to $1.53M a year ago.

On a YTD basis, their summarized results are as follows:

Total revenue of $42.9M, a 25.6% increase

Gross margin improvement of 270 basis points to 54.3% generating 32% more GP dollars

YoY flat operational expenses at $14.1M, but this includes a $1.2M restructuring charge this year for CEO and CFO changes

$9.15M of net income before taxes, nearly 3x more than the $3.16M from last year

Easily a Wolf trifecta of significant double digit revenue increases, improved margin, and operational excellence on their YTD performance.

Overall:

If there is a surprise or a slight letdown in these results it would be from the top line of only a 4% increase in total revenue. This comes after their previous two quarters which resulted in 49% and 33% gains in Q1 and Q2 respectively. That is also a 14% decline on a QoQ basis off their record quarter reported in November.

While installation revenue is expected to be lumpy, perhaps the most surprising portion of the Q3 results were royalty revenues dipping by $80k. While the market knew total box office numbers were down to last year (nearly 7%), I think the overwhelming consensus from retail investors was the move to more premium seating would shield them a little better. This was supported by language from theatres recent financials as well.

Perhaps a small fly in the ointment, but I don’t think that impacts the long term thesis.

Royalty revenues are up 31% YTD and total revenue to theatrical customers are up 74%. System installations continue to grow with 86 installations in Q3 to a total of 1145 active at year end. That is still a very minute market penetration when you consider North America has 42,000 screens with the worldwide number at 200,000.

Cinemark alone is planning another 70 screens this year and D-Box was also installing additional screens in Australia very recently.

The best recent update out their comes from Rivemont Microcap’s event from a few weeks ago. Here is Mathieu’s video that he recently posted which gives a great overview of what the company is working on.

The $4.1M in deferred revenue in Q3 also can give some indication of what is to come in Q4 from late quarter installs. Q4 of last year is also the company’s weakest quarter of the last eight which sets up an interesting comparable when they report next in early June. That deferred revenue is nearly half of the $8.6M they reported last year.

From a valuation perspective, one has to strip out some of the noise and that includes the big tax birdie which inflated this quarter’s net income to over $9M. To normalize their net income I would also add back the $1.2M in one time restructuring costs.

From that and the continued operational improvements we could expect in Q4, I project their NNI for the full year to be somewhere in the $11.5M range. That would give a P/E ratio of around 16. Certainly not the sub 8 P/E cheapie when I awarded the stock a Seal of Approval pick twelve months ago, but not overly expensive based on the upside they present. The company’s balance sheet is immaculate and they are becoming a cash flow producing beast.

Being a bit of an Olympics junkie, I’d be remiss not to insert some form of an analogy. This may not have been a gold medal performance on the top line like the last two quarters, but it sure isn’t akin to the Canadian women’s hockey team performance yesterday either. I had to get that off my chest.

It should be an interesting stock to watch today for the market’s reaction.

Let’s not forget D-Box brings over 21% of their current revenues to the bottom line. For that reason I’m maintaining my 4.5 stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Love the review, love the company. You really seemed to enjoy writing this one, Wolf. I can sense the joy you get from diving into the numbers.

Great detailed review wolf,thanks