Someone said something pretty amusing in the Wolf Den discord yesterday in the D-Box chat channel:

“I was so skeptical when you gave the seal of approval to a company that makes vibrating theatre seats (WTF). Glad I came around haha.”

To be honest, I questioned the sector choice myself initially. Movie theatres are not exactly on everyone’s radar as a massive growth opportunity. But results are results, good management teams are few and far between in microcaps a, and growth opportunities almost always exist - even in stagnant or declining sectors.

As of yesterday, D-Box was a penny shy of becoming a four bagger (300% increase) from when they reported their Q2 of 2024 financials back in February. That is also the date I gave D-Box the Wolf Seal of Approval. Had you added in any of the above buy zones you would have also made out pretty well too.

I also had this to say in my October WWW article:

That was on Oct 20th when the stock was at 40 cents. It touched 56 yesterday as astute investors started to catch on that a pretty good quarter was on the horizon given comments in the earnings releases from two of their customers, Cineplex and Cinemark. That 20% upside I mentioned turned into 40% and the company just dropped their Q3 after hours. It’s currently 7 pm, these financials are an hour old, and I couldn’t wait to start diving in and writing about them. The initial glance was that good. LFG.

D-Box received a rare four star upgraded review last quarter.

Balance Sheet:

With deferred revenues removed from liabilities, DBO sports a very healthy current ratio of 3.5 that consists of $10.5M in cash, $10.3M in A/R, $7.1M worth of inventory and $1.2M in other short term assets against just $8.5 in current liabilities. The company has a mere $411k of debt.

Their cash position alone well covers their liabilities over the next twelve months so liquidity is also quite strong.

Short balance sheet sections are always a positive sign.

Cash Flow:

Even with large working capital adjustments in A/R ($3.2M) and investments in inventory ($1.4M), D-Box has generated $4.1M in operational cash flow at the midway point of their 2024 fiscal year, which is 37% higher than they achieved a year ago.

Through six months, they have invested $330k in net asset purchases, paid down $817k of debt, and received $55k from options exercised.

Overall they have improved their cash position from the start of the year by 36%.

Share Capital:

222.5M shares outstanding, only 1% dilution over the past 18 months from options exercised

8.9M options outstanding, all well ITM including a significant 5.8M awarded this year at an avg of 26 cents (5M to the new CEO)

2.5M RSU’s were outstanding at year end. The company does not update the current number in these filings and leaving out this figure when calculating their fully diluted float within their MD&A

10% insider and 18% institutional ownership

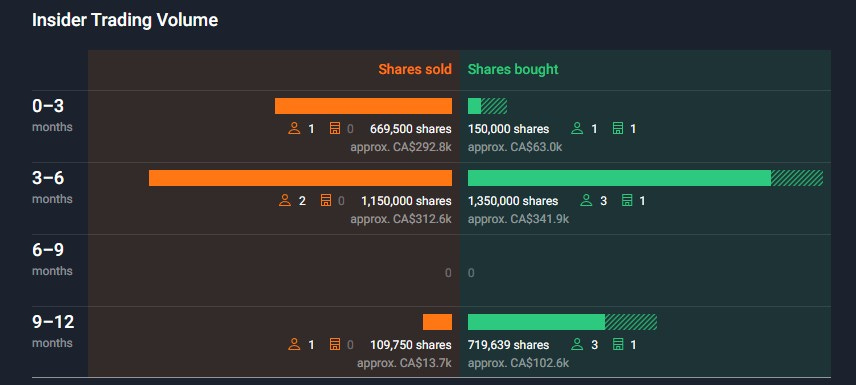

Mixture of insider buying and selling in the past twelve months. Also notable that institutional investors have been increasing their positions (Fidelity)

Income Statement:

D-Box was up against their largest second quarter in the history of the company and blew it away by 33%, achieving $16.1M in the process. In addition they also improved margins by 200 basis points from 53% to 55% YoY, which drove 38% more dollars to the gross profit line.

The company achieved all of that with only a 1.5% increase in total expenses. In fact, when you remove a $200k+ bogey in foreign exchange included in total expenses, the company actually spent 4% less within their cash burning expenses including a 32% reduction in selling and marketing expenses, modest increases in Admin costs and investing 20% more in R&D compared to last years Q2.

Oh yeah, the company also had a $400k restructuring charge in the quarter. There are few better examples of a Wolf Trifecta, if any.

Net income in the quarter came in at $4.53M, 123% better than the $2.03M a year ago and an incredible 28% of total revenue.

Their YTD numbers through six months are equally as good:

Total revenue of $29.1M, an increase of 40%

Gross margin up by 300 basis points to 55.6% and gross profit dollars up by 48%

Total expenses only rose by 6.4% including sales and marketing savings of 20%, 18% higher admin costs and 25% higher investments in R&D

$6.56M of net income, more than 3x YoY ($1.9M)

Overall:

Where does one start? I kind of pride myself in being able to find holes in anyone’s financial statements. There are NONE here.

As I said off the top, there are almost always growth opportunities, even in stagnant or declining sectors and there is no better proof of that than the company comments within their press release last night.

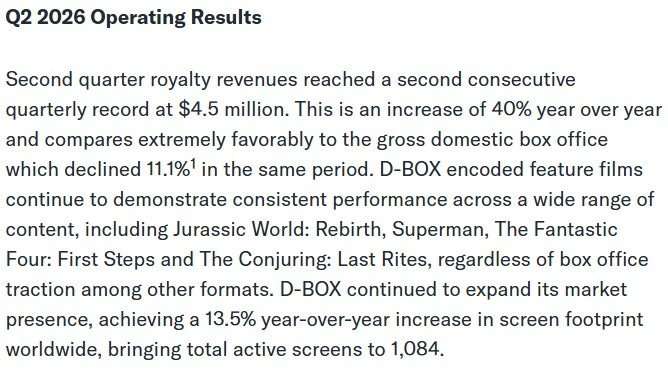

Royalty revenues from asses in D-Box theatre seats were up 40% while box office numbers suffered by 11%.

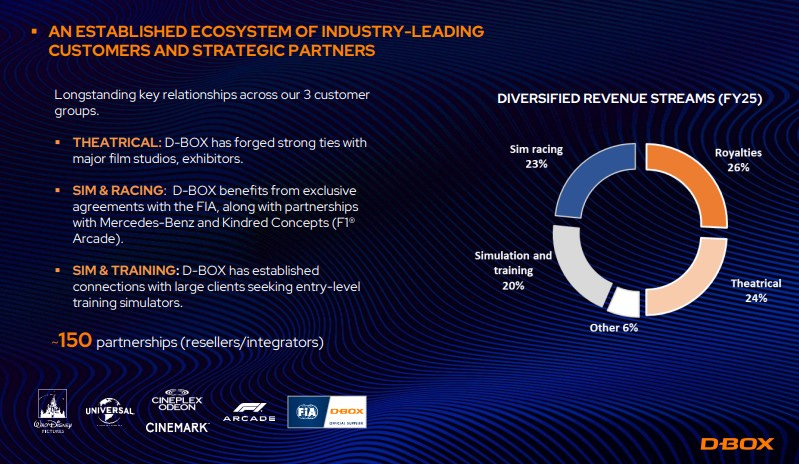

It would also be incorrect to assume that D-Box solely relies on the theatre industry itself - their revenue streams are much more diversified than that, and 50% of the YTD system sales come from other avenues.

The Theatrical segment is the big story however with that segment growing by 64%, along with royalty revenues growing by 40%. Those royalty revenues are pure margin and will greatly assist when a lumpy quarter presents itself.

If you’re wondering if there is much meat left on the bone, note the logos you do not see on the above slide. I’m talking about AMC and Regal, the two largest in the theatre industry, and apparently discussions are happening. Even without that, their sales pipeline is strong and they continue to expand internationally, including increased traction in Latin American and Australia.

Now how about the current valuation of a $116M market cap? The company suggests they be measured on a TTM basis, so let’s start there. D-Box has produced $8.5M in net income over that time span and that takes you to a 13.6 P/E. It’s not the cheap 8 P/E when I selected the stock as a Seal of Approval pick, but with everything the company has going on, there is still juice here to be squeezed.

That P/E on TTM also seems very conservative given the Net Income delivered in Q2 is more than their previous three combined. They also sit at $6.5M YTD. Hypothetically, even if they did half that for the back half of the year to put them at $10M net income. At a 15 multiple, that’s a $150M market cap - 30% higher valuation which comes with a 68 cent share price.

A full half star upgrade to 4.5 stars. Only one other stock, ZOMD has received a rating that high in the last eighteen months.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf great review. That AMC and Regal potential could be huge considering how much market share they have in the USA. I appreciate you look for holes in financials and as a share holder of this company glad you didn't find any. Keep up the frequent and good work Wolf.

Against my better judgement, I bought more this morning(overbought on RSI and Stochastics) but I think a 20X PE is more deserving for this one.