D-Box Technologies is one of my two Seal of Approval (SOA) picks from this year, this one chosen back in February. These SOA picks are equivalent to my annual picks with the exception of being chosen mid year. When I made the selection the stock was trading at 14.5 cents, and even with a down day after reporting their financials Tuesday evening, it closed at 27 cents for an 86% return. The other SOA pick of 2025 is McCoy Global (MCB.TO) chosen in March and that has returned 74% since then, a much better performance that my six 2025 Wolf Picks which are up a combined average of 12.6%.

D-Box received a fantastic 3.75 review back in that February review which now seems like an eternity ago. It took some time for the stock to catch fire starting it’s big move near the end of May.

If you have been to a movie theatre then you have likely experienced what D-Box technologies can do, but the company also has footprints within Entertainment and Industrial segments through their simulation gaming and training products.

My initial look the other night suggested these results could be somewhat disappointing, or at least not comparable to the very strong Q3. Let’s take a deep dive to find out.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year Seal of Approval picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

DBO has a solid current ratio of 3.2 (deferred revenue removed) which consists of $7.8M in cash, $6.9M of A/R, $5.6M worth of inventory and $800k in other short term assets against just $6.7M in short term liabilities. We always like to see that cash number alone covering all of their next twelve months of liability commitments and we have that here.

While the company does not provide a typical aging report, what they do provide looks quite satisfactory and appears to be in good shape.

The company only has $920k of long term debt at attractive rates. Overall great start.

Cash Flow:

D-Box generated over $7.3M of operating cash flow in their 2024 fiscal year, more than doubling the $3.1M from the prior year, and much of that came without the assistance of working capital adjustments. They utilized $1.2M via asset purchases and eliminated $1.26M worth of debt.

Overall they improved their cash position by 170% during the fiscal year.

Share Capital:

A rather bloated float of 221.9M shares, with only minor dilution occurring from the exercise of options

8.05M options outstanding including 3M awarded this year at 16 cents, and the vast majority currently ITM

Insider ownership of 11% and institutions range from 20-25% ownership depending on which site you look at. No activity in the open market in 2025, but insider were net buyers in 2024

Income Statement:

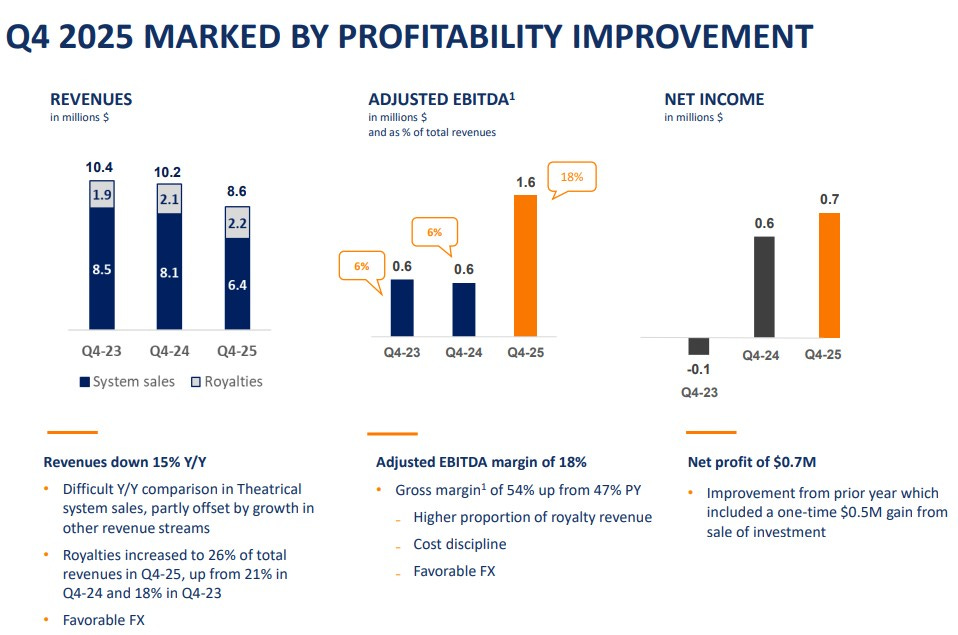

A lumpy revenue year from quarter to quarter but DBO finished 2024 up by 8%. Where the company made more substantial strides was in their margin performance which was up over 500 basis points to 52.2%, which resulted in a 20% increase in gross margin dollars and this was due to changing the market mix of where revenues came from. D-Box was able to achieve the above on better than flat controllable expenses within their SG&A expenses, saving over $100k while achieving 20% more on the gross profit line. R&D came in 11% higher and even with a $550k bogey to last year within foreign exchange, they were able to improve their profitability by 262% to $3.86M which represented 9% of their total revenues.

Overall:

Overall, a solid year for D-Box Technologies but most investors have a “what have you done for me lately” attitude and with the company experiencing their softest top line of the last five quarters, the stock has retreated by 16% since these numbers were released earlier in the week.

While margin and expense control continued to improve, system sales were down significantly.

The company’s current valuation metrics are as follows, a 1.4 P/S ratio with EV/EBITDA of 8.3, a P/E of 14.3 with 22% ROIC. I would suggest it’s relatively reasonably priced, perhaps a touch on the cheap side.

DBO had a pretty transformative year, so what do they do now for an encore? The key to that could lie in the recent change at the top, with the new CEO Naveen Prasad assuming the role effective last week. Mr. Prasad was already serving on the board, boasts an impressive resume within the industry, but it is notable that his appointment was announced as just an interim CEO.

So far in 2025 they have announced theatre expansions in both the US and Argentina, and each of these new screens will provide ongoing royalty revenue, increasing their recurring revenue component and margins.

D-Box’s Q1 will end in a couple of weeks and we should see those numbers by the middle of August. They are up against a rather soft quarter and the only negative profitability quarter of the last five.

Maintaining my 3.75 star rating, but closer to downgrading than upgrading due to the softer Q4.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.