After a rather mediocre end to their 2024 year, I didn’t exactly have Cipher as a must review for Q1. But, the requests out of the new Wolf Den discord were numerous and the Wolf gives the people what they want.

I gave them a rather pedestrian three star review the day after their annuals came out in March. One of my biggest concerns is 74% of their 2024 profits came from income tax recoveries on depleting tax pools, margin issues as well as SG&A costs ballooning so I had big concerns regarding their profitability metrics leading into 2025.

The stock has been on a downwards trend since September. Judging by the market reaction since their financials were released last week, it’s safe to say they were displeased with the share price dropping 11% while the rest of the market has seen a rebound.

Will I feel differently?

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

NEW - Access to The Wolf Den discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

We begin with a very strong current ratio of 2.3 (improved from the 1.9 at year end) which consists of $22M of cash, $11.8M of receivables, $5.5M worth of inventory and $800k of prepaids over top of $17.6M in current liabilities. Excellent start with very solid liquidity as their current cash position covers all of their next twelve months of financial commitments.

$40M of long term debt which is unchanged from year end relating back to the Natroba acquisition at nearly 6 points. They have another $50M available to them under a revolving facility & accordion feature. Post financials, on the same date of their filings, paid this down considerably by $15M, leaving a $25M balance.

Sadly, no details surrounding their A/R but they do have some customer concentration issues with 79% of that balance from six customers.

Cash Flow:

Operational cash flow (OCF) of $4.2M, 73% better than their first quarter a year ago. That comes with a big caveat however as their OCF before working capital changes is slightly down, and they had a $5.3M swing due to overcollection of accounts receivable year over year. It’s good, just not as good as it looks.

Next to nothing occurring within the investing and financing side of the cash flow statement in Q1, so overall the company improved their cash position by 24%.

I find it a little curious that the company paid down so much of their debt post financials, as that represented 68% of the company’s cash position. It will be interesting to see how this impacts their liquidity when they report Q2.

Share Capital:

25.6M shares outstanding in a historically well managed float, 6% dilution over the past twelve months

1.3M options, with the majority ITM

218k RSU’s

The company renewed their NCIB on May 1. They didn’t utilize their last one very much despite strong wording to the contrary previously. Due to deciding to tackle their debt by $15M post financials, I don’t anticipate much utilization of future share buy backs.

Cipher has an ESPP allowing employees to purchase shares at a 15% discount which has only been utilized very sporadically - I think this is quite telling

Not much activity on the open market aside from one director selling on the open market to fund option exercises

Insider ownership of 42% with 1.5% institutional (per YF) with minimum share ownership requirements for insiders and directors

CEO takes no base salary currently other than fees as board chair. Receives 100% of his comp via SBC

Income Statement:

Absolutely blew the doors off revenues which was expected with the acquisition. Top line came in at $12M, 104% more than their Q1 of last year but unfortunately that is where the positive story ends.

I don’t know why the company continues to be incapable of showing a gross margin line on their P&L, but I find it irritating as hell. Gross profit decreased by 600 basis points from 82% to 76%.

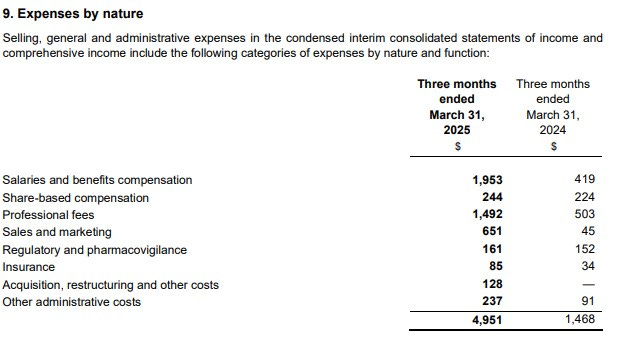

Total operating expenses soared by nearly 4x over last year on 2x more revenue. While $1.6M of that are in non-cash burning depreciation and amortization of intangibles from the acquisition, their SG&A expenses are once again off the charts, growing by 237%.

Once you add in a $1M swing from interest income to interest expense and another $1.2M less in deferred tax recovery, it results in $2.6M of net income. A solid number on $12M in revenue, but 47% less than the $4.9M achieved a year ago.

Overall:

After looking at the results, I feel the concerns I had two months ago coming out of their 2024 annuals were justified. They were trading at a 19 P/E and those earnings looked like they were at risk coming into 2025. Through three months, that assessment is holding up. That 11 year payback period on the Natroba deal is starting to look expensive. Can they turn it around? Sure, but that 19 P/E from their year end has now turned into a 26 P/E after these latest results. If they are more expensive now than two months ago and I was unconvinced then, my sentiment certainly hasn’t changed. Add in $1M worth of litigation costs to defend one of their partners and it just adds drama and Wolf doesn’t dig drama.

Since they are still profitable and producing good cash flow I can’t in good conscience downgrade them to less than three stars, but I’ve come to the conclusion that Cipher isn’t a good fit for me.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Thanks wolf great reviewand your pe comments really stood out for me. Keep it up

Thanks wolf, it all sounded good and quite reasonable up to a point, as an amateur I guess it's down to management in the end and their shortfalls...could it be bad decision making, or the influence of a funky cfo ?....kinda weird, even to a amateur...thanks for the review