New to the TSXV in July 2025 after an RTO transaction back in February.

Not a lot to discuss in terms of their chart being under six months old since trading, but the stock did open at $1.25 and now currently sits at $1, having their bell rung by 20% since ringing the bell on the Venture.

Even though they are relatively new, they have already created a bit of chatter within the Canadian microcap community, and multiple requests for a review came through the Wolf Den discord.

Cheelcare is a medical mobility device tech company who makes innovative products for the wheelchair industry and those who need them. I’ve attached a short video below showcasing one of their products and their investor deck which can be found on their investor relations home page.

Overall, they look like a fun new ticker to cover early in 2026. Let’s get into it. As with the majority of my new coverage, this will be a paid subscriber review with a future free release later this month.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

Cheelcare starts out with a decent current ratio of 2 although we are looking at some pretty small numbers overall with $850k in cash, $425k in receivables, $732k worth of inventory and $55k in prepaids overtop of $1.03M in short term liabilities due over their next twelve months.

Trade payables are quite small under $300k but the company does not provide an aging report. Their inventory ramp up strikes me as high given their level of revenue through six months.

Cheelcare has a relatively small amount of debt, $130k via bank loans and most interestingly a promissory note which is structured more like a convertible debenture with the holder of the loan being Namesilo Technologies. The current balance of the loan is $368k with annual interest costs of 12% and convertible at URL’s option at $0.75 per share. Given the promissory note’s expiry is early September of 2026, it appears to have been misclassified as a long term liability.

Cash Flow:

On paper, Cheelcare has burned $2.08M via operations through their first six months compared to generating $31k during the same time frame last year. This is somewhat misleading given their $1.2M in listing expenses to become a public company and all working capital adjustments have worked against them given their significant inventory ramp up. Even given those factors they still wouldn’t have delivered positive operational cash flow and given their liquidity is just on the acceptable side, investors should be monitoring closely.

There isn’t a lot happening outside of the operations section of the cash flow statement but they did pay down some debt to both banks and to shareholders YTD.

Overall their cash position from the start of the year has significantly eroded from the beginning of the year, down by more than three quarters ending October with $850k compared with nearly $3.6M to start the year.

Share Capital:

19.6M shares outstanding, dilutionary measures were significant post RTO but less relevant given their younger than six month status on the V

2.7M warrants outstanding with only 67k currently ITM. The remainder at $1.50 all expire in 2027

1.2M options, all ITM at 30 and 38 cents with the bulk at 38 and expiring in 2029. The company currently has a reasonable 10% SBC option plan

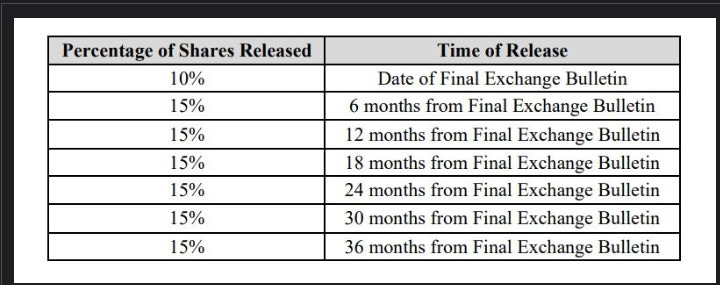

Approximately 45% insider ownership, much of which under escrow releasing in 15% increments every 6 months

Nothing occurring on the open market since they became publicly traded

Approx 500k shares converting in Sept regarding the promissory note

Income Statement:

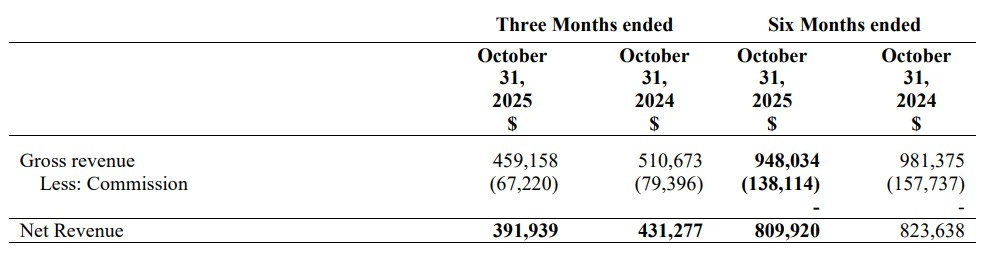

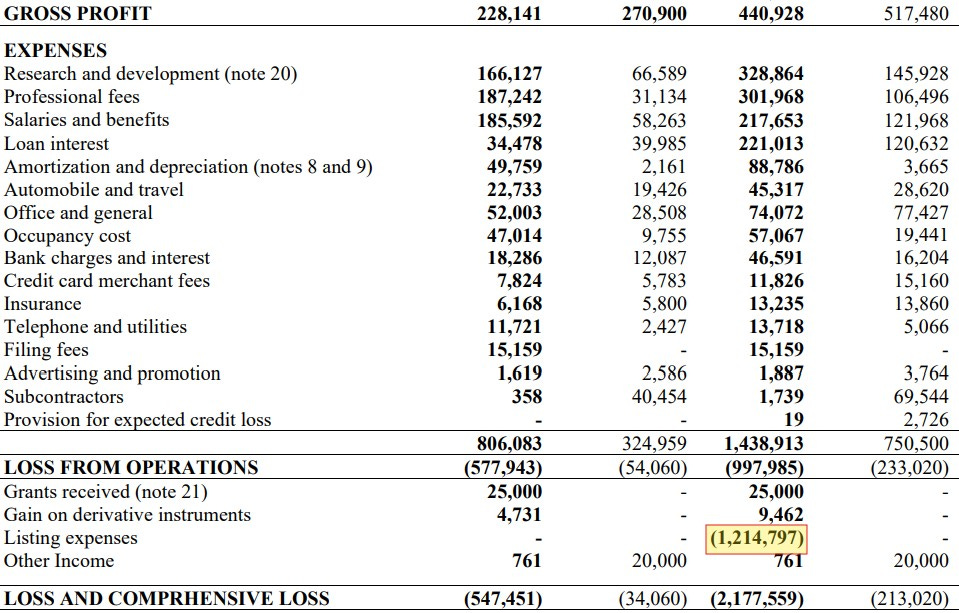

Net revenue of $391k in the quarter, down 9.3% from a year ago. The quarter also saw over 430 basis points of margin erosion from 62.6% down to 58.3%, resulting in 16% less dollars delivered to the gross profit line.

Expenses were up 150% in the quarter over last year resulting in a $577k loss from operations. After some small one time gains below that line their net losses amounted to $547k, 16x greater than the previous year of $34k.

YTD numbers tell a similar story:

Net Revenue of $810k, down 1.7%

Gross margin off by over 800 basis points to 54.4%’

Expense growth by 92%

Operational loss of $1M vs $233k

$1.2M in listing fees grew their net losses to $2.18M

Overall:

If the plan was to come out of the gate with some strong numbers to the market as a publicly traded company, they have certainly failed in that regard with revenues, margin and expenses all moving in the wrong direction.

Cheelcare distributes and sells their products through a global dealer network (500 per their latest MD&A). It appears those Dealers are compensated through a commission model which is shown above the net revenue line, and the rate is somewhere in the 15% range, likely a variable rate depending on the product.

For what it’s worth, I searched online the three closest dealers to Oakville, one in Mississauga and the two others in Hamilton. Searches on the first two for their Companion and Curio lines on both dealer websites came up empty.

I did find two wheelchairs named Companion, but they were both made by a company called Golden Technologies. Perhaps I did something wrong.

On my third Dealer search I was able to find their Companion Q model, but it did not list any pricing.

Back to the P&L, after you account for the one time listing costs in addition legal and other fees listed within their professional fees, they still fall quite short break even.

While they have some catalysts in the hopper, I can’t tell you enough how difficult it is operating within a Dealer model such as this. It relies very heavily on their internal field teams ability to “sell” the product to their Dealers so they will in turn promote it well within their own customers bases.

Given their Dealer base went from 300 from the initial SmallCap Discovery video to over 500 now, that revenue performance looks rather uninspiring out of the gate. I’ve attached the full video from June which was prior to their listing recorded in June. It’s important to note that of the founders of SDC - Trevor Treweeke sits on the board of Cheelcare and Paul is the CEO of NameSilo which holds the promissory notes described earlier.

With the company burning through three quarters of their capital they raised prior to the RTO and TSXV listing, and delivering uninspiring revenue in their first two quarters, it’s hard to see them not needing to raise capital at some point before their fiscal year end.

They listed at an approximate $25M market cap valuation and now sit at approximately $20M. That for a company with $800k in revenue at the midway point of the year, down to last year with both margins and expenses going the wrong way not long after launching as a public company.

To sum it up, I was expecting much better given some of the comments I’ve seen within the micro cap community, but I guess it would be boring if we all liked the same things. Watchlist worthy at best for me. Two stars.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.