For someone who poked fun of this sector and their investors for years, I have certainly come around as more interesting companies have begun to emerge over the past twelve months or so. Many of these more interesting players are in the microcap space, and Cannara looks like they should be included in this list.

This will be my first formal review of LOVE who has seen a nice 75% return for shareholders over the past year. They are slightly off their ATH when the company was first introduced on the Venture back in early 2021.

Will the Wolf love LOVE? Let’s find out.

Balance Sheet:

We begin where we always do, looking at their current ratio that sits at a solid 2.3. That consists of $5.06M in cash, $15.6M in receivables, a inventory including biological assets worth $45.4M, and $9.2M in other short term assets including $4.9M of assets for sale. These total over $75M and is overtop of $31M in liabilities due over the next twelve months.

While their ratio is strong, liquidity is somewhat lacking with their cash and receivables making up just 27% of their current assets. The bulk (60%) is made up of inventory, therefore their quick ratio is a less sexy 0.9.

Unfortunately the company does not provide any details surround their A/R. It would make me feel better about their liquidity if they did, but I will say if you go back to their annual filings they state none of their receivables were past due. Comforting, but more continuous disclosure is always better. While inventory values make up the bulk of their current assets, it has grown at about half the rate as their revenue increases suggesting inventory turnover and efficiencies are improving.

The $4.9M of assets for sale involve land that has actively been on the market since January 2024.

Including convertible debentures, LOVE has $48.3M worth of debt, which looks substantial on a sub $130M market cap. About $41M of that is bank debt at market reasonable rates of around 7%, with the remainder in debentures at 10.75%. Most of these debentures date back to 2021, and were recently amended for the third time. Another revision is anticipated in September to satisfy current portions of partial repayments for the original debentures. Clear as mud? The positive here is it will extend the repayments scheduled and improve near term liquidity, the downside is approximately $5M of annual finance expense and fees.

Cash Flow:

Year to date, LOVE has achieved $3.3M in operational cash flow (OCF), which is about a $100k improvement over the same time frame as last year. Even with improvements in net income, OCF in this sector are very difficult to predict and trend due to adjustments around inventory and working capital changes. Further evidence of that is $5.8M of OCF generated in Q1 followed by $2.5M of operational burn in Q2. The company’s YTD is also trending less than the $10M they generated in 2024, and they have never been free cash flow positive on an annualized basis.

Cannara has invested $2.7M in assets during the year. They paid down a modest $92k of their debt and incurred $2M of interest and other financing costs. Overall their cash position has depleted by 23% during their first two quarters.

Share Capital:

91.4M shares outstanding with 1.5% dilution from RSU’s this year and only 4% dilution going back to the end of their 2022 fiscal year end.

10:1 reverse split in early 2023

5.1M options outstanding. 1.3M ITM with 2.06M not far behind at a $1.51 exercise price. Remainder all at $1.80

625k PSU’s and 180k RSU’s.

Maintains a 10% SBC plan with recent history deemed (IMO) as fairly reasonable

50% insider ownership (per IR deck)

Multiple insiders were not shy about slapping the ask during the middle of last year at share price lows, particularly Olymbec Investments.

Olymbec is the top shareholder with nearly 20M shares. VP of Olymbec is on the company BOD and they are the holder of most of the company’s convertible debentures

Income Statement:

Ok, onto the fun stuff.

Until the feds do something about excise taxes, I only speak to net revenue in this space. Net revenues in the quarter were up 35% to $26.6M, and YTD are up an equally impressive 32%. Note these total revenues also include about $1M/month in lease revenue and other income.

YTD gross margins have improved by over 1000 basis points to 42.8%, which has driven more than a 78% improvement to last year in gross profit dollars on 32% more business.

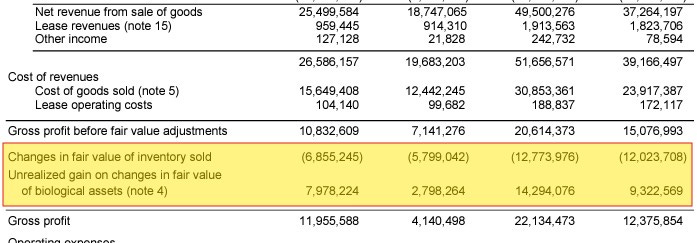

Normally this type of revenue and margin improvements would have me perk up in my chair. However due to the funky IFRS accounting rules around inventory in the space, I’m more reserved. This isn’t a Cannara Biotech issue, it’s a common one in the space that can confuse the hell out of an average retail investor, and even a self proclaimed FINS guru.

I find it a prudent approach to look at the total numbers and then also revise them on both the margin and profitability lines since they are non cash impacting. These adjustments have the ability to make profitability look better than their cash flows may suggest. That is indeed the case here as the net effect of these two accounts were positive this year, and negative last year.

The good news for Cannara is their margins have also improved before these adjustments, but those improvements were 150 basis points bringing them to 40% on a YTD basis, but nowhere near the 1000 basis point improvement with those adjustments included.

I hope everyone reading this took half of that information in, as I was the one who typed it out and I feel like I need a stiff drink.

Total operating expenses were flat in the quarter and 10% higher on a YTD basis, which is excellent conversion on 32% more revenue and 37% higher GP dollars (before adjustments). Again this is somewhat misleading as the biggest variances are much less SBC expense this year - actual cash burning expenses have risen by 20% led by a heavy marketing spend increase of 55% YTD.

Even with $2.1M in higher deferred income taxes this year, they still delivered $5.6M in net income through six months, compared to a net loss of $1.34M at this stage last year. That works out to about a $7M improvement in profitability. If you remove the unique margin adjustment lines discussed earlier however, those improvements shrink to $2.8M. Still impressive on a $50M YTD business, particularly when you factor in paying no taxes last year and $2.1M this year, but maybe not as off the chart impressive if you only looked at the top and bottom line.

Overall:

I think my view of a great performance but maybe not as great as it looks may explain the rather muted response from the market this week which was basically flat since their release this Monday.

There is a lot to like about Cannara, including the advantages of being a Quebec producer and their market share numbers in the province are very impressive. That leaves me wondering if they are poised to take advantage of upcoming improved interprovincial trade.

Two notable concerns. Their marketing expense rising at a 55% clip to generate 35% more revenues can’t continue forever. The other is debt. Their debt ratios aren’t a concern but their interest coverage as it relates to their current cash flows are. Obviously if they keep compounding high double digit revenue increases, these concerns will lessen over time. The incestuous relationship of the top shareholder being on the board, holding the majority of debentures, leasing office space from and charging additional fees for other lending arrangements is also less than ideal.

It feels like I’ve been rather verbose on this one so let’s wrap it up. It’s almost edible time.

It’s a very interesting time with seemingly very well run small players in this space like LOVE, HASH, MTLC and ROMJ to name a handful. Full disclosure I have a decent position in HASH which has been a recent butt puckering experience over the past few weeks and I named MTLC as a longshot pick of the year. One or more of these have the potential to be sizeable multibagger in the years ahead.

A definite watchlist worthy candidate and I’m interested in improving my DD. An initial three star rating.

Paid Subscriber Benefits:

FinsDontLie Scholastic Series - exclusive educational posts

First access to annual picks, upgrades and mid year picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

Paid subscriber chat.

My entries & exits. Thoughts, charts and Q&A.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

I love the detail and verbose color. Especially when the great numbers aren’t moving the market.

Thanks wolf. Appreciate the review