Lube up your box. Your inbox that is, as the hardest working man in microcaps will be hitting it on a very regular basis over the next couple of weeks during one of the three busiest reporting periods of the year. I’m coming in hot.

I’m starting my third review in the last 24 hours, all three current or former Wolf Picks. Cannara Biotech is one of three mid year picks given the Seal of Approval in 2025.

LOVE is up by 172% over the past twelve months, but it has weakened over the past couple. If you read my November What’s Wolf Watching article, you know I had some concerns about their comps coming in. And let’s face it, cannabis companies, even with decent earnings have not been treated well by the market of late.

Cannara may have bucked the trend here, rising by 7.5% after their annual earnings were released pre market on Monday. The company received a 3.75 rating back in July which seems like an eternity ago now. Can they improve on that?

(Full disclosure: I do hold shares here)

Some mixed signals on the balance sheet. The current ratio is strong at 2.4 and is made up of $14.4M in cash, $14.1M of receivables, over $51.3M in inventory (including biologics) and $2.4M in prepaids over top of $34.2M in current liabilities.

For liquidity to be considered strong (quick ratio), you want to have the following formula be true:

Cash + Receivables > Current Liabilities. The equation here is false with their quick ratio coming in at .83

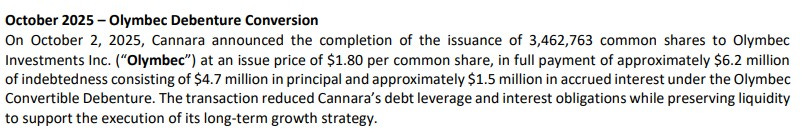

Cannara does has some debt, including convertible debentures totalling $41.2M. During their Q4, they were approved for another $10M facility slated for future capital expansion projects at their Valleyfield site.

It is also important to note that not all of that debt are cash settled liabilities. The convertible debentures ($6.2M) were settled via equity in the form of 3.5M shares post financials.

Cash Flow:

Operational cash flow topped $20M in their 2025 fiscal year, 87% greater than the $10.7M achieved in 2024. That also includes a negative $6.3M of working capital impact so their OCF is legit.

The company also paid down net debt of $3.2M, paid out another $3.1M of interest costs and utilized almost $6M investing in assets including additional cultivating space.

Overall Cannara improved their cash position by 117% during 2025. Things are headed in the right direction, particularly with settling their convertible debentures in October, but their liquidity, debt and cash flow are things to be continually monitored by investors.

Share Capital:

94.9M shares outstanding including the 3.5M shares from the debentures post financials. Overall very limited dilution over the past three years

10:1 reverse split in early 2023

5.1M options outstanding. 1.3M ITM with 2.06M not far behind at a $1.51 exercise price. Remainder all at $1.80, just a penny out of the money

625k PSU’s and 203k RSU’s

Maintains a 10% SBC plan with recent history deemed (IMO) as fairly reasonable

50% insider ownership (per IR deck)

Multiple insiders were not shy about slapping the ask during the middle of last year at share price lows, particularly Olymbec Investments. 500k more shares were purchased during the week after their Q2

Olymbec is the top shareholder with nearly 23M shares. VP of Olymbec is on the company BOD and was the holder of most of the company’s convertible debentures

Income Statement:

LOVE topped $107.3M in revenue during 2025 beating last year by 31%. Gross margin has been outstanding growing by nearly 800 basis points to 44%. The margin line before fair value inventory adjustments is always one to look at in the sector and it was strong as well at 41.4%, 750 basis points better than the 33.9% a year ago. The above translates to $17M more gross profit dollars (up 56%) than last year on $25M more net revenue.

Total operating expenses grew by 24%, but cash burning expenses grew by a lower rate of 21%. That was led by Selling, Marketing and Promotion costs rising by 47%.

21% cash burning expense growth on 31% more revenue and 56% more gross profit dollars is a Wolf Trifecta.

After $1.5M savings to last year on combined debt reduction and interest rate relief, Net Income for their 2025 year totalled $13.1M, more than double last years $6.4. That also includes $5M in income tax expense when they had $1.95M of tax recovery in 2024. A very successful year for Cannara Biotech.

I did have good reason to be concerned about their LY comps however for Q4. While revenue was 20% higher, total net income was 42% lower or $2.4M. That is all due to the tax related expense mentioned above as their Q4 net income BEFORE income taxes was 20% higher, $4.54M vs $3.8M.

Overall:

Cannara Biotech has now had TWENTY consecutive quarters with year over year growth topping 20%. In that time span they went from $2.5M of revenue in 2020, to over $107M this year. That will present some pretty tough 2026 comps so I wouldn’t be surprised to see that streak come to an end, but I don’t think that should necessarily deter shareholders either.

They are only utilizing 50% of their current capacity today and have very strong share of the Quebec market, while making some slow in-roads into the other provinces. The opportunity is there, but that exists within a very competitive environment so nothing will be handed to them.

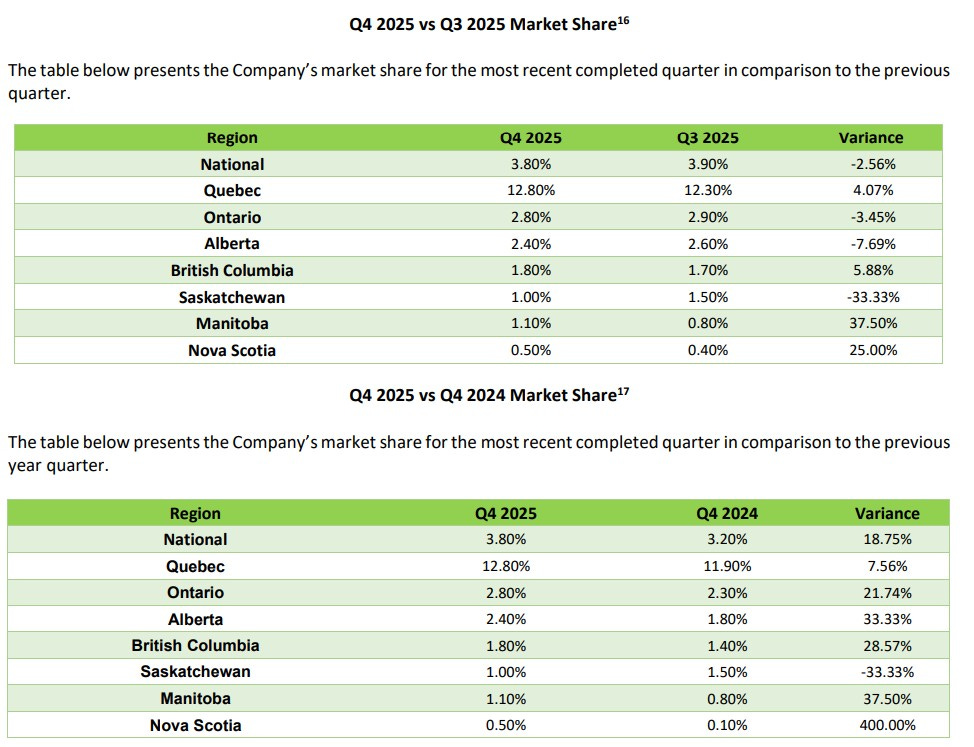

Year over year market share was strong with double digit gains across all provinces with the exception of Saskatchewan but was a little lumpier on a QoQ basis. October (below) has some very encouraging National gains which could be an indicator of a strong first quarter which investors will be able to see in January.

For a more complete deep dive breakdown of Cannara, I will attach Mathieu Martin’s recent Cannabis sector update. If I’m the hardest working guy in Microcaps recently, he’s the hardest working guy in the Canadian Cannabis space with some excellent work across a number of names. His piece also includes an interview with LOVE’s CEO.

At a $169M market cap, Cannara Biotech trades at 1.5x revenue and a 12 P/E. Not dirt cheap but certainly has upside potential if they can maintain their levels of growth, and continue to reduce debt and the corresponding finance costs. They have the catalysts to achieve all of that.

Maintaining the 3.75 stars and my current position.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

TWENTY consecutive quarters? Damn that's impressive!

Thanks for the shoutout. Excellent overview of the opportunity!