Cannara Biotech was one of three mid year Seal of Approval picks in 2025. Of the three Cannara has been the least exciting, delivering only a 8% return since the end of July when I upgraded them to 3.75 stars.

Over the past year they are up a more impressive 77%.

LOVE dropped their first quarter of fiscal 2026 yesterday morning before open. In my What’s Wolf Watching article nine days ago I said we could very well see the stock breach $2 for the first time ever. That did occur in the first hour of yesterday’s trading but it did not last with the share price only closing up a penny to end the session at $1.93.

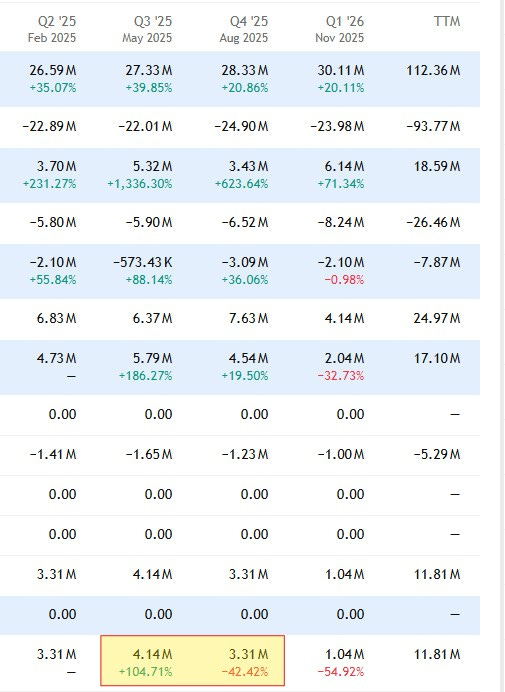

The news release highlights looked quite good, achieving yet another 20% YOY revenue increase and you would have to go back to the end of 2020 to find the last quarter where that metric was not achieved. But the devil is always in the details and it didn’t take very long to notice a pretty large miss on the bottom line as net income came in 55% lower than Q1 of 2025.

My only other current holding in this space is Rubicon Organics. After their latest quarter I halved my position in ROMJ, and frequent readers know my story with Simply Solventless. Will these results have a similar impact on my portfolio weighting and am I starting to re-think this sector all together?

As I write this, I’m not sure myself so let’s get into the review.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

LOVE’s current ratio is in good shape, coming in at 2.7 and consisting of $16.5M in cash, $15.2M of receivables, a significant $52M worth of inventory (including biologics) and $1.3M in prepaids over top of $31.5M in current liabilities. Their quick ratio has also improved from where I had some slight concerns in my last review.

Cannara has $27.6M of debt within a term loan and another $6.8M drawn on their revolving facilities. Both are with BMO and come at preferred lending rates.

Cash Flow:

Operational cash flow in the quarter was very solid coming in just shy of $8M, 36% more than the $5.8M achieved in Q1 of last year.

Even after the company utilized $4.3M in capex mainly on the expansion of their Valleyfield facility, paying down their debt by $.5M and a similar amount in interest payments they were still able to increase their cash position by 15% in the quarter.

Share Capital:

94.9M shares outstanding, 5% dilution over the past year mainly due to the redemption of $6.2M worth of convertible debentures at $1.80 in the quarter.

8.7M options outstanding, all ITM with the vast majority expiring in Dec 2029 or later

Approx 1M of RSU and PSU’s

52% insider ownership (per IR deck) & no insider activity on the open market since last May

Income Statement:

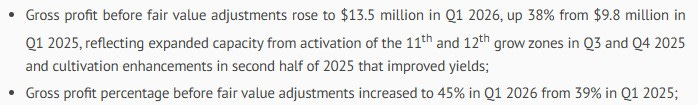

Revenue in Q1 increased by 20%, for the first time exceeding $30M in revenue coming in at $30.1M against $25.1M last year. Gross margin slipped however by 340 basis points to 37.2% vs 40.6%, so on 20% more revenue, only took half of that rate (10.1%) to the gross profit line.

Total expenses rose by 43%, significantly higher than both their rate of revenue and gross profit. The biggest increases came within non cash items, particularly share based compensation of $1.72M vs $321k last year. Actual cash burning expenses rose by 22%.

The lower margin rate and higher SBC costs resulted in 36% lower operating income and 55% less net income.

Overall:

I think you have the rationale for the stocks pop at the open yesterday only to fall back later in the day as investors had a chance to digest the total results.

Back to the top of the review on whether or not I’m re-considering not only my position on Cannara itself but the sector in it’s entirety. Those questions are certainly leaning towards a firm yes.

Let’s just look at Cannara first.

Overall their metrics look fantastic with 20% or more growth achieved in 21 consecutive quarters. Regardless of the sector those are incredible numbers, and they have been profitable for the last four years on top of that while driving impressive operational cash flow. I had originally planned to cover many of their slides from their investor deck after listening to their conference call yesterday. Instead to save time, I’ll link the entire presentation below.

This latest SBC charge is a little bit of a yellow flag for me and it looks like it might be just the tip of the iceberg with more to come.

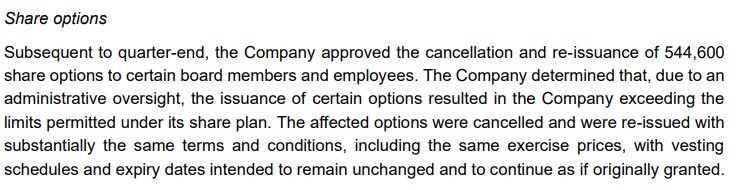

Firstly, I had a difficult time reconciling this quarters SBC hit, as options or RSU/PSU’s granted or vested in the quarter, nor to any of the SEDI filings within the September to November time frames line up. Perhaps it’s partially to do with this gaffe the company had:

Post financials, there were a heavy number of stock award that vested which indicates their next quarter could see the same bottom line impacts from share based compensation.

While the above was explained in their financials, the $550k in shares awarded for services rendered were not.

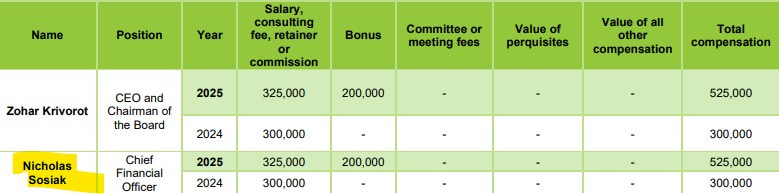

Perhaps that explanation will come but I wonder how they will justify it after that CFO received a raise in 2025 along with a $200k bonus.

In addition to the above, in two days Cannara will have their annual meeting and one piece on the agenda is to revise their Share Based Compensation program, increasing it from a 10% plan to 15%. With insider ownership of 52% and the average retail investor likely oblivious to this occurring, I think you know which way the vote will end up.

So despite the 20+ consecutive quarters of 20% growth, great cash flow numbers, and the significant investments in growth to double their capacity by 2030, the above is indeed questioning whether my investment dollars have better options.

The SBC issue aside, the other item which had a negative impact on their net income was their gross margin. This didn’t occur from traditional margin metrics of your revenue less COGS - those numbers were actually excellent.

Those fair value adjustments were $1.5M lower YoY which had a 500 basis point impact not only on the gross profit line but all the way down the P&L.

I’m certainly not suggesting I have discovered something new here that nobody else has, as this has been discussed for years with how to best determine valuations on cannabis stocks. It’s definitely not net income like most other sectors, but instead your preference of cash flow or adjusted EBITDA. Given the SBC components I would personally add that back if you opted for the latter.

Currently they are trading at about 10x cash flow which seems pretty reasonable.

If you are looking in this sector than it’s hard to find many with better overall metrics and growth/expansion upside, but given their next two quarters of comps on the profitability side, I’m not feeling great about their near term upside. My negative near term sentiment only escalates from the SBC in this quarter, the RSU’s already vested recently in Q2 and the new plan which appears surely to be adopted in the next few days.

A slight downgrade here to 3.5 stars. An hour into the trading day on Tuesday, I’m halfway out of my position with the rest on the ask. Wolf may be back to just being a consumer.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.