Some interesting cannabis stocks in the microcap space have risen to the forefront over the past year or so and Cannara Biotech is certainly more than worthy to be included within that list.

My initial review of LOVE was in early May, giving them and encouraging and watchlist worthy three stars. You can read that review below:

Coming out of their Q2, Cannara didn’t get a lot of “LOVE” with the stock sliding by 23% over the next six weeks, but after hitting a low of $1.08 back on June 11, the stock is up 66% since. Q3 financials were released yesterday morning and at first glance I thought they would have had a fantastic day, but they only finished just better than flat, up a paltry .56%. Were these numbers already priced in?

Balance Sheet:

Cannara has a solid current ratio coming in above 2.4 that consists of $14.4M in cash, $14.1M of A/R, $49M worth of inventory and biological assets, $5M in assets up for sale and $1.6M in prepaids against $34.6M in current liabilities. With inventory including biological assets making up 58% of their current assets, liquidity isn’t their strong suit with cash and receivables not quite covering their twelve month liability commitments.

Cannara also has $47M worth of debt including $6.8M in three short term credit facilities, a $34M mortgage on their Quebec facilities and $6M in convertible debentures. They also owe $10.7M in various taxes.

Post financials, the company announced reducing the convertible debentures by $1M and secured a 50 basis point reduction in their credit facilities, reducing their total interest on their debt burden to under 6%, which is a pretty good place to be comparably in this sector.

The company also expects to close the $5M in asset sale within the next month.

Cash Flow:

Through three quarters, Cannara has delivered $17.2M worth of operational cash flow (OCF), compared to $7.5M at this stage last year for a 129% improvement year over year. This includes $13.9M in Q3 alone although this was assisted greatly by working capital adjustments so I would not try to trend this Q3 result, but the YTD numbers are quite solid and nearly $2M per month in OCF.

The company utilized that OCF on $4.7M worth of financing activities, about half towards debt reduction and the other half on interest costs, and spent another $4.7M on asset purchases including activating additional cultivating space. Overall, Cannara finished Q3 with $14.4M in cash, 118% more than they started their 2025 fiscal year with.

Share Capital:

91.4M shares outstanding with 1.5% dilution from RSU’s this year and only 4% dilution going back to the end of their 2022 fiscal year end.

10:1 reverse split in early 2023

5.1M options outstanding. 1.3M ITM with 2.06M not far behind at a $1.51 exercise price. Remainder all at $1.80, just a penny out of the money

625k PSU’s and 203k RSU’s

Maintains a 10% SBC plan with recent history deemed (IMO) as fairly reasonable

50% insider ownership (per IR deck)

Multiple insiders were not shy about slapping the ask during the middle of last year at share price lows, particularly Olymbec Investments. 500k more shares were purchased during the week after their Q2

Olymbec is the top shareholder with nearly 20M shares. VP of Olymbec is on the company BOD and they are the holder of most of the company’s convertible debentures

Income Statement:

A heck of a quarter on the top line for Cannara with $27.3M in revenue, 40% better than the comparable quarter from last year. Their core business was up by 44% with a decrease in lease revenues. That is also their 19th consecutive quarter of delivering a 22% or higher YoY revenue increase, with most coming in substantially higher than that. Gross profit results are even more impressive coming in at 49% which is over 1000 basis points better than the 38.2% (utilizing revenue from sale of goods only). Therefore on 40% more revenue, LOVE delivered 85% more gross profit dollars.

YTD numbers tell a similar story - now up to $79M in revenue, up 36% from a year ago while earning 81% more gross profit dollars with sale of goods rate of 46.2% vs 34.8%.

The company has also converted extremely well on their expenses which are up 26.9% YTD compared to last year through nine months. Where the company has invested more resources is in their Selling, Marketing and Promotions bucket which rose by 57%. That additional $2.6M in spend has delivered over $20M in revenues and $15.7M in gross profit dollars. Their next largest expense bucket, G&A expenses have only risen by 6% YTD which shows very impressive efficiencies and productivity to generate the top line and margin that they have.

The revenue, margin and expense conversion performance, awards them the rare Wolf Trifecta:

That all obviously converts very well to the bottom line and includes $1M in savings in interest costs over last year. Cannara Biotech delivered $4.14M in net income in the quarter, more than doubling last year and have now achieved $9.8M of net income YTD, over 14x more than last year. That is even more impressive considering this is after the company had $3.8M income tax expense compared to $0 in 2024.

Overall:

So, yes the fact that the stock only rose by a penny after these numbers is a bit of a surprise given everything I’ve said above.

So what may the future hold?

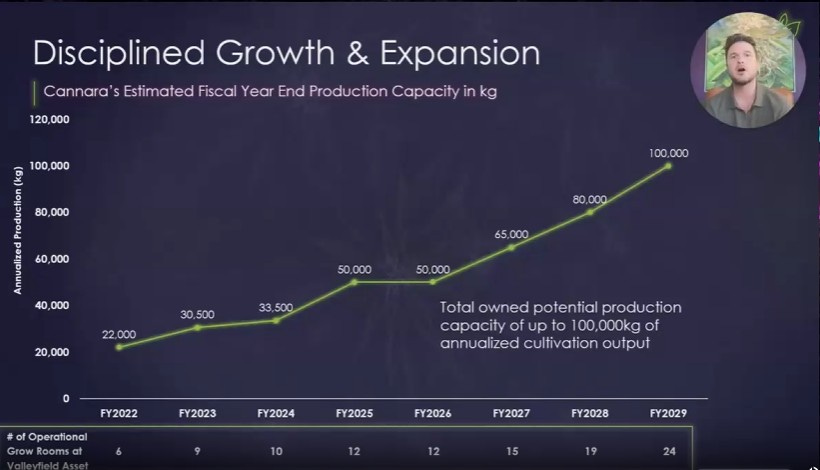

Well, in terms of production metrics, shortly the company will have 50% more production capacity than they did just eighteen months ago and expect that to double by 2029 all through the addition of grow rooms at their Valleyfield, QC facility.

That Valleyfield facility of course was acquired back in 2021 for $27M, which is nearly just a tenth of the build cost.

The company is also launching 11 new products in Q4 of this year with additional vape cartridge sku’s in 2026 in the province of Quebec (new category in QC) where the company is already the market leader by a substantial margin.

Cannara also has a couple of things in my view that sets them apart from others in the sector. While other in the sector have significant insider ownership, much of their competitors have done that through the benefit of high dilutionary measures and egregious share based compensation plans, and other greasy looking related party type transactions benefitting only insiders and not retail shareholders. That doesn’t appear to be the case with Cannara who have had very little dilutionary measures over the past few years. In terms of management, I have listened to them a lot more recently and while youthful, have an apparent maturity beyond their years (fuck that makes me sound old).

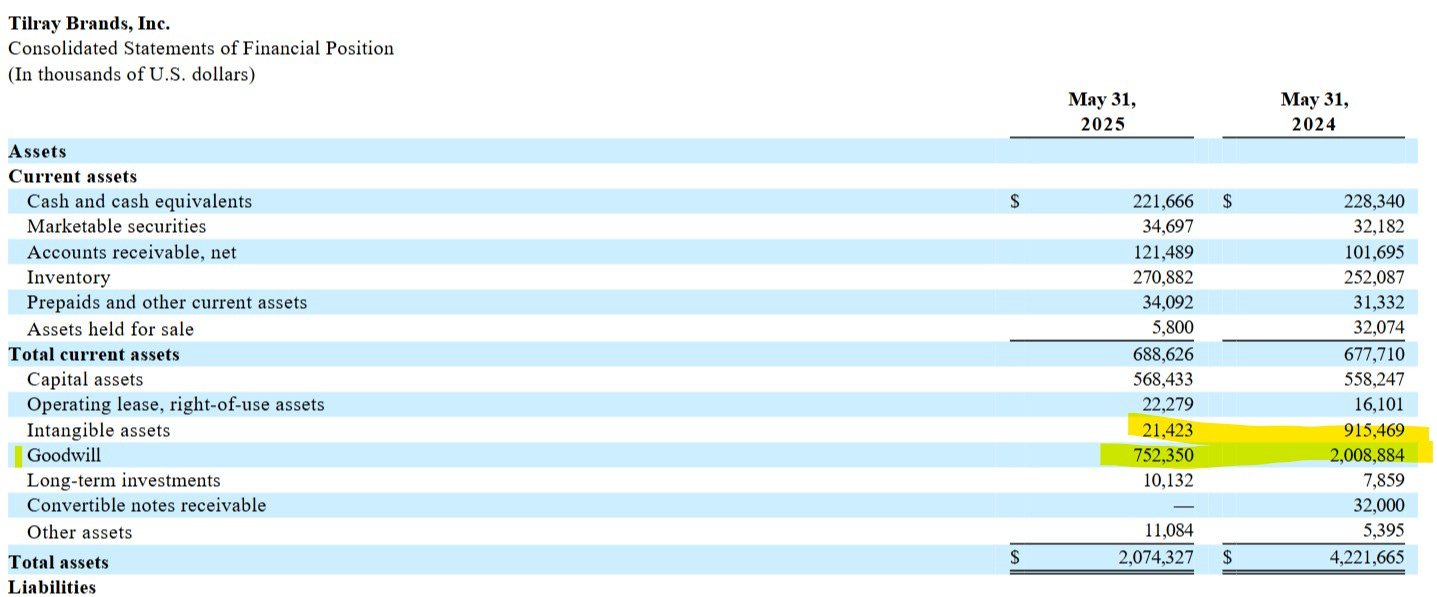

Another apparent differentiator within this space is the quality of their assets. They’re real actual TANGIBLE assets. They do not have a bullshit book value due to previously overpaid, shitty acquisitions which generated inflated goodwill and intangible asset values. I’m looking directly at you Tilray who wrote down another $2.2B (yes with a B) in 2024 who also reported yesterday. Imagine if you invested in Tilray’s based on their price to book value in May of 2024?

In terms of current valuation, LOVE trades at a 10.5 P/E and has shown the ability to drive consistent growth (19 consecutive quarters of significant double digit growth). They have a solid balance sheet, albeit slightly illiquid but their recent ability to drive cash flow offsets that. The debt level is a factor, but it is also at some of the best market rates in the sector, and it isn’t doesn’t come with mob like VIG’s like you’ll see in the rest of this occasional slimy space.

The one danger is they are up against a very strong Q4 and investors will not see those results until the end of November with the added time allowed for filing on the Venture. While they did $4.2M in net income in their most recent quarter, they are up against $5.75 next time around.

That’s one of the only mildly cautiously negative things I can say about the company. Big upgrade to 3.75 stars and awarding just my third Wolf Seal of Approval pick for 2025. This one may take a little while to see the more immediate payback as my two previous SOA picks, McCoy Global (up 65%) and D-Box Technologies (up 107%).

No position. Yet.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Proffesionell like always...nice job wolf

Thanks for the review, Wolf!