California Nanotechnologies ($CNO.V) FINS Review

2025 Annual Filings (3 / 5 stars) *Downgraded*

Throughout the past year or so of covering California Nanotech, the reviews have bounced around between 3.25 and 3.75 stars with their most recent Q3 rated right in the middle at three and a half.

In their last quarter they took a large one time non cash hit to their P&L that I suggested investors shouldn’t punish them for.

Punish them they did however, with the stock slowly tumbling by as much as 46% over the next three and a half months, which was 75% less than their highs from last fall.

With the stock near that 48 cent support area, an area that hadn’t been seen in nearly a year, I talked about a potential buy zone opportunity in my latest “WWW - What’s Wolf Watching” article last week.

That panned out, at least temporarily with the stock jumping as much as 35%. It didn’t go unnoticed that the volume picked up in the hours after my article dropped which also prevented me from capitalizing as much as I wanted to personally.

After a brief review of the overall numbers, I’m not sure that they met the expectations that I had leading into their final quarter, and with the stock pulling back by 9% on Friday it seems investors were not fond of the details either.

Let’s get into it.

Balance Sheet:

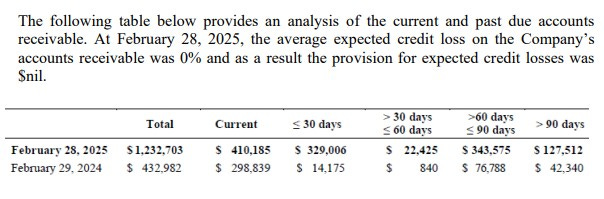

With their warrant liabilities removed their current ratio sits at 1.4 which slipped from 1.8 from their Q3. It consists of just $533k in cash, $1.23M in receivables and some minimal prepaid expenses overtop of $1.3M in liabilities due over the next twelve months.

The company’s receivables border on unacceptable with two thirds of the balance as past due and nearly 40% of them older than 60 days. While they do not anticipate taking any credit losses, managing your receivables this way is just bad for cash flow and increases risk for a company of this any size, but particularly for a microcap.

The company extinguished nearly $1M of debt that they had to begin the year and are now debt free.

Cash Flow:

Despite the concerns with their A/R, the company still produced over $2.9M of operational cash flow during their fiscal year, nearly 30x more than the $104k they produced last year. They utilized all and more of that however spending over $2.1M on new equipment and paying off their previously mentioned debt which was owed to Omni Lite. In total the company finished the year with 37% less than they began the year with.

With them producing positive operational cash flow the decline in cash isn’t a huge concern but just over a half milly isn’t a huge sum so the importance of collecting their receivables on time is that much more important given their growing payables and it does make one wonder if they have been holding back paying invoices of their own.

Share Capital:

44.2M shares outstanding with 6% dilution during their recent fiscal year all from options and warrants exercised.

1.87M warrants at 25 cents expiring in October which one would expect to be fully exercised

5.1M options outstanding including 1.3M granted during the year under their new, retail unfriendly 20% SBC plan.

About 1/3 of outstanding shares are owned by non-retail holders. The largest shareholder is still Omni Lite Industries, 13% made up of insiders and 3.6% by Quisnam Capital - a company run by the same CEO (Roger Dent) who also sits on CNO’s and OML’s BOD’s.

One insider purchase this calendar year by the CEO for 50k shares, but Omni Lite has been reducing their position for sometime

Income Statement:

For their fiscal year, California Nano delivered $6.22M of revenue, 87% more than the year prior while also improving gross profit by 380 basis points to a very impressive 73.7%. Unfortunately they didn’t convert much within their operational spending with total expenses growing by 89%. With depreciation and SBC removed, cash burning expenses were slightly better rising by 77%.

Operations income therefore rose by 118% to $1.38M. Unfortunately after the non cash loss of warrants of $1.25M and a $168k bogey to last year on income tax expense they experienced a net loss of $158k compared to a net profit of $381k a year ago.

The quarter itself you would have to call disappointing. While revenues were up by 24%, that is the lowest rate of increase of their last eight quarters. Margin, while still overly strong at 69.4% was their lowest rate of the year but the biggest concern of all was operational spending of $1.2M, which was greater than their revenue of $1.15M, including 70% of their annual SBC expenses. That resulted in a loss from operations of $406k and a net income loss of over $300k which would have been worse were it not for a reversal of some of their warrant liabilities.

Overall:

They ended the back half with quite the whimper compared to the front half of the year.

While the overall normalized net income looks better than their actual due to the non cash loss on warrants, it’s still only around $1M annualized for a company with a market cap of $28M and coming off of a very disappointing quarter, and now facing their two best quarters when they report again. When I add in the recently increased 20% SBC expense, lack of conversion on cash burning expenses, lack of momentum or news flow, I’m fading them and downgrading them to my lowest review of the company yet - 3 stars.

Thanks for the 20% plus flip during the last week though, but I’m out like a trout.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Wolf I love how many graphs and charts you use. So your providing your view but the facts are their as well. Keep up the great job much appreciated

Thanks for the review, Wolf. Was hoping for a more positive outlook for the company, but appreciate the honesty.