I haven’t formally reviewed CNO since January of this year when they reported their Q3 of 2025. The stock has certainly been “through some things” over the past year. After a 5x move in the summer of last year which nearly brought the stock to the $2 mark, all of those gains have been wiped out.

After a nice run up leading into these financials, they once again gave back those gains with what apparently seems like disappointing financials. After only going through the highlights it would be difficult for me to do anything but concur. But let’s take a deep dive to make sure.

Paid Subscriber Benefits:

First access to annual picks, upgrades and mid year “Seal of Approval” picks.

Monthly “What’s Wolf Watching” preview of upcoming earnings and potential market moves.

FinsDontLie Scholastic Series - exclusive educational posts

Access to The Wolf Den Discord community (daily insights, charts, chat & Q&A)

Balance Sheet:

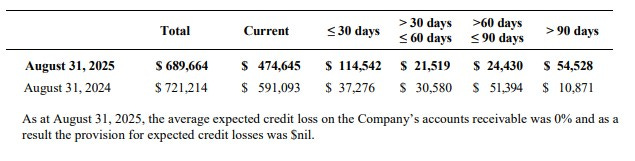

A once strong current ratio on previous reviews of well over two has now shrunk down to a much more suspect looking 1.2 that consists of just $240k in cash, $690k of receivables and $68k in other short term assets totaling just under $1M. Those current assets are overtop of $834k in liability commitments due over the next twelve months.

CalNano remains debt free with just $1.2M in longer term commitments on leases.

Their aging reports are ok but not as solid as they looked last year and with less than a quarter milly in cash they can’t afford for any more receivables to slide past current.

Cash Flow:

With the thin cash position already mentioned, seeing that they burned $220k via operations is not a welcome sight. That is over a $800k turnaround from last year when they generated $615k at this point.

YTD they have seen $200k of inflow from warrants and options exercised and also spent $50k on assets.

Overall their cash position has been depleted by over 55%.

Share Capital:

45.6M shares outstanding with 3% dilutionary measures through their first two quarters from options and warrant conversions

930k warrants outstanding, well ITM at 25 cents and expiring at the end of this month. It would be a surprise if all were not exercised which would bring a much needed $232k to the treasury

4.32 options outstanding with approximately 3M ITM. Oddly enough, 140k at 8 cents expired unexercised YTD.

29% closely held shares. 14% ownership by Omni-Lite Industries ($OML.V) with the balance held by insiders.

With the exception of OML who was on a selling spree of shares for sometime, insiders have been active in the open market with one director most recently splurging for nearly 1.6M shares or about 3.5% of the float

I like to delve into share based compensation plans and this one I find intriguing, and to be honest, it is quite the turnoff.

Last year the stock made a move from the end of June where it was trading around 37 cents all the way up to $1.95 on October 4th. They were producing great results and getting a lot of attention on FinTwit (including myself). In the midst of that share price rise the company amended their SBC plan from a 10% to a 20% one, virtually doubling the amount of stock options available under the plan.

The date of the shareholders meeting was actually October 24th of last year, not in August as incorrectly stated in these financials, and after approval the company had up to 9.03M options to award.

Turn the calendar one year later and CNO is back at it with an amended stock option plan for up for a vote at this years annual meeting (which actually takes place tomorrow). Under the amendment they would reset the number of options available back to 20% of the current level of outstanding shares. This is necessary under a “fixed” plan as opposed to a “rolling” SBC plan.

It’s important to note that as of the date of their information circular (September 18), the company had 4.32M options remaining to be awarded under the plan from last October, meaning that they already awarded 4.7M or more than half of the available options to them since the last shareholders meeting. Those 4.7M options represents 11% of what the outstanding float was at the end of their Q1 last year.

The amendment to the plan would reset the number of available options to 9.6M. Since September 18 when the information circular was issued, they awarded an additional 1.36M.

The majority of the options are going to Eric Eyerman and Chris Melnyk who coincidentally received salary raises of 27% and 95% respectively in 2025 vs 2024. All of that in exchange for this stock performance:

Unfortunately, most retail investors are idiots and don’t read information circulars, never mind vote at annual meetings. I would venture a guess that most retail shareholders are unaware of these last few paragraphs of ramblings.

Income Statement:

For the second straight quarter, CNO’s revenue dropped in half with $780k in revenue compared to $1.52M in Q2 of last year. That brings their YTD total to $1.5M vs $3.27M at the midway point of the year, a decrease of 54%.

If you think it couldn’t get worse, check that thought. Gross margin was off last year by 1400 basis points, dropping from 73.5% to 59.5% on a YTD basis. The second quarter was off by more than 2000 basis points. Gross profit dollars were down overall by 63%.

You must be thinking expenses had to have come in better than a year ago, right?

Total expenses have in fact grown by 36% YTD and 25% in Q2. Every single expense bucket is higher than last year on a YTD basis including office costs by 65%, professional fees by 133%, supplies by 22%, travel and entertainment by 46% and SBC costs by 99%,

When you get to income from operations its a YTD loss of $774k vs income of $1.18M last year.

Overall:

This is far from the same company we looked at over a year ago which received a rating of 3.5 stars.

The biggest reason for the drop was of course the loss of a major customer in their green steel customer manufacturing segment. That alone was worth over $1.1M last year at this stage. On the plus side their other segment was double last year but it’s peanuts compared to the revenues lost.

The company’s largest news item of late is a $1M agreement to provide high grade military brakes to a customer they have had a relationship with since 2019. The problem when I read that is not only is that just an LOI, but it’s a non binding LOI at that. Sorry, but an agreement to possible agree on a final agreement isn’t anything that I’m going to get excited over.

The loss of that large customer and segment isn’t new news, so it is very concerning to see the lack of expense controls when the company knew the level of revenue and margins were going to be significantly impaired. When you tack that on to the dreadful cash position they have, this is about as ugly as it gets. They appear to be heavily reliant now on options and warrant conversions in order to keep operations going and to avoid a raise.

Coincidentally, I write this the day after the company presented at the Planet Microcap showcase. I will be the first to admit that being physically present at these meetings outweighs listening online. Click the link to hear for yourself, but their presentation didn’t do anything for me.

The stock rose by nearly 9% yesterday to 43.5 cents which made me think it received a boost throughout the day from their 9 am presentation. Well it turns out almost all of that volume came in the last half hour of trading.

As of this morning there are no bids over 39.5.

Downgrading all the way down to 2 stars, which actually feels somewhat generous as they are starting to make even Pyrogenesis look attractive. 150+ EV/EBITDA and a $21M market cap for these results? GTFOH.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from companies I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

This does appear to be a dog.

Excellent Wolf typing like it is. I think at times management doesn't understand that many investors do understand numbers and when numbers don't add up or subtract to much for useless things it effects confidence in the management. Keep up the good work appreciate it.