I did not review CNO's annuals which came out last month, with my last review of them nearly six months ago now when they released their Q3. It was a pretty encouraging review (upgraded from my previous one) receiving 3.5 stars and the stock has basically doubled from the 24 cents it was back then. The stock is also up about 20% from their annuals released just a couple of weeks ago and the company is getting these Q1 results out pretty quick and well before their deadline which is usually an encouraging sign. Let's see how they have progressed since the last time we took a peek.

Balance Sheet:

A pretty good current ratio of 1.4 but no where near the 5.0 ratio they sat at six months ago. They currently have $484k in cash, just shy of $1M in accounts receivables and a whopping $1.4M of prepaids against $2.07M worth of short term liabilities due within the next year.

You'd have to call this a little messy to be frank for a company who has performed so well on the P&L side. Their cash position is less than half of what is what six months ago, with receivables up substantially and prepaid expenses have exploded by over $1.3M which is a very odd number considering they have only done about $3M in volume over that time period. With their substantial growth you would also anticipate their A/R to grow as well, but a couple of minor concerns arise when looking at their aging report. Overdue accounts have gone from 25% a year ago to 41% today and their two largest accounts represent 69% of the total which would be near $700k. So their ability to pay their own bills hinges strongly on being able to get paid from these two accounts as their current cash position does not offset their commitments over the next year. Major concerns? Not yet, but certainly worth monitoring and I'd love to know more about these prepaids which I may inquire directly about.

They have about $1M in debt with $729k due within a year to Omni-Lite, a related company who is also the top shareholder.

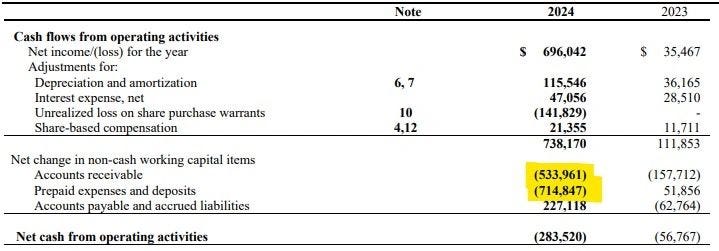

Cash Flow:

My concerns above translate down to the cash flow statement, with CNO burning $283k operationally within their first quarter compared to a burn of only $56k in the comparable quarter. Prior to working capital adjustments they were nearly 7x better than they were at the same time last year, but the concerns raised around A/R and prepaids had a negative $1.2M impact to their OCF. This could easily reverse once these prepaid expenses are allocated to the P&L and with a good collections quarter, but again slightly concerning given three of their last five quarters have experienced negative operational cash flow.

There was minor activity throughout the rest of their cash flow statement but overall their cash position depleted by 42% during the quarter.

Share Capital:

42.1M shares outstanding, slightly higher than at their year end due to 252k warrants being exercised

3.6M warrants all well ITM at .25, expiring in October '25 and will bring in $900k to the treasury before then.

4.2M options, all ITM so with the warrants, fully diluted float very close to 50M outstanding shares.

41% insider ownership, but there has been no insider activity in the open market in some time

Income Statement:

This is where CNO has really shined during my last couple of reviews and this quarter looks even better. Revenue was up by 243% to $1.75M compared to $509k in Q1 of last year. Gross profit was equally impressive improving by over 1100 basis points to 65.7% so their gross profit dollars were 4x better than they were in the comparable quarter. Expenses grew by 168%, much lower than their revenue increase so they converted here also and that translates to $590k in Income from Operations, which is over NINE times better than Q1 of last year and with one time gains due to warrant valuations, their income before taxes was 19 times better. It's very hard to imagine a P&L that would look better than this one on a year over year basis.

Overall:

The P&L is five star worthy, but unfortunately that is only one of four statements one needs to consider along with your valuation of the share price, and the company will have to show me they can manage their cash flow and balance sheet better than they have to prove to me they are four star or higher material. It's also worth noting that their Q4 from last year was mediocre at best barely breaking even on $1M of revenue.

From a valuation standpoint, they are trading at 3.6x TTM revenue and 11.2 EV/EBITDA. If you extrapolate just this quarter its 2.85x revenue and 5.7x EV/EBITDA - which would be an absolute steal at 47 cents/share. I do think that an expectation of producing 50% EBITDA for the entire year is a little unrealistic given their Q4 results so I think somewhere in the middle of those EV/EBITDA is more reasonable. Therefore with continued revenue growth there could still be a lot of value left here - how much depends on how they can grow that top line. It's not without it's warts as I mentioned, but it's certainly worthy of a second consecutive upgrade and a big chance for another in three months time if they can improve their balance sheet and cash flow.

Have a request to review a stock you are interested in?

Paid subscribers have priority access to request financial reviews of stocks they have interest in. Request via subscriber chat, DM or email at thewolf@wolfofoakville.com

Chat with me and 3000+ other members daily in the TSA Discord.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.