Sometimes you need to be prepared to zig when the market zags. I don’t often show or discuss hourly charts but it’s the best way to outline what has happened to the share price between their Q2 and Q3, which they reported earlier this week.

Their last quarter saw a 29% revenue increase and doubling of their earnings year over year. I ended up using that positive news as exit liquidity and in under two months, the stock had lost about 23% of it’s value.

What would have made that story even better is if I also bought back in at those lows about a month ago as the stock has almost clawed all the way back.

Biorem had some very tough comps coming into this quarter to try and repeat from last year, so that rebound over the last month caught me off guard indeed. Bumpy journey’s are what investors have experienced with BRM over the last couple of years going through their discovery phase in 2024 where they went 3.5x - now down about a third since then.

You know the results are not going to be great when their earnings headlines start with backlog.

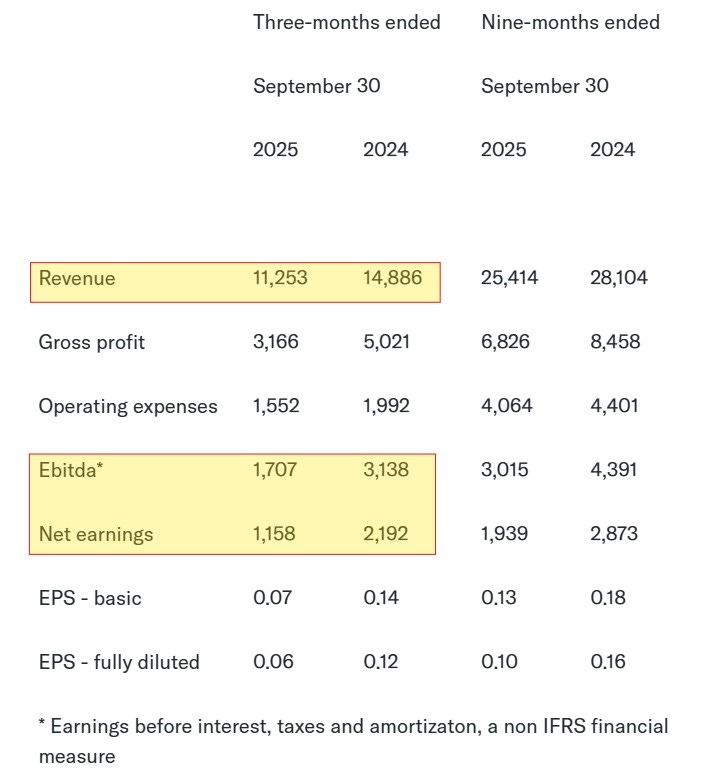

You didn’t have to scroll very far to see why backlog was the lede with significant misses to last year on both the top and bottom.

That was my rationale for exiting on the positive news last quarter as outlined in my August review.

My expectations (or hope) was that the hard times the share price had about a month ago would have continued through these earnings. But now that the stock is much higher than that, how much interest do I still have? Let’s find out as I’m not sure myself at this point.

Balance Sheet:

Biorem has a stellar looking balance sheet overall with a 4.1 current ratio with unearned revenue removed (it looks pretty good without as well). They ended Q3 with $8.35M in cash, $9.2M of receivables, $2.1M worth of inventory and $5.3M of other short term assets overtop of just $6M in liability commitments over their next twelve months.

Receivables are down to last year, unsurprisingly since their YTD revenues are as well. Unfortunately Biorem only discloses A/R aging within their annual filings, and it wasn’t without concerns then. In fact the company disclosures overall are extremely light as they choose to produce quite simple quarterly financials in general. I’m always a proponent for more information, but we carry on.

Biorem has $2M of debt at an attractive 4.07% interest rate expiring in 2028.

With just their cash position easily covering their short term liability commitments, liquidity is quite good and can happily move on without concern despite their limited detailed disclosures.

Cash Flow:

Strong operational cash flow through three quarters of $4.26M, but similar to their YTD revenue declines, is off last year by 21%.

During the year they have purchased $340k worth of assets, bought back $100k worth of stock and made debt repayments of $425k.

Overall they have improved their cash position by 60% thus far in 2025, which is relatively encouraging considering their revenue miss.

Share Capital:

6M shares outstanding in a historically well managed float - 1.2% dilution over the past year

An unheard of very retail friendly 5% SBC plan

3.3M options were outstanding. They don’t provide an updated table in these financials with their previously mentioned weak disclosures and I’m not interested enough to go find it

Not a lot of skin in the game from insiders at 2% ownership

Minor insider buying in the the last couple of years (much less than I did)

Announced an NCIB in June. Bought back a limited number of shares over a few week period since. Not much of a commitment here - more like a game of just the tip to see how it feels.

Income Statement:

As we already know, the top line came in pretty rough compared to their record quarter of last year with $11.25M in revenue, down over 24%. Perhaps more concerning is they also took it in teeth in gross margin falling by over 550 basis points to 28.1%, down from 33.7%, resulting in 37% less gross profit dollars than last year.

If there is a positive in Q3 is that they were able to avoid a complete disaster by saving 22% in operating expenses including spending 43% less within their G&A expenses.

That wasn’t enough however to spare them from a 47% decline in net income, $1.16M vs $2.19M.

Through two quarters, Biorem had a 7% increase in revenues and 15% more net income. At the three quarter pole they have seen revenues erode by 10%, gross margin deplete by 20% and net income plummet by over 32%.

Overall:

While expectations were not high coming into Q3, that last paragraph really puts things into perspective on how bad of a quarter this really was.

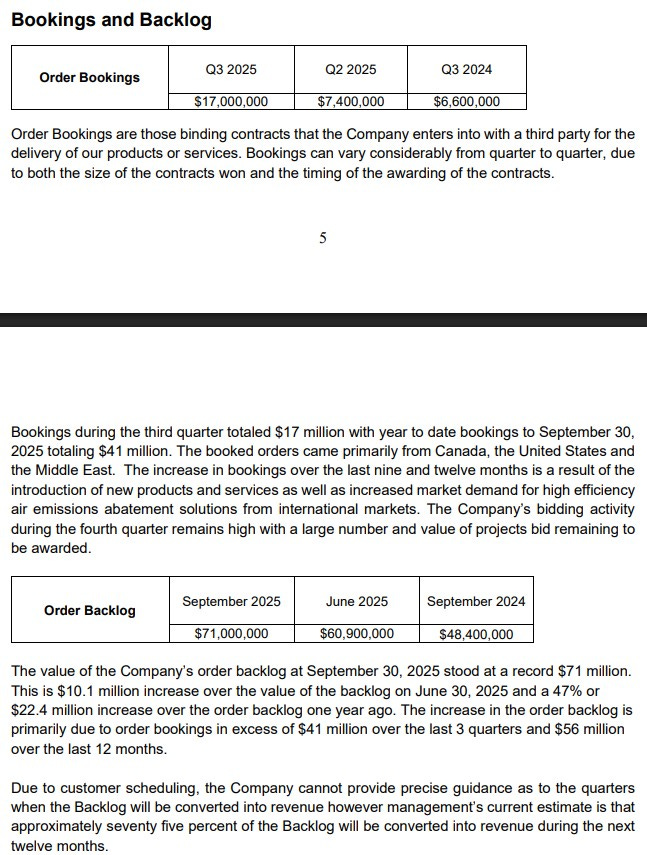

What gives bulls encouragement, and rightly so is their Q3 bookings of $17M and a record backlog of $71M.

The last portion of that snip from their Q3 MD&A caught my eye and if you take 75% or their $71M backlog, that equates to over $53M in approximate revenue they expect over the next four quarters. That is 53% more revenue than the $34.7M the company has done on a TTM basis, and 42% better than their best year.

Even though on the surface BRM looks like they shit the bed this quarter it’s actually their second best quarterly performance of their last seven, and was also 19% better on a QoQ basis.

Biorem is like that cute girl at the end of the bar. Part of you wants to get up and perhaps ask, “May I meet you?”. The other part is hoping her much hotter friend will show up.

18x cash flow and a near 22 P/E look a little pricey to me, and the strong rejection off $2.44 resistance tells me to wait for cheaper days. I would have another look in that targeted zone above as I expect future financials to be much better than these ones.

Liquidity is a factor here investors need to consider as well, particularly if you’re buying in size. While I made some money on my last go around here, it could have been much better if it was easier to exit when I decided to do so.

Maintaining 3.25 stars mainly based on what could be much better future results.

Disclaimer:

My intent is for my reviews to be a bolt on to due diligence that you have already completed. I receive dozens of review requests a week, therefore my own DD may be great or none whatsoever. Unless otherwise stated or implied, my opinions are on the financial performance of the company based on their most recent filings. I conduct these reviews to assist other retail investors whose research skills are limited when it comes to reviewing financial statements. I do not accept compensation of any kind from company’s I review.

Wolf FINS Reviews are intended to be informational and are based on personal opinion. They are not intended to be financial advice, and all readers are encouraged to perform their own due diligence prior to their investment decisions, including discussions with their investment advisor.

Sold my shares some months back, but that order backlog is making it look very attractive. Also respect their 5% SBC; one of the reasons I invested in them in the first place.